The IRS 8379 form, also known as the Injured Spouse Allocation, is a document that allows individuals to claim their share of a joint tax refund in situations where the refund was applied to the spouse's past due obligations. By...

The IRS Form 8379, also known as the Injured Spouse Allocation, serves a crucial purpose. It allows individuals who file joint tax returns to request their portion of a tax refund, which may be applied against the past due debts...

The IRS 8396 form is a document used by taxpayers to claim a mortgage interest credit, a beneficial tool for homeowners with low income. This credit directly reduces the amount of income tax they owe to the federal government. Filing...

The IRS 8396 form is specifically designed for homeowners to claim the Mortgage Interest Credit, a boon for those who qualify based on mortgage interest paid on their first home. This credit not only helps to reduce the amount of...

The IRS 8396 form, officially known as the Mortgage Interest Credit form, serves an essential purpose for homeowners. It allows individuals who receive a mortgage credit certificate from their state or local government to claim a tax credit for a...

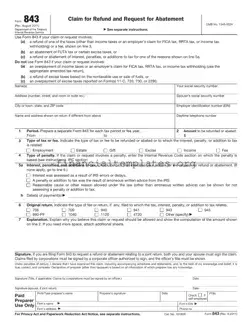

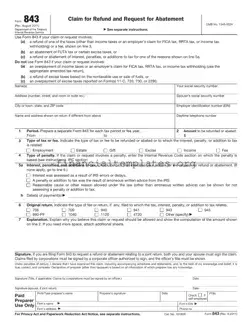

The IRS 843 form is a document individuals use to request a refund or ask for an abatement of certain taxes, interest, penalties, fees, and additions to tax. This form allows taxpayers to communicate directly with the tax authorities about...

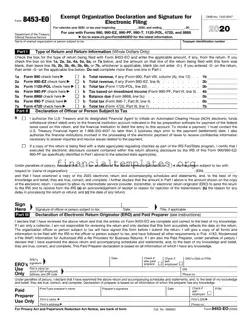

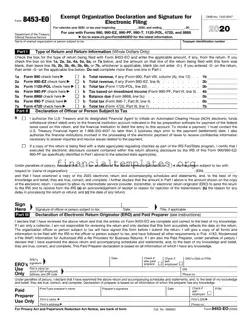

The IRS Form 8453-EO serves as the Exempt Organization Declaration and Signature for Electronic Filing. It is utilized alongside various forms such as Forms 990, 990-EZ, 990-PF, 990-T, 1120-POL, 4720, and 8868, enabling authorized individuals to authenticate and electronically submit...

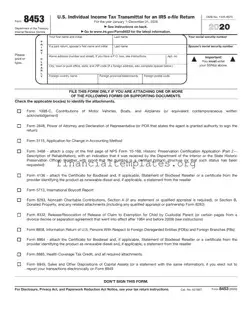

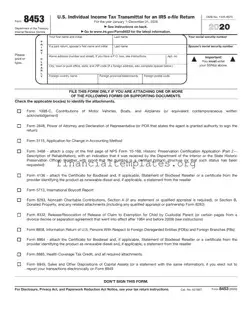

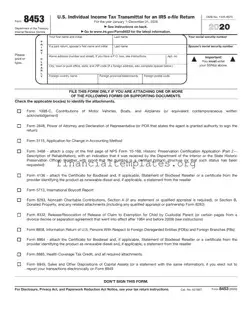

The IRS 8453 form serves as an official declaration, allowing taxpayers to submit their tax returns electronically while mailing in any accompanying documents that need to be filed in paper form. This process ensures the secure and efficient processing of...

The IRS 8453 form is an official document used by taxpayers to submit their tax return information electronically to the Internal Revenue Service (IRS). It serves as a cover sheet, providing the IRS with a summary of the attachments being...

The IRS Form 851, known as the Affiliations Schedule, plays a critical role for corporations submitting a consolidated income tax return. This form outlines the identification of a common parent corporation and its affiliates, detailing overpayment credits, estimated tax payments,...

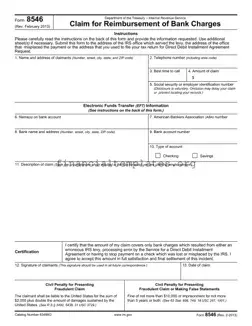

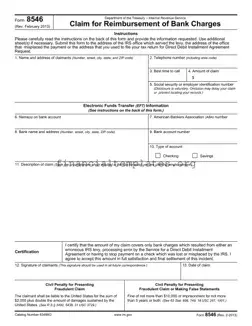

The IRS Form 8546, issued by the Department of the Treasury and the Internal Revenue Service, serves as a claim for reimbursement of bank charges due to IRS errors. This form is utilized by individuals seeking to recover costs incurred...

The IRS Form 8582 is a document used by taxpayers to report passive activity loss limitations. It's designed to help individuals navigate the complex rules surrounding the deductions they can take from passive income activities. Understanding and correctly filling out...