Get Payg Payment Summary Individual Non Business Form

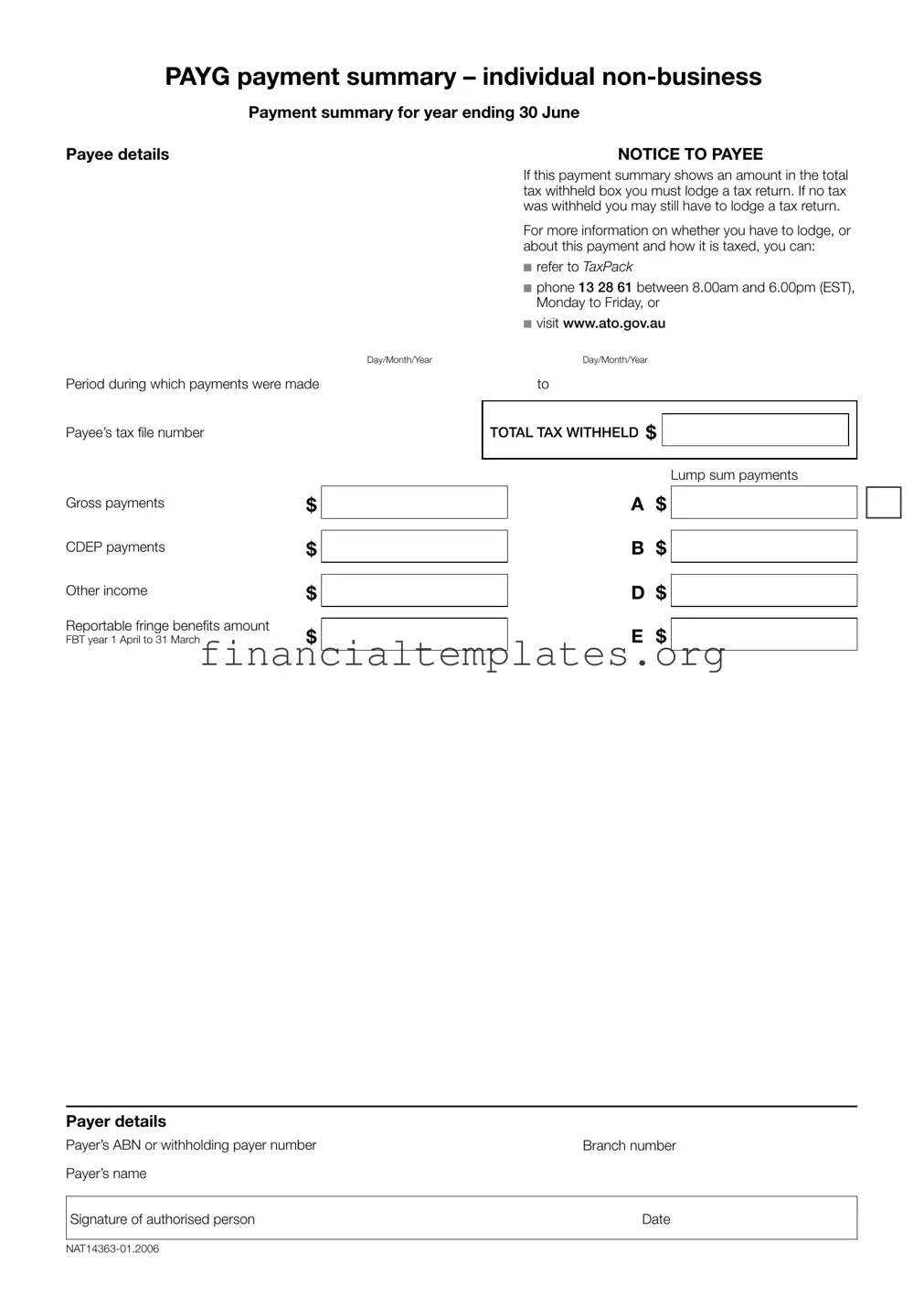

The Pay As You Go (PAYG) Payment Summary – Individual Non-Business form serves as a crucial document for both taxpayers and employers in Australia, outlining earnings from employment that are not related to business activities for a specific fiscal year ending on 30 June. It delineates key information including the payee's details, such as tax file number, and breaks down earnings into categories like gross payments, Community Development Employment Projects (CDEP) payments, other income, and reportable fringe benefits with a defined Fringe Benefits Tax (FBT) year from 1 April to 31 March. The form also specifies whether tax was withheld from these payments and if so, how much, guiding individuals on their obligation to lodge a tax return. Additionally, it captures lump sum payments categorized into types A, B, D, and E, further clarifying the nature of payments received. It concludes with essential payer information, such as the Australian Business Number (ABN) or withholding payer number, and the signature of an authorized person, cementing its role as a fundamental record for income reporting and tax lodgment purposes. This comprehensive document, sourced from the Australian Taxation Office, enables individuals to accurately report their income and determine their tax responsibilities, offering an informative resource for those seeking detailed insights on non-business income within the specified financial year.

Payg Payment Summary Individual Non Business Example

PAYG payment summary – individual

Payment summary for year ending 30 June

Payee details |

NOTICE TO PAYEE |

Day/Month/Year

Period during which payments were made

Payee’s tax file number

Gross payments |

$ |

CDEP payments |

$ |

Other income |

$ |

Reportable fringe benefits amount |

$ |

FBT year 1 April to 31 March |

If this payment summary shows an amount in the total tax withheld box you must lodge a tax return. If no tax was withheld you may still have to lodge a tax return.

For more information on whether you have to lodge, or about this payment and how it is taxed, you can:

■refer to TAXPACK

■phone 13 28 61 between 8.00am and 6.00pm (EST), Monday to Friday, or

■visit www.ato.gov.au

Day/Month/Year

to

TOTAL TAX WITHHELD $

Lump sum payments

A $

B $

D $

E $

Payer details

Payer’s ABN or withholding payer number |

Branch number |

Payer’s name |

|

|

|

Signature of authorised person |

Date |

|

|

Document Specifics

| Fact Name | Fact Description |

|---|---|

| Form Title | PAYG payment summary – individual non-business |

| Reporting Period | Covers the financial year ending 30 June |

| Payee Information | Includes payee details like tax file number and gross payments |

| Income Reporting | Details on gross payments, CDEP payments, other income, and reportable fringe benefits |

| FBT Reporting Period | FBT year runs from 1 April to 31 March |

| Tax Obligations | Advises on necessity to lodge a tax return based on whether tax was withheld |

| Resources for Assistance | Includes references to TAXPACK, telephone, and the ATO website for more information |

| Payer Details | Contains payer's ABN, branch number, and name |

| Authentication | Must be signed by an authorised person with the date |

Guide to Writing Payg Payment Summary Individual Non Business

Once an individual receives the PAYG Payment Summary – Individual Non-Business form, it is crucial to fill it out accurately to comply with tax obligations. This form, detailing earnings outside of business activities, plays a pivotal role in the tax filing process. It includes information on gross payments, reportable fringe benefits, and any tax withheld, amongst other details. Ensuring every section is completed correctly is essential for reporting to the Australian Tax Office (ATO).

- Start with the 'Payment summary for year ending 30 June' section: Enter the relevant financial year the payment summary pertains to.

- Fill in 'Payee details':

- Complete the 'Day/Month/Year' with the date you are filling the form.

- Indicate the 'Period during which payments were made' by specifying the start and end dates.

- Enter the 'Payee’s tax file number' accurately.

- Enter payment information:

- In the 'Gross payments $' field, fill in the total amount of payments received before tax.

- For 'CDEP payments $', specify any Community Development Employment Projects payments.

- Add any 'Other income $' received.

- Determine the 'Reportable fringe benefits amount $' for the FBT year running from 1 April to 31 March.

- Report the 'TOTAL TAX WITHHELD $': Specify the total amount of tax withheld from payments during the financial year.

- Detail any 'Lump sum payments' in the sections marked A, B, D, and E based on their specific categories.

- Provide 'Payer details':

- Enter the 'Payer’s ABN or withholding payer number' correctly.

- Include the 'Branch number' if applicable.

- Write the 'Payer’s name' as shown on your records.

- 'Signature of authorised person': The form must be signed by an individual with the authority to do so, confirming the accuracy of the form’s contents. Fill in the date next to the signature.

After completing the PAYG Payment Summary – Individual Non-Business form, it's imperative to review it for accuracy. This form is a key document for tax purposes and must be retained for personal records. It should also be readily available for submission to the Australian Tax Office either by yourself or through a tax professional. Filling out the form meticulously ensures compliance with tax laws and helps avoid potential issues with the ATO.

Understanding Payg Payment Summary Individual Non Business

What is a PAYG Payment Summary – Individual Non-Business?

The PAYG Payment Summary – Individual Non-Business is a document provided by an employer or payer to an individual showing the total amount of payments made to them and the amount of Australian tax withheld during the financial year, which ends on 30 June. This summary includes various types of income such as gross payments, CDEP (Community Development Employment Projects) payments, and other income. It also details any reportable fringe benefits and lump sum payments.

What should I do if I receive a PAYG Payment Summary?

If the payment summary indicates tax was withheld, you're required to lodge a tax return. However, even if no tax was withheld, you might still need to lodge a return depending on various factors related to your income and tax situation. It's recommended to refer to TAXPACK, contact the Australian Taxation Office via phone at 13 28 61, or visit the www.ato.gov.au for further guidance on your obligation to lodge a return.

Where can I find my Tax File Number on the payment summary?

On the PAYG Payment Summary, your Tax File Number (TFN) will be listed under the "Payee details" section. It's a unique number issued by the Australian Taxation Office (ATO) to you for tax and superannuation purposes.

How do I know if I need to report CDEP payments on my tax return?

CDEP payments shown on your PAYG Payment Summary are part of your income and should be reported on your tax return. These payments are made under the Community Development Employment Projects program and are taxable. For specific guidance on how to report these payments, consult the TAXPACK or the ATO directly.

What are lump sum payments A, B, D, E as seen on the payment summary?

Lump sum payments are additional forms of income that may be paid to you under certain circumstances, such as redundancy, early retirement, or arrears payments. Each type (A, B, D, E) refers to specific conditions under which these payments are made, and they are subject to different tax treatments. Detailed explanations for each payment type can be found on the ATO's website or by consulting with a tax professional.

What are reportable fringe benefits?

Reportable fringe benefits are certain benefits you receive from your employer, in addition to your salary or wages, that need to be reported on your tax return. These can include car benefits, loans at reduced rates, or payment of private expenses. The amount shown on your PAYG Payment Summary reflects the total value of these benefits for the FBT (Fringe Benefits Tax) year, which runs from 1 April to 31 March.

How can I get help or more information?

If you need further assistance or have specific questions about your PAYG Payment Summary or how to lodge your tax return, it's advisable to start by consulting the TAXPACK for general guidance. For more personalized assistance, you can phone the Australian Taxation Office at 13 28 61 or visit their website at www.ato.gov.au. They provide a wealth of information and support tools to help you understand your tax obligations.

Common mistakes

When filling out the PAYG Payment Summary – Individual Non-Business form, people sometimes make mistakes that can complicate their tax situation. Understanding these common errors can help ensure the process goes smoothly. Here are six mistakes to watch out for:

-

Incorrect payee details: Entering wrong information in the payee details section, such as an incorrect tax file number or name, can lead to delays or issues with the Australian Tax Office (ATO).

-

Misreporting payment periods: It's crucial to accurately report the period during which payments were made. Incorrect dates can cause confusion and potential discrepancies with employer records.

-

Underreporting gross payments: All gross payments received must be accurately reported. Failing to include some payments can result in underreporting income, leading to penalties.

-

Omitting other income: If there are any 'Other income' amounts, these must be included on the form. This section is often overlooked, which can result in incomplete income reporting.

-

Incorrectly reporting fringe benefits: The reportable fringe benefits amount must reflect the value of certain fringe benefits received. Misunderstanding what needs to be reported here can cause errors in taxation obligations.

-

Forgetting to include lump sum payments: Any lump sum payments, labeled as A, B, D, or E on the form, must be correctly reported. Overlooking these can significantly impact tax calculations.

Beyond these common errors, ensure that the payer details are filled in correctly, including the payer’s ABN and the signature of the authorised person. Paying attention to these potential pitfalls can help avoid unnecessary delays or corrections down the line.

Remember, the information on this form is crucial for accurate tax reporting. If there is any confusion or uncertainty, it's always best to refer to the TAXPACK, call the ATO directly, or visit their website for guidance. Ensuring the accuracy of this document is a key step in managing your tax responsibilities effectively.

Documents used along the form

When handling taxes, especially for individuals with non-business income in Australia, the PAYG Payment Summary – Individual Non-Business form is pivotal. However, it's often just one piece of the puzzle. To ensure a comprehensive approach to tax returns and filings, several other documents may be required to accompany this form. These forms provide additional information on various sources of income and tax deductions, ensuring a thorough and accurate tax filing process.

- Income Tax Return – This is the main form filed by individuals to report their annual income to the Australian Taxation Office (ATO). It includes all sources of income, deductions, and tax offsets to calculate the tax payable or refundable for the year.

- Statement of Superannuation Contributions – This document details the contributions made to a superannuation fund during the financial year. It's vital for individuals who make their contributions or have additional contributions made on their behalf, as these can affect tax calculations.

- Medicare Levy Exemption Certification – Some individuals are exempt from paying the Medicare Levy, based on specific criteria such as medical disability or foreign residency. This certification confirms eligibility for exemption and affects the overall tax payable.

- Private Health Insurance Statement – This statement provides information on any private health insurance coverage held during the financial year. It is necessary for calculating the Private Health Insurance Rebate or for determining the Medicare Levy Surcharge, which impacts the total tax obligation.

Each of these documents plays a specific role in ensuring that an individual's tax affairs are accurately recorded and assessed by the ATO. When used together with the PAYG Payment Summary – Individual Non-Business form, they provide a complete picture of an individual's financial status for the year, aiding in the efficient and accurate preparation of tax returns.

Similar forms

The W-2 form in the United States serves a purpose quite similar to the PAYG payment summary – individual non-business form. Both documents provide detailed records of an individual's earnings from employment or services provided and include information on the tax withheld during the financial year. The W-2 form breaks down the employee's income, taxes withheld, and benefits such as social security and Medicare taxes paid. It is essential for filing personal income tax returns, mirroring the necessity of the PAYG summary for individuals to accurately lodge their tax returns in Australia.

The 1099-MISC form is another document that has similarities with the PAYG payment summary. This form is used in the United States to report payments made to independent contractors, freelancers, and other non-employees. Like the PAYG summary, it documents other income not subject to regular wage withholding, making it an essential piece of documentation for individuals to manage their tax responsibilities. While the 1099-MISC captures a broader range of non-employee compensation, both forms play a crucial role in tax reporting and compliance.

The P45 form in the United Kingdom is equivalent in many ways to the PAYG payment summary. When an employee leaves a job, the employer issues a P45, detailing the pay and the tax that has been deducted during the employment period. This document is crucial for understanding one's tax position and ensuring the correct tax code is used in future employment, similar to how the PAYG summary provides necessary income and tax details for individuals to remain compliant with the Australian Tax Office (ATO).

Lastly, the T4 slip in Canada shares purposes with the PAYG payment summary, as it provides employees with a record of their income earned and taxes paid over the financial year. Employers must issue this slip to all employees who receive salary, wages, tips, or any other remuneration. The T4 slip is fundamental for Canadians in preparing and filing their personal income tax and benefits return. It aligns with the PAYG summary's role in aiding individuals to accurately declare their earnings and tax obligations to the respective tax authority.

Dos and Don'ts

When filling out the PAYG Payment Summary – Individual Non-Business form, ensuring accuracy and compliance is essential. To help you navigate the process smoothly, here are some key dos and don'ts.

Dos:

- Double-check the payee details, including the Day/Month/Year and the period during which payments were made, to ensure that all information is accurately reflected.

- Accurately report the Gross Payments, CDEP payments (if any), Other Income, and the Reportable Fringe Benefits Amount, as these figures directly impact your tax obligations.

- Verify your Tax File Number (TFN) for correctness. Providing an incorrect TFN can lead to delays or issues with your tax return.

- Consult the instructions provided by the Australian Taxation Office (ATO) or use their resources such as TAXPACK and www.ato.gov.au for guidance if you're unsure about any details.

- Ensure the total tax withheld and lump sum payments (Sections A, B, D, and E) are accurately reported to avoid any discrepancies.

- Confirm that the Payer’s details, including the ABN or withholding payer number and branch number, are correct. The signature of the authorised person and the date should also be verified for authenticity.

Don'ts:

- Don't rush through the form without checking each section for accuracy. Take your time to avoid mistakes that could complicate your tax situation.

- Don't leave any applicable sections blank. If a certain section does not apply to you, ensure you understand the correct way to indicate this according to ATO guidelines.

- Avoid guessing or estimating amounts. Use exact figures wherever possible to prevent any unnecessary queries or adjustments from the ATO.

- Don't ignore the instructions and resources provided by the ATO. These are designed to assist you in completing the form correctly and can save you time and effort.

- Don't submit the form without ensuring all necessary sections are completed and that the information provided matches your records.

- Do not disregard the importance of lodging a tax return if this payment summary shows a total tax withheld amount. Even if no tax was withheld, you may still be obligated to lodge a tax return.

By following these simple guidelines, you can complete the PAYG Payment Summary – Individual Non-Business form with confidence, ensuring compliance with Australian tax laws and avoiding potential headaches down the line.

Misconceptions

Understanding the PAYG Payment Summary - Individual Non-Business can often lead to confusion. Let's clear up some common misconceptions about this document.

- Misconception 1: It's only for employees. Many believe this form is exclusively for those in traditional employment. However, it also covers other types of payments like pensions, annuities, and social security payments, making it broader in scope than many realize.

- Misconception 2: No need to file a tax return if tax is not withheld. The document states, "If no tax was withheld you may still have to lodge a tax return." This clarifies that everyone who receives a PAYG summary may need to file a tax return, regardless of whether tax was withheld or not, based on their total income.

- Misconception 3: Lump sum payments are not important for tax filings. The form mentions various categories under lump sum payments (A, B, D, E). Each category has different tax implications, highlighting the importance of accurately reporting these payments on tax returns. Misunderstanding this can lead to incorrect tax calculations.

- Misconception 4: You can only get information about your PAYG summary by calling during business hours. While the document suggests calling a specific number for more information, it also encourages visiting the ATO website. This means that payees have 24/7 access to critical information online, offering convenience beyond traditional methods.

Understanding these aspects of the PAYG Payment Summary - Individual Non-Business form is crucial for accurately managing one's financial affairs and ensuring compliance with tax obligations in Australia. Dispelling these misconceptions encourages informed decisions and smoother engagements with tax requirements.

Key takeaways

When dealing with the PAYG Payment Summary – Individual Non-business form, it is important to understand the various components and requirements for accurate completion and usage. Here are eight key takeaways to guide you through this process:

- The payment summary is applicable for the fiscal year ending on 30 June, necessitating annual attention to ensure proper documentation and submission.

- Payee details section requires careful entry of personal information, including the tax file number and the specific period during which payments were made, ensuring accurate identification and tax processing.

- Understanding the difference among gross payments, CDEP (Community Development Employment Projects) payments, and other income is crucial for correct financial reporting.

- The segment dedicated to Reportable Fringe Benefits and the corresponding FBT (Fringe Benefits Tax) year, running from 1 April to 31 March, highlights the necessity of tracking benefits received outside of regular salary or wages.

- Noting the amount in the total tax withheld box is essential, as it determines whether a tax return must be lodged. This emphasizes the importance of this document in personal tax management and compliance.

- Lump sum payments are categorized into several types (A, B, D, E), each with specific tax implications, showcasing the need to understand the nature of any lump sum received during the financial year.

- The section detailing the payer's information, including ABN or withholding payer number and branch number, is critical for identifying the source of payments, ensuring traceability, and verification purposes.

- If you have questions or require additional information about the form, how to fill it out, or the implications of the payments reported, resources such as TAXPACK, the provided phone number, and the ATO website are available for assistance.

Accurately completing and understanding the PAYG Payment Summary – Individual Non-business form is essential for both compliance with tax obligations and the effective management of personal finances. It serves as a clear record of income received outside of business activities, which is vital for accurate tax reporting and planning.

Popular PDF Documents

House Tax Form - Discover how businesses in Broward County must report all tangible personal property used for commercial purposes not already assessed with real property.

Hawaii Department of Revenue - For changes in licenses such as General Excise/Use, Transient Accommodations, or others, the BB-1X form is required.

Pag-ibig Calamity Loan Online - Demands a declaration of authenticity for the information provided, emphasizing the legal responsibilities of the applicant.