The IRS Form 8949 is a tax document used for reporting the sales and exchanges of capital assets. This form is essential for taxpayers to detail individual transactions and the capital gains or losses from each. It plays a crucial...

The IRS 8959 form is an essential document for taxpayers who need to report additional taxes on income not subject to regular withholding or Medicare wages exceeding a certain threshold. It serves as a crucial tool in ensuring that individuals...

The IRS 8959 form is a tax document used to calculate Additional Medicare Tax on incomes that exceed certain thresholds. It is designed for individuals who earn above these limits, ensuring they contribute a bit more towards Medicare. This form...

The IRS 8960 form is a document utilized by taxpayers to calculate the Net Investment Income Tax on certain investment income. This tax applies to individuals, estates, and trusts with income above the statutory threshold amounts. Understanding this form is...

The IRS 8960 form is used to calculate the Net Investment Income Tax applicable to individuals, estates, and trusts with income above the statutory threshold. This tax ensures that higher-income earners contribute a fair share towards Medicare funding. Understanding and...

The IRS Form 8960 is utilized to calculate the Net Investment Income Tax that certain individuals, estates, and trusts must pay. This tax applies to individuals with an income above a certain threshold who earn investment income. Understanding this form...

The IRS Form 8962, officially titled the Premium Tax Credit (PTC) form, is a crucial document for individuals who purchase health insurance through the marketplace established by the Affordable Care Act. This form is used to calculate the amount of...

The IRS Form 8962 is used to calculate the premium tax credit (PTC) for individuals and families who have obtained health insurance through the Health Insurance Marketplace. This form plays a crucial role in ensuring that taxpayers receive the correct...

The IRS Form 8965, titled Health Coverage Exemptions, is a crucial document for individuals seeking to report any exemptions from the health coverage requirement. This form is intended to be attached to the annual Form 1040 tax return, providing a...

The IRS Form 906 is a document utilized by the Department of the Treasury—Internal Revenue Service to establish a closing agreement between a taxpayer and the Commissioner of Internal Revenue. This form allows for a final determination on specific matters...

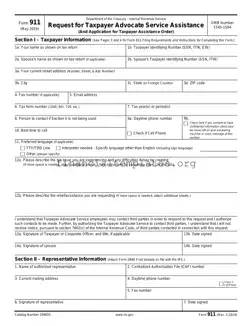

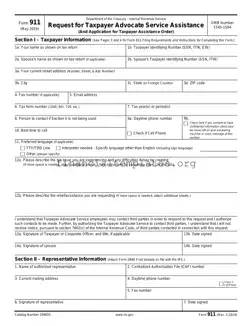

The IRS Form 911 is a request for taxpayer assistance. This form serves as a means for individuals to seek help from the Taxpayer Advocate Service when they are experiencing significant hardship due to tax issues. It is a critical...

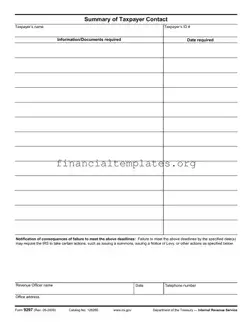

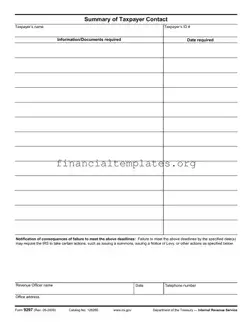

The IRS Form 9297, also known as Summary of Taxpayer Contact, serves as a critical communication tool between the Internal Revenue Service and taxpayers. It outlines the information or documents required from the taxpayer, specifies the deadlines for submission, and...