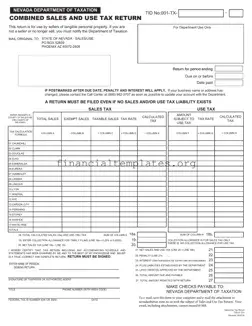

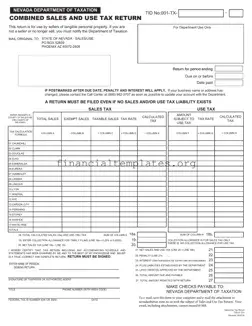

The State Nevada Tax form, officially known as the Combined Sales and Use Tax Return, is a document that facilitates the reporting and payment of sales and use taxes by sellers of tangible personal property in Nevada. It's designed for...

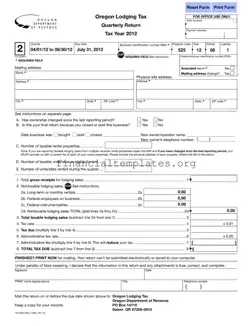

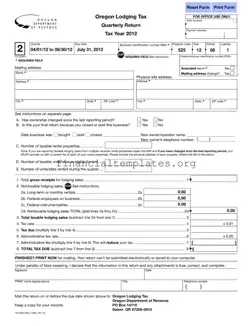

The State of Oregon Lodging Tax form serves as a quarterly tax return for businesses providing temporary lodging accommodations. This document outlines the responsibility for businesses to report their gross receipts from lodging sales, distinguish taxable from non-taxable sales—such as...

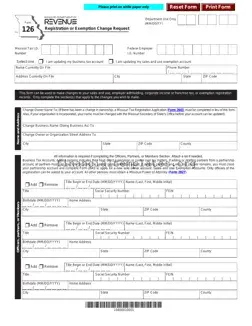

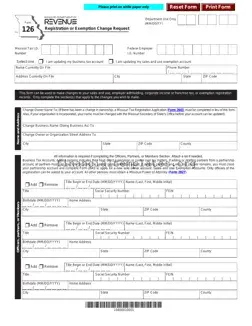

The State Tax 126 form is a versatile document utilized by businesses and organizations within Missouri to request changes to various tax records, including sales and use, employer withholding, corporate income or franchise tax, and exemption registrations. It facilitates updates...

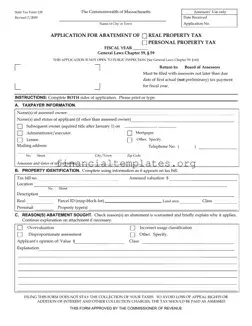

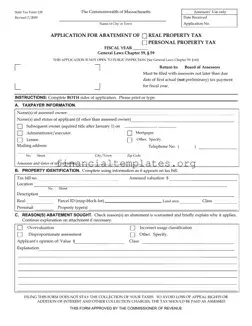

The State Tax Form 128 serves as a critical document for individuals or entities in Massachusetts seeking an abatement of real or personal property tax under General Laws Chapter 59, § 59. Updated in July 2009, it outlines the procedure...

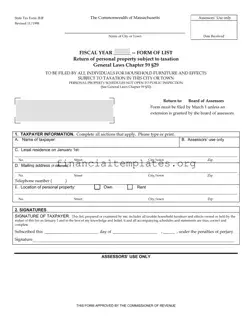

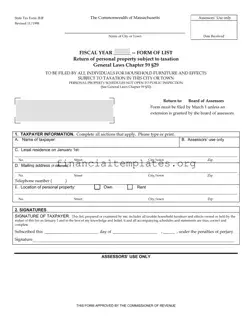

The State Tax Form 2HF is designed for individuals in Massachusetts to report personal property subject to taxation, not located at their primary residence on January 1. This document, revised in November 1998, requires taxpayers to list all taxable household...

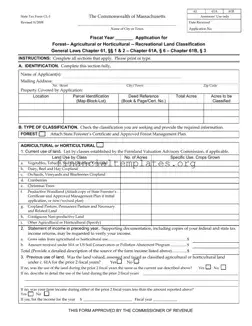

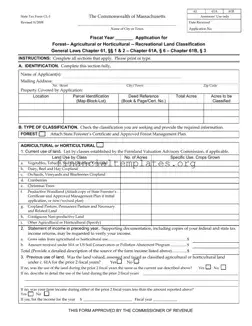

The State Tax Form CL-1 is a crucial document for property owners in Massachusetts seeking classification for their land as Forest, Agricultural or Horticultural, or Recreational under General Laws Chapter 61, §§ 1 & 2 – Chapter 61A, § 6...

The Statement of Financial Affairs form, known as Form B 7, is a document that every debtor is required to complete in United States Bankruptcy Court proceedings. It provides a comprehensive account of the debtor's financial transactions and is necessary...

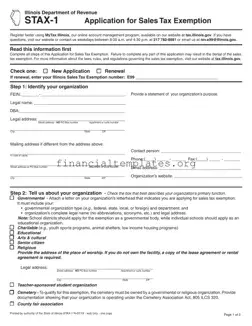

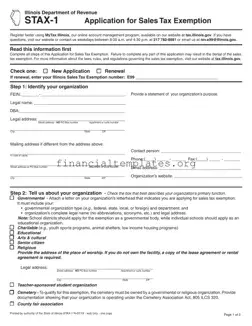

The STAX-1 form is an essential document for organizations seeking a sales tax exemption in Illinois. It is provided by the Illinois Department of Revenue and serves as an Application for Sales Tax Exemption. Organizations must complete this form accurately...

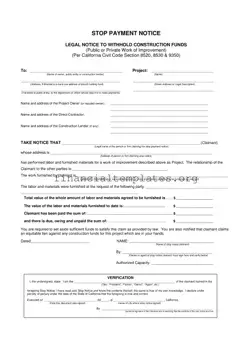

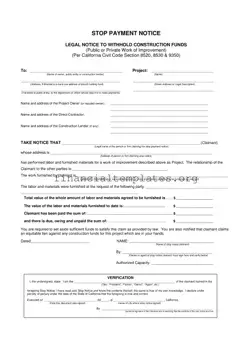

A Stop Payment Notice is a legal notification requiring that construction funds be withheld due to an unsettled claim for work performed or materials provided on a construction project. This form is applicable under California Civil Code Sections 8520, 8530,...

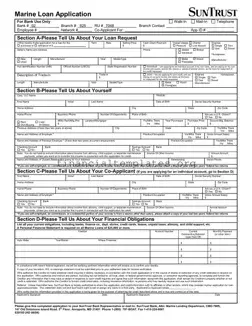

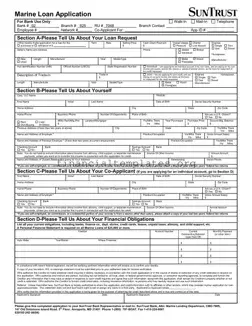

The Suntrust Marine Loan Application form is a comprehensive document designed for individuals seeking financing for the purchase or refinance of a marine vessel. It gathers detailed information about the applicant, co-applicant (if applicable), the requested loan, and both parties'...

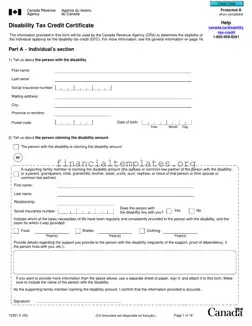

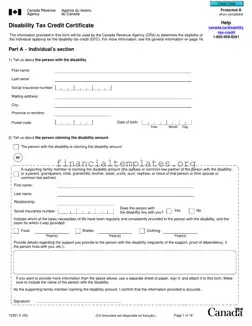

The T2201 Tax Credit form, formally known as the Disability Tax Credit Certificate, is a critical document for individuals seeking to apply for the Disability Tax Credit (DTC) in Canada. This form is used by the Canada Revenue Agency (CRA)...

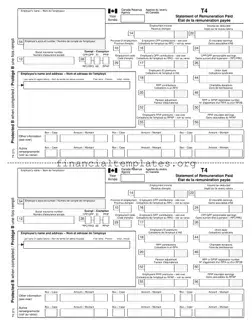

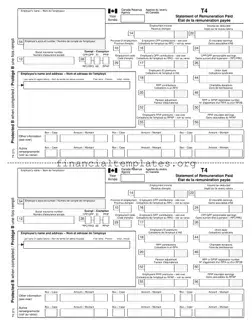

The T4 Federal Tax form is a crucial document that Canadian employers issue to provide a record of an employee's earnings and deductions for the year. It lists information such as employment income, income tax deducted, employer's name and account...