The IRS 940-B form, officially known as the Request for Verification of Credit Information Shown on Form 940, serves as a critical document for employers. It allows them to request a verification of their reported credit information relating to unemployment...

The IRS 940 Schedule A form, officially titled "Multi-State Employer and Credit Reduction Information," is a crucial document for employers operating across state lines. It is designed to accompany Form 940, aiding employers in reporting Federal Unemployment Tax Act (FUTA)...

The IRS 940 form is a federal document used primarily to report an employer's annual Federal Unemployment Tax Act (FUTA) tax. This contribution is essential for funding state workforce agencies. Understanding and correctly filling out this form is vital for...

The IRS 940 form, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a document that employers must file annually. It is used to report the amount of unemployment tax owed to the federal government. This form...

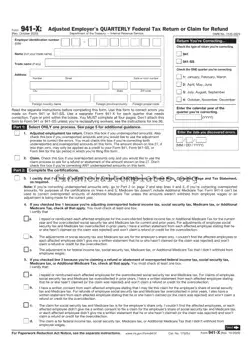

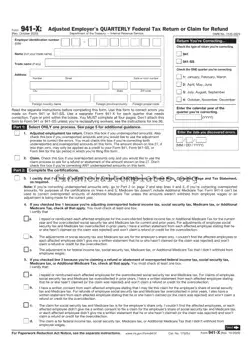

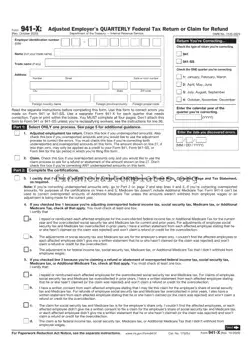

The IRS 941-X form is a critical document for businesses needing to correct errors on a previously filed Form 941. Whether it's about reporting incorrect wages, tips, or taxes, this form serves as the pathway to setting things right. It's...

The IRS Form 941-X is utilized by employers to correct mistakes made on a previously filed Form 941, which reports quarterly federal tax returns. This form ensures that any errors in reporting wages, tips, and other compensation are properly addressed....

The IRS 941 form, known as the Employer's Quarterly Federal Tax Return, is a crucial document for businesses. It's used to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and it also reports the employer's...

The IRS 941 form serves as a quarterly tax return for employers, detailing wages paid, taxes withheld from employees, and the employer's portion of social security and Medicare taxes. It plays a crucial role in ensuring that employees' income tax...

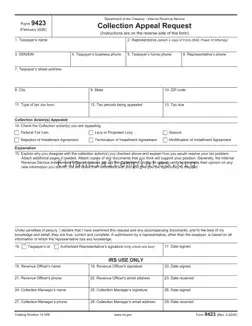

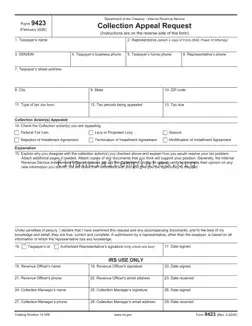

The IRS 9423 form is a crucial document used in the process of requesting a Collection Appeal. This form provides taxpayers an opportunity to present their case when they disagree with certain IRS collection actions. It serves as a bridge...

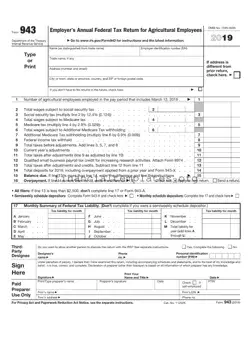

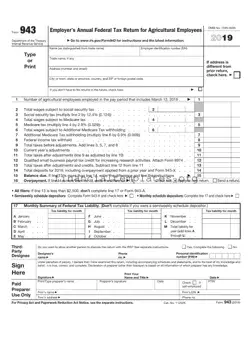

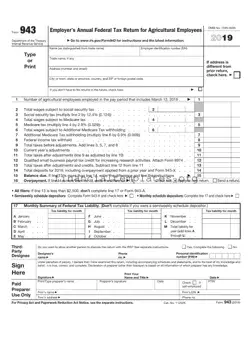

The IRS 943 form is a vital document used by employers to report annual federal tax returns for agricultural workers. This form plays a crucial role in ensuring that employment taxes are accurately reported and paid for those working in...

The IRS 943 form is a crucial document for employers who pay wages to agricultural workers. It serves as an annual tax report detailing the federal income, social security, and Medicare taxes withheld from their pay. Understanding and properly filling...

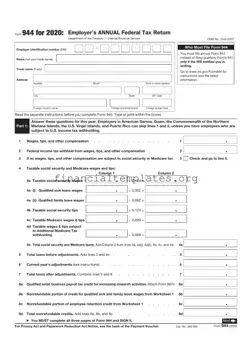

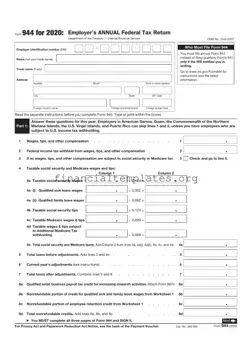

The IRS 944 form is a tax document designed specifically for small employers to report their annual federal tax liabilities. This form simplifies the reporting process by allowing eligible businesses to file once per year instead of every quarter. Its...