Get Pagibig Multi Purpose Loan Form

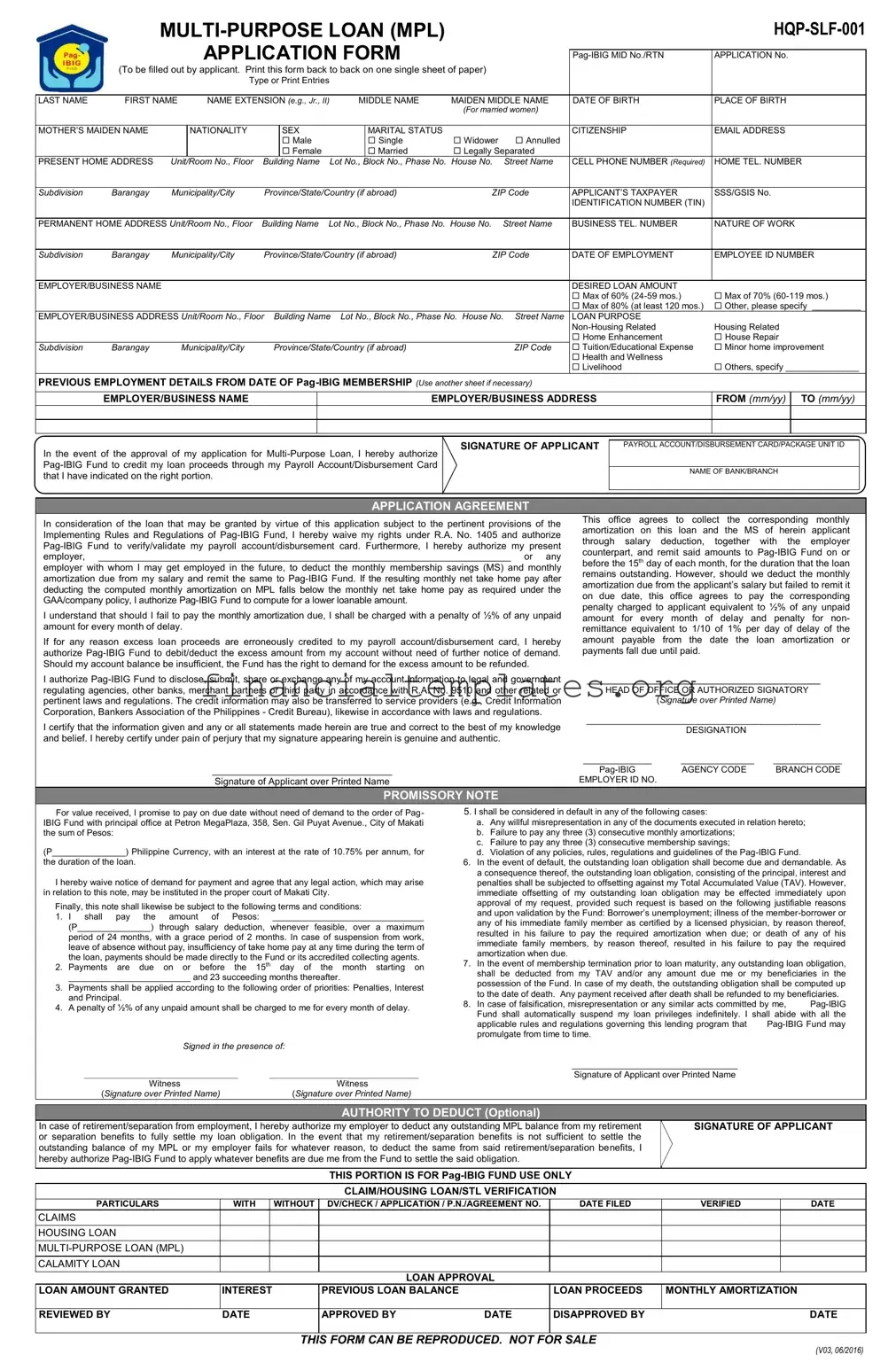

Navigating the intricacies of financial assistance through the Pag-IBIG Fund can seem daunting at first, yet understanding the Multi-Purpose Loan (MPL) Application Form is a critical step towards leveraging this valuable resource. The MPL, detailed in form HQP-SLF-001, offers a lifeline for members requiring immediate financial aid for various needs, from home repairs to educational expenses. Applicants are guided to meticulously fill in their personal information, loan purpose, and employment details, ensuring accuracy to avoid any delays in processing. The loan amount, determined by the member's contributions and length of membership, marks a flexible approach to borrowing, accommodating different financial capacities. The form also delves into repayment terms, emphasizing the commitment to making monthly amortizations through convenient methods like salary deductions. Importantly, it outlines the borrower's responsibilities, including consent for Pag-IBIG to verify account details and the consequences of defaulting on the loan. Prospective borrowers are reminded of the necessity of a thorough understanding of the form's content, as it lays the groundwork for a mutually beneficial agreement between the member and the Pag-IBIG Fund, ultimately aligning with the fund's mission to provide accessible financial assistance to its members.

Pagibig Multi Purpose Loan Example

|

||

APPLICATION FORM |

|

|

APPLICATION No. |

(To be filled out by applicant. Print this form back to back on one single sheet of paper)

|

|

|

|

Type or Print Entries |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

LAST NAME |

FIRST NAME |

|

NAME EXTENSION (e.g., Jr., II) |

MIDDLE NAME |

MAIDEN MIDDLE NAME |

DATE OF BIRTH |

PLACE OF BIRTH |

||||||||

|

|

|

|

|

|

|

|

|

|

|

(For married women) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

MOTHER’S MAIDEN NAME |

|

|

NATIONALITY |

|

SEX |

|

|

MARITAL STATUS |

|

CITIZENSHIP |

EMAIL ADDRESS |

||||

|

|

|

|

|

|

Male |

|

|

Single |

Widower |

Annulled |

|

|

|

|

|

|

|

|

|

|

Female |

|

|

Married |

Legally Separated |

|

|

|

||

PRESENT HOME ADDRESS |

Unit/Room No., Floor |

Building Name |

Lot No., Block No., Phase No. House No. |

Street Name |

CELL PHONE NUMBER (Required) |

HOME TEL. NUMBER |

|||||||||

|

|

|

|

|

|

|

|

|

|||||||

Subdivision |

Barangay |

Municipality/City |

Province/State/Country (if abroad) |

ZIP Code |

APPLICANT’S TAXPAYER |

SSS/GSIS No. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

IDENTIFICATION NUMBER (TIN) |

|

|

|

|

|

|

|

|

|

|

||||||||

PERMANENT HOME ADDRESS Unit/Room No., Floor |

Building Name |

Lot No., Block No., Phase No. House No. |

Street Name |

BUSINESS TEL. NUMBER |

NATURE OF WORK |

||||||||||

|

|

|

|

|

|

|

|

|

|||||||

Subdivision |

Barangay |

Municipality/City |

Province/State/Country (if abroad) |

ZIP Code |

DATE OF EMPLOYMENT |

EMPLOYEE ID NUMBER |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER/BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

DESIRED LOAN AMOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Max of 60% |

Max of 70% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Max of 80% (at least 120 mos.) |

Other, please specify __________ |

|

EMPLOYER/BUSINESS ADDRESS Unit/Room No., Floor Building Name |

Lot No., Block No., Phase No. House No. Street Name |

LOAN PURPOSE |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing Related |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Enhancement |

House Repair |

|

Subdivision |

Barangay |

|

Municipality/City |

Province/State/Country (if abroad) |

|

ZIP Code |

Tuition/Educational Expense |

Minor home improvement |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Health and Wellness |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Livelihood |

Others, specify _______________ |

|

PREVIOUS EMPLOYMENT DETAILS FROM DATE OF |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

EMPLOYER/BUSINESS NAME |

|

|

|

|

|

|

EMPLOYER/BUSINESS ADDRESS |

FROM (mm/yy) |

TO (mm/yy) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF APPLICANT

In the event of the approval of my application for

PAYROLL ACCOUNT/DISBURSEMENT CARD/PACKAGE UNIT ID

NAME OF BANK/BRANCH

APPLICATION AGREEMENT

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of the Implementing Rules and Regulations of

employer with whom I may get employed in the future, to deduct the monthly membership savings (MS) and monthly amortization due from my salary and remit the same to

I understand that should I fail to pay the monthly amortization due, I shall be charged with a penalty of ½% of any unpaid amount for every month of delay.

If for any reason excess loan proceeds are erroneously credited to my payroll account/disbursement card, I hereby authorize

This office agrees to collect the corresponding monthly amortization on this loan and the MS of herein applicant through salary deduction, together with the employer counterpart, and remit said amounts to

remains outstanding. However, should we deduct the monthly amortization due from the applicant’s salary but failed to remit it

on due date, this office agrees to pay the corresponding penalty charged to applicant equivalent to ½% of any unpaid amount for every month of delay and penalty for non- remittance equivalent to 1/10 of 1% per day of delay of the amount payable from the date the loan amortization or payments fall due until paid.

I authorize

I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge and belief. I hereby certify under pain of perjury that my signature appearing herein is genuine and authentic.

__________________________________

Signature of Applicant over Printed Name

_________________________________________

HEAD OF OFFICE OR AUTHORIZED SIGNATORY

(Signature over Printed Name)

________________________________________________

|

DESIGNATION |

|

______________ |

_______________ |

______________ |

AGENCY CODE |

BRANCH CODE |

|

EMPLOYER ID NO. |

|

|

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of Pag- IBIG Fund with principal office at Petron MegaPlaza, 358, Sen. Gil Puyat Avenue., City of Makati the sum of Pesos:

(P_______________) Philippine Currency, with an interest at the rate of 10.75% per annum, for

the duration of the loan.

I hereby waive notice of demand for payment and agree that any legal action, which may arise in relation to this note, may be instituted in the proper court of Makati City.

Finally, this note shall likewise be subject to the following terms and conditions:

1.I shall pay the amount of Pesos: _______________________________

(P_______________) through salary deduction, whenever feasible, over a maximum period of 24 months, with a grace period of 2 months. In case of suspension from work, leave of absence without pay, insufficiency of take home pay at any time during the term of the loan, payments should be made directly to the Fund or its accredited collecting agents.

2.Payments are due on or before the 15th day of the month starting on

_________________________ and 23 succeeding months thereafter.

3.Payments shall be applied according to the following order of priorities: Penalties, Interest and Principal.

4.A penalty of ½% of any unpaid amount shall be charged to me for every month of delay.

Signed in the presence of:

___________________________________ |

__________________________________ |

Witness |

Witness |

(Signature over Printed Name) |

(Signature over Printed Name) |

5. I shall be considered in default in any of the following cases:

a.Any willful misrepresentation in any of the documents executed in relation hereto;

b.Failure to pay any three (3) consecutive monthly amortizations;

c.Failure to pay any three (3) consecutive membership savings;

d.Violation of any policies, rules, regulations and guidelines of the

6.In the event of default, the outstanding loan obligation shall become due and demandable. As a consequence thereof, the outstanding loan obligation, consisting of the principal, interest and penalties shall be subjected to offsetting against my Total Accumulated Value (TAV). However, immediate offsetting of my outstanding loan obligation may be effected immediately upon

approval of my request, provided such request is based on the following justifiable reasons and upon validation by the Fund: Borrower’s unemployment; illness of the

7.In the event of membership termination prior to loan maturity, any outstanding loan obligation, shall be deducted from my TAV and/or any amount due me or my beneficiaries in the possession of the Fund. In case of my death, the outstanding obligation shall be computed up to the date of death. Any payment received after death shall be refunded to my beneficiaries.

8. In case of falsification, misrepresentation or any similar acts committed by me,

applicable rules and regulations governing this lending program that |

|

promulgate from time to time. |

|

__________________________________ |

|

Signature of Applicant over Printed Name |

|

AUTHORITY TO DEDUCT (Optional)

In case of retirement/separation from employment, I hereby authorize my employer to deduct any outstanding MPL balance from my retirement |

SIGNATURE OF APPLICANT |

||||||

or separation benefits to fully settle my loan obligation. In the event that my retirement/separation benefits is not sufficient to settle the |

|

|

|

||||

outstanding balance of my MPL or my employer fails for whatever reason, to deduct the same from said retirement/separation benefits, I |

|

|

|

||||

hereby authorize |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

THIS PORTION IS FOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLAIM/HOUSING LOAN/STL VERIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

PARTICULARS |

WITH |

WITHOUT |

DV/CHECK / APPLICATION / P.N./AGREEMENT NO. |

DATE FILED |

VERIFIED |

|

DATE |

CLAIMS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOUSING LOAN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALAMITY LOAN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN APPROVAL |

|

|

|

|

LOAN AMOUNT GRANTED |

INTEREST |

PREVIOUS LOAN BALANCE |

LOAN PROCEEDS |

MONTHLY AMORTIZATION |

|

||

|

|

|

|

|

|

|

|

REVIEWED BY |

DATE |

APPROVED BY |

DATE |

DISAPPROVED BY |

DATE |

THIS FORM CAN BE REPRODUCED. NOT FOR SALE

(V03, 06/2016)

CERTIFICATE OF NET PAY

NAME OF BORROWER

For the month of: _________________

Basic Salary |

_________________ |

|

Add: Allowances |

|

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

Gross Monthly Income |

__________ |

|

Less: Deductions |

|

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

_____________________ |

__________ |

|

Total Deductions |

|

__________ |

Net Monthly Income |

|

__________ |

Issued this _______ day of _________, 20__.

I certify under pain of perjury that the above- mentioned information is true and correct.

___________________________________________

HEAD OF OFFICE/AUTHORIZED SIGNATORY

(Signature over printed name)

I hereby authorize ____________________________,

our Fund Coordinator or Liaison Officer to file my MPL Application and receive the

________________________________

Signature of Applicant over Printed Name

GUIDELINES AND INSTRUCTIONS

A.Who May File

Any

1.Has made at least

2.For members who have withdrawn their membership savings due to membership maturity, the reckoning date of the updated 24 MS shall be the first MS following the month the member qualified to withdraw his MS due to membership maturity;

3.Has five (5) MS for the last six (6) months as of month prior to date of loan application.;

4.If with existing

5.If with existing MPL and/or Calamity Loan, the account/s must not be in default as of date of application.

B.How to File

The applicant shall:

1.Secure the

2.Accomplish 1 copy of the application form.

3.For releasing of loan proceeds through Payroll Account/Disbursement Card, attach photocopy of payroll account/disbursement card/deposit slip (for

4.Submit complete application, together with the required documents to any

C.Loan Features

1.Loan Amount

A qualified

1.1Loan Entitlement

The loan entitlement shall depend on the number of MS made, based on the following schedule:

Number of MS |

Loan Amount |

24 - 59 months |

Up to 60% of the Total Accumulated Value (TAV) |

60 - 119 months |

Up to 70% of TAV |

At least 120 months |

Up to 80% of TAV |

1.2Capacity to Pay

An eligible borrower’s loan shall be limited to an amount for which statutory deductions, monthly repayment of principal and interest, and other obligations will not render the borrower’s net take home pay to fall below the minimum requirement as prescribed by the General Appropriation Act (GAA) or company policy, whichever is applicable.

If the borrower has an existing Calamity Loan, the loanable amount shall be the difference between

80% of the borrowers TAV and the outstanding balance of his Calamity Loan; provided, it does not exceed the borrower’s loan entitlement.

2.Interest Rate

The loan shall bear an interest at the rate of 10.75% per annum for the duration of the loan.

3.Loan Term

The loan shall be repaid over a maximum period of

4.Loan Release

The loan proceeds shall be released through any of the following modes: a) Crediting to the borrower’s cash card/disbursement card;

b) Crediting to the borrower’s bank account through LANDBANK’s Payroll Credit Systems Validation

(PACSVAL);

c) Check payable to the borrower; d) Other similar modes of payments.

5.Loan Payments

5.1The loan shall be repaid in equal monthly payments in such amounts as may fully cover the principal and interest over the loan period. Said amortization shall be made, whenever feasible, through salary deduction.

5.2Payments shall be remitted to the Fund on or before the fifteenth (15th) day of each month, starting on the third (3rd) month following the date on the DV/check.

5.3The borrower may fully pay the outstanding balance of the loan prior to loan maturity.

5.4The borrower shall pay directly to the Fund in case the borrower is unable to pay through salary deduction for any of the following circumstances, such as but not limited to:

a.Suspension from work;

b.Leave of absence without pay;

c.Insufficiency of take home pay at any time during the term of the loan.

6.Penalties

A penalty of ½% of any unpaid amount shall be charged to the borrower for every month of delay. However, for borrowers paying through salary deduction, penalties shall only be reversed upon presentation of proof that

7.Application of Payments

7.1Payments shall be applied according to the following order of priorities:

a.Penalties; if any,

b.Interest; and

c.Principal

7.2Accelerated Payments – any amount in excess of the required monthly amortization shall be applied to future amortizations.

8.Default

The borrower shall be in default in any of the following cases:

a. Any willful misrepresentation made by the borrower in any of the documents executed in relation hereto. b. Failure of the borrower to pay any three (3) consecutive monthly amortizations.

c. Failure of the borrower to pay any three (3) consecutive MS.

d. Violation by the borrower of any of the policies, rules, regulations and guidelines of

D.Other Provisions

1.The MPL and Calamity Loan shall be treated as separate and distinct from each other. Hence, the member shall be allowed to avail of an MPL while he still has an outstanding Calamity Loan, and vice versa.

Application for loan on these two programs shall be governed by their corresponding guidelines. In no case, however, shall the aggregate

2.For borrowers with existing Calamity Loan at the time of availment of MPL, the outstanding loan balance of the Calamity Loan shall not be deducted from the proceeds of the MPL.

3.In the event that an MPL account has a marginal balance of not more than P10.00 despite the payment of

the required 24 monthly amortization by the borrower, the Fund shall offset the said marginal balance from the borrower’s TAV.

4.In the event of membership termination prior to loan maturity, the outstanding loan obligation shall be deducted from the borrower’s TAV and/or any amount due him or his beneficiaries in the possession of the Fund. In case of borrower’s death, the outstanding obligation shall be computed up to the date of death. Any payments received after death shall be refunded to the borrower’s beneficiary.

5.An eligible member who is an active member under more than one employer shall have only one outstanding MPL at any given time. At point of application, he shall choose which employer shall deduct and remit his monthly MPL amortization.

6.A borrower may renew his MPL upon payment of at least six (6) monthly amortizations and he meets the eligibility criteria. The proceeds of the new loan shall be applied to the borrower’s outstanding MPL obligation and the net proceeds shall then be released to him.

7.If TAV offsetting has been effected on the borrower’s defaulting MPL, he may immediately apply for a new

MPL provided he has paid at least 6 monthly amortizations prior to default and meets the eligibility criteria. However, if he has paid less than 6 monthly amortizations prior to default, he may apply for a new loan only after two (2) years from date of TAV offsetting.

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Title | MULTI-PURPOSE LOAN (MPL) APPLICATION FORM |

| Form Number | HQP-SLF-001 |

| Application Requirements | Applicant must fill out details including Pag-IBIG MID No./RTN, personal, employment information, and desired loan amount. |

| Loan Purpose Options | Includes both housing (e.g., Home Enhancement, House Repair) and non-housing related purposes (e.g., Tuition/Educational Expense, Health and Wellness). |

| Disbursement Method Authorization | Applicants authorize Pag-IBIG Fund to credit loan proceeds through specified Payroll Account/Disbursement Card. |

| Employer Participation | Employer agrees to deduct monthly loan amortization from the applicant's salary and remit it to Pag-IBIG Fund. |

| Legal Compliance and Penalties | Includes waivers under R.A. No. 1405 for account verification, penalties for late payments, and authorization to debit overpaid amounts. |

| Loan Default Consequences | Details conditions under which a loan is considered in default, including failure to make payments and misrepresentation. |

Guide to Writing Pagibig Multi Purpose Loan

Successfully applying for a Pag-IBIG Multi-Purpose Loan (MPL) requires careful attention to detail and complete documentation. The process can seem complex but following a step-by-step guide ensures that applicants provide all the necessary information for a smooth application. The steps listed below will guide you through each part of the MPL application form.

- Start with your personal details. Enter your Pag-IBIG MID No./RTN, followed by your last name, first name, name extension (if applicable), middle name, and if you are a married woman, your maiden middle name.

- For your contact information, fill in your present home address, including unit/room number, floor, building name, lot number, block number, phase number, house number, street name, subdivision, barangay, municipality/city, province/state/country (if abroad), and ZIP code. Also, include your cell phone number, home telephone number, and email address.

- Specify your loan purpose by checking the appropriate box. Options include non-housing related purposes like home enhancement, house repair, tuition/educational expenses, health and wellness, minor home improvement, livelihood, or other purposes which require specification.

- Under the “Employer/Business Details” section, write down your employer or business name, the desired loan amount, and your employer/business address, including specifics similar to your home address input.

- Provide your Applicant’s Tax Identification Number (TIN) and your Employee Identification Number.

- Detail your previous employment, indicating the employer/business names and addresses, alongside the dates of your employment in mm/yy format. If necessary, use an additional sheet for extra employment history.

- Sign the form to authorize the credit of your loan proceeds to your indicated payroll account/disbursement card.

- Complete the "Application Agreement" section, where you must fill in your current or future employer's details to authorize deductions for loan repayment from your salary. This includes agreeing to the terms regarding insufficiency of net take home pay, penalties for late payments, and authorization for Pag-IBIG Fund to offset any overpaid loan proceeds.

- Ensure the "Employer’s Certification" area is signed by your employer's head or authorized signatory, confirming their agreement to collect and remit your loan repayments through salary deductions.

- Under the "Promissory Note" section, read through the terms regarding your repayment obligation, the loan's interest rate, terms of payment, prioritization of payments, penalties for delays, and the implications of defaults. Then, sign your name to indicate your understanding and agreement.

- If applicable, fill out the "Authority to Deduct" section to authorize deduction from your retirement/separation benefits to settle any outstanding MPL balance should you retire or separate from your employment.

- The "For Pag-IBIG Fund Use Only" section is reserved for office use, so leave it blank.

Once you have completed the form following these steps, gather any required documentation specified in the instructions, such as proof of income or employment. Submit the completed application form and supporting documents to your nearest Pag-IBIG Fund branch. An officer will review your application, and you will be notified of the decision or if further information is needed. Ensure all information provided is accurate and complete to avoid delays in processing your application.

Understanding Pagibig Multi Purpose Loan

Who is eligible to apply for a Pag-IBIG Multi-Purpose Loan (MPL)?

To be eligible, a Pag-IBIG member must have made at least 24 membership savings (MS); have at least five (5) MS for the last six (6) months as of the month prior to loan application; must not have an existing Pag-IBIG Housing Loan that is in default; and must not have an existing MPL and/or Calamity Loan that is in default as of the date of application.

How does one apply for a Multi-Purpose Loan?

To apply, secure and fill out the MPL Application Form (MPLAF) available from any Pag-IBIG Fund branch. Submit the completed application form along with the required documents and a photocopy of your payroll account/disbursement card/deposit slip (for newly-opened accounts) to any Pag-IBIG Fund Branch.

What are the loanable amounts under the MPL?

The amount you can borrow is based on your Total Accumulated Value (TAV), desired loan amount, and your capacity to pay. Specifically, you can borrow up to 60% of your TAV for 24-59 months of membership, up to 70% for 60-119 months, and up to 80% if you've been a member for at least 120 months.

What is the interest rate for an MPL?

The MPL carries an interest rate of 10.75% per annum for the duration of the loan.

What is the repayment period for the MPL?

The loan must be repaid over a maximum period of 24 months, with a grace period of two (2) months.

How will the loan proceeds be released?

Loan proceeds can be released through various modes such as crediting to the borrower’s cash card/disbursement card, bank account through LANDBANK’s PACSVAL, issuance of a check payable to the borrower, or other similar modes of payments.

How are loan payments made?

Loan repayments are made in equal monthly installments covering both principal and interest, ideally through salary deduction. Payments should be remitted to Pag-IBIG Fund on or before the fifteenth (15th) day of each month, starting on the third (3rd) month following the loan release date.

What happens if a loan payment is delayed?

A penalty of ½% per month is charged for every month of delay. If the delay is due to the employer's failure to make deductions for salary deductions, penalties applied to the borrower may be reversed upon showing proof of the employer’s fault.

Can a Pag-IBIG member avail of an MPL if they have an existing Calamity Loan?

Yes, members can apply for an MPL even if they currently have an outstanding Calamity Loan. The MPL and Calamity Loan are treated as separate loan facilities, subject to the condition that the total short-term loan should not exceed 80% of the borrower’s TAV.

Common mistakes

Filling out a Pag-IBIG Multi-Purpose Loan (MPL) form seems straightforward, yet many people make mistakes that can delay the process or affect their loan approval chances. Understanding these common errors can help ensure a smoother application experience. Here are nine mistakes to avoid:

- Not filling out the application form completely: Omitting details such as the Pag-IBIG MID No./RTN, personal information, and employment details can lead to delays in processing.

- Incorrect or outdated information: Providing information that is not current, especially contact details and employment status, can hinder communication and processing.

- Failure to specify the loan purpose accurately: Not clearly indicating whether the loan is for housing-related purposes or other non-housing-related needs can cause confusion.

- Choosing an incorrect loan amount category: Applicants often misunderstand their eligibility and select the wrong loan amount based on their contribution history and capacity to pay.

- Forgetting to sign the application form: An unsigned form is considered incomplete and will not be processed until rectified.

- Not attaching required documentation: Failing to include necessary documents like proof of income or identification can stall the loan process.

- Miscalculating the loanable amount: Overestimating the loan amount without considering the Pag-IBIG guidelines on loan entitlement and capacity to pay can lead to disappointments.

- Ignoring the terms of the loan: Not thoroughly understanding the loan’s terms and conditions, such as the interest rate, repayment period, and penalties for late payment, can result in unforeseen challenges.

- Incorrectly filling out the employer details: If the employer information is incorrect or not updated, it can complicate the verification process and delay loan disbursement.

Avoiding these mistakes can significantly enhance your chances of a smoother and more efficient loan application process. Always ensure that you read through the form carefully, understand the Pag-IBIG Fund's requirements, and double-check all the information before submission.

Documents used along the form

When applying for a Pag-IBIG Multi-Purpose Loan (MPL), complementing the application form with required documents is crucial to expedite the approval process. Applicants should ensure they have compiled all necessary forms and documents to avoid delays. Here are five significant documents often used alongside the MPL application form, each serving a specific purpose in the application process.

- Proof of Income: This includes the latest one-month payslip, Certificate of Employment and Compensation, Income Tax Return, and/or any official document that verifies an applicant's income. It's essential for determining the loan amount based on the borrower's capacity to repay.

- Valid ID: Government-issued IDs (e.g., Passport, Driver’s License, UMID) are required to validate the applicant’s identity. At least two valid IDs are typically necessary for the loan application process.

- Proof of Pag-IBIG Fund Membership: Documentary evidence such as the Pag-IBIG Loyalty Card or Member’s Data Form (MDF) serves to prove active membership and confirm that the member has met the required number of contributions.

- Authorization Document: If the applicant opts for another individual to process the loan on their behalf, an Authorization Letter or a Special Power of Attorney (SPA) is needed, specifying the representative’s authority to act on the applicant's behalf.

- Updated Statement of Account (SOA) for existing Pag-IBIG Loan Borrowers: For applicants with existing Pag-IBIG Fund loans, submitting the latest SOA is crucial. It's used to assess the outstanding balance, ensuring that the current loan is not in default.

Beyond merely submitting these forms and documents, it’s imperative that applicants ensure that all information provided is accurate and up-to-date. Mistakes or outdated information can lead to unnecessary delays or even the rejection of the loan application. Therefore, a meticulous review of all documents and adherence to the instructions stipulated by the Pag-IBIG Fund can significantly streamline the loan application process.

Similar forms

The Pag-IBIG Multi-Purpose Loan (MPL) application form shares similarities with other loan application forms such as personal loans, home improvement loans, or education loans offered by banks and other financial institutions. These forms generally require personal information, loan amount request, purpose of the loan, employment details, and income verification to assess the borrower's capability to repay the loan. The key aspect they have in common is the structured way they gather essential information to evaluate the borrower's creditworthiness and allocate funds accordingly.

Similarly, the auto loan application forms you find in banks also resemble the MPL application in structure. Applicants must provide identification details, financial information, and specifics about the loan they seek, such as desired loan amount and repayment terms. Both forms often necessitate details about the applicant's employment and income to ensure they have the means for repayment, emphasizing the lenders' need to mitigate risk.

The business loan application forms echo the MPL form by requesting detailed business information alongside personal identification. They seek to understand the nature of the business, its financial health, and the purpose of the loan. This comprehensive data collection is crucial for lenders to gauge the risk of lending and the business's ability to sustain repayment, mirroring the individual assessment seen in the MPL application.

Credit card application forms, while generally more succinct, share the essence of collecting personal, employment, and income information to establish creditworthiness. Like the MPL form, they require the applicant to disclose financial details to determine the credit limit, which directly correlates with the loan amount assessment in the MPL application process.

Scholarship and grant application forms, although not loan-related, similarly gather detailed personal, educational, and financial information to decide on the allocation of funds. The objective is to evaluate the applicant's need and qualifications, paralleling the MPL's goal of assessing the borrower's capacity to repay the loan.

Mortgage application forms are another document type with a striking resemblance to the MPL form. Applicants need to provide extensive details about their finances, employment, and the property in question, much like how the MPL form requires comprehensive personal and financial information to evaluate loan eligibility and repayment ability.

Debt consolidation application forms also share similarities with the MPL form by asking for personal information, details on existing debts, and financial standing. The aim is to assess whether consolidating debts into a single loan is feasible for the applicant, akin to how the MPL assesses the borrower's capability to manage the loan.

Lastly, government assistance application forms, though not always related to loans, require detailed personal and financial information from applicants to determine eligibility for aid. This process mirrors the MPL application's thorough assessment of the applicant's financial situation to ensure they qualify for the loan and can uphold the repayment agreement.

Dos and Don'ts

When filling out the Pag-IBIG Multi Purpose Loan (MPL) form, there are essential do's and don'ts to keep in mind to ensure a smooth processing of your loan application.

- Do ensure that all the information provided on the form is complete and accurate.

- Do double-check your Pag-IBIG MID No./RTN and other personal details for correctness.

- Do indicate the specific loan purpose by ticking the appropriate box and specifying details if you select "Other Purpose".

- Do sign the form as required to certify the accuracy of the information and your agreement to the terms.

- Do attach a photocopy of your payroll account/disbursement card or deposit slip, if necessary, for the releasing of loan proceeds.

- Do submit the form and any additional required documents to the nearest Pag-IBIG Fund Branch.

- Don't leave any required fields blank. If a section does not apply, mark it as N/A.

- Don't provide false or misleading information, which could lead to the rejection of your application or further legal implications.

- Don't forget to specify your desired loan amount and ensure it aligns with your eligibility and repayment capacity.

- Don't overlook the need to authorize your employer to deduct loan repayments from your salary, if applicable.

- Don't neglect to review the loan terms, conditions, and interest rates to fully understand your obligations.

- Don't hesitate to ask for clarification or assistance from Pag-IBIG Fund personnel if any part of the form or process is unclear.

Misconceptions

Understanding the Pag-IBIG Multi-Purpose Loan (MPL) can sometimes be complicated, leading to misconceptions among members. Here are eight common misunderstandings:

Only employed individuals can avail of the MPL. Contrary to this belief, self-employed and voluntary members who meet the required number of contributions and other criteria are also eligible for the loan.

The loan can only be used for housing-related expenses. While housing is a significant component, the MPL is designed for various purposes, including education, health, and livelihood.

Loan approval is guaranteed once you apply. Approval depends on several factors, including your contribution history, existing loan balances, and capacity to pay.

Loan amount entitlement is fixed. The amount you can loan varies based on your total accumulated value (TAV) and your ability to repay, among other factors.

Having an existing loan automatically disqualifies you from the MPL. Members with outstanding loans may still qualify provided those loans are not in default at the time of application.

Interest rates and terms are the same for everyone. Interest rates and loan terms are subject to change and can vary based on prevailing conditions and policies at the time of the loan application.

You can renew or apply for a new loan immediately after fully paying an existing one. While early renewal is possible, it requires at least six (6) monthly amortizations and meeting the eligibility criteria again.

Loan proceeds can only be received through Payroll Accounts. Several disbursement options are available, including cash cards and bank transfers, to accommodate different members' needs.

It's important for Pag-IBIG Fund members to understand the details and conditions of the MPL to fully benefit from it and plan their finances accordingly.

Key takeaways

Filling out and using the Pag-IBIG Multi-Purpose Loan (MPL) form requires attention to detail and understanding of the eligibility criteria and loan features. Here are key takeaways to ensure a smooth application process:

- Applicants must have made at least twenty-four (24) membership savings (MS) contributions to qualify for an MPL.

- Prior to application, applicants should have contributed five (5) MS in the last six (6) months.

- Loan purposes can vary broadly from housing-related needs such as home enhancement and minor repairs to non-housing needs including tuition expenses, livelihood, and health and wellness.

- The desired loan amount should be indicated, noting that it will be subject to your payment capacity and total accumulated value (TAV).

- Loan entitlement is based on the number of MS contributions, with percentages ranging from 60% up to 80% of the TAV depending on the MS count.

- The application must be filled out accurately, with personal details including employment or business information, Pag-IBIG MID No./RTN, and contact information.

- Applicants must not have any outstanding Pag-IBIG Housing Loan or MPL/Calamity Loan in default at the time of application.

- The application form necessitates the applicant's signature to authorize the processing of the loan, including deductions from salary for loan payment.

- Loan proceeds can be received through various modes such as credit to a payroll account/disbursement card, bank account, or via check.

- The interest rate for the loan is set at 10.75% per annum, and the loan must be repaid within a maximum period of 24 months, with a two-month grace period.

Ensuring these points are carefully observed and complied with can lead to a successful MPL application process, enabling members to utilize their Pag-IBIG benefits effectively for their various needs.

Popular PDF Documents

Closing Agreement - Facilitates a mutual understanding and settlement of tax disputes between the taxpayer and IRS.

IRS 1120 - The 1120 form's comprehensive nature helps ensure corporations are taxed fairly based on their genuine economic activities.