The IRS Form 8867 is a crucial document for tax professionals, acting as a due diligence checklist for those claiming Earned Income Tax Credit, Child Tax Credit, and other related tax benefits. This form is designed to ensure accuracy and...

The IRS 8867 form, known as the "Due Diligence Checklist," is a critical document for tax preparers. It is designed to ensure that they have performed the necessary due diligence when claiming certain tax credits for their clients. This form...

The IRS 8868 form is a document utilized by tax-exempt organizations to apply for an extension of time to file their return. This allows organizations more time to gather necessary information and ensure the accuracy of their submission. Understanding how...

The IRS 8868 form serves as an application for organizations seeking an extension of time to file their tax-exempt return or notice. It's designed to provide relief for entities that need additional time to compile their necessary documentation. By submitting...

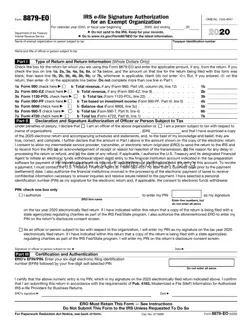

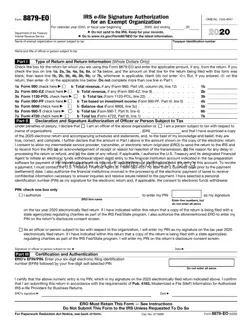

The IRS Form 8879-EO serves as the IRS E-FILE Signature Authorization for Exempt Organizations, enabling officers or persons subject to tax within these organizations to utilize a Personal Identification Number (PIN) for the electronic signature of their electronic return. Applicable...

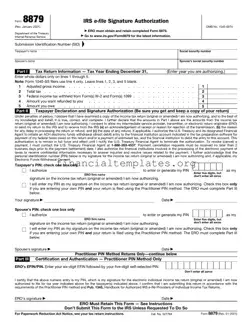

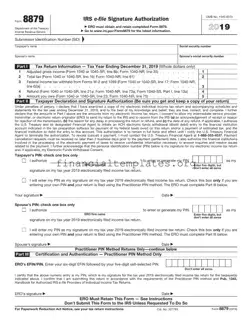

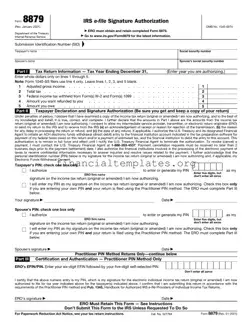

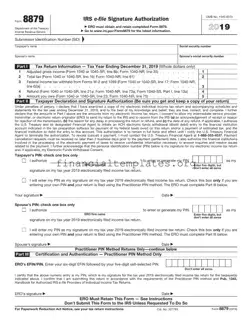

The IRS 8879 form is a document that allows tax preparers to electronically file an individual's federal income tax return with the taxpayer's authorization. This form serves as a critical step in ensuring that the tax filing process is both...

The IRS 8879 form serves as the electronic signature authorization for an individual's tax return filed through the IRS e-file system. This key document allows taxpayers to verify their return information, consenting to electronic submission without needing a paper signature....

The IRS 8880 form is a document used by taxpayers in the United States to claim the Credit for Qualified Retirement Savings Contributions. This credit is intended to encourage individuals and families to save for retirement by offering a tax...

The IRS 8880 form is a document used by taxpayers to claim the credit for qualified retirement savings contributions. It helps individuals reduce their tax liability by providing a credit for contributions to IRAs, 401(k)s, and certain other retirement plans....

The IRS 8888 form allows taxpayers to allocate their federal tax refund across multiple accounts. This mechanism not only simplifies the process of distributing funds to various destinations, such as checking and savings accounts, but also enables the purchase of...

The IRS Form 8888 is a document taxpayers use to allocate their federal tax refund among two or three different accounts. This option allows individuals to directly deposit their refunds into savings, checking, or retirement accounts, offering a streamlined approach...

The IRS Form 8888 is designed for taxpayers who wish to allocate their federal tax refund across multiple accounts. This option enables individuals to directly deposit their refunds into two or more bank accounts, or purchase U.S. Series I Savings...