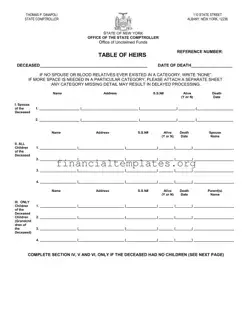

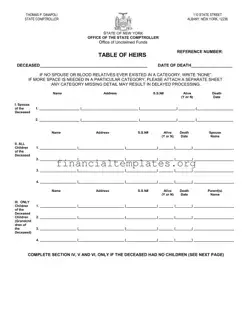

The Table of Heirs form serves as a critical tool for resolving the distribution of unclaimed funds or assets when a person passes away. It meticulously delineates the relationships and details of potential heirs, ensuring that any assets left by...

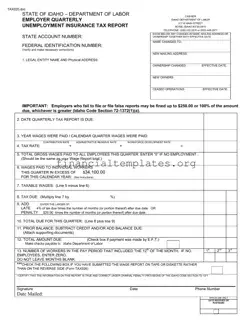

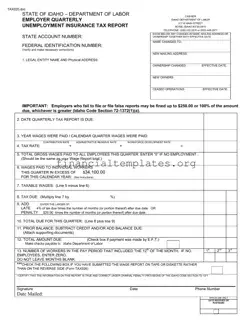

The Tax 020 form, also known as the Employer Quarterly Unemployment Insurance Tax Report, plays a critical role for employers in the state of Idaho. It's a document that the Idaho Department of Labor uses to calculate the unemployment insurance...

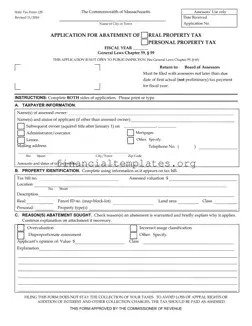

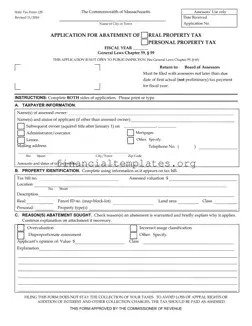

The Tax 128 form is a document used by the Commonwealth of Massachusetts for individuals or entities applying for an abatement of real or personal property tax. Designed to challenge the assessed value or classification of property, it necessitates thorough...

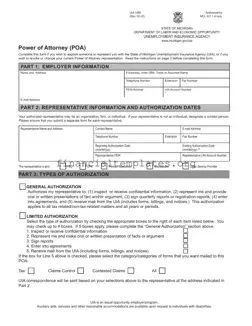

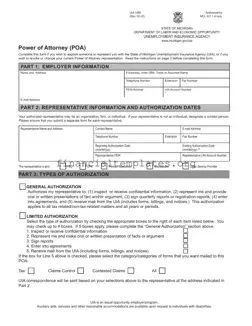

The Tax 1488 form, authorized by the State of Michigan Department of Labor and Economic Opportunity Unemployment Insurance Agency, serves as a Power of Attorney (POA) document. It allows individuals to appoint or change representatives who can act on their...

The New York State Department of Taxation and Finance's Form IT-214, titled "Claim for Real Property Tax Credit for Homeowners and Renters," serves as a crucial document for eligible New York residents seeking to claim a tax credit based on...

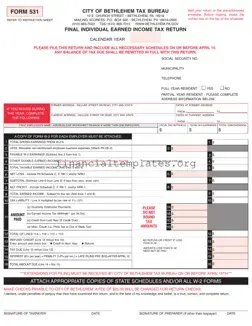

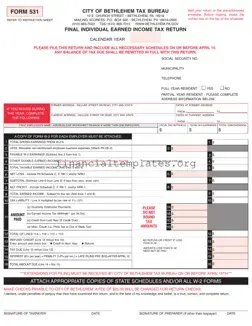

The Form 531 serves as the Final Individual Earned Income Tax Return for residents of Bethlehem, PA, facilitating the reporting and payment of local earned income taxes. This document, distributed by the City of Bethlehem Tax Bureau, demands submission alongside...

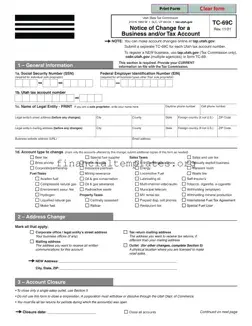

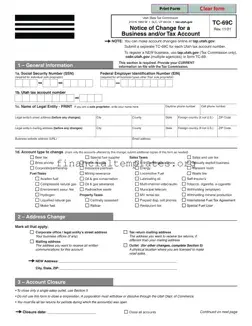

The Tax 69 C form, officially known as the TC-69C, serves a specific purpose for businesses and tax accounts within the Utah State Tax Commission's purview. This document is integral for notifying changes regarding a business’s and/or tax account’s particulars,...

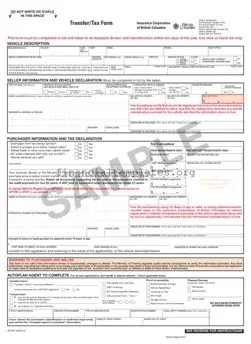

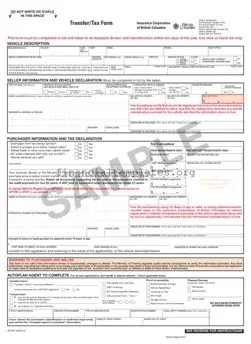

The Tax APV9T form is an essential document for transferring vehicle ownership and addressing tax considerations within British Columbia, Canada. It encompasses various acts, including the Motor Vehicle Act, Commercial Transport Act, Provincial Sales Tax Act, among others. As a...

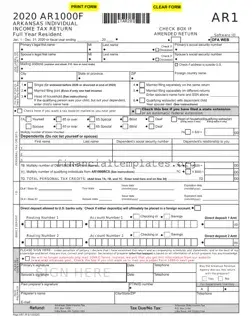

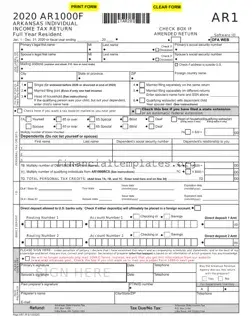

The Tax AR1000F form is a document required for filing individual income tax returns in Arkansas. It encompasses various sections for taxpayers to report income, calculate taxes owed or refunds due, and claim any eligible credits. This form is applicable...

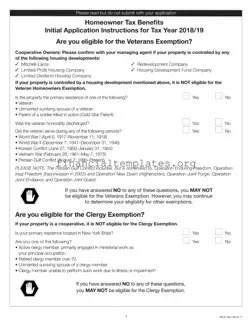

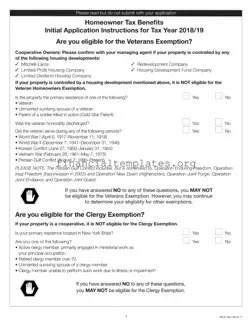

The Tax Benefits Application form is a critical document for homeowners seeking to leverage tax exemptions available for the 2018/19 tax year. It outlines eligibility requirements and provides detailed instructions for applying for benefits such as the Veterans Exemption and...

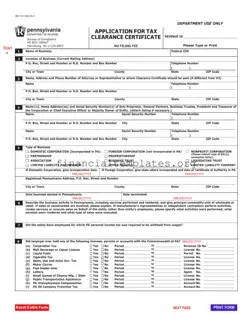

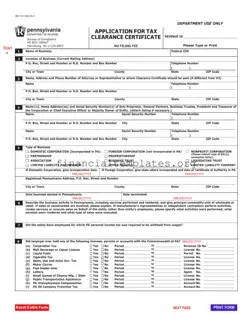

The Tax Certificate Pa form, officially known as REV-181, is a crucial document for businesses in Pennsylvania seeking a Tax Clearance Certificate from the Bureau of Compliance within the Department of Revenue. This form serves as an application for businesses...

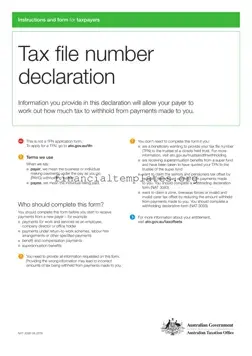

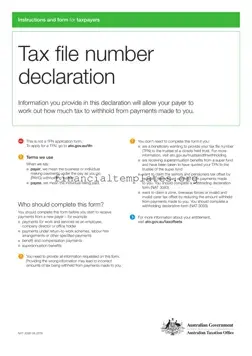

The Tax Declaration NAT 3092 form is a crucial document for both businesses and individuals participating in the Australian pay-as-you-go (PAYG) withholding system. It allows the payer to determine the correct amount of tax to withhold from payments made to...