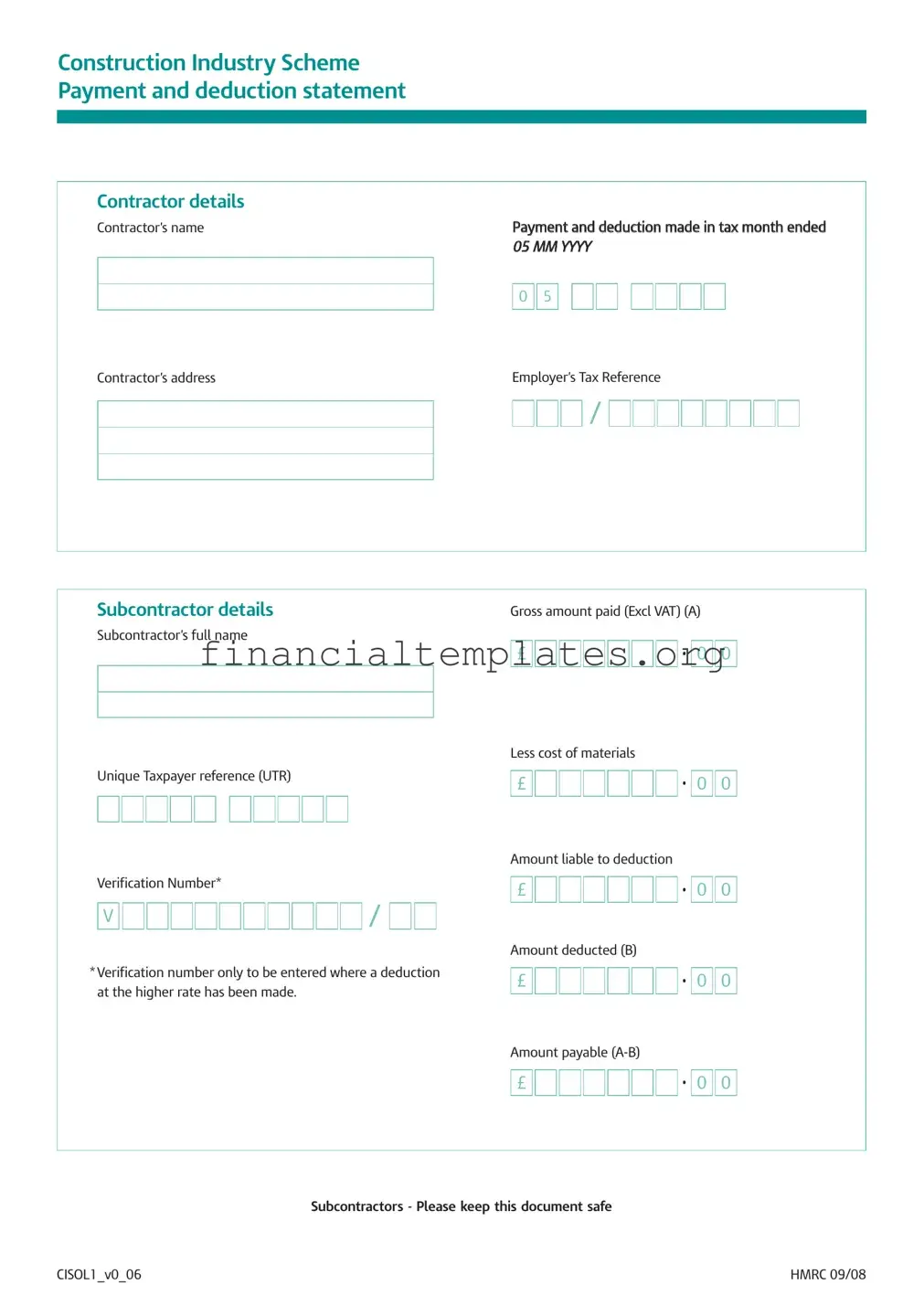

Get Payment Deduction Statement Form

In the landscape of financial documentation within the construction industry, the Payment Deduction Statement form emerges as a pivotal element under the Construction Industry Scheme (CIS). The essence of this form lies in its ability to encapsulate detailed transactions between contractors and subcontractors, emphasizing payments, deductions, and net amounts payable. Crafted to streamline tax-related processes, this document meticulously records the contractor's name and address, the reference period in question, and a precise breakdown of the financial engagement. It distinguishes the gross amount paid, exclusive of VAT, from the net amount, after considering any deductions and the cost of materials. For contractors, this form serves not just as a financial ledger but also as a legal requirement, ensuring compliance with tax obligations by accurately noting deductions made at both standard and higher rates, identifiable via the Verification Number for the latter. Subcontractors, on their part, are urged to safeguard this document, serving as a tangible reference to their financial dealings and deductions subjected for tax purposes, a testament to the meticulous financial administration dictated by the HMRC. Thus, the Payment Deduction Statement form stands as a cornerstone in the financial management and regulatory compliance within the construction sector, embodying the financial dynamics between contractors and subcontractors.

Payment Deduction Statement Example

Construction Industry Scheme

Payment and deduction statement

Contractor details

|

Contractor’s name |

|

|

|

|

|

|

|

|

|

Payment and deduction made in tax month ended |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

05 MM YYYY |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractor’s address |

|

|

|

|

|

|

|

|

|

Employer’s Tax Reference |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Subcontractor details |

|

|

|

|

|

|

|

|

Gross amount paid (Excl VAT) (A) |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Subcontractor’s full name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less cost of materials |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Unique Taxpayer reference (UTR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount liable to deduction |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Verification Number* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount deducted (B) |

|

|

|

|

|

|

|

|

|||||||||||

* Verification number only to be entered where a deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

£ |

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

|

||||||||||||||||||||||||

|

at the higher rate has been made. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

Amount payable |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subcontractors - Please keep this document safe

CISOL1_v0_06 |

HMRC 09/08 |

Document Specifics

| Fact Name | Detail |

|---|---|

| Scope of Form | This form is used within the Construction Industry Scheme to document payments and deductions made to subcontractors. |

| Key Contents | The form includes contractor and subcontractor details, gross amount paid, cost of materials, amount liable to deduction, and the amount deducted. |

| Unique Feature | A Verification Number must be entered if a deduction at the higher rate has been made. |

| Governing Law | This process is regulated under the UK's Finance Act, specifically dealing with tax treatment in the construction sector. |

| Calculation Method | The amount payable to the subcontractor is calculated by subtracting the amount deducted (B) from the gross amount paid (A). |

| Purpose of the Form | It ensures transparency in payments and deductions and aids in tax compliance within the construction industry. |

| Document Retention | Subcontractors are advised to keep this document safe for record-keeping and potential future reference. |

Guide to Writing Payment Deduction Statement

Filling out a Payment Deduction Statement is a critical task for documenting deductions and payments within the Construction Industry Scheme (CIS). The accuracy of this document is paramount as it records financial transactions between contractors and subcontractors, ensuring compliance with HMRC regulations. Following a structured approach to complete this form can streamline the process, ensuring all pertinent details are accurately captured and reducing the likelihood of errors.

- Start by entering the Contractor’s name at the top of the form. This identifies the contractor responsible for the payment.

- Fill in the tax month's end date under Payment and deduction made in tax month ended, using the format 05 MM YYYY to specify when the recorded payments and deductions were made.

- Provide the Contractor’s address below their name, ensuring it is the current and correct address for any official correspondence.

- Enter the Employer’s Tax Reference number next to the contractor’s address. This unique number is crucial for identifying the contractor in the tax system.

- In the section labeled Subcontractor details, write the Subcontractor’s full name to specify to whom the payment and deductions apply.

- Record the Gross amount paid (Excluding VAT) in the designated area (A), which represents the total payment made to the subcontractor before any deductions.

- Subtract any costs of materials, noting this amount in the provided space, to determine the portion of the payment that is liable to deductions.

- Details of the Unique Taxpayer Reference (UTR) should follow, identifying the subcontractor within the tax system.

- Where applicable, include the Verification Number (preceded by "V") in the specified spot. This is only necessary if a deduction at the higher rate has been applied.

- The Amount liable to deduction should then be entered, reflecting the portion of the gross payment from which deductions will be calculated.

- Calculate and fill in the Amount deducted (B), showing how much tax was withheld from the subcontractor’s payment.

- To find the Amount payable (A-B), subtract the amount deducted from the gross amount paid; this is the net amount payable to the subcontractor.

Once the Payment Deduction Statement is fully completed, it’s important to review the entries for accuracy. The subcontractor should receive a copy for their records, reinforcing transparency and providing necessary documentation for tax purposes. Keeping this document secure and accessible is crucial for both parties to ensure compliance and facilitate any required future references to these transactions.

Understanding Payment Deduction Statement

What is a Payment Deduction Statement form used for in the construction industry?

A Payment Deduction Statement form is used to itemize and document payments and deductions made to subcontractors under the Construction Industry Scheme (CIS). This form ensures that contractors accurately report how much they have paid to each subcontractor, detailing any deductions for materials and taxes, so that subcontractors can reconcile these deductions with their own tax obligations.

Who needs to fill out a Payment Deduction Statement form?

Contractors who are registered with the Construction Industry Scheme (CIS) and make payments to subcontractors for construction work must fill out this form. It serves as a detailed record of the payments made and any material costs or tax deductions applied to those payments.

What information is required on the Payment Deduction Statement form?

The form requires details such as the contractor’s name and address, the employer’s tax reference, and subcontractor details including their name, unique taxpayer reference (UTR), and the verification number if applicable. Additionally, financial details needed include the gross amount paid to the subcontractor (excluding VAT), the cost of materials deducted, the amount liable for deduction, and the actual amount deducted. Finally, it calculates the net amount payable to the subcontractor.

Why is the Verification Number required on the form?

The Verification Number is essential for situations where a deduction at the higher rate has been made. This unique number is provided by HMRC when a subcontractor is verified, confirming the subcontractor's tax status and determining the correct rate of deduction. It ensures compliance with HMRC regulations and helps in preventing fraud.

What does "Amount liable to deduction" mean on the form?

The "Amount liable to deduction" refers to the portion of the payment that is subject to the CIS tax deduction. This does not include the cost of materials provided by the subcontractor, as those are deducted before calculating the net amount that the tax deduction applies to.

How should contractors and subcontractors use the Payment Deduction Statement?

Contractors must provide this statement to each subcontractor they make payments to under the CIS scheme. It serves as a receipt for the subcontractor, detailing the gross payment, any deductions for materials, the tax deducted, and the net amount paid. Subcontractors should keep this document safe as it is crucial for their tax records, allowing them to verify payments and deductions made by contractors.

Is it mandatory to exclude VAT from the gross amount paid on the form?

Yes, it is mandatory to exclude VAT from the gross amount paid when filling out the Payment Deduction Statement. This ensures that the tax deductions calculated under the CIS scheme accurately reflect the labor component of the subcontractor's services, excluding any VAT, which is handled separately in tax accounts.

What happens if a Payment Deduction Statement is incomplete or incorrect?

If a Payment Deduction Statement is incomplete or incorrect, it can lead to discrepancies in the subcontractor’s tax records, potentially causing issues with HMRC. Both parties should review the statement for accuracy before it is finalized. Contractors may need to correct and reissue the statement if errors are found, to ensure compliance with the Construction Industry Scheme regulations and to avoid penalties.

Common mistakes

When filling out the Payment Deduction Statement form for the Construction Industry Scheme, it's crucial to avoid common mistakes that could lead to errors in reporting or processing. Here are four common errors people make:

-

Incorrectly reporting the Gross Amount Paid. Often individuals might accidentally include VAT in this figure, although the form explicitly states it should be excluded (Excl VAT). This section should only reflect the payment made before any deductions, like taxes or material costs, not including VAT.

-

Failing to properly document the Cost of Materials. This mistake can result in the misrepresentation of the Amount Liable to Deduction. It's essential to accurately account for the cost of materials to ensure the deduction amount is correct, as only the labor component is subject to deduction under CIS.

-

Omitting or incorrectly entering the Verification Number when a higher rate deduction has been applied. The verification number is a crucial piece of information that validates the subcontractor’s tax status and the rate at which deductions should be made. If this number is incorrect or missing, it could lead to issues with tax compliance.

-

Miscalculating the Amount Deducted (B) and the Amount Payable (A-B). It's easy to make arithmetic errors when determining these amounts. Ensuring the accuracy of these calculations is vital, as they affect the final payment to the subcontractor and the financial records for both parties.

To prevent these errors, always double-check the figures entered against your financial records and ensure that all required fields are accurately completed. This diligence will help maintain compliance with the Construction Industry Scheme requirements and ensure smooth financial operations.

Documents used along the form

When dealing with the Construction Industry Scheme (CIS), the Payment Deduction Statement form is crucial for documenting deductions from subcontractor payments. However, to manage financial and legal responsibilities efficiently, other forms and documents are often used alongside it. The comprehensive tracking of transactions, details, and compliance statuses that these documents provide ensures a smoother operational flow in the construction sector.

- Employment Status Declaration: This form is used to clarify the employment status of an individual working for a contractor, determining whether they should be treated as employed or self-employed under the CIS. This distinction is vital for tax and national insurance contribution purposes.

- Subcontractor Verification Statement: Before a contractor can pay a subcontractor under the CIS, they need to verify the subcontractor's status with HMRC. This statement confirms HMRC's response, including the subcontractor's tax treatment and any deductions to be made at the standard or higher rates.

- Monthly Return to HMRC: Contractors must submit a monthly return that reports all the payments made to subcontractors, including those documented on Payment Deduction Statements, during the tax month. This return is crucial for HMRC to reconcile payments and deductions made under the CIS.

- Subcontractor’s Invoice: This document provides detailed information on the work completed or services provided by a subcontractor, including the gross amount charged before any CIS deductions. When paired with the Payment Deduction Statement, it offers a transparent financial trail of the agreed work and the corresponding deductions.

Together with the Payment Deduction Statement form, these documents play a pivotal role in maintaining compliance within the transactions between contractors and subcontractors in the construction industry. The clarity and accuracy provided by these documents are imperative for the transparency and accountability required in the financial affairs of construction projects.

Similar forms

The Payment Deduction Statement form, used in the Construction Industry Scheme (CIS), shares similarities with many financial and tax documents across various sectors. One such document is the W-2 form used in the United States to report wages paid to employees and the taxes withheld from them. Both forms serve as official records for tax purposes; the W-2 captures employee income tax withholding, while the Payment Deduction Statement details tax deductions from payments to subcontractors.

Another comparable document is the 1099-MISC form, commonly used to report payments made to freelance workers and independent contractors in the U.S. Both the 1099-MISC and the Payment Deduction Statement offer a summary of non-employee compensation, crucial for the payee's tax filings. The key difference lies in their jurisdictional use and the specifics of the information reported, as the 1099-MISC encompasses a wider range of payment types.

The Invoice serves as a multifaceted tool in business transactions, detailing goods or services provided, their costs, and VAT if applicable. Similar to the Payment Deduction Statement, an invoice outlines the financial transaction between parties, but it lacks specific tax deduction details. The invoice plays a preliminary role, preceding the need for a Payment Deduction Statement, which exclusively deals with tax deductions.

Pay Stubs, given to employees by employers, detail wages earned, taxes, and other deductions over a pay period. They share common ground with the Payment Deduction Statement in itemizing deductions; however, pay stubs differ in scope, focusing on employment relationships rather than subcontractor arrangements within the construction industry.

The Schedule C (Form 1040) used in the U.S. for reporting profit or loss from a business is somewhat akin to the Payment Deduction Statement. Self-employed individuals use Schedule C to detail expenses and income, which may include subcontractor payments. While Schedule C encompasses a broader business income report, the CIS form specifically deals with the tax aspect of subcontractor payments.

The Profit and Loss Statement (P&L), another key financial document, compares revenues, costs, and expenses during a specific period. While serving a broader purpose of presenting a business's financial health, it indirectly relates to the Payment Deduction Statement by potentially including subcontractor costs as expenses, thereby affecting the net income figure reported.

Bank Statements, offering a record of transactions within an account, might include details of payments made to subcontractors. While they provide proof of payment similar to the Payment Deduction Statement, bank statements do not specify tax deductions or serve a direct tax reporting purpose.

The VAT Return, a crucial document for businesses to report the amount of VAT due to or from the tax authorities, shares the tax documentation aspect with the Payment Deduction Statement. Both detail tax-related transactions, yet the VAT Return focuses on the value-added tax specifically, unlike the CIS document's focus on income tax deductions for subcontractors.

The Cash Flow Statement, a financial statement showing the cash and cash equivalents entering and leaving a company, might reflect payments to subcontractors and associated tax deductions indirectly through its reporting of operating activities’ cash flows. Although it provides a broader view of a company's financial activity, the Payment Deduction Statement offers a detailed account of specific tax deductions.

Lastly, the Employment Eligibility Verification Form I-9, which verifies an employee's authorization to work in the U.S., is connected through its role in the employment process, ensuring legal work status. While fundamentally different, both forms underscore the importance of verifying work-related details – the I-9 confirms employment eligibility, whereas the Payment Deduction Statement confirms tax compliance for subcontractor payments in the construction industry.

Dos and Don'ts

When filling out the Payment Deduction Statement form, specifically designed for the Construction Industry Scheme (CIS), it's important to approach the process with care and attention. This document plays a crucial role in ensuring that payments and deductions are accurately reported to HMRC. Here are six dos and don'ts to help guide you through the process:

- Do ensure you have all the relevant information before starting to fill out the form. This includes contractor and subcontractor details like names, addresses, and tax identifiers such as the Employer’s Tax Reference and the subcontractor's Unique Taxpayer Reference (UTR).

- Do accurately report the gross amount paid to the subcontractor, excluding VAT. Precision is crucial to avoid any discrepancies that could lead to issues with HMRC.

- Do deduct the cost of materials provided by the subcontractor from the gross amount before applying the CIS tax deduction. This ensures the deduction is applied only to the labor component of the subcontractor's charge.

- Do not forget to include the verification number where a deduction at the higher rate has been made. This is a specific requirement and is essential for the paperwork to be processed correctly.

- Do not rush through the calculations of deductions and the final amount payable to the subcontractor. Mistakes in these calculations can lead to under or overpayments, resulting in financial discrepancies and potential penalties.

- Do not lose or misplace the completed Payment Deduction Statement. Both contractors and subcontractors must keep this document safe as it is vital for tax records, and may need to be referenced in future communications with HMRC.

By following these guidelines, individuals and businesses involved in the construction industry can ensure they comply with the CIS requirements, helping to streamline tax affairs and avoid potential complications with HMRC.

Misconceptions

Misunderstandings often arise regarding the Payment Deduction Statement form, used in the Construction Industry Scheme (CIS). This document is crucial for both contractors and subcontractors as it outlines the payment details and tax deductions made on behalf of the subcontractor. Here are five common misconceptions about this form.

- The Payment Deduction Statement is only for the contractor's records.

Many believe the Payment Deduction Statement is solely for the contractor to keep for their records. However, this statement is equally important for subcontractors. It provides them with a clear record of the payments made to them, including any tax deductions. Subcontractors should retain these statements to manage their tax obligations accurately.

- VAT is included in the gross amount paid.

It's a common mistake to think that the gross amount paid to a subcontractor includes Value Added Tax (VAT). The form clearly requires the gross amount paid excluding VAT. This distinction is crucial for accurately reporting the payment and for the subcontractor's tax preparation.

- The 'cost of materials' is optional information.

Another misconception is that the cost of materials deducted from the gross amount is optional or a minor detail. This information is vital because it determines the amount subject to tax deductions. Including the cost of materials helps accurately calculate the net payment to the subcontractor after tax deductions.

- The Unique Taxpayer Reference (UTR) is not necessary if a Verification Number is provided.

There's a misunderstanding that providing a Verification Number negates the need for a Unique Taxpayer Reference (UTR). Both pieces of information serve different purposes. The UTR is crucial for identifying the subcontractor's tax records, while the Verification Number is required only when a deduction at the higher rate has been made. Both are essential for appropriate record-keeping and tax compliance.

- The Amount Deducted and Amount Payable figures are calculated by HMRC.

Finally, some think that the figures for Amount Deducted and Amount Payable are calculated and filled in by HM Revenue & Customs (HMRC). In reality, it's the contractor's responsibility to calculate these amounts based on the agreed payment and the tax deduction rate applicable to the subcontractor. The contractor must accurately report these figures on the form.

Understanding these aspects of the Payment Deduction Statement ensures that both contractors and subcontractors can navigate the CIS more effectively, promoting better compliance and financial management in the construction industry.

Key takeaways

Filling out and using the Payment Deduction Statement form is a critical process in the Construction Industry Scheme (CIS) for both contractors and subcontractors. Understanding the key takeaways can help ensure compliance and accurate financial management. Here are nine crucial aspects to keep in mind:

Ensure all contractor details are correctly filled in, including the contractor’s name and address, to establish the identity of the contractor for whom the work was done.

Accurately enter the Employer’s Tax Reference as this links the payment to the contractor’s tax records.

The payment period, labeled as "Payment and deduction made in tax month ended," requires careful attention to ensure that the record corresponds correctly to the tax month being reported.

For each subcontractor, their full name and Unique Taxpayer Reference (UTR) must be clearly and accurately entered to correctly identify the subcontractor within the HMRC system.

The gross amount paid (excluding VAT) to the subcontractor needs to be precisely calculated and recorded. This is critical as it represents the payment before any deductions are applied.

When applicable, correctly deduct the cost of materials provided by the subcontractor from the payment. This ensures that deductions are only made on the labor portion of the payment.

The amount liable to deduction should be calculated by subtracting the cost of materials from the gross amount, aligning with the CIS deduction rules.

Enter the deduction amount clearly. This is the actual amount being withheld from the payment to the subcontractor, based on the CIS tax rates.

The verification number is crucial for subcontractors being deducted at the higher rate. This number, provided by HMRC, should be recorded accurately to substantiate the deduction rate applied.

Finally, calculate the net amount payable to the subcontractor by subtracting the deduction amount from the amount liable to deduction. This is the amount that the subcontractor will receive after CIS deductions.

Remember: The Payment Deduction Statement is an important document for both contractors and subcontractors within the CIS. It provides a record of the payments and deductions made and should be kept safely for future reference, as mentioned in the note, "Subcontractors - Please keep this document safe." By diligently following these key points, contractors can ensure they are compliant with CIS regulations, and subcontractors will have accurate records for their financial management and tax obligations.

Popular PDF Documents

Sales Tax New York City - To qualify for a rebate, applicants must ensure they are not claimed as dependents on another's application, maintaining the program's integrity by avoiding duplicate claims.

IRS 8868 - Organizations should note the specific deadlines that apply to their filing to use form 8868 effectively.

Inua Jamii Loans - The form outlines specific documentary requirements for construction-related financing, including approved building and structural plans.