The IRS Schedule K-1 1041 form is issued by estates and trusts to report a beneficiary's share of income, deductions, and credits. This document plays a crucial role in helping individuals understand their tax obligations related to inheritances or distributions....

The IRS Schedule K-1 1041 form is a document used to report the income, deductions, and credits of a beneficiary who earns income from an estate or trust. This pivotal tax form ensures individuals accurately report their share of estate...

The IRS Schedule K-1 1041 form serves as a document used to report the incomes, deductions, and credits of a trust or estate. It plays a crucial role in ensuring that beneficiaries and estates comply with tax filing requirements. By...

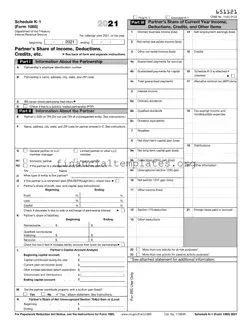

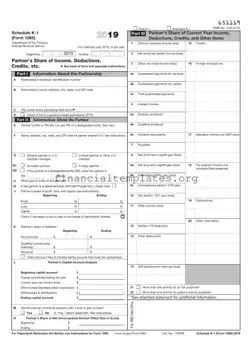

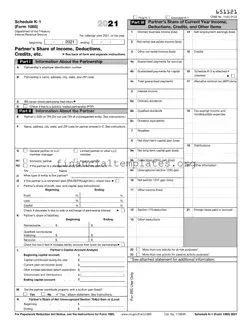

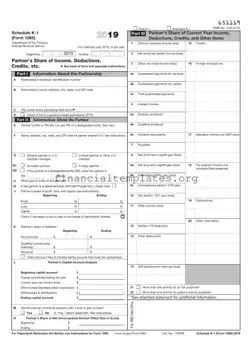

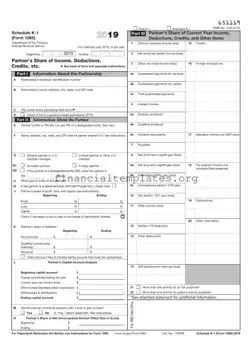

The IRS Schedule K-1 1065 form is a document used by partnerships to report each partner's share of the partnership's earnings, losses, deductions, and credits. It serves as a means to ensure that the partnership's income is reported accurately on...

The IRS Schedule K-1 (Form 1065) is a document used by partnerships to report each partner's share of the business's earnings, losses, deductions, and credits. This form is essential for partners to accurately report their income on their individual tax...

The IRS Schedule K-1 1065 form is a document used to report the income, deductions, and credits of a partnership to its partners. It plays a key role in ensuring that partners report their share of the partnership's financial activities...

The IRS Schedule K-1 1120-S form serves as a document that reports each shareholder's share of income, deductions, credits, and other financial information from an S corporation. This form plays a crucial role in ensuring that the corporation's income is...

The IRS Schedule K-1 1120-S form is crucial for shareholders of an S corporation, serving as a document that reports each shareholder's share of the corporation's income, deductions, credits, and other pertinent tax items. It enables them to accurately report...

The IRS Schedule M-3 1120 form is a document that corporations file to report both financial and tax information. Designed for those with $10 million or more in assets, it provides a detailed look at a company's financial state. This...

The IRS Schedule O 990 or 990-EZ form serves as a supplement for providing additional information and explanations required by Form 990 or 990-EZ filings, used by tax-exempt organizations. This form allows these organizations to furnish detailed narratives or explanations...

The IRS Schedule O for Forms 990 or 990-EZ serves as a document where organizations provide explanations and additional details to responses given in the main form. It is designed to offer transparency and a deeper understanding of the organization’s...

The IRS Schedule SE 1040 form is a crucial document for individuals who are self-employed, as it calculates the amount of self-employment tax owed based on net earnings. This form is an essential part of the tax filing process for...