The IRS 8582 form, officially known as the Passive Activity Loss Limitations form, is used to calculate and report the amount of loss from passive activities that can be deducted in the current tax year. It ensures that taxpayers comply...

The IRS 8655 form, formally known as the Reporting Agent Authorization, serves a key role in the tax administration process. It allows taxpayers to appoint third parties to perform various tax-related functions on their behalf. This authorization encompasses actions such...

The IRS 8718 form is a critical document used to determine the user fee for certain tax-exempt applications. It serves as a calculation tool to establish the appropriate fee based on the type of exemption requested. This form is necessary...

The IRS 8718 form is a crucial document required for tax-exempt organizations seeking classification under sections 501(c)(3) and 4942(j)(3). This form accompanies the payment for services rendered in determining the organization's tax-exempt status. Its completion is a vital step for...

The IRS Form 8734 serves as a Support Schedule for Advance Ruling Period, a crucial document for organizations aiming to maintain their tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is designed to track and detail...

The IRS 8801 form is a document used by individuals to calculate the minimum tax for purposes of the credit for prior year minimum tax. This form plays a key role for taxpayers who need to carry over certain credits...

The IRS 8801 form is a document used by individuals to calculate the Minimum Tax Credit (MTC) for certain prior year taxes. It serves as a mechanism to potentially reduce future taxes if an individual was subject to the Alternative...

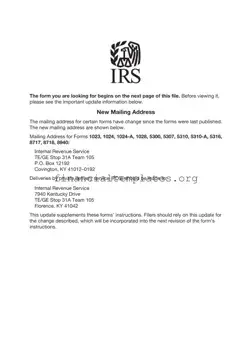

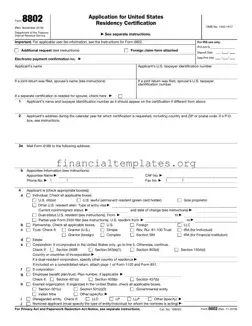

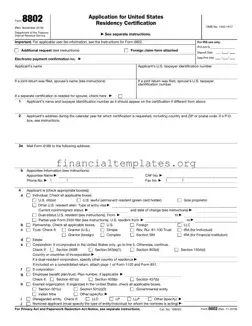

The Form 8802, issued by the Department of the Treasury's Internal Revenue Service, serves as an Application for United States Residency Certification. It plays a crucial role for individuals, partnerships, corporations, and other entities requiring official proof of U.S. residency...

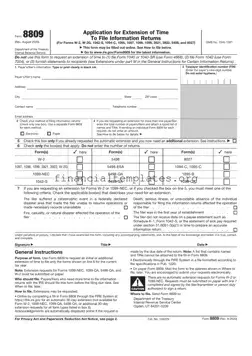

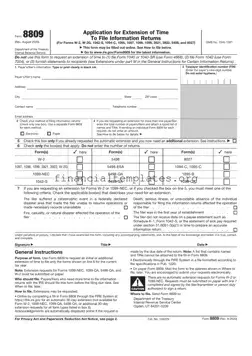

The IRS Form 8809 is an application used for requesting an extension of time to file certain information returns. This form is crucial for businesses and individuals who need extra time to compile and submit their tax documentation accurately. It...

The IRS 8812 form, known as the Additional Child Tax Credit form, is a crucial document for taxpayers seeking to claim the additional child tax credit on their tax return. It serves as an attachment to Form 1040, Form 1040A,...

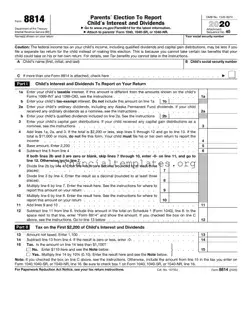

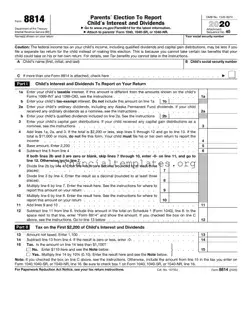

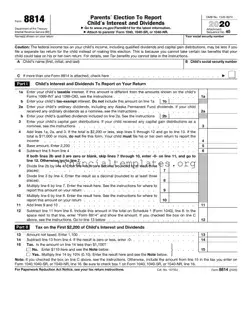

The IRS 8814 form is a document used by parents or guardians to report their child’s income on their own tax returns. This form simplifies the tax filing process for families by consolidating income reports. It is specifically designed to...

The IRS 8814 form is a document used by parents to report their child’s investment income on their own tax returns. This option can provide simplicity and potential tax savings, allowing the child's income to be taxed at the parent's...