The IRS 8821 form serves as an authorization document allowing individuals to permit any person or organization, not just their authorized tax professional, to access or receive their private tax information. This access can facilitate a broad range of purposes,...

The IRS 8821 form serves as a pivotal tool, allowing taxpayers to authorize any individual or organization to access their tax information. This authorization facilitates communication and the efficient handling of tax matters by representatives. It simplifies the process of...

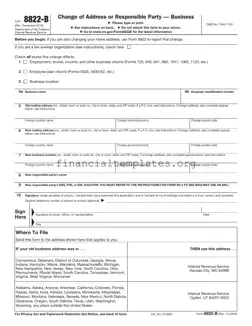

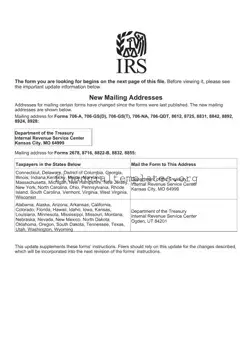

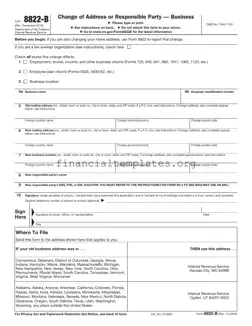

The IRS 8822-B form serves a crucial role for individuals and businesses that need to report a change in address or the identity of their responsible party to the Internal Revenue Service. Ensuring this information is up-to-date is not just...

The IRS 8822 form is a document designed for taxpayers wishing to formally notify the Internal Revenue Service (IRS) of a change in address. Ensuring the IRS has the correct address is critical for receiving timely tax refunds and important...

The IRS Form 8822 serves a critical purpose: it notifies the Internal Revenue Service about a change in address for individuals, ensuring that tax documents and refunds get directed to the right location. Keeping the IRS updated with current address...

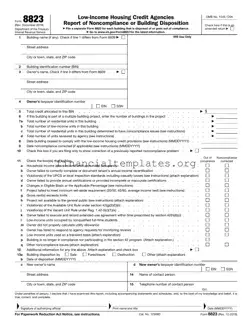

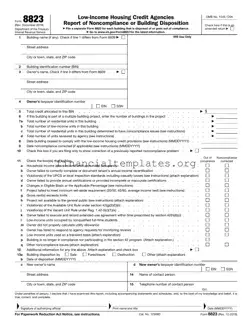

The IRS Form 8823 is utilized by Low-Income Housing Credit Agencies to report any noncompliance issues or the disposition of buildings within the framework of the low-income housing credit provisions. This form plays a critical role in the IRS's compliance...

The IRS 8829 form is a crucial document for individuals who use part of their home for business purposes. It's designed to calculate the allowable expenses for business use of your home, helping you to determine the deduction you can...

The IRS 8829 form is essential for individuals who use part of their home for business, as it allows them to calculate and claim deductions for business use of their home. This form takes into account various expenses such as...

The IRS 8829 form is a crucial document for individuals who operate their business from home, allowing them to calculate the allowable expenses for business use of their residence. This form helps to deduct a portion of the operating and...

The IRS 8832 form serves as a critical document for businesses electing their tax classification. This customizable option allows entities to be taxed as a corporation, partnership, or as disregarded entity, impacting how they report income and expenses. Understanding this...

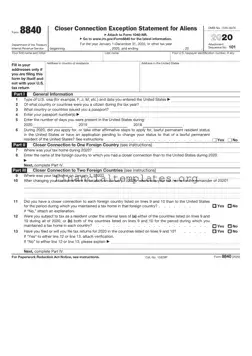

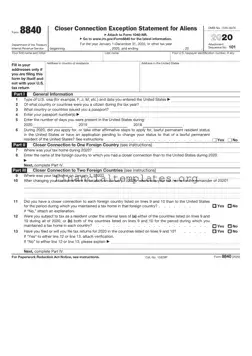

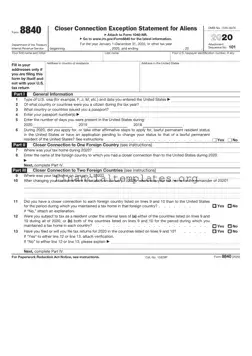

The IRS 8840 form, often referred to as the "Closer Connection Exception Statement for Aliens," is a crucial document for non-resident aliens in the United States. It allows individuals to claim they have a closer connection to a foreign country...

The IRS 8840 form, officially known as the "Closer Connection Exception Statement for Aliens," is a critical document for non-residents who spend a significant amount of time in the United States but wish to claim they maintain a closer connection...