The IRS 8843 form is a statement for nonresident aliens who need to clarify their tax status in the United States. Specifically designed for individuals who are present in the U.S. under certain visas but do not qualify as residents...

The IRS Form 8843 is a statement for certain nonresident aliens, including international students and scholars, detailing their presence in the United States for a specific tax year. It is not a tax return but a required form for individuals...

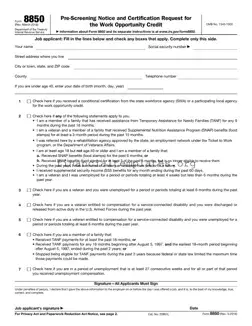

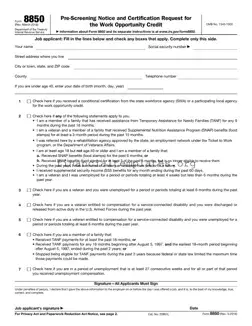

The IRS Form 8850, titled "Pre-Screening Notice and Certification Request for the Work Opportunity Credit," is a vital first step for employers seeking to claim the Work Opportunity Tax Credit (WOTC). This form, provided by the Department of the Treasury's...

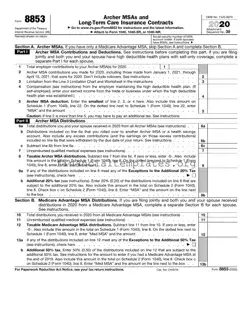

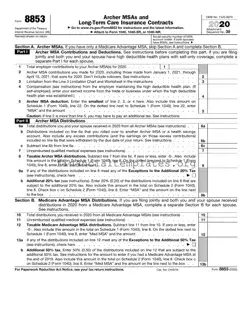

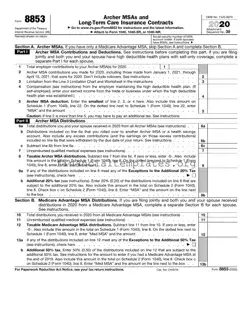

The IRS 8853 form serves as a critical document for taxpayers wanting to report Medical Savings Account (MSA) and Medicare+Choice MSA contributions and distributions. It acts as a conduit for individuals to correctly disclose this information as part of their...

The IRS Form 8853 is a document used to report certain types of expenditures and savings related to long-term care insurance and Medical Savings Accounts (MSAs). It plays a critical role for individuals who wish to account for these transactions...

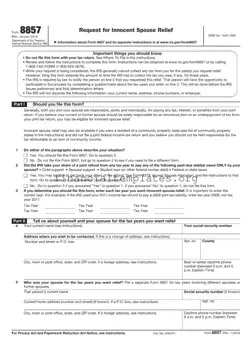

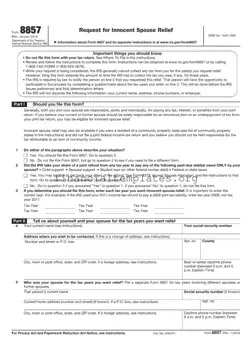

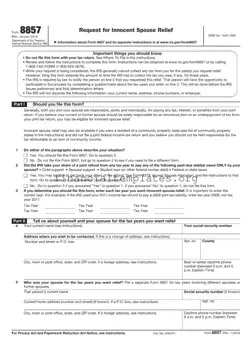

The IRS Form 8857, also known as the Request for Innocent Spouse Relief, serves as a pivotal document for individuals seeking to be absolved from liability for tax debt attributed to a spouse or ex-spouse. This form allows taxpayers to...

The IRS 8857 form is a request for relief from joint and several liabilities for taxes. This form provides a way for individuals to apply for relief if they believe they should not be held responsible for tax, interest, and...

The IRS 8862 form, also known as "Information To Claim Certain Refundable Credits After Disallowance," is essentially a taxpayer's ticket back to eligibility for claiming specific tax credits that were previously denied. This form plays a critical role for those...

The IRS 8862 form, often encountered during tax season, serves a crucial purpose: it's essentially a second chance for taxpayers. This document is needed when someone, previously denied certain tax credits due to mistakes or discrepancies, seeks to claim those...

The IRS 8863 form is a document that taxpayers in the United States use to claim education credits. These credits, including the American Opportunity Credit and the Lifetime Learning Credit, help reduce the amount of tax owed on a return....

The IRS 8863 form is a document used by individuals to claim education credits on their federal income tax return. These credits, known as the American Opportunity Credit and the Lifetime Learning Credit, are designed to offset the costs of...

The IRS 8863 form is a crucial document for individuals seeking to claim education credits on their federal tax return. It serves as a pathway to potential savings for those paying for higher education, including tuition and fees. By adequately...