The OCAIRS Forensic Mental Health Interview (Form 2) is a comprehensive tool designed to capture a wide range of information about an individual's roles, habits, and personal causation. It explores aspects like family responsibilities, contact with loved ones, daily routines,...

The Occupational Tax form, specifically the Form P.R.-1 for the City of Birmingham, Alabama, serves as a monthly return for employers to report and remit taxes withheld from employees' gross salaries, wages, and commissions. This requirement, stipulated under Ordinance No....

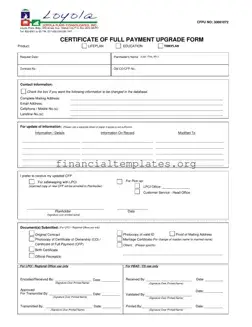

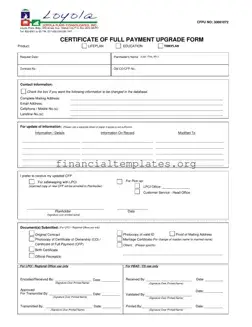

The Certificate of Full Payment Upgrade Form serves as a formal acknowledgment from an institution, like Loyola Plans, that a planholder has completed all required payments toward a particular financial product, such as a life, education, or time plan. This...

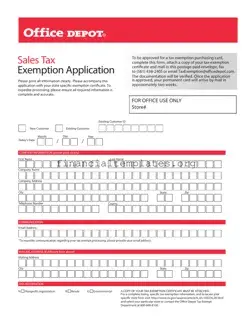

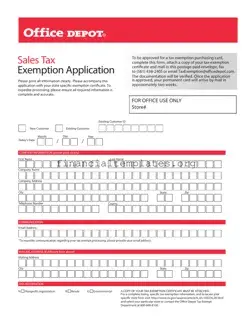

The Office Depot Tax Exempt form is designed for customers seeking exemption from sales tax on eligible purchases. This form requires applicants to provide comprehensive information, including a state-specific tax exemption certificate, to validate their eligibility. It facilitates a streamlined...

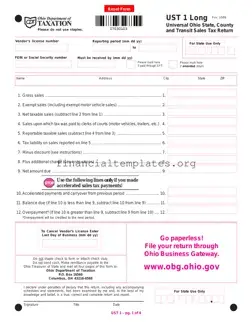

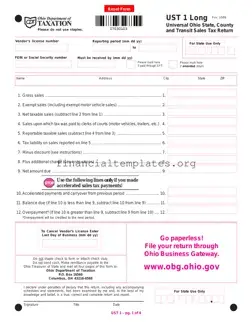

The Ohio Sales Tax UST 1 form serves as a comprehensive report for businesses to declare their state, county, and transit sales tax dues. Designed to provide details on gross sales, exempt sales, net taxable sales, and tax liability, this...

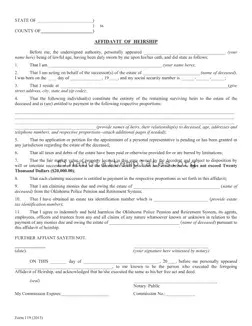

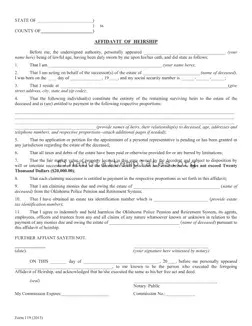

The Oklahoma Legal Heirship form is a legal document used to identify and attest the rightful successors or heirs of a deceased person's estate, without the need for formal administration through probate court. It serves as an affidavit, allowing individuals...

The Oklahoma Minimum Franchise Tax form, designated as Form 215, serves a specific purpose for businesses that are delinquent in their franchise tax filings. This form is utilized exclusively by entities that have either missed their original filing date or...

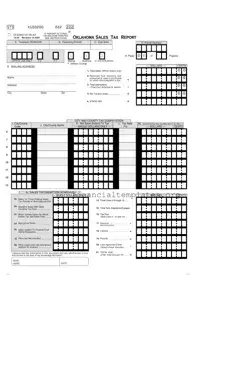

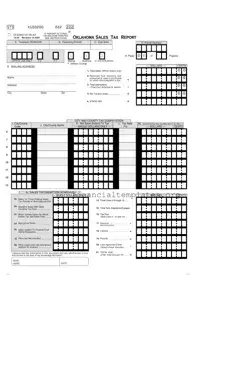

The Oklahoma Sales Tax Report form, officially designated as STS 4100200, serves as a crucial document for businesses in Oklahoma. It is meticulously designed for the collection and remission of state and applicable local sales taxes. This form encompasses a...

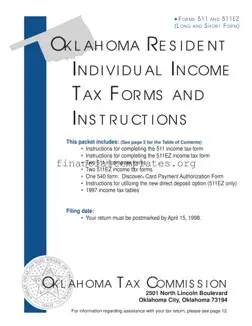

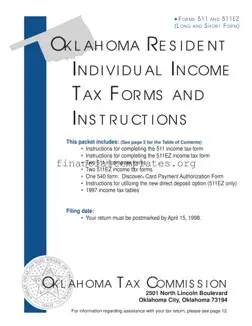

The Oklahoma State Tax form is a crucial document for residents of Oklahoma, encompassing various components to assist taxpayers in filing their state income taxes accurately. This form includes the 511 and 511EZ income tax forms, directions for completing each,...

The Oklahoma Tax Return 200 form, officially known as the Oklahoma Annual Franchise Tax Return, is a critical document for corporations operating within the state. It facilitates the reporting and payment of the annual franchise tax, based on a corporation’s...

The Oregon Monthly Mileage Tax form is a detailed document required by the Oregon Department of Transportation, Commerce and Compliance Division, for carriers to report and pay taxes based on the miles operated on Oregon roads. It serves as a...

The OTC 901 Oklahoma Tax Form serves as a foundational document for businesses in Oklahoma to declare their taxable personal property for a given tax year. Specifically designed for the 2022 tax period and last revised in November 2021, it...