The IRS Schedule B 941 form is a critical document for employers who report taxes on a quarterly basis. It's specifically designed for tallying tax liabilities. Knowing how to accurately complete this form is essential for staying compliant with IRS...

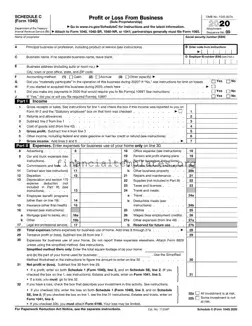

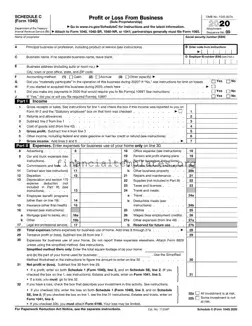

The IRS Schedule C 1040 form is a document that sole proprietors and single-member LLCs use to report their business income and expenses. This form is crucial for determining the profit or loss from a business, which is then reported...

The IRS Schedule C 1040 form is a document used by self-employed individuals to report profits or losses from their business operations. This form is integral to calculating taxable income and determining the amount of social security and Medicare taxes...

The IRS Schedule C-EZ form is a simplified document designed for small business owners and self-employed individuals to report their net profit from business operations. Catering specifically to sole proprietorships, this form requires fewer details than the standard Schedule C...

The IRS Schedule D (Form 1040 or 1040-SR) is a tax form used to report capital gains or losses from the sale of property, stocks, bonds, and other investments. It is an essential part of an individual's tax return, providing...

The IRS Schedule D 1040 or 1040-SR form is used to report the sale or exchange of capital assets. It is an essential tool for taxpayers to calculate their capital gains or losses. This form plays a crucial role in...

The IRS Schedule D 1040 or 1040-SR form is a document that taxpayers use to report the capital gains or losses from the sale of assets. This form is crucial for individuals who need to adjust their income tax returns...

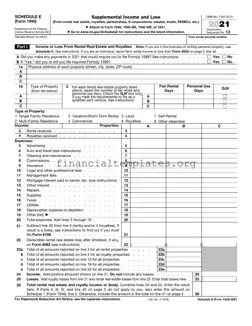

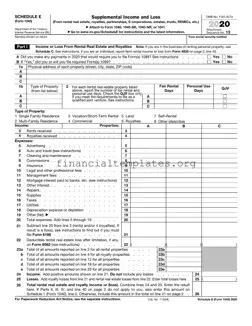

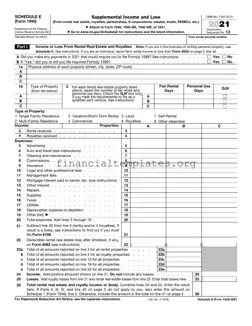

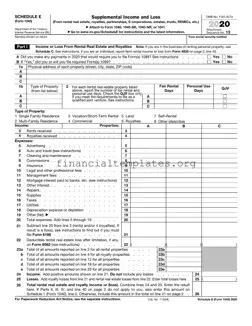

The IRS Schedule E (1040) form is a critical document used by taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Understanding this form is essential for those involved...

The IRS Schedule E 1040 form is a document used by taxpayers to report income and expenses from rental real estate, royalties, partnerships, S corporations, trusts, and estates. This form plays a crucial role in outlining passive income or losses...

The IRS Schedule F (Form 990) is a document designed for organizations to report their activities outside the United States. It encompasses a detailed account of the organization's engagements, including grants, other forms of assistance to entities, individuals overseas, and...

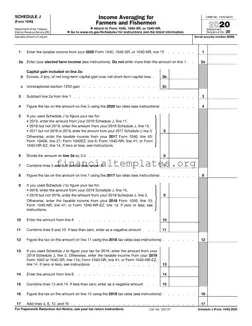

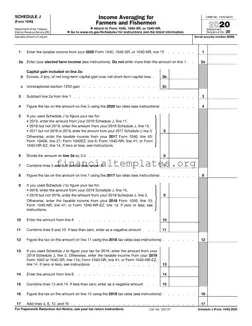

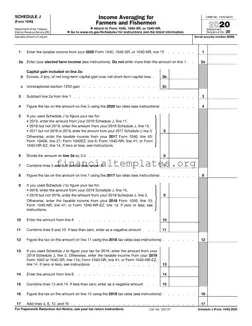

The IRS Schedule J 1040 form plays a crucial role for taxpayers who need to calculate and report their income averaging over the past three years. This form aids individuals whose income can fluctuate significantly from year to year, ensuring...

The IRS Schedule J 1040 form is a document utilized by taxpayers to calculate and report taxes owed on income that is averaged over a period of time, typically to smooth out fluctuations in income and tax rates. This form...