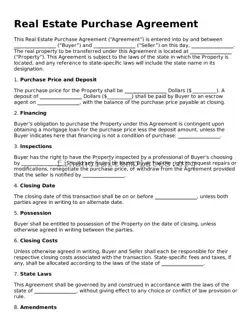

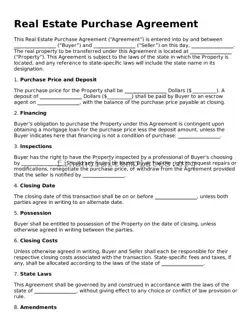

A Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions of the purchase and sale of property between a buyer and a seller. It details specifics such as the price, location, and any...

A Purchase Agreement Addendum form is a legal document that makes changes or additions to an existing purchase agreement. This tool ensures that any new terms, conditions, or details agreed upon by the parties involved are formally recognized. It plays...

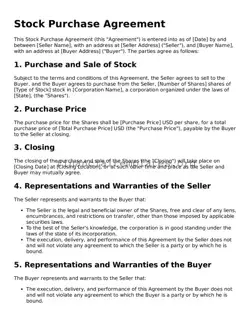

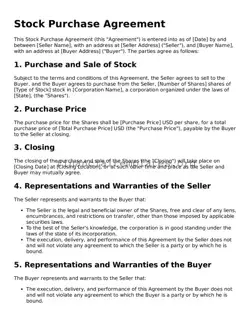

A Stock Purchase Agreement form is a legal document that details the sale and purchase of shares in a company between the seller and the buyer. It outlines the terms of the transaction, including the number of shares being sold,...

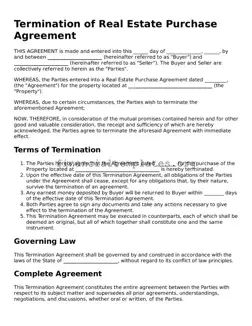

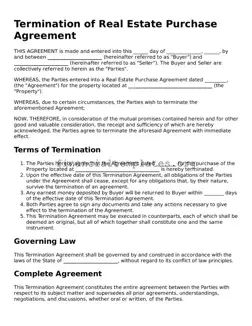

The Termination of Real Estate Purchase Agreement form is a critical document utilized when parties decide to cancel a previously agreed upon contract for the purchase of property. It serves to formally end the agreement between the buyer and the...

The Realtors Tax Deduction Worksheet serves as a comprehensive guide for real estate professionals aiming to optimize their tax filings by systematically identifying deductible business expenses. It emphasizes the importance of categorizing expenses as "ordinary and necessary" for them to...

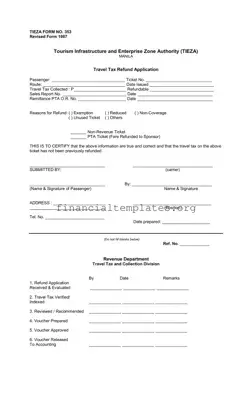

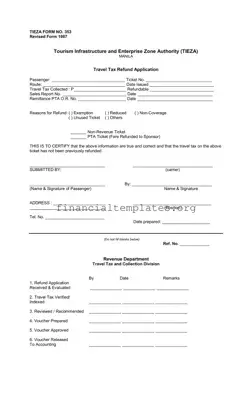

The Refunding Travel Tax form, known as TIEZA FORM NO. 353, Revised Form 1987, is a critical document for passengers seeking a refund of their travel tax. Issued by the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) in Manila, it...

The Repayment Plan Request form serves as a vital tool for borrowers under the William D. Ford Federal Direct Loan and Federal Family Education Loan Programs seeking to manage their loan repayment based on their income. It is designed to...

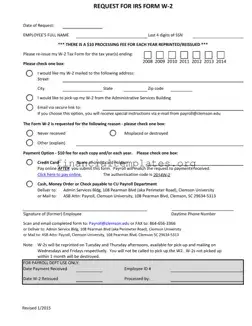

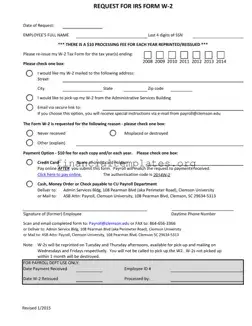

The Request for IRS Form W-2 is designed for individuals seeking to obtain a reprint or reissue of their W-2 Tax Form for a specific tax year. Individuals can request this form due to reasons such as not receiving the...

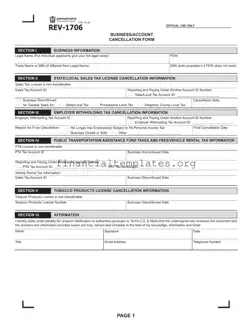

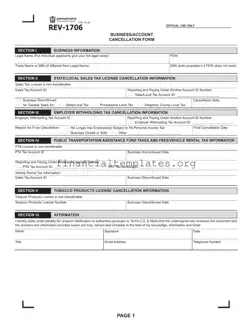

The Rev 1706 Tax form, officially recognized as the Business/Account Cancellation Form, serves as a vital document for businesses ceasing operations or undergoing significant changes in Pennsylvania. This form is meticulously designed to notify the state of various tax license...

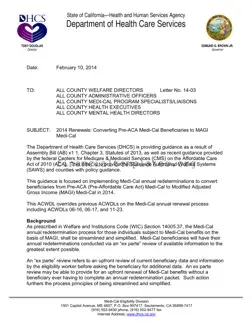

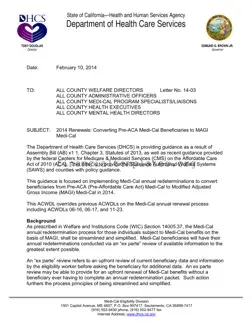

The Request For Tax Household Information (RFTHI) Redetermination Packet, a crucial element in the transition from Pre-Affordable Care Act (ACA) Medi-Cal to Modified Adjusted Gross Income (MAGI) Medi-Cal, is designed to streamline the annual redetermination process for Medi-Cal beneficiaries. This...

The Rushmore Loan Management Services form is a comprehensive document aimed at borrowers seeking modification of their mortgage terms due to financial hardships. It outlines the necessary steps and documents required from all obligated parties, including especial provisions for non-borrowers...

The Form RUT-75, also known as the Aircraft/Watercraft Use Tax Transaction Return, is a mandatory document for individuals who acquire an aircraft or watercraft through gift, donation, transfer, or non-retail purchase. It covers a wide range of aircraft and watercraft...