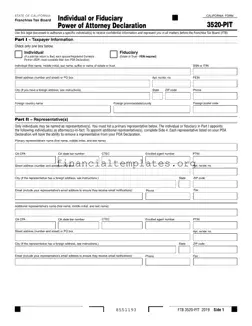

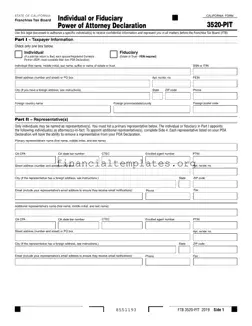

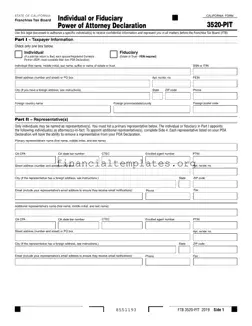

The Tax POA 3520-PIT form, an essential document for taxpayers, serves as a power of attorney specifically designed for tax purposes. It allows individuals to grant another person the authority to handle their tax matters, ensuring that their obligations are...

The Tax POA 3520-PIT form, often simply known as a Tax Power of Attorney, grants an individual the authority to handle tax matters on another's behalf. This crucial document empowers a trusted person, typically a professional, to communicate with tax...

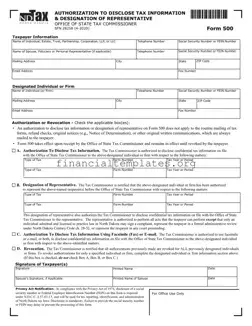

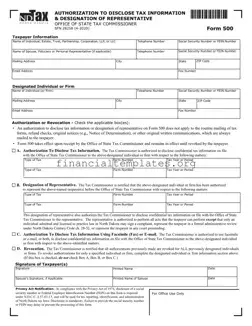

The Tax POA 500 form, officially known as the Tax Power of Attorney form, is a legal document. It grants one individual the authority to represent another in matters pertaining to taxes. This form plays a critical role in ensuring...

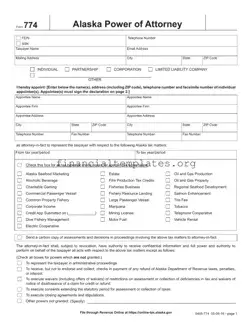

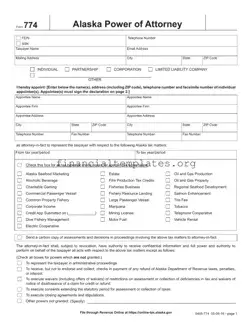

The Tax POA 774 form, officially known as the Power of Attorney and Declaration of Representative form, is a document that allows individuals to grant authorization to a representative. This representative is thereby empowered to handle tax matters on behalf...

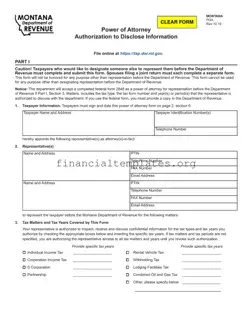

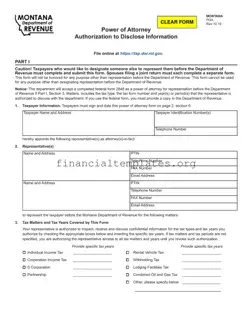

The Tax POA (Power of Attorney) Authorization to Disclose Tax Information form empowers individuals to appoint a trusted representative to access their confidential tax information. This document serves as a vital tool for managing tax affairs through another party, ensuring...

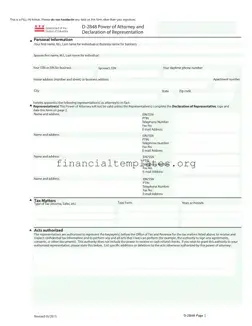

The Tax POA D-2848 form is a crucial document that grants someone else the authority to handle your tax matters. This could mean allowing them to talk to the IRS on your behalf, access confidential tax information, or even make...

The Tax POA (Power of Attorney) form is a legal document that allows an individual to grant another person the authority to handle their tax matters. This document is crucial for individuals who need assistance with their taxes, especially when...

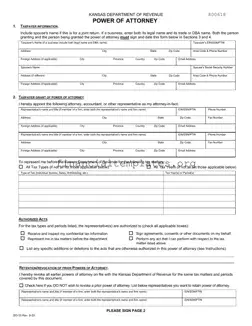

The Tax POA DO-10 form is a government-issued document that allows an individual or entity to grant another person or organization the authority to represent them in tax matters. This form is critical for those who need assistance in handling...

The Tax POA DR 835 form serves as a legal document, empowering individuals to grant authority to another person to handle their tax matters. Through this form, the designated person, often referred to as an agent, is given the capability...

The Tax POA E1285V4 form serves as a critical document for individuals looking to grant someone else the authority to handle their tax matters. This legal document, often used within various jurisdictions, ensures that tax-related tasks can be executed by...

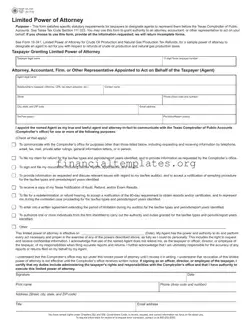

The Tax Power of Attorney (POA) form 01-137 is a legal document that allows individuals to grant another person the authority to handle their tax matters. This form is particularly vital for those who need assistance in managing their taxes,...

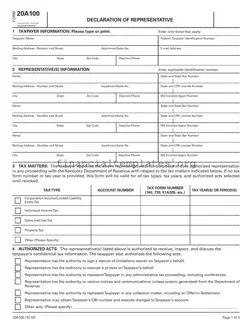

The Tax POA (Power of Attorney) form 20a100 is an important document that authorizes an individual or entity to handle tax matters on behalf of another person. This form is crucial for those who need assistance with their tax obligations...