The IRS 4868 form is a document that allows individuals to request an extension of up to six months to file their federal income tax return. This extension provides extra time to gather necessary documentation and ensure the accuracy of...

The IRS 4868 form is an application for an automatic extension of time to file a U.S. individual income tax return. By submitting this form, taxpayers can receive up to six more months to file their taxes, without incurring penalties...

The IRS 4868 form serves as an application for an automatic extension of time to file a U.S. individual income tax return. By submitting this form, taxpayers can obtain an extra six months to file their returns, without facing late...

The IRS 4952 form is a critical piece of documentation for taxpayers looking to calculate the amount of investment interest expense they can deduct on their federal income tax return. It aids in determining the allowable deduction that could significantly...

The IRS 4952 form, officially known as the Form for Investment Interest Expense Deduction, serves an essential purpose for taxpayers. This document is used to calculate the amount of investment interest expense that can be deducted from one's taxable income....

The IRS 4972 form is designated for taxpayers to calculate the tax on lump-sum distributions from qualified retirement plans. This form is utilized when individuals decide to take their retirement plan distribution in one large sum, rather than receiving periodic...

The IRS 4972 form, known officially as the Tax on Lump-Sum Distributions, is used by taxpayers to compute the tax on a lump-sum distribution they have received from a qualified retirement plan. This form allows for special tax calculations that...

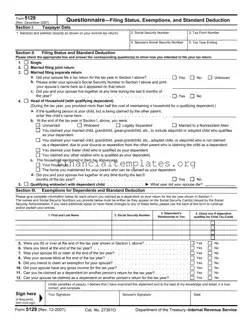

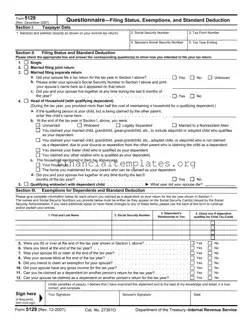

The IRS Form 5129, also known as the Questionnaire for Filing Status, Exemptions, and Standard Deduction, is a comprehensive form designed to gather taxpayer data, including personal information and tax filing preferences. It focuses on determining the most suitable filing...

The IRS 5304-SIMPLE form is a document used by small businesses to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA. This type of plan enables employees and employers to contribute to traditional IRAs, set up for the employees,...

The IRS 5305-SEP form serves as a simplified agreement for entrepreneurs and small business owners to establish a Simplified Employee Pension (SEP) plan. This pivotal document outlines the basic structure and guidelines for contributing to an SEP, which, in turn,...

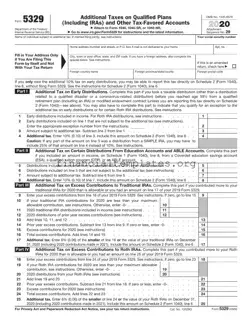

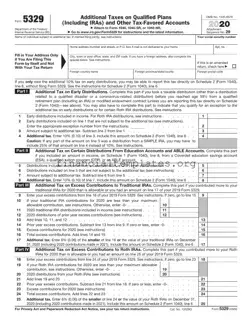

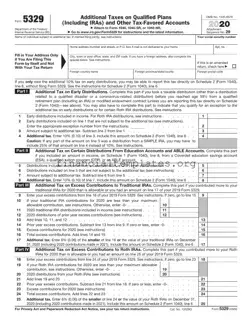

The IRS 5329 form is a crucial document used to report additional taxes on IRAs, other qualified retirement plans, and other tax-favored accounts. Its main aim is to help individuals calculate taxes related to excess contributions, premature distributions, and other...

The IRS 5329 form is a tax document used to report additional taxes on IRAs, other qualified retirement plans, and other tax-favored accounts. It serves as a tool for taxpayers to inform the Internal Revenue Service about insufficient contributions or...