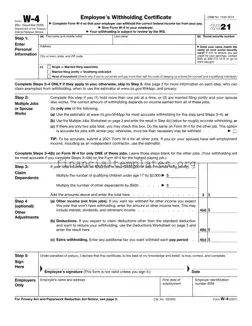

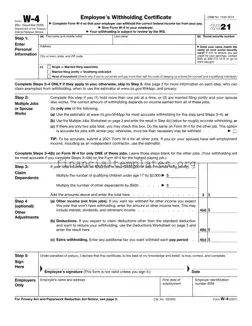

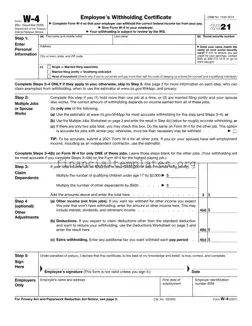

The IRS W-4 form is a critical document that employees fill out to indicate their tax situation to their employer. It determines how much federal income tax is withheld from their paychecks. Understanding how to accurately complete this form is...

The IRS W-4 form, officially titled the Employee's Withholding Certificate, is a crucial document that determines the amount of federal income tax withheld from an employee's paycheck. It helps ensure that employees are not underpaying or overpaying their taxes throughout...

The IRS W-4P form is an essential document for those receiving pension or annuity payments, creating a way to determine the amount of federal income tax to be withheld from these payments. This form provides the payer with accurate information...

The IRS W-4P form is a critical document for retirees and recipients of pension or annuity payments who want to manage the amount of federal income tax withheld from their distributions. It's a tool that empowers individuals to tailor their...

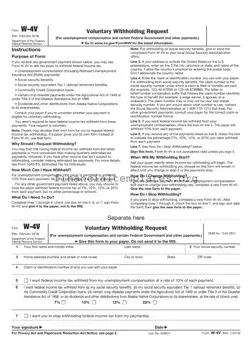

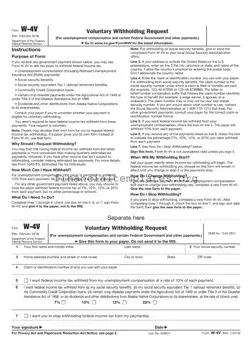

The IRS W-4V form, officially known as the Voluntary Withholding Request, is a document that allows individuals to request federal tax withholding from certain government payments. This process is crucial for those looking to manage their taxes more effectively, especially...

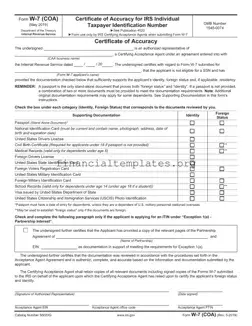

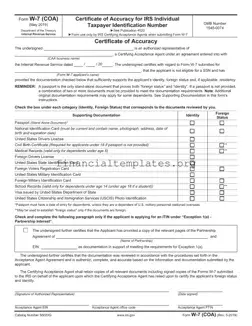

The IRS W-7 (COA) form serves a pivotal role in the tax filing process, designed for individuals who require an Individual Taxpayer Identification Number (ITIN) but lack a Social Security Number. This critical document ensures that everyone, regardless of citizenship...

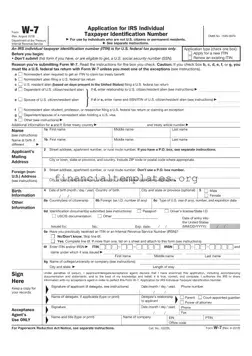

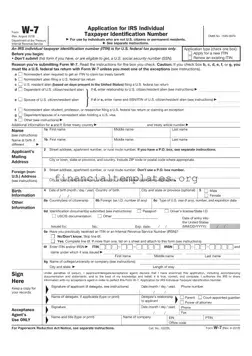

The IRS W-7 form is a critical document for individuals who are not eligible to receive a Social Security Number (SSN) but who still need a taxpayer identification number to comply with U.S. tax laws. This form is primarily used...

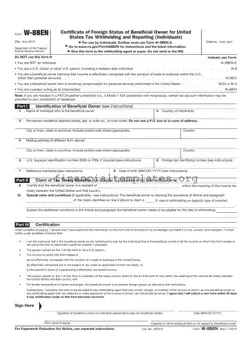

The IRS W-8BEN-E form is designed for foreign entities to certify their status for purposes of withholding taxes on income connected to the US. This form distinguishes entities from individuals, guiding them on how to declare their tax situation relative...

The IRS W-8BEN-E form is a crucial document for foreign entities looking to navigate the complexities of US tax law. Its primary purpose is to certify a foreign entity's status under the Foreign Account Tax Compliance Act (FATCA), helping to...

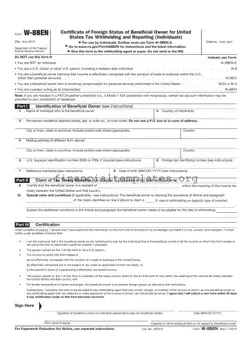

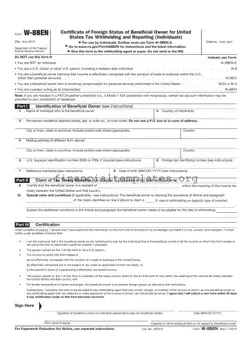

The IRS W-8BEN form, a crucial document for non-U.S. residents, serves a specific purpose: to certify an individual's foreign status and eligibility for specific tax withholding rates under income tax treaty benefits. This form plays a pivotal role in ensuring...

The IRS W-8BEN form, officially titled "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)," serves a crucial function. It allows non-U.S. individuals to claim exemption from certain U.S. tax withholdings on income earned...

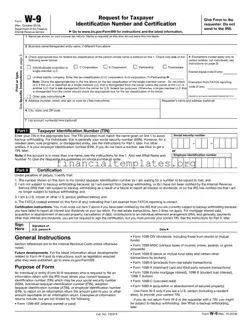

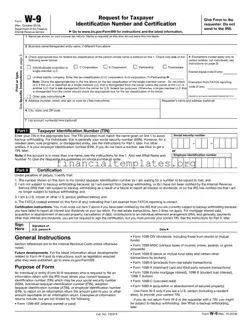

The IRS W-9 form is an official document that organizations use to gather information from individuals or entities they pay for services. It's a critical tool for ensuring the accuracy of financial records and compliance with tax withholding requirements. Used...