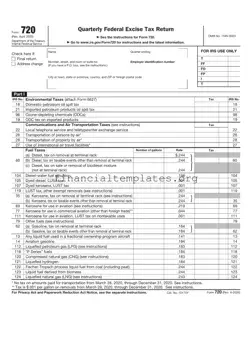

The IRS 720 form is a quarterly federal excise tax return used by taxpayers to report and pay on certain types of transactions. It covers a wide range of products and services, from fuel to indoor tanning services. Understanding this...

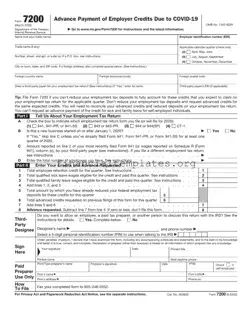

The IRS 7200 form is a document businesses use to request an advance payment of employer credits due to COVID-19. This form allows companies to get quicker access to funds they're entitled to from certain tax credits. It's an essential...

The IRS 7200 form, also known as the "Advance Payment of Employer Credits Due to COVID-19," is a document designed for employers to request an advance payment of tax credits for qualified sick and family leave wages and the employee...

The IRS Form 7575 is designated for State Aid for Local Transportation, as outlined in a June 2007 example. It carries a clear warning: the form is intended strictly for informational purposes and should not be replicated by taxpayers on...

The IRS Form 785 provides crucial guidance on Purchase Money Mortgages (PMM), Purchase Money Security Interests (PMSI), and the subordination of the Federal Tax Lien. It outlines the possibility for lenders to secure a priority interest over a pre-existing Notice...

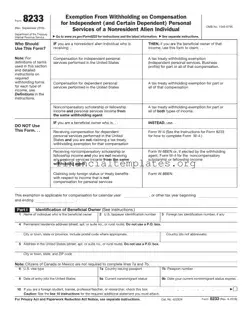

The IRS Form 8233 is designed for nonresident aliens to claim a tax treaty benefit or to assert an exemption from withholding on income earned in the United States. This critical document ensures that individuals eligible for tax benefits do...

The IRS 8282 form, officially known as the "Donee Information Return," is utilized by organizations to report information to the IRS about charitable contributions they have sold, exchanged, or otherwise disposed of within a certain period. This form plays a...

The IRS 8282 form, known as the "Donee Information Return," is a critical document for organizations that receive charitable donations of property valued over $5,000 and then sell, exchange, or otherwise dispose of the property within three years of receipt....

The IRS 8283 form is a document used by individuals to report non-cash charitable contributions to the Internal Revenue Service. This form becomes necessary when the value of the donated property exceeds $500. It ensures that taxpayers accurately report the...

The IRS 8283 form is a document used by individuals who donate property valued over $500 to claim a tax deduction on their federal tax returns. Its purpose is to provide the Internal Revenue Service (IRS) with detailed information about...

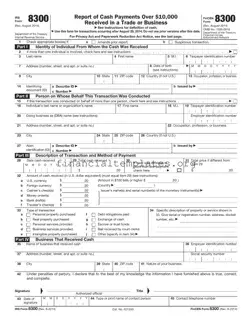

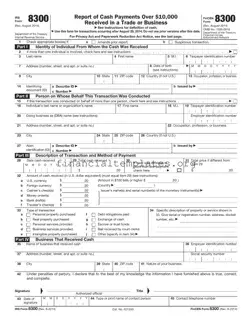

The IRS 8300 form plays a crucial role in the financial reporting landscape, serving as a tool for reporting cash payments exceeding $10,000 received in a trade or business transaction. This mandate, aimed at combatting money laundering and maintaining financial...

The IRS 8332 form is a document that allows a custodial parent to release their right to claim a child as a dependent, enabling the non-custodial parent to claim the child on their tax return. This form is especially important...