The IRS 5330 form is a document used for reporting and paying taxes on specific retirement plans and tax-exempt organizations. It serves as a means to comply with certain tax obligations that arise from specific types of transactions within these...

Form IRS 5405 is a critical document for those buying or selling a home, particularly if they are seeking specific tax credits related to home ownership. It serves as a guide for reporting the details of such transactions to the...

The IRS 5405 form serves as a critical document for taxpayers who are looking to benefit from first-time homebuyer credits. It sets the stage for individuals to navigate the complexities of tax benefits associated with purchasing their first home. This...

The IRS 5472 form is a requirement for certain U.S. businesses involved with foreign individuals or entities to report transactions between the U.S. company and the related foreign party. Its main purpose is to ensure transparency and compliance with international...

The IRS 5472 form is a tax document required by the United States Internal Revenue Service (IRS) for certain transactions between a U.S. reporting corporation and a foreign or related party. It serves to report the nature and amount of...

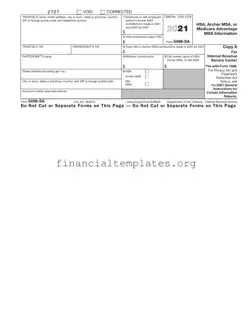

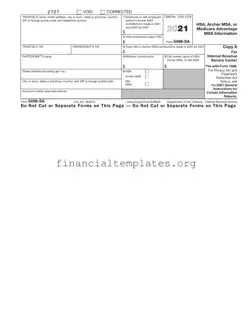

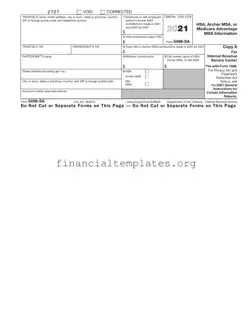

The IRS 5498-SA form is a document that trustees and issuers of Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), or Medicare Advantage (MA) Medical Savings Accounts are required to file with the Internal Revenue Service. This form...

The IRS 5498-SA form is a document that trustees or issuers of a Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage MSA (MA MSA) must file with the Internal Revenue Service. This form reports contributions...

The IRS 5498 form is an essential document for taxpayers who have an individual retirement arrangement (IRA). It provides detailed information about contributions to the account, including any rollovers, conversions, and the fair market value of the account. This form...

The IRS 5498 form is an essential document for individuals who have an IRA (Individual Retirement Account) or similar retirement plans. It provides detailed information regarding contributions to these accounts within a tax year. The form is used by financial...

The IRS 5498 form serves as an annual statement that outlines individual retirement account (IRA) contributions. Financial institutions are required to file this document with the IRS and also send a copy to the account holder. Its purpose is to...

The IRS 5558 form serves as an application for an extension of time to file certain employee plan returns. This form allows taxpayers to request additional time to submit detailed and often complex financial information. Ensuring accuracy and compliance, the...

The IRS Form 56, known as the Notice Concerning Fiduciary Relationship, serves a crucial role under the auspices of the Internal Revenue Code Sections 6036 and 6903. It's a formal declaration to the Internal Revenue Service that an individual is...