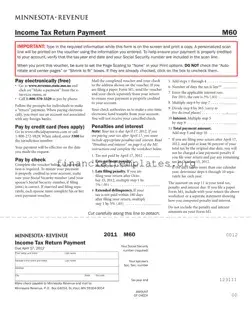

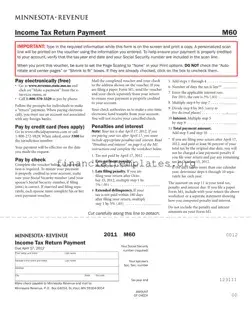

The Mn Tax Return Payment form (M60) serves as a critical tool for taxpayers in Minnesota to submit their income tax payments accurately and efficiently. This form provides a comprehensive method for including necessary personal details and the precise amount...

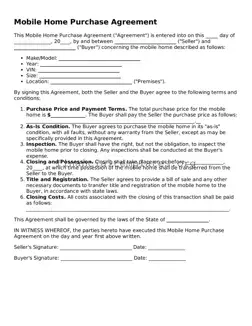

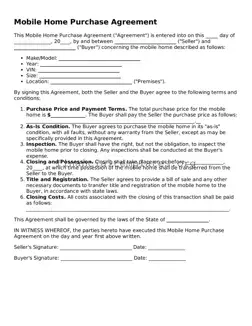

The Mobile Home Purchase Agreement form is a legally binding document that outlines the terms and conditions under which a mobile home will be bought and sold. It covers various critical details, including the sale price, description of the property,...

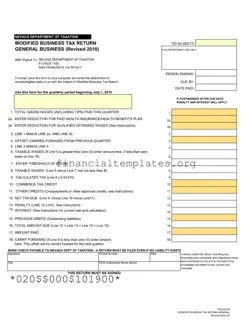

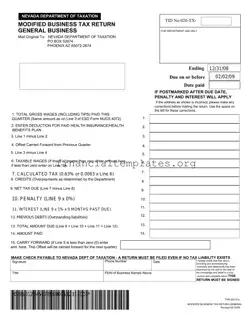

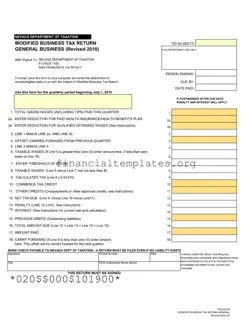

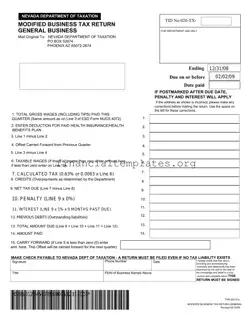

The Modified Business Tax form, as outlined by the Nevada Department of Taxation, serves as a crucial document for businesses operating within Nevada. This form is designed for general businesses to report and calculate the taxes due based on the...

The MoneyGram® ExpressPayment® Service form is an essential tool for individuals looking to promptly pay bills or load cards, enabling transactions both domestically and internationally. Tailored for MoneyGram customers, this form facilitates same-day notification payments to a wide array of...

The Mp Commercial Tax 49 form is a requisite document for dealers engaged in business within Madhya Pradesh, facilitating the movement of goods by providing necessary tax clearance details. Starting from July 7th, 2011, the Madhya Pradesh Commercial Tax Department...

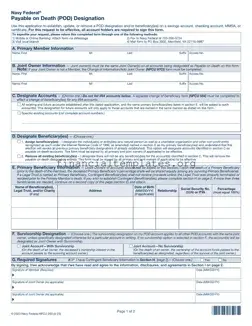

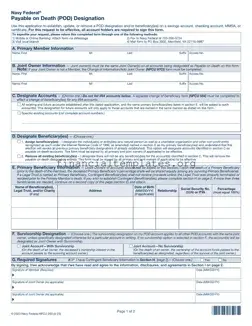

The Navy Federal Payment On Death (POD) form is an important document for Navy Federal Credit Union members who want to ensure their assets are directly passed to designated beneficiaries upon their demise. This form allows members to add, update,...

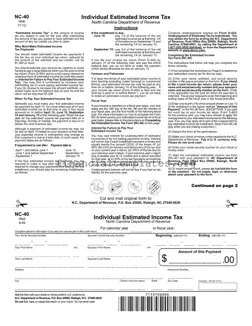

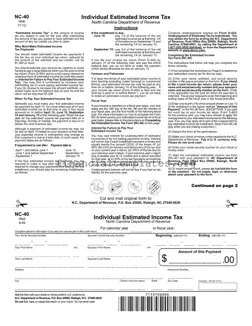

The North Carolina Estimated Tax Payment form, known as Form NC-40, serves individuals who anticipate owing $1,000 or more in income tax for the year beyond what is covered by withholdings and tax credits. It outlines the process for estimating...

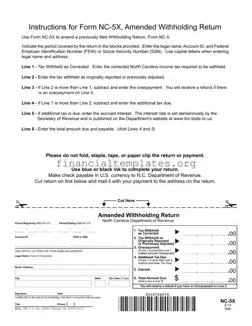

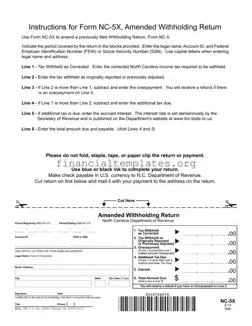

The North Carolina Tax Payment Voucher Form (NC-5X) serves as a critical tool for correcting previously filed Withholding Returns. It allows tax filers to amend details, such as the amount of income tax withheld, by providing a structured way to...

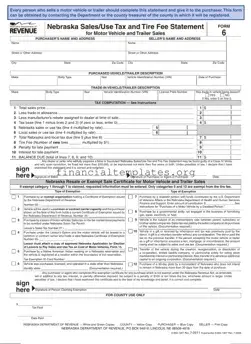

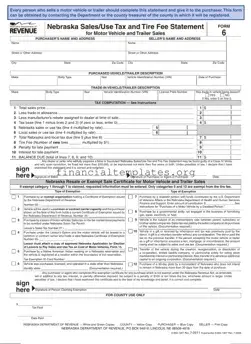

The Nebraska Sales Tax Statement form is a crucial document for individuals involved in the sale of a motor vehicle or trailer in Nebraska. This form, officially known as the Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle...

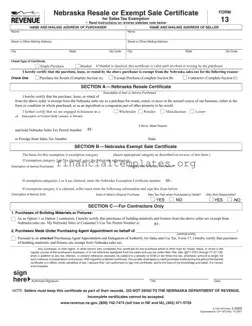

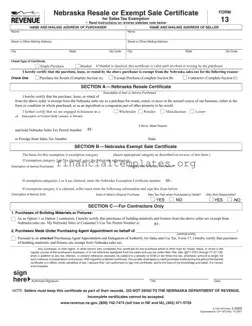

The Nebraska Sales Tax Form, formally known as the Nebraska Resale or Exempt Sale Certificate for Sales Tax Exemption, serves a critical function in facilitating tax-exempt purchases within the state. It is designed for use by individuals or entities engaging...

The Nevada Modified Business Tax Return form is a crucial document for employers in Nevada, designed for reporting and calculating the tax on gross wages paid to their employees each quarter. Managed by the Nevada Department of Taxation, it includes...

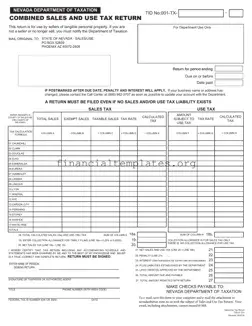

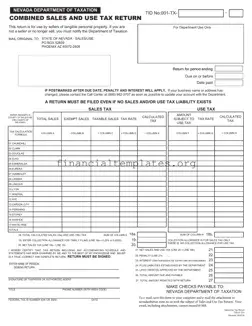

The Nevada Sales Tax Form, officially titled the "Combined Sales and Use Tax Return," is a crucial document for businesses selling tangible personal property within Nevada. It is designed to be filed with the Department of Taxation by sellers to...