The IRS Schedule SE 1040 form is a crucial document for individuals who are self-employed or work as independent contractors. It's used to calculate the amount of self-employment tax owed, which covers the individual's Social Security and Medicare obligations. Navigating...

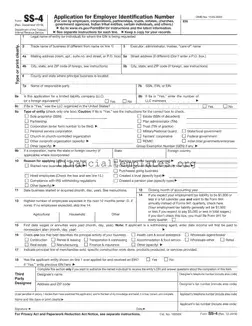

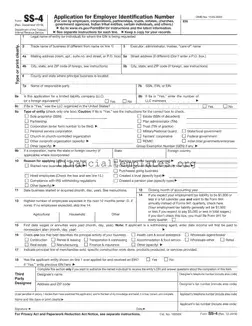

The IRS SS-4 form is a crucial document for any entity seeking to obtain an Employer Identification Number (EIN), a unique nine-digit number assigned by the Internal Revenue Service. This form serves as the application and is used by businesses,...

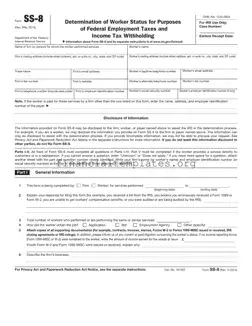

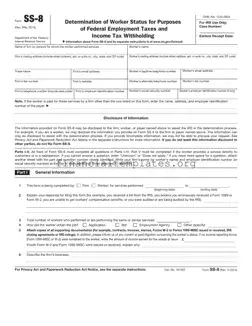

The IRS SS-8 form serves as a critical tool for determining a worker's employment status, specifically distinguishing between an independent contractor and an employee. This distinction carries significant implications for tax obligations and benefits eligibility. By submitting this form, individuals...

The IRS Tax Table is an essential component found within the instructions for Form 1040, primarily utilized by individuals to calculate their federal income tax. These tables offer guidance for not just Forms 1040 filers but also those using Forms...

The IRS W-10 form is a crucial document employed by taxpayers to provide information regarding the identity of their child or dependent care provider. This form aids in validating the eligibility of expenses related to care when claiming the Child...

The IRS W-2 form is a document that employers are required to send to their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee's annual wages and the amount of taxes withheld...

The IRS W-2 form, commonly known as the Wage and Tax Statement, serves a pivotal role in the financial lives of both employees and the Internal Revenue Service. It outlines the annual wages paid and taxes withheld from an employee's...

The IRS W-2 form is a crucial document issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. It serves as a cornerstone for individuals to accurately file their tax returns. Understanding...

The IRS W-2c form is a document used to correct information previously reported on a W-2 form, the document employers use to report wages and taxes withheld for employees. If an error was made on the original W-2 form, such...

The IRS W-3 form, often referred to as the Transmittal of Wage and Tax Statements, serves as a summary document for all W-2 forms sent by an employer to the Internal Revenue Service (IRS). This form plays a crucial role...

The IRS W-3 form, serving as a transmittal document, submits information from individual W-2 forms in aggregate to the Social Security Administration. This form encapsulates employment tax records for a given year, rendering a summary crucial for federal tax purposes....

The IRS W-3 form, officially known as the Transmittal of Wage and Tax Statements, serves as a summary document for all W-2 forms sent by an employer to the Internal Revenue Service (IRS). This form consolidates information about an employee's...