The IRS Schedule 3 1040 or 1040-SR form serves as a critical tool for taxpayers, facilitating the process of reporting additional credits and payments beyond the standard deductions and income entries. This intricate document helps in consolidating various financial elements,...

IRS Schedule 3 of the 1040 or 1040-SR form is a vital tool for taxpayers, allowing them to claim various credits and make additional payments beyond the standard income tax. This form is designed to make tax time a bit...

The IRS Schedule 3 1040 or 1040-SR form is a tax document used to report additional credits and payments that don't fit on the main form of an individual's tax return. It serves as a collection point for various nonrefundable...

The IRS Schedule 8812 1040 form is a tax document used by individuals to calculate and claim the Child Tax Credit. It serves to ensure that qualifying taxpayers receive the credit they are entitled to for their dependents. This form...

The IRS Schedule 8812 1040 form is a critical document for taxpayers claiming the Child Tax Credit. This form serves as an addendum to the primary tax return, helping to determine the eligibility and calculate the credit amount for qualifying...

The IRS Schedule A (Form 1040 or 1040-SR) is a tax form used by U.S. taxpayers to itemize deductions on their income tax returns. Itemizing allows individuals to lower their taxable income by documenting eligible expenses, such as medical costs,...

The IRS Schedule A (Form 1040 or 1040-SR) is an important tax document used to report itemized deductions a taxpayer can claim in lieu of the standard deduction. These deductions range from medical and dental expenses to mortgage interest and...

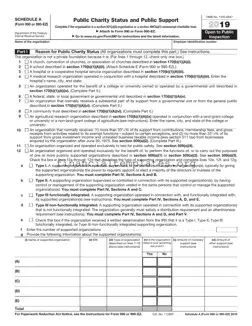

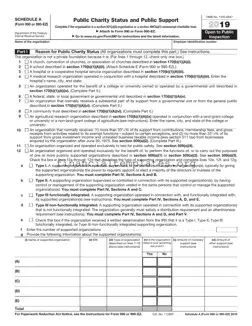

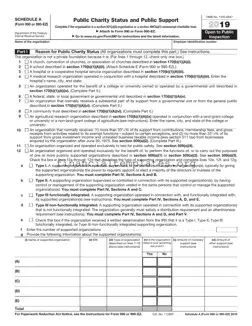

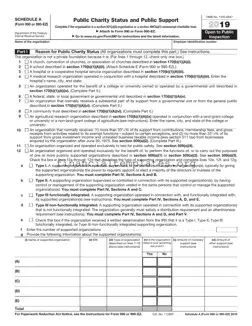

The IRS Schedule A 990 or 990-EZ form is a required document for nonprofit organizations, designed to provide the Internal Revenue Service with detailed information on their charitable activities and financial practices. This form plays a crucial role in maintaining...

The IRS Schedule A 990 or 990-EZ form is a crucial document used by public charities and other non-profit organizations to provide detailed information about their public support status. This form helps these organizations demonstrate they meet the IRS criteria...

The IRS Schedule A 990 or 990-EZ form is a document that non-profit organizations use to provide the Internal Revenue Service with information about their public charity status and activities. It's an essential part of their annual filing, helping to...

The IRS Schedule B 1040 form is a document used by taxpayers to report their interest and dividend income from various sources. This form is supplementary to the main tax return form and is essential for individuals who receive income...

The IRS Schedule B 1040 form is used to report interest and ordinary dividends received over a certain threshold during the tax year. It serves as a detailed account of each source of income, ensuring taxpayers accurately disclose earnings that...