Get Pay Business Tax Certificate Form

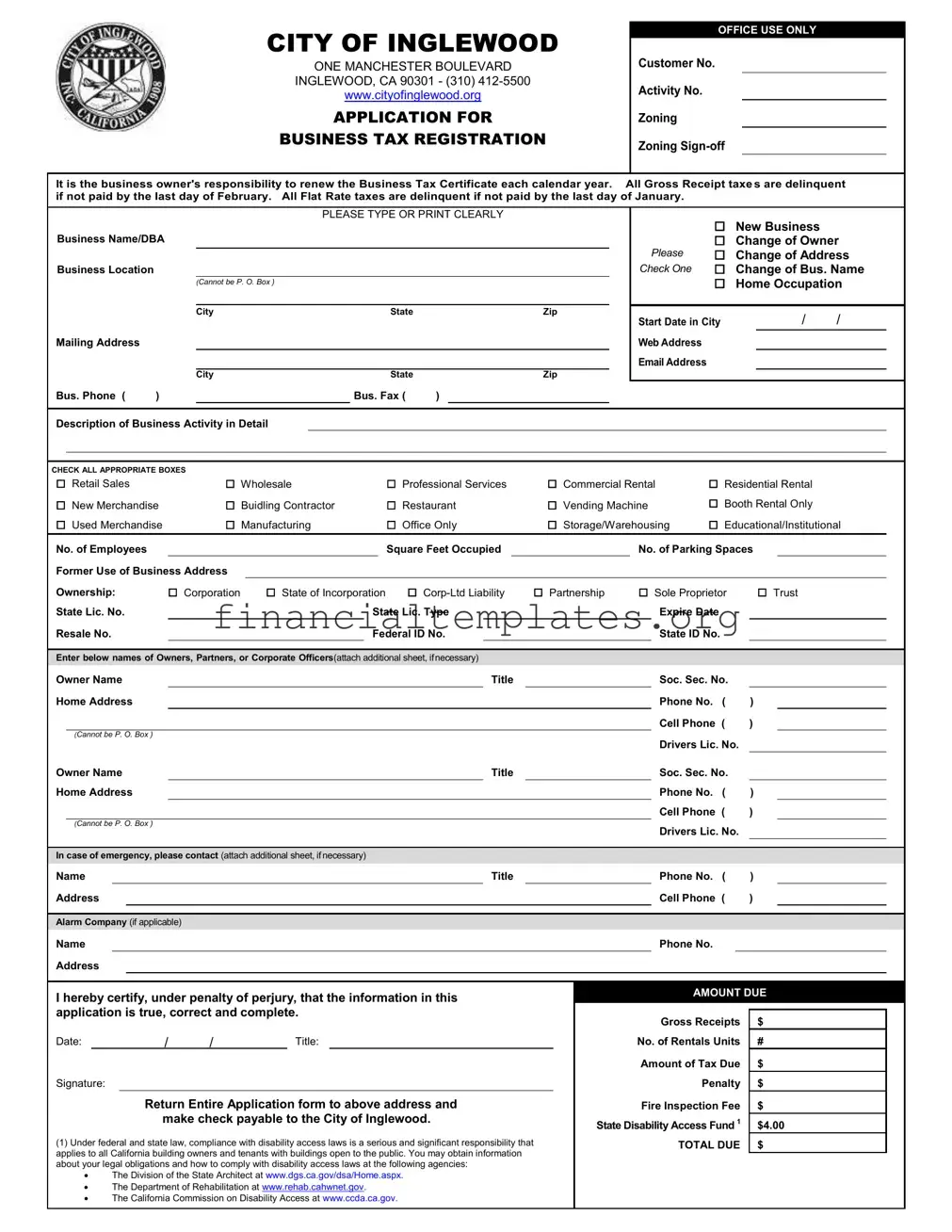

The Pay Business Tax Certificate form serves a crucial function for businesses operating within the City of Inglewood, ensuring compliance with local tax regulations and contributing to the city's infrastructure and community services through tax contributions. Located at One Manchester Boulevard, the city’s application process requires businesses to provide detailed information about their operations, including business names, locations—highlighting the prohibition against P.O. Box addresses for business locations and mailing addresses alike—, ownership types, and a thorough description of business activities. Various categories, such as retail sales, professional services, manufacturing, and more, allow businesses to clearly define their operational niche. Furthermore, the form adapts to diverse business changes such as new ownership, address changes, or shifts in business activities. It outlines the responsibility of business owners to renew their Business Tax Certificate annually, with specific deadlines for gross receipt taxes and flat-rate taxes to avoid delinquency. Additionally, it provides for the inclusion of owner, partner, or corporate officer information, and mandates the submission of the application under penalty of perjury, emphasizing the seriousness of providing accurate and complete information. Payment details, including taxes due and additional fees like the State Disability Access Fund contribution, underline the financial obligations businesses must meet. Lastly, the form underscores the importance of compliance with federal and state disability access laws, offering resources for businesses to understand these responsibilities, marking itself as more than just a tax document but a guide for legal and accessible business operations within Inglewood.

Pay Business Tax Certificate Example

CITY OF INGLEWOOD

ONE MANCHESTER BOULEVARD

INGLEWOOD, CA 90301 - (310)

www.cityofinglewood.org

APPLICATION FOR

BUSINESS TAX REGISTRATION

OFFICE USE ONLY

Customer No.

Activity No.

Zoning

Zoning

It is the business owner's responsibility to renew the Business Tax Certificate each calendar year. All Gross Receipt taxes are delinquent if not paid by the last day of February. All Flat Rate taxes are delinquent if not paid by the last day of January.

|

|

|

PLEASE TYPE OR PRINT CLEARLY |

|||

Business Name/DBA |

|

|

|

|

||

Business Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(CANNOT BE P. O. BOX ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip |

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip |

Bus. Phone ( |

) |

|

|

Bus. Fax ( |

) |

|

|

New Business |

|

Change of Owner |

PLEASE |

Change of Address |

CHECK ONE |

Change of Bus. Name |

|

Home Occupation |

Start Date in City |

/ |

/ |

Web Address |

|

|

Email Address |

|

|

Description of Business Activity in Detail

CHECK ALL APPROPRIATE BOXES |

|

|

|

|

Retail Sales |

Wholesale |

Professional Services |

Commercial Rental |

Residential Rental |

New Merchandise |

Buidling Contractor |

Restaurant |

Vending Machine |

Booth Rental Only |

Used Merchandise |

Manufacturing |

Office Only |

Storage/Warehousing |

Educational/Institutional |

|

No. of Employees |

|

|

|

|

|

|

|

Square Feet Occupied |

|

|

|

|

|

No. of Parking Spaces |

|

|

||||||||||

|

Former Use of Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Ownership: |

|

Corporation |

State of Incorporation |

|

Partnership |

Sole Proprietor |

Trust |

|

||||||||||||||||||

|

State Lic. No. |

|

|

|

|

|

|

State Lic. Type |

|

|

|

|

|

|

Expire Date |

|

|

|

|||||||||

|

Resale No. |

|

|

|

|

|

|

|

|

|

Federal ID No. |

|

|

|

|

|

|

State ID No. |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Enter below names of Owners, Partners, or Corporate Officers(attach additional sheet, ifnecessary) |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Owner Name |

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

Soc. Sec. No. |

|

|

|

|||||||

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone No. ( |

) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cell Phone ( |

) |

|

|

|

|

|

(CANNOT BE P. O. BOX ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drivers Lic. No. |

|

|

|

|

|

Owner Name |

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

Soc. Sec. No. |

|

|

|

|||||||

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone No. ( |

) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cell Phone ( |

) |

|

|

|

|

|

(CANNOT BE P. O. BOX ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drivers Lic. No. |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

In case of emergency, please contact (attach additional sheet, ifnecessary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

Phone No. ( |

) |

|

|

||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cell Phone ( |

) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Alarm Company (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone No. |

|

|

|

|||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

I hereby certify, under penalty of perjury, that the information in this |

|

|

|

|

|

AMOUNT DUE |

|

|||||||||||||||||||

|

application is true, correct and complete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

Gross Receipts |

$ |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Date: |

|

|

|

/ |

/ |

|

Title: |

|

|

|

|

|

|

|

No. of Rentals Units |

# |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Tax Due |

$ |

|

|

||

|

Signature: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penalty |

$ |

|

|

|||

|

|

|

|

|

|

Return Entire Application form to above address and |

|

|

|

|

Fire Inspection Fee |

$ |

|

|

|||||||||||||

|

|

|

|

|

|

|

make check payable to the City of Inglewood. |

|

|

|

State Disability Access Fund 1 |

$4.00 |

|

||||||||||||||

|

(1) Under federal and state law, compliance with disability access laws is a serious and significant responsibility that |

|

|

|

TOTAL DUE |

$ |

|

|

|||||||||||||||||||

|

applies to all California building owners and tenants with buildings open to the public. You may obtain information |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

about your legal obligations and how to comply with disability access laws at the following agencies: |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

The Division of the State Architect at www.dgs.ca.gov/dsa/Home.aspx. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

The Department of Rehabilitation at www.rehab.cahwnet.gov. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

The California Commission on Disability Access at www.ccda.ca.gov. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | The form is an application for Business Tax Registration for the City of Inglewood. |

| 2 | Business Tax Certificates must be renewed each calendar year. |

| 3 | Gross Receipt taxes become delinquent if not paid by the last day of February annually. |

| 4 | Flat Rate taxes become delinquent if not paid by the last day of January annually. |

| 5 | Applicants are required to provide detailed business activity descriptions. |

| 6 | The form includes a section for identifying the business structure, such as Corporation, Partnership, or Sole Proprietor. |

| 7 | State License Number, Resale Number, Federal ID Number, and State ID Number are required for application completion. |

| 8 | An emergency contact must be provided by the applicant. |

| 9 | The application includes a mandatory declaration under penalty of perjury that the information provided is accurate. |

| 10 | California building owners and tenants with buildings open to the public are reminded of their legal obligations to comply with federal and state disability access laws. |

Guide to Writing Pay Business Tax Certificate

Filling out the Pay Business Tax Certificate form is necessary for businesses operating in certain jurisdictions to ensure they are registered to pay business taxes according to local requirements. This process requires attention to detail and accurate information about your business operations, location, ownership, and activities. Following the correct steps to complete the form ensures that your business complies with local tax regulations and can operate without legal hindrances.

- Begin by entering your business name or DBA ("Doing Business As") in the space provided.

- Fill in the business location details, including address, city, state, and zip code. Remember, a P.O. Box is not acceptable for this address.

- Provide the mailing address if different from the business location address, including city, state, and zip code.

- Enter your business phone and fax numbers in the designated spaces. Include the area code.

- Check the appropriate box to indicate if your submission is due to a new business, change of owner, change of address, change of business name, or home occupation.

- Specify the start date of your business activity in the city.

- Include a web address and email address for your business if available.

- Describe your business activity in detail in the space provided.

- Check all boxes that apply to the type of business activities you engage in, such as retail sales, professional services, manufacturing, etc.

- Fill in the number of employees, square feet occupied, and the number of parking spaces available.

- Indicate the former use of the business address if applicable.

- Select the type of ownership for your business and provide additional information such as state of incorporation, license numbers, and expiration dates as required.

- Under the section for owners, partners, or corporate officers, enter full names, titles, social security numbers, home addresses (no P.O. Boxes), phone numbers, cell phone numbers, and driver’s license numbers. Attach an additional sheet if more space is needed.

- In the emergency contact section, enter the name, title, phone number, cell phone number, and address of the person to contact. Attach another sheet if more space is needed.

- If applicable, provide the name, phone number, and address of your alarm company.

- Carefully review the amount due section, including gross receipts, number of rental units, tax due, penalty, fire inspection fee, and the State Disability Access Fund fee.

- Sign and date the form, certifying that all provided information is true, correct, and complete. Include your title next to your signature.

- Prepare a check for the total amount due, made payable to the City of Inglewood, and send the completed application along with the check to the provided address.

Following these detailed steps ensures that your Pay Business Tax Certificate form is filled out correctly and submitted properly. This process is crucial for fulfilling your legal obligations and ensuring your business operates in compliance with local taxation laws.

Understanding Pay Business Tax Certificate

Frequently Asked Questions about the Pay Business Tax Certificate Form

What is the purpose of the Pay Business Tax Certificate form?

The Pay Business Tax Certificate form is essential for businesses operating in the city of Inglewood, California. It's used to apply for or renew a Business Tax Certificate, necessary for legal operation within the city. This document helps ensure businesses comply with local tax regulations by declaring their activity types, gross receipts, and other vital information used to calculate their tax obligations.

Who needs to fill out this form?

Any business entity, whether new or existing, that undertakes commercial activities within Inglewood's jurisdiction must fill out this form. This includes corporations, limited liability companies, partnerships, sole proprietors, and trusts planning to operate a business location or conduct sales within the city limits. It's also required when there are changes in ownership, business address, or business name.

What are the deadlines for submitting this form?

All Gross Receipt taxes are due by the last day of February each year, and all Flat Rate taxes are to be paid by the last day of January. Submitting this form and making payments before these deadlines helps avoid penalties and ensures the business remains in good standing.

How can a business determine its tax obligations?

Tax obligations vary based on the nature and scale of the business operation. The form requires detailed information about business activities, number of employees, and square footage occupied. These details, alongside the classification between Gross Receipt taxes and Flat Rate taxes, help determine the specific financial obligations of a business. For accurate calculations and compliance, businesses may also consult with a tax advisor or the city's tax office.

What happens after the form is submitted?

Upon submission, the city reviews the application to ensure completeness and compliance with local zoning and business operation laws. The business may be subject to inspection or further inquiry. Once approved, the city issues a Business Tax Certificate, confirming the business's legality. This certificate must be displayed prominently at the place of business and renewed annually.

Are there additional resources for understanding disability access compliance?

Yes. Recognizing the importance of accessibility, the form lists several resources for business owners to understand and adhere to federal and state disability access laws. These include the Division of the State Architect, the Department of Rehabilitation, and the California Commission on Disability Access. These agencies provide valuable information on legal obligations and how to ensure spaces are accessible to everyone.

Common mistakes

When filling out the Pay Business Tax Certificate form for the City of Inglewood, it's crucial to provide accurate and complete information to avoid common errors that may lead to delays or penalties. Here are the top 10 mistakes people often make:

- Failing to renew the Business Tax Certificate annually. It's the responsibility of the business owner to remember that this certificate must be renewed each year to stay in compliance.

- Using a P.O. Box as the business location. The form explicitly requires a physical location and doesn't accept P.O. Boxes for the business location or the home addresses of owners, partners, or corporate officers.

- Not checking the appropriate status box for changes, such as a new business, change of owner, address, or business name, and home occupation.

- Leaving the description of business activity vague. A detailed description ensures the city understands the scope and scale of operations for tax and zoning purposes.

- Forgetting to check all relevant boxes under the type of business activity, such as retail sales, wholesale, professional services, etc., which could affect tax rates and compliance requirements.

- Miscalculating the number of employees, square footage, or parking spaces. These figures play a critical role in determining the amount of tax due and the allocation of city resources.

- Omitting ownership information or the respective entity type, such as corporation, partnership, or sole proprietorship. Lack of clarity about the business's legal structure can complicate tax processing.

- Overlooking to provide or incorrect entering of license and ID numbers, including state license number, resale number, federal ID, and state ID, which are essential for verifying the business's legitimacy and tax obligations.

- Not attaching additional sheets when necessary for listing all owners, partners, or corporate officers and emergency contacts. This omission could lead to incomplete records, affecting contactability and legal compliance.

- Incorrect calculation of taxes due, penalties, or other fees. Misunderstanding the fiscal responsibilities can result in underpayment, penalties, or delays in the issuance of the Business Tax Certificate.

Compliance with these details ensures a smoother process in obtaining or renewing a Business Tax Certificate with the City of Inglewood. It's wise to double-check the application for accuracy before submission to avoid common pitfalls.

Documents used along the form

When managing and organizing a business, especially when dealing with aspects like paying business taxes, it's crucial to be aware of and understand other forms and documents that are often needed alongside the Pay Business Tax Certificate form. These documents not only help in complying with legal requirements but also in ensuring that your business operates smoothly. Below is a list of other essential forms and documents frequently used in conjunction with the Pay Business Tax Certificate form. Each plays a significant role in the broader scope of business administration and compliance.

- Employer Identification Number (EIN) Confirmation Letter: This is an official letter from the IRS confirming the unique nine-digit number assigned to a business entity for tax purposes. It’s essential for tax reporting and is often required when opening a business bank account.

- Business License Application: This form initiates the process of obtaining a legal permit to operate your business in a particular municipality or county. It varies by location and type of business activity.

- Zoning Compliance Form: This document verifies that the location of your business complies with local zoning laws. It's crucial for ensuring that your business activity is allowed in the proposed location.

- Sales Tax Permit: If your business sells goods or provides taxable services, this permit is essential for collecting, reporting, and paying sales tax. The requirements and application process vary by state.

- Fire Department Permit: Depending on your business type and location, a permit from the fire department might be necessary to ensure that your business complies with fire safety regulations. It’s important for businesses that see a high volume of public foot traffic or use flammable materials.

- Certificate of Occupancy: This document certifies that your business premise meets building codes and zoning laws. It's usually required for businesses operating from commercial or industrial spaces and must be obtained before the space is used.

Understanding and securing these documents can be just as critical as obtaining the Pay Business Tax Certificate itself. Each plays a pivotal role in ensuring that your business is legally compliant and set up for success. While the process may seem complex, staying informed about what documents and forms are necessary will help you navigate the bureaucratic waters with more ease and confidence.

Similar forms

The "Business License Application" form is a close relative of the Pay Business Tax Certificate. Both serve as essential steps for legitimizing a business in the eyes of local governments. The Business License Application typically encapsulates more thorough information regarding the business operations, ownership, and specific permits needed, in addition to the tax registration requirements found in the Pay Business Tax Certificate form. Moreover, this process is crucial in ensuring that all businesses operate within the legal framework set by the municipality or city.

Similar to the Pay Business Tax Certificate, the "Employer Identification Number (EIN) Application" is another mandatory document for new businesses. The IRS uses the EIN to identify business entities for tax purposes. While the Pay Business Tax Certificate focuses on local tax obligations, the EIN application is about federal taxes, yet both are fundamental in the fiscal structure of a business, ensuring compliance with tax regulations at different government levels.

The "Sales Tax Permit" form shares similarities with the Pay Business Tax Certificate, especially for businesses involved in retail or wholesale. This permit allows businesses to collect sales tax on transactions, as mandated by state law. The process of acquiring a Sales Tax Permit underscores a business's commitment to adhering to state tax collection laws, paralleling the local tax compliance demonstrated through the Business Tax Certificate.

"Zoning Permit Applications" are also akin to the Pay Business Tax Certificate in terms of ensuring a business's operations align with local regulations. Zoning permits focus on the physical location and type of activities conducted, ensuring they meet the area's zoning requirements. This process complements the Business Tax Certificate by validating the appropriateness of the business's location in addition to its fiscal responsibilities.

The "Fire Department Permit" process is related to the Pay Business Tax Certificate since both involve ensuring safety and compliance from a business. While the Business Tax Certificate deals with financial and operation legality, Fire Department Permits ensure that the business meets fire safety standards, protecting both the premises and patrons. These permits often are required for businesses that deal with flammable materials, host large public gatherings, or operate in particular industries.

A "Certificate of Occupancy" is necessary for businesses to confirm their premises are suitable for their intended use, mirroring the purpose of the Pay Business Tax Certificate in establishing a business's legitimacy. While the Certificate of Occupancy focuses on building and safety codes compliance, the Business Tax Certificate verifies the business’s right to operate within a specific jurisdiction, both aiming to ensure public safety and order.

Another document akin to the Pay Business Tax Certificate is the "DBA (Doing Business As) Filing." This document is essential for businesses operating under a name different from their legal entity name. Like the Business Tax Certificate, which legitimizes a business in its locality for tax purposes, the DBA filing legally establishes the business's operating name, a crucial step in brand identity and legal transactions.

The "Home Occupation Permit" parallels the Pay Business Tax Certificate for businesses operating out of residential areas. This permit ensures that home-based businesses comply with local zoning and operational standards, limiting potential disruptions in residential neighborhoods. It works hand-in-hand with the Business Tax Certificate to authorize and regulate the operation of home-based businesses at the local level.

"Environmental Permits" are necessary for businesses that may impact air, water, and land. They are analogous to the Pay Business Tax Certificate as they ensure that the business's operations comply with environmental protection regulations. Such permits are indicative of a business's adherence to sustainable and eco-friendly practices, aligning with the Business Tax Certificate's role in confirming legal and accountable business operations.

Lastly, "Health Department Permits" serve a purpose akin to that of the Pay Business Tax Certificate for businesses involved in food service, beauty, health, and certain other sectors. These permits confirm that the establishment meets health and sanitation standards critical for public safety. Like the Business Tax Certificate, they are a testament to the business's commitment to operating within the legal and regulatory frameworks that safeguard community well-being.

Dos and Don'ts

When completing the Pay Business Tax Certificate form for the City of Inglewood, there are crucial steps to follow to ensure the process is carried out correctly, and common missteps to avoid. Here is a guide on what to do and what not to do.

Things You Should Do:

Provide accurate and detailed information about your business activity to ensure proper classification and taxation.

Check the correct box to indicate if your application is for a New Business, Change of Owner, Change of Address, Change of Business Name, or Home Occupation.

Ensure that the Business Location address is not a P.O. Box, as physical addresses are required for the registration of your business.

Include all relevant owner, partner, or corporate officer information, including additional sheets if necessary, to comply with city regulations.

Sign and date the form under the certification that all provided information is true, correct, and complete, as this is a declaration under penalty of perjury.

Things You Shouldn't Do:

Do not leave any required fields blank. Incomplete forms may lead to processing delays or outright denial of your Business Tax Certificate.

Avoid guessing on details about your business activities or classification—incorrect information can lead to improper taxation or legal issues.

Do not use a P.O. Box as your business or home address for owners, partners, or corporate officers, as a physical address is necessary for registration and contacts.

Refrain from omitting the emergency contact information. This is crucial for the city to have in case of an urgent situation involving your business.

Avoid late submission of your application and payment. Note the delinquency dates to prevent penalties: last day of February for Gross Receipt taxes and last day of January for Flat Rate taxes.

Misconceptions

Dealing with a Pay Business Tax Certificate can often be intertwined with misunderstandings and misconceptions. Here's a closer look at some of the common misunderstandings surrounding this crucial document and what you should know to navigate the process more effectively.

Only physical stores need a Business Tax Certificate. A wide misconception is that online businesses or those operating from home do not need to register for a Business Tax Certificate. However, any form of business, including home occupations, online stores, and freelance ventures, must comply with local tax registration requirements, regardless of their physical presence.

It’s a one-time requirement. Contrary to what some might think, obtaining a Business Tax Certificate is not a one-off task. Business owners must renew it annually to stay in compliance. The renewal deadlines, often at the end of January or February depending on the tax structure, are critical dates that can't be ignored.

Rental businesses are exempt. Whether you’re renting out commercial or residential properties, your business falls under the scope requiring a Business Tax Certificate. Overlooking the need to register rental activities can lead to penalties.

The form is only for collecting tax information. While tax information is a substantial part of the application, the form also gathers comprehensive data about your business, including its physical and mailing address, ownership type, and emergency contacts, highlighting its multifaceted purpose beyond just tax collection.

Filling out the application once is enough. Changes in your business, like a new owner, change of address, or a shift in business activity, necessitate updating your Business Tax Certificate. Keeping your certificate in line with your current business operations is essential for legal compliances.

No need to detail business activities. It's essential to describe your business activities in detail when applying for a Business Tax Certificate. This ensures that the information reflects your business accurately and aids in determining the correct tax rate and compliance with zoning rules.

Penalties for late payment are negotiable. Taxes are due by specific deadlines (end of February for Gross Receipt taxes and end of January for Flat Rate taxes), and penalties for late payments are standard. Assuming that these penalties could be easily waived or reduced without proper justification can lead to unexpected financial burdens.

Information on disability access is optional. Compliance with federal and state disability access laws is a crucial aspect of your application. The form directs business owners to resources for understanding their legal obligations regarding accessibility, underscoring the importance of this information, not only for legal compliance but for fostering inclusivity.

Navigating the complexities of a Pay Business Tax Certificate doesn't have to be a daunting task. Armed with the right information and an understanding of common misconceptions, business owners can ensure they remain compliant while concentrating on growing their businesses.

Key takeaways

When you're preparing to fill out the Pay Business Tax Certificate form for the City of Inglewood, there are several important considerations to keep in mind. This document is essential for ensuring your business operates legally within the city. Here are key takeaways that can guide you through the process:

- Ensure you renew your Business Tax Certificate annually. Compliance with the renewal cycle is crucial as this certificate is required to legally conduct business in Inglewood.

- Be aware of the deadlines for tax payments: Gross Receipt taxes must be paid by the last day of February, and Flat Rate taxes by the last day of January. Late payments can lead to penalties.

- Provide clear and detailed information about your business when filling out the form. This includes specifying the type of business activity, number of employees, square footage occupied, and other relevant details that affect tax computation and zoning regulations.

- Mark the appropriate changes if your business undergoes any significant changes like ownership change, address change, or a change in the business name. Updating this information is essential for maintaining accurate records and compliance.

- Understanding your tax obligations depends on the nature of your business. The form categorizes businesses into various types (e.g., Retail Sales, Manufacturing, Professional Services), and your tax rate may vary accordingly.

- Include accurate and up-to-date contact information for owners, partners, or corporate officers. This information is crucial for communication and any necessary follow-up regarding your business tax certificate.

- The application must be certified under penalty of perjury, emphasizing the importance of providing true, correct, and complete information. Any discrepancy or omission can result in legal complications.

- Remember, compliance with federal and state disability access laws is mandatory for buildings open to the public. The form reminds applicants of their obligations and provides resources for obtaining more information.

Fulfilling your business tax obligations in the City of Inglewood requires careful attention to the details specified on the Pay Business Tax Certificate form. By adhering to these guidelines, you can help ensure your business operates smoothly and remains in good standing within the community.

Popular PDF Documents

Faa 8050-2 - This form must be filled out in ink and signed by the seller or an authorized representative to be considered valid.

Ho-chunk Nation per Capita Payments 2023 - The Per Capita Pledge Agreement section mandates that any future per capita distributions may be used as collateral if the advance becomes delinquent, safeguarding the nation's financial interests.

Sba 1201 Loan Forgiveness - Offers flexibility in payment type, accommodating both cash and check payments to suit employer preferences.