The IRS 6744 form is designed for those looking to test their knowledge of preparing taxes. It's utilized mainly for training purposes, helping individuals to hone their skills in tax preparation through various scenarios. This form is a valuable resource...

The IRS 6744 form serves as a vital instrument for those looking to test or refresh their knowledge on preparing tax returns. This comprehensive resource, offered at no charge, is designed to both train and certify volunteers in the IRS's...

The IRS 6781 form serves as an essential document for taxpayers who engage in certain types of financial transactions, specifically gains and losses from Section 1256 contracts and straddles. It allows individuals to report both their gains and losses, ensuring...

The IRS 6781 form, also known as the "Gains and Losses From Section 1256 Contracts and Straddles," is a required document for taxpayers who engage in certain types of investment transactions. It serves to report profits or losses from straddles...

The IRS 6781 form is a crucial document for taxpayers who engage in foreign currency contracts and commoditities futures, among other financial instruments. It serves the purpose of reporting gains and losses under the specific tax regulations governing these transactions....

The IRS 7004 form serves as an application for automatic extension of time to file certain business income tax, information, and other returns. It's designed to provide entities with additional time to prepare their financial details accurately, without the stress...

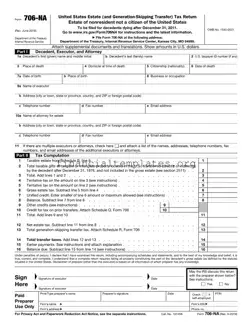

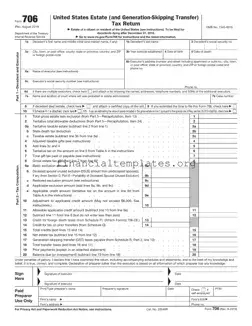

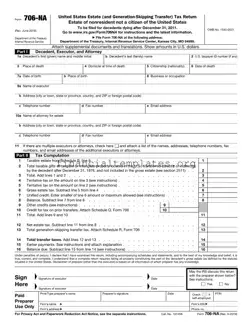

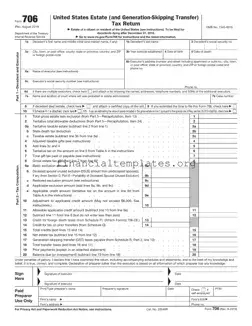

The IRS Form 706-NA is a crucial document for estates of nonresidents who are not citizens of the United States, dealing with estate (and generation-skipping transfer) tax returns for decedents passing away after December 31, 2011. It outlines the necessary...

The IRS Form 706 is a document used to report an individual's estate and calculate any taxes due on it after their death. It's essential for estates that exceed the exemption threshold established by the federal government. This form plays...

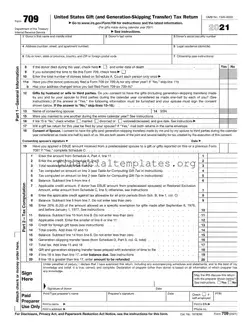

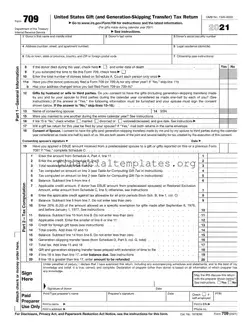

The IRS 709 form serves as the United States Gift (and Generation-Skipping Transfer) Tax Return document. Individuals use it to report gifts that exceed the annual exclusion limit, ensuring compliance with tax regulations. It plays a critical role in the...

The IRS 709 form, officially titled "United States Gift (and Generation-Skipping Transfer) Tax Return," is a document required for reporting gifts that exceed the annual exclusion limit set by the IRS. This form is an essential tool for individuals to...

The IRS 709 form serves a critical function in the United States tax system, acting as the United States Gift (and Generation-Skipping Transfer) Tax Return. It records the transfer of property or money to another person without receiving something of...

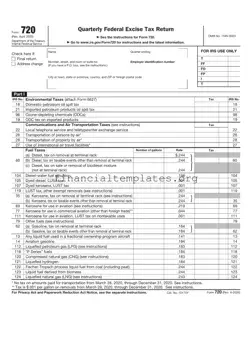

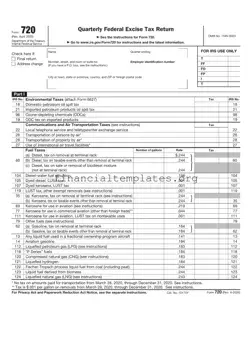

The IRS 720 form serves as a quarterly federal excise tax return used by taxpayers to report and pay taxes on specific goods, services, and activities. This requirement applies to a varied range of businesses and operations, entailing the collection...