Get Parent Plus Loan Form

Navigating the process of securing financial aid for a child's education, parents find the 2021-2022 Federal Direct Parent (PLUS) Loan Request Form for Blue Ridge Community College a critical step. This comprehensive form not only facilitates the application for funds to cover educational expenses but also outlines a series of steps essential for eligibility and approval. Initially, it necessitates the completion of the Free Application for Federal Student Aid (FAFSA) to determine one's eligibility for the loan, requiring the inclusion of BRCC’s school code. Subsequently, an application for an online credit decision must be submitted, involving a credit check by the Department of Education to ascertain the borrower's eligibility. Importantly, alongside this application, the parent must complete a Master Promissory Note (MPN), which is a legally binding agreement to repay the loan under its terms. Finally, the form details the mandatory submission of the BRCC Loan Request Form, a crucial step for the college to process the loan. This document also provides vital information, such as loan disbursement details, the impact of a credit check denial, and options regarding loan repayment start times. It emphasizes the importance of submission instructions and borrower certification, ensuring parents are fully informed about the procedures and commitments involved in applying for a PLUS loan.

Parent Plus Loan Example

Blue Ridge Community College

Application Instructions:

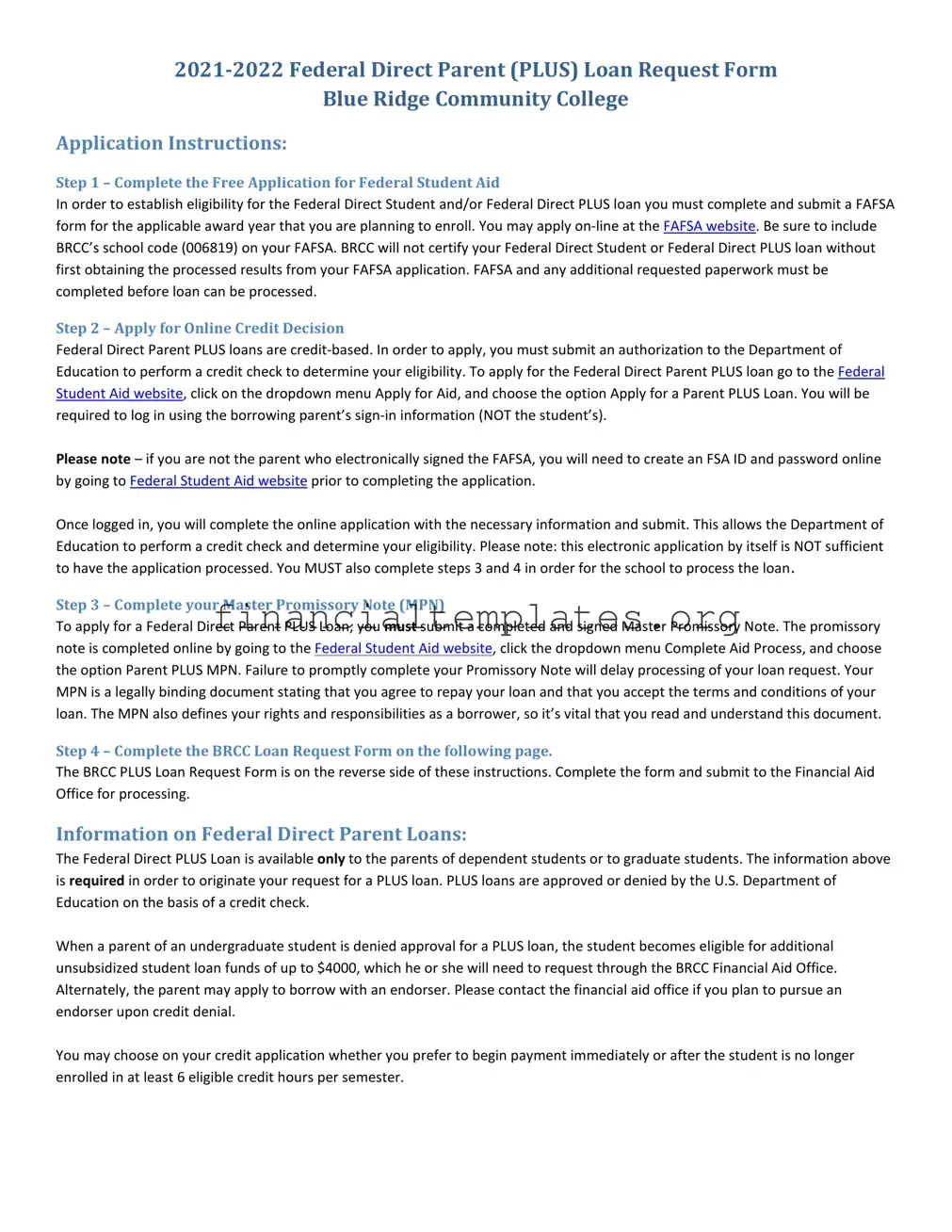

Step 1 – Complete the Free Application for Federal Student Aid

In order to establish eligibility for the Federal Direct Student and/or Federal Direct PLUS loan you must complete and submit a FAFSA form for the applicable award year that you are planning to enroll. You may apply

Step 2 – Apply for Online Credit Decision

Federal Direct Parent PLUS loans are

Please note – if you are not the parent who electronically signed the FAFSA, you will need to create an FSA ID and password online by going to Federal Student Aid website prior to completing the application.

Once logged in, you will complete the online application with the necessary information and submit. This allows the Department of Education to perform a credit check and determine your eligibility. Please note: this electronic application by itself is NOT sufficient to have the application processed. You MUST also complete steps 3 and 4 in order for the school to process the loan.

Step 3 – Complete your Master Promissory Note (MPN)

To apply for a Federal Direct Parent PLUS Loan, you must submit a completed and signed Master Promissory Note. The promissory note is completed online by going to the Federal Student Aid website, click the dropdown menu Complete Aid Process, and choose the option Parent PLUS MPN. Failure to promptly complete your Promissory Note will delay processing of your loan request. Your MPN is a legally binding document stating that you agree to repay your loan and that you accept the terms and conditions of your loan. The MPN also defines your rights and responsibilities as a borrower, so it’s vital that you read and understand this document.

Step 4 – Complete the BRCC Loan Request Form on the following page.

The BRCC PLUS Loan Request Form is on the reverse side of these instructions. Complete the form and submit to the Financial Aid Office for processing.

Information on Federal Direct Parent Loans:

The Federal Direct PLUS Loan is available only to the parents of dependent students or to graduate students. The information above is required in order to originate your request for a PLUS loan. PLUS loans are approved or denied by the U.S. Department of Education on the basis of a credit check.

When a parent of an undergraduate student is denied approval for a PLUS loan, the student becomes eligible for additional unsubsidized student loan funds of up to $4000, which he or she will need to request through the BRCC Financial Aid Office. Alternately, the parent may apply to borrow with an endorser. Please contact the financial aid office if you plan to pursue an endorser upon credit denial.

You may choose on your credit application whether you prefer to begin payment immediately or after the student is no longer enrolled in at least 6 eligible credit hours per semester.

Complete this form and submit it to the Financial Aid Office as soon as possible. Incomplete forms will be returned unprocessed. If you do not know your 7 digit Student ID number, see How to Look Up Emplid.

A. Parent Applicant Information

Last Name: ______________________________ First Name: ______________________________ Middle Initial: ______

Date of Birth: ___________________ Phone Number: ____________________________

Street Address: __________________________________________________________________________

City: __________________________________ State: ______ Zip: ______________

Email Address: _________________________________________________________________________________

Gender: ☐ Male ☐ Female ☐ Other Relationship to Student: __________________________________

Marital Status: ☐ Single |

☐ Married ☐ Divorced ☐ Separated ☐ Widowed |

Are you a U.S. Citizen? ☐ |

Yes ☐ No If not, what is your current citizenship status? ___________________________ |

*If you are the parent borrower and your SSN is not listed on the FAFSA, please contact the Financial Aid Office by telephone, mail, or in person to provide your full SSN. Never send your full SSN by email.

B. Student Information

Last Name: |

____________________________ |

First Name: ________________________ |

Middle Initial: ____ |

Student ID: |

____________________________ |

Date of Birth: ___________________ Phone Number: _________________________ |

|

C. Semester:

I am requesting to borrow for the following term(s):

☐ Fall and Spring ☐ Fall Semester Only ☐ Spring Semester Only ☐ Summer Semester Only

D. Loan Information

Loan Amount Requested: _________________________

Important Information about Loans

•Loan amount borrowed will be reduced by up to 4.2% in loan origination fees.

•Loans borrowed for a single term will be disbursed in 2 disbursements, the first of which will be at the normal time for financial aid disbursement and the second of in the final third of the semester. A fall spring loan will be divided into half, with half disbursing in the fall and half in the spring.

•Submission of request form does not guarantee loan eligibility nor does it guarantee that eligible students will receive the full amount.

C.Checklist and Certification – Check each item below once you have completed it

☐FAFSA Completed

☐Credit Check Completed *

☐Master Promissory Note Completed *

☐All fields on this form completed

☐Student enrolled in at least 6 eligible credit hours for the term you are borrowing for.

* Credit Check and Master Promissory Note must be completed electronically at the Federal Student Aid website.

BORROWER CERTIFICATION:

I authorize the Financial Aid Office at Blue Ridge Community College to forward my request for the Direct Loan indicated above. In order to complete the loan process, I understand that I must have signed the appropriate promissory note electronically at https://studentaid.gov. I authorize the College to transfer loan proceeds received by electronic funds (EFT) or Master Check to Student Financial Services to pay for ALL incurred expenses. Incurred expenses can include but are not limited to tuition, fees, books, supplies, and other miscellaneous fees.

Borrower’s Signature__________________________________________________________ Date: _____________________

Please return your completed form in one of the following ways: Electronic: Upload to

at DropSecure. Note: Forms must be physically signed with a pen or drawn using the “fill and sign” option on the PDF. TYPED SIGNATURES ARE NOT ACCEPTED. Fax to

Document Specifics

| Fact Name | Description |

|---|---|

| FAFSA Requirement | To be eligible for a Federal Direct Parent PLUS loan, completing and submitting a FAFSA for the relevant award year is mandatory. |

| Credit-Based Application | The Federal Direct Parent PLUS loans require a credit check by the Department of Education to determine eligibility. |

| Master Promissory Note (MPN) | An MPN must be completed and signed online, agreeing to the loan's terms, to apply for a Federal Direct Parent PLUS Loan. |

| Submission Instructions | The form, along with completed FAFSA, credit check, and MPN, must be submitted to the BRCC Financial Aid Office for the loan request to be processed. |

Guide to Writing Parent Plus Loan

Applying for a Parent Plus Loan involves a series of steps to ensure that financial support for your child's education is in place. This process, while it may initially seem complicated, is broken down into manageable parts to help parents apply for the Federal Direct Parent (PLUS) Loan. It's important for parents to understand that these steps are designed not only to determine their eligibility for the loan but also to establish the terms of repayment. Following these steps carefully is crucial for a successful application.

Steps for Filling Out the Parent Plus Loan Form:

- Start by completing the Free Application for Federal Student Aid (FAFSA) online. Visit the FAFSA website and be sure to include Blue Ridge Community College's school code (006819) on your application. The completion of a FAFSA form is necessary to establish eligibility for the loan.

- Apply for an online credit decision. Go to the Federal Student Aid website, select "Apply for Aid" from the dropdown menu, and then choose the option "Apply for a Parent PLUS Loan." You will need to log in with the borrowing parent's information. If you were not the parent who signed the FAFSA electronically, you must first create an FSA ID and password on the Federal Student Aid website.

- Complete your Master Promissory Note (MPN) online. Navigate to the Federal Student Aid website, click on the dropdown menu "Complete Aid Process," and select "Parent PLUS MPN." The MPN is a legal document where you agree to the terms of the loan and promise to repay it. Pay close attention to the rights and responsibilities outlined in this document.

- Fill out the BRCC PLUS Loan Request Form, which can be found on the reverse side of the loan instruction sheet. Once completed, submit this form to the Financial Aid Office at Blue Ridge Community College for processing. Make sure all sections are filled out to avoid delays.

Upon completion, the financial aid office will proceed with your loan request based on the information provided. Remember that approval is subject to a credit check by the U.S. Department of Education. In cases where a loan application is denied, students may become eligible for additional unsubsidized student loans. Additionally, payment options on the loan can be selected to begin immediately or deferred until the student is no longer enrolled in at least 6 credit hours per semester. Following these steps thoroughly will ensure that you successfully navigate the application process for a Parent Plus Loan.

Understanding Parent Plus Loan

Welcome to our FAQ section on the Federal Direct Parent (PLUS) Loan. Here, we aim to provide clear and helpful answers to common questions you might have about the Parent PLUS Loan form, especially in relation to the 2021-2022 application instructions from Blue Ridge Community College.

What is the first step in applying for a Parent PLUS Loan?

The first step is to complete the Free Application for Federal Student Aid (FAFSA) for the appropriate award year of enrollment. Make sure to include Blue Ridge Community College's school code (006819) on your FAFSA. This step is vital as the school cannot certify your loan without the processed FAFSA results. The FAFSA serves as the foundation of determining your eligibility for federal student loans, including the PLUS loan.

How do I apply for a credit decision for a Parent PLUS Loan?

To apply for a Parent PLUS Loan, you must authorize the Department of Education to perform a credit check. This is done by visiting the Federal Student Aid website, navigating to the "Apply for Aid" dropdown menu, and selecting "Apply for a Parent PLUS Loan." Use the borrowing parent’s sign-in information to log in and complete the application. Remember, if you aren't the parent who signed the FAFSA electronically, you will need to create an FSA ID and password before applying.

What is a Master Promissory Note (MPN), and why is it important?

An MPN is a legal document in which you commit to repaying your loan along with any accrued interest and fees. It also outlines the terms and conditions of your loan. Completing your MPN is critical as it symbolizes your agreement to the loan's terms and is required to proceed with the loan application process. You can complete this online by visiting the Federal Student Aid website and following the steps provided for Parent PLUS MPN under the "Complete Aid Process" menu.

What happens after submitting the online credit application?

Submitting the online credit application alone does not complete the loan application process. You must also submit the completed BRCC PLUS Loan Request Form to the Financial Aid Office and ensure that all other necessary paperwork is duly filled and submitted. These steps are essential for the school to process your loan successfully.

What should I do if my application for a PLUS loan is denied?

If a parent’s application for a PLUS loan is denied, the dependent student may become eligible for additional unsubsidized student loan funds, up to $4000. The student needs to request these funds through the BRCC Financial Aid Office. Alternatively, parents may seek to borrow with an endorser. An endorser is someone who agrees to repay the loan if you cannot. It’s important to contact the financial aid office for guidance on pursuing an endorser option.

When can I start repaying the Parent PLUS Loan?

You have the option to start repayment either immediately or after the student is no longer enrolled in at least 6 eligible credit hours per semester. This choice can be made during the credit application process, allowing some flexibility based on your financial situation.

What are the loan fees associated with the Parent PLUS Loan?

The amount you request to borrow will be reduced by up to 4.2% in loan origination fees. This means if you request a certain amount, the actual amount disbursed after the deduction of fees will be slightly less. It’s important to take this into consideration when determining the loan amount you need to cover educational expenses.

Does completing the PLUS loan request form guarantee that I will receive the loan?

No, completing the request form does not guarantee loan eligibility nor does it assure that eligible students will receive the full requested amount. Eligibility for federal loans depends on several factors including financial need, credit approval, and other federal aid requirements.

Should you have more questions or need assistance, please don't hesitate to contact the Blue Ridge Community College Financial Aid Office directly at 540-453-2301.

Common mistakes

Not completing the Free Application for Federal Student Aid (FAFSA) first is a common mistake. The FAFSA form is a prerequisite for the Federal Direct Student and/or Federal Direct PLUS loan eligibility. Without submitting a FAFSA form for the applicable award year, parents may find themselves ineligible for the loan.

Failing to include the school code on the FAFSA can lead to delays. Blue Ridge Community College's (BRCC) school code (006819) is essential for the college to certify any Federal Direct Student or Federal Direct PLUS loans.

Skipping the online credit decision application is another oversight. For a Federal Direct Parent PLUS loan, an authorization to the Department of Education to perform a credit check is necessary. This step is crucial to determine eligibility for the loan.

Using the student’s sign-in information instead of the borrowing parent’s during the application process can cause complications. Parents need to use their own FSA ID and password to submit the application correctly.

Delaying the completion of the Master Promissory Note (MPN) can postpone the loan request processing. The MPN is a legally binding document that outlines the borrower's agreement to repay the loan along with the terms and conditions.

Submitting an incomplete BRCC PLUS Loan Request Form can lead to the form being returned unprocessed. Ensuring all fields are filled accurately is critical for the application to move forward.

Choosing not to check the student’s enrollment in at least 6 eligible credit hours for the term the loan is being borrowed for can affect the loan approval. Verification of the student’s enrollment status is a necessary step in the loan process.

Ignoring the loan origination fees and how they reduce the final loan amount received is a common oversight. An understanding that the loan amount will be reduced by up to 4.2% in loan origination fees is important for accurate financial planning.

Documents used along the form

When applying for a Federal Direct Parent (PLUS) Loan, there are several documents and forms that play crucial roles in the application process, alongside the PLUS Loan request form itself. These documents are instrumental in establishing eligibility, defining terms, detailing borrower information, and ultimately, facilitating the loan acquisition and repayment process. Understanding these documents can make the application process smoother for both parents and students.

- Free Application for Federal Student Aid (FAFSA): A fundamental step in securing educational loans, the FAFSA evaluates a family's financial need and is a prerequisite for the Parent PLUS Loan application.

- Online Credit Decision Application: This is where parents authorize the Department of Education to perform a credit check, which is a critical step in determining eligibility for the Parent PLUS Loan.

- Master Promissory Note (MPN): The MPN is a legal document in which the borrower agrees to repay the loan. It outlines the loan's terms and conditions, including interest rates and repayment schedules.

- Loan Request Form Specific to Institution: Similar to the BRCC Loan Request Form, this document varies by institution and captures specific loan amount requests and borrower details relevant to the school.

- Student Aid Report (SAR): Received after submitting the FAFSA, the SAR summarizes the information submitted and indicates the Expected Family Contribution (EFC), which is used to determine loan eligibility.

- Endorser Addendum: If a Parent PLUS Loan application is denied due to credit issues, an endorser (co-signer) can support the application, and this document is used to record their agreement.

- Annual Credit Report: Although not directly part of the PLUS Loan application, reviewing one’s annual credit report can be beneficial before applying, to understand and possibly improve credit standings.

- Credit Appeal Documentation: If a Parent PLUS Loan is initially denied due to an adverse credit history, parents have the opportunity to appeal the decision by providing documentation of extenuating circumstances.

- Direct PLUS Loan Entrance Counseling: This online session is required for first-time PLUS Loan borrowers to ensure they understand the responsibilities and obligations they are undertaking.

- Income-Driven Repayment Plan Request: For parents who might need to adjust their repayment plan based on income, this form allows them to apply for such adjustments, ensuring the loan remains in good standing.

Collectively, these documents ensure that both the borrower and the lender are informed about the terms of the loan, and they establish a clear pathway to repayment. Familiarity with each of these forms and documents can significantly ease the procedure of obtaining a Parent PLUS Loan, empowering parents to make educated decisions in support of their child's education.

Similar forms

The Parent Plus Loan form, much like a credit card application, necessitates the applicant's consent to a credit check. This step is vital for financial institutions to assess the applicant's creditworthiness before approving the loan or credit card. Both documents require detailed personal and financial information, ensuring that the institution can make an informed decision based on the applicant's credit history and financial stability.

Similar to a mortgage application, the Parent Plus Loan form involves a thorough review of the applicant's financial background to determine eligibility for a loan. In both cases, the applicant must provide comprehensive financial information and agree to have their credit history reviewed. The purpose is to ascertain the applicant's ability to repay the loan, whether it's aimed at acquiring a home or financing a child's education.

The Master Promissory Note (MPN) within the Parent Plus Loan process shares similarities with a car loan agreement. Both are legally binding documents that outline the terms and conditions of the loan, including repayment obligations, interest rates, and the repercussions of default. Applicants must sign these documents to acknowledge their understanding of the responsibilities and commitments involved in taking out the loan.

The Parent Plus Loan form and a rental application both require the applicant to provide personal and financial information to assess their ability to fulfill financial commitments. While the former focuses on determining the parent's eligibility to borrow funds for their child's education, the latter assesses a potential tenant's capability to pay rent. Despite their different purposes, both processes involve evaluating financial reliability and stability.

Completing the Free Application for Federal Student Aid (FAFSA) as part of the Parent Plus Loan application mirrors the process of applying for unemployment benefits. Both require the submission of detailed personal and financial information to a governmental body to determine eligibility for financial support. The underlying principle in both is the assessment of the applicant's need and qualification for financial assistance.

The procedure of applying for a Parent Plus Loan, which includes submitting a loan request form, is akin to the process of applying for a personal loan at a bank. In both instances, the applicant must fill out forms that detail their financial status and loan requirement, followed by a credit check to evaluate their creditworthiness. These steps are critical in determining whether the applicant is eligible for the loan they are seeking.

The completion and submission of a Parent Plus Loan request form bear resemblance to the paperwork involved in securing a health insurance policy. Applicants must provide comprehensive information, including personal details and financial status, in both scenarios. The objective is to ascertain eligibility—either for a loan to finance education or for coverage that meets the individual’s health care needs. In each case, the information provided forms the basis for the approval process.

Filing a Parent Plus Loan form is reminiscent of the process involved in applying for a government grant. Both require the applicant to meticulously supply personal and financial information, which is then reviewed by the respective authorities to determine eligibility. While the specific purposes differ—one aims to secure funding for education, and the other seeks financial assistance for a project or need—they share the foundational process of evaluating eligibility based on provided information.

Dos and Don'ts

When it comes to filling out the Federal Direct Parent (PLUS) Loan Request Form, it is essential to approach the process with a clear understanding of the steps involved. Here’s a guide on what parents should and shouldn't do to ensure a smooth application process:

- Do complete the Free Application for Federal Student Aid (FAFSA) before applying for a Parent PLUS Loan. Since eligibility for the PLUS loan is partly determined based on FAFSA information, this step is crucial.

- Don't use the student's sign-in information when applying for the Parent PLUS loan on the Federal Student Aid website. Use the borrowing parent’s credentials unless you are the parent who electronically signed the FAFSA, in which case you may need to create an FSA ID and password.

- Do apply for a credit decision online by authorizing the Department of Education to perform a credit check. This is necessary to determine your eligibility for the loan.

- Don't assume filling out the electronic application is enough to process your loan. One must also complete the Master Promissory Note (MPN) and the BRCC Loan Request Form to have the loan processed by the school.

- Do complete your Master Promissory Note (MPN) promptly. Delay in completing your MPN can result in the processing of your loan request being delayed.

- Don't forget to provide your full Social Security Number (SSN) if it wasn't listed on the FAFSA. However, for security purposes, never send your SSN via email. Contact the Financial Aid Office through safer means like telephone, mail, or in person.

- Do ensure all sections of the BRCC Loan Request Form are completed and submit it to the Financial Aid Office as directed. Incomplete forms will be returned unprocessed, leading to potential delays in loan disbursement.

- Don't neglect the terms of repayment. Whether you choose to begin repayment immediately or defer until after the student drops below half-time enrollment, it’s important to plan ahead for repayment to avoid future financial difficulties.

Taking these do’s and don’ts into account can help streamline the application process for a Parent PLUS Loan, making it less stressful for both parents and students. Always remember to double-check all paperwork for accuracy and completeness before submission.

Misconceptions

There are several misconceptions surrounding the Federal Direct Parent (PLUS) Loan process that can lead to confusion for applicants. Here's a concise explanation to clear up some of these common misunderstandings:

The FAFSA requirement is optional for Parent PLUS loans: This is incorrect. Completing the Free Application for Federal Student Aid (FAFSA) is a mandatory step for determining eligibility for a Parent PLUS loan. Without submitting a FAFSA, the loan request cannot be processed.

Any parent can apply for a Parent PLUS loan regardless of their relationship to the student: Only biological or adoptive parents (and, in some cases, stepparents) of a dependent undergraduate student are eligible to apply. Guardians or relatives who do not fit these criteria cannot apply for this loan.

Credit checks are only a formality: In fact, the credit check for a Parent PLUS loan is a critical part of the application process. The U.S. Department of Education evaluates the borrower’s credit for adverse history, and approval or denial is based on this assessment.

Signing the Master Promissory Note (MPN) is all that's needed to process the loan: While completing the MPN is a crucial step, it is not sufficient on its own. The BRCC PLUS Loan Request Form must also be completed and submitted for the loan to be processed.

Repayment begins after the student graduates: Parents have the option to defer payments on the PLUS loan until after the student graduates or drops below half-time enrollment. However, interest accrues during this period, and parents can choose to make payments earlier to reduce the cost of the loan.

Loan amounts are flexible and can exceed the student's financial need: The amount a parent can borrow is limited to the cost of attendance minus any other financial aid received by the student. This ensures that the loan amount aligns with the actual educational expenses.

Parent PLUS loans cannot be transferred to the student: Legally, the responsibility for repaying a Parent PLUS loan lies with the parent who signed the MPN. The obligation cannot be transferred to the student under the loan's terms.

Approval for a Parent PLUS loan guarantees the full requested amount: Approval for a loan does not necessarily mean the parent will receive the full amount requested. The final loan amount can be influenced by the student's cost of attendance and any other financial aid awarded.

The endorser option is only for denied applicants: If a parent’s application for a PLUS loan is denied due to an adverse credit history, they may seek an endorser who does not have such a history to cosign the loan. However, considering an endorser can also be a strategy for parents who anticipate denial or who have been initially denied and do not wish to appeal the decision or document extenuating circumstances.

Understanding the terms, requirements, and conditions of the Parent PLUS loan process is crucial for ensuring a smooth application process and for making informed decisions about financing a student's education.

Key takeaways

Filling out and using the Federal Direct Parent (PLUS) Loan form involves a process that can help parents of dependent undergraduate students (or graduate students themselves) to borrow funds to cover education expenses. Here are key takeaways to guide applicants through this process:

- FAFSA First: Completing the Free Application for Federal Student Aid (FAFSA) is a mandatory first step. Applicants must include the school code for the institution where the student is enrolled or plans to enroll. Without FAFSA, the PLUS loan process cannot proceed.

- Credit Check: The Parent PLUS Loan requires a credit check. Applicants need to authorize the Department of Education to conduct this check by applying online. This step determines eligibility for the loan based on creditworthiness.

- Sign-In Information: It's important to use the borrowing parent’s sign-in information. If the parent applying has not electronically signed the FAFSA, they must first create an FSA ID and password.

- Master Promissory Note (MPN): Applicants must complete a Master Promissory Note (MPN) online. This legal document highlights the borrower's commitment to repay the loan along with terms and conditions, making understanding its contents crucial.

- School-Specific Forms: In addition to federal requirements, schools may have their own request forms, such as the BRCC PLUS Loan Request Form. Completing and submitting these forms to the financial aid office is typically necessary.

- Credit Denial Alternatives: If a parent is denied a PLUS loan due to credit reasons, the student may become eligible for additional unsubsidized student loan funds. Alternatively, parents can reapply with an endorser.

- Repayment Options: Borrowers can choose when to start repaying the loan—either immediately or after the student drops below half-time enrollment.

- Loan Fees and Disbursement: The loan amount will be reduced by origination fees, and the disbursement schedule may vary, especially for loans covering a single term.

Thoroughly completing and understanding each part of the application process is essential for securing a Parent PLUS loan. It's also important for borrowers to be aware of their rights and responsibilities as outlined in the Master Promissory Note.

Popular PDF Documents

Total Ordinary Dividends Vs Qualified Dividends - Details on integrating Form 2555 or 2555-EZ with the Qualified Dividends Tax Worksheet for individuals with foreign earned income.

Mortgage Modification Form - A contractual renegotiation aimed at adjusting mortgage rates and payments to accommodate changes in the borrower's financial situation.