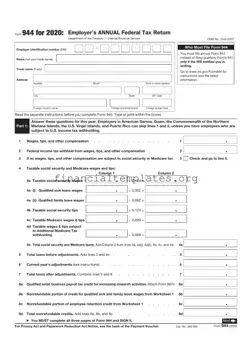

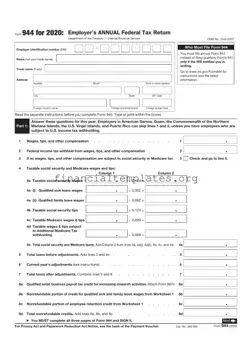

The IRS 944 form is designed for small employers to report their annual federal tax returns. It simplifies the process by consolidating what would otherwise be quarterly filings into a once-a-year submission. This form aims to streamline tax reporting for...

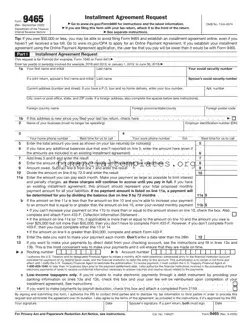

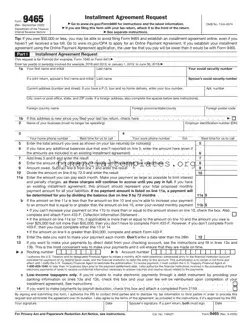

The IRS 9465 form is a document used by taxpayers to request a monthly installment plan if they cannot pay their tax debt in full by the due date. This form offers a structured way for individuals to propose a...

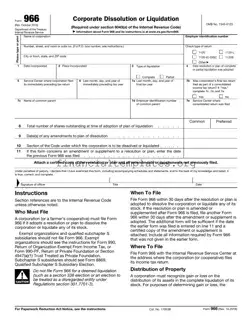

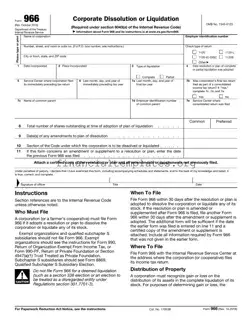

The IRS 966 form, formally known as the "Corporate Dissolution or Liquidation" form, serves a critical function in the documentation of a corporation's decision to dissolve or liquidate. This form is a requirement for any corporation that decides to terminate...

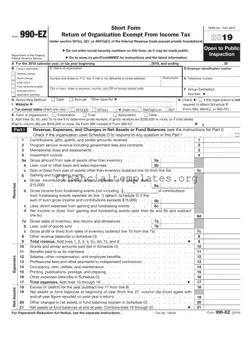

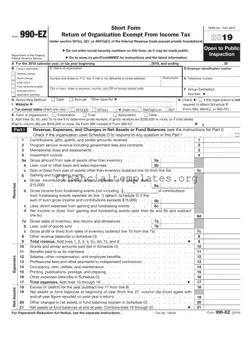

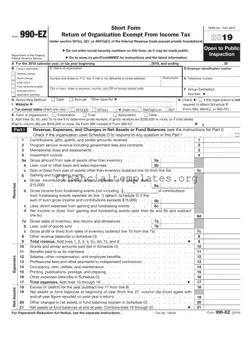

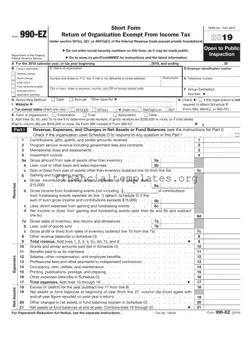

The IRS 990-EZ form is a shorter version of the standard IRS Form 990. It is designed for certain types of nonprofit organizations to report their annual financial information. Organizations that meet specific criteria regarding their gross receipts and total...

The IRS 990-EZ form serves as a shorter version of the standard 990 form, designed for smaller tax-exempt organizations to report their annual financial information. It simplifies the process of compliance for these entities, making it less daunting to fulfill...

The IRS 990-EZ form serves as a shorter, less complex version of the standard IRS 990 form, designed for certain non-profit and tax-exempt organizations to report their annual financial information. It simplifies the reporting process for organizations that meet specific...

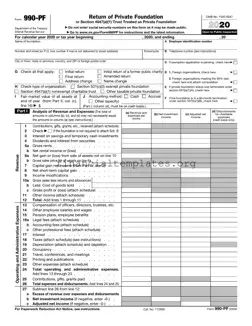

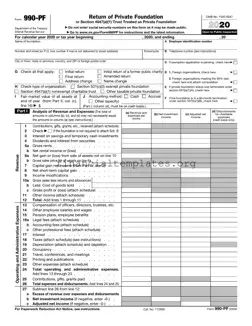

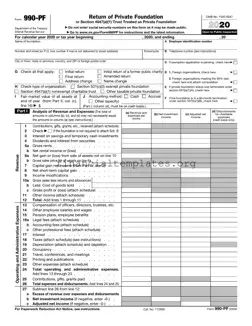

The IRS 990-PF form is a tax document specifically designed for private foundations in the United States. It serves as a report of their annual financial activities, including income, expenses, and contributions. This form plays a critical role in ensuring...

The IRS 990-PF form is a tax document required from private foundations in the United States, used to report their annual financial activities. It provides a comprehensive overview of a foundation's assets, grants, and income over the fiscal year. This...

The IRS 990-T form is a document filed by tax-exempt organizations to report their unrelated business income and calculate the income tax owed on that income. This form is crucial for maintaining compliance with federal tax obligations. Understanding and correctly...

The IRS 990-T form is a tax document required for tax-exempt organizations to report their unrelated business income. This form ensures that income generated from activities not directly related to an organization's exempt purpose is appropriately taxed. It serves as...

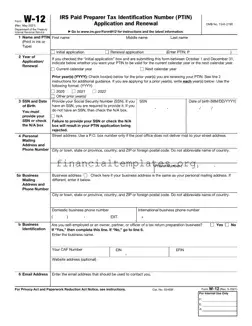

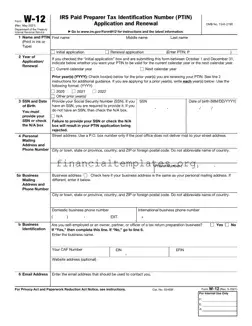

The IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal, known as Form W-12, is a document issued by the Department of the Treasury's Internal Revenue Service. This form facilitates both the initial application for a PTIN and its...

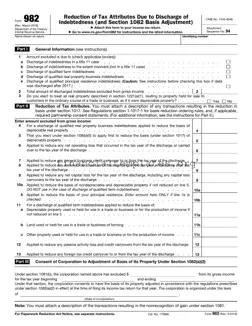

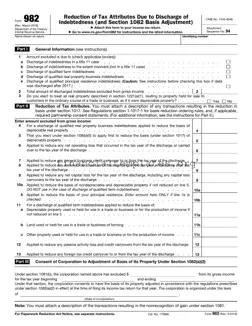

The IRS Insolvency Form, known officially as Form 982: Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment), serves a critical role for individuals and businesses navigating through financial hardship. It's designed to assist taxpayers...