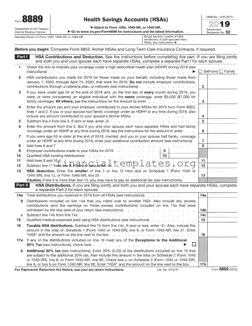

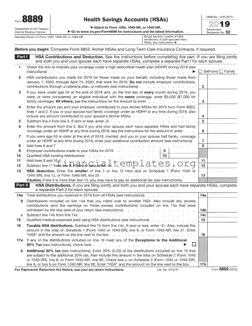

The IRS 8889 form is a crucial document for individuals participating in Health Savings Accounts (HSAs). It serves as the primary means to report contributions, distributions, and tax deductions associated with these accounts. Proper completion of this form is essential...

The IRS 8889 form is a crucial document for individuals with Health Savings Accounts (HSAs), serving as the primary means to report contributions, distributions, and tax deductions related to HSAs on their federal income tax returns. Ensuring accurate and timely...

The IRS 8889 form is a crucial document for taxpayers who have a Health Savings Account (HSA). It is used to report contributions, distributions, and to calculate the tax deductions related to HSAs. Understanding how to properly complete this form...

The IRS 8917 form, known as the Tuition and Fees Deduction form, allows taxpayers to deduct qualified education expenses. These expenses must be for higher education paid during the tax year for themselves, their spouse, or a dependent. This deduction...

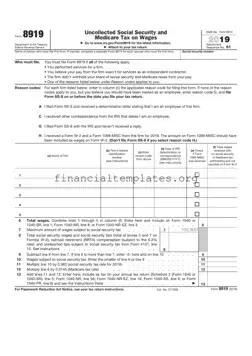

The IRS 8919 form is used by employees to report taxes on wages not accounted for by employers through payroll withholding. This situation typically occurs when an employer incorrectly classifies an individual as an independent contractor rather than an employee....

The IRS 8919 form is used by workers to report uncollected Social Security and Medicare taxes due to their employer's failure to properly classify them as employees. It serves as a means for individuals to ensure they receive proper credit...

The IRS 8919 form is a document used by workers to report their wages and taxes from an employer who did not withhold these amounts as required. It serves as a crucial tool for employees improperly classified as independent contractors...

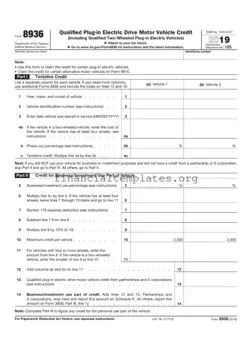

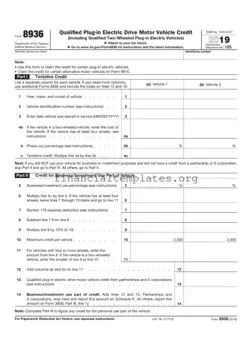

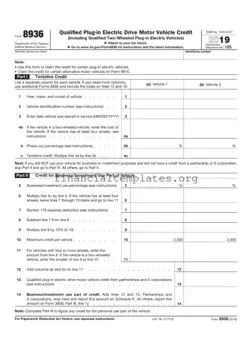

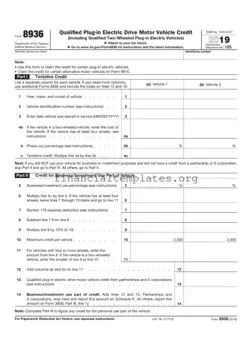

The IRS 8936 form, officially titled the Qualified Plug-in Electric Drive Motor Vehicle Credit, is a critical document for taxpayers seeking to claim a credit for their electric vehicle (EV) purchases. This form allows individuals to calculate and report the...

The IRS 8936 form is a document specifically designed for individuals and businesses to claim a tax credit for the purchase of qualified plug-in electric drive motor vehicles, including passenger vehicles and light trucks. This credit serves as an incentive...

The IRS 8936 form is a document used by taxpayers to claim the federal income tax credit for qualified plug-in electric drive motor vehicles, including passenger vehicles and light trucks. This credit is part of the government's incentive to encourage...

The IRS Form 8949 serves a critical role for individuals and entities by documenting capital gains and losses from transactions in securities, like stocks and bonds. This form helps taxpayers accurately report their investment activity to the Internal Revenue Service,...

The IRS 8949 form is a document that taxpayers use to report the sale and exchange of capital assets. This includes stocks, bonds, and real estate, providing details on gains or losses from these transactions. It's a key part of...