The Tax Exempt Apply To Costco form serves as a pathway for members and organizations to request a sales tax exemption on eligible purchases made through Costco.com. Despite the inability to process tax exemptions at the point of sale, the...

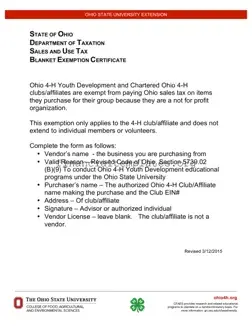

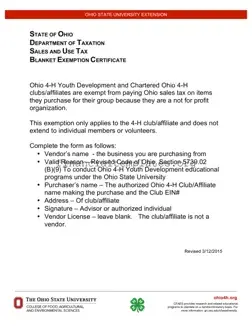

The Tax Exempt Ohio form, designated as STEC B Rev. 3/15, serves as a Sales and Use Tax Blanket Exemption Certificate. It facilitates purchasers in claiming exemptions or exceptions on all eligible purchases of tangible personal property and selected services...

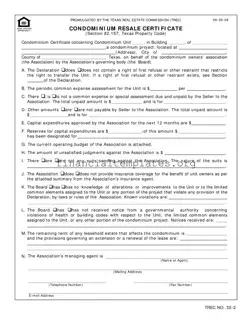

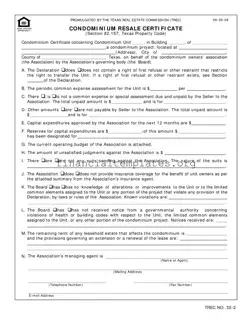

The Tax Exemption Certification form, promulgated by the Texas Real Estate Commission (TREC), serves as a crucial document in condominium resale transactions. It outlines critical information about the condominium unit, including details about fees, assessments, and the governing body's decisions....

The Tax Exemption For Cooperatives form is a critical document that provides cooperatives with the necessary guidelines to apply for and confirm their tax incentives under RA 9520, also known as the new Cooperative Code. By adhering to the prescribed...

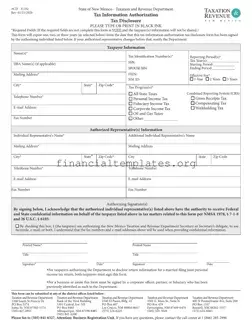

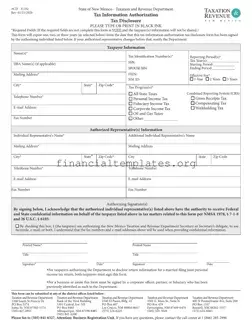

The Tax Information Authorization form, specifically referred to as ACD-31102, is a critical document issued by the State of New Mexico - Taxation and Revenue Department. It serves as an authorization for designated individuals to access confidential tax information on...

The Ohio Form IT 501, known as the Employer’s Payment of Ohio Tax Withheld, is a crucial document for employers in the Buckeye State. It serves as a vessel for employers to remit withheld taxes from their employees' wages directly...

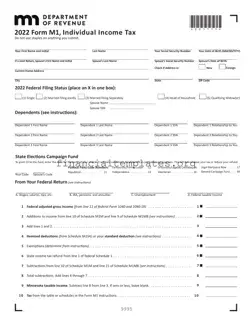

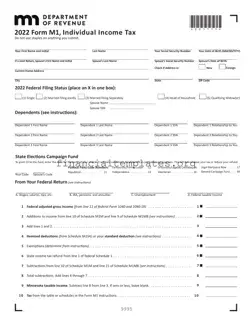

The 2020 Form M1, Individual Income Tax, is a crucial document for residents filing their state income tax return in Minnesota. It gathers comprehensive information about the filer's income, deductions, and credits to calculate the state tax owed or refund...

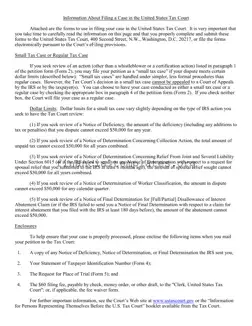

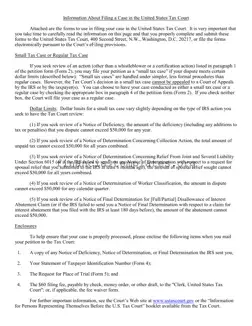

A Tax Petition form plays a crucial role for individuals or businesses seeking to challenge the Internal Revenue Service's (IRS) decision regarding their taxes in the United States Tax Court. It is a formal process, requiring careful completion and submission...

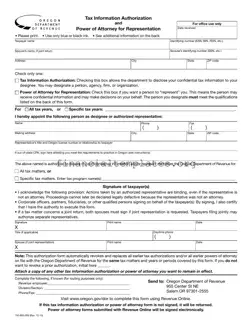

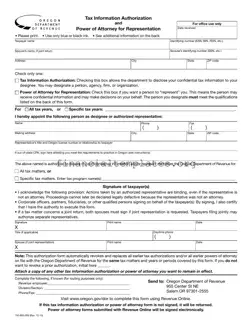

The Tax POA 150-800-005 form is an official document that empowers an individual or organization to act on another person's behalf in matters related to taxes. It grants a designated agent the authority to communicate with tax authorities, make decisions,...

The Tax POA 151 form, a pivotal document in tax management, serves as a formal authorization allowing a designated individual or entity to represent and act on behalf of another in tax matters with the IRS. This legal instrument ensures...

The Tax Power of Attorney (POA) Form 2848a serves as a critical legal document, empowering an individual to grant another person the authority to handle their tax matters. This form facilitates a wide range of tax-related activities, enabling the appointed...

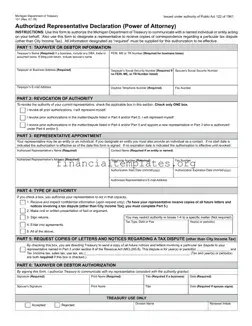

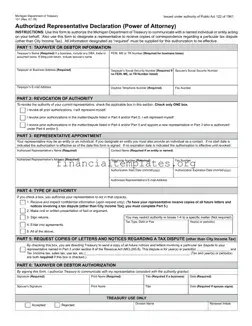

The Tax POA 285-I form serves as a cornerstone for granting authority in tax matters, allowing individuals or businesses to appoint representatives to act on their behalf with the tax authorities. This document is pivotal for those seeking guidance or...