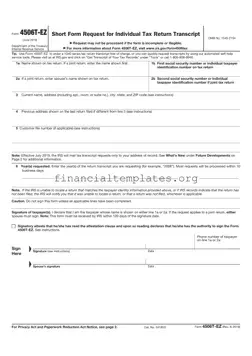

The IRS 4506T-EZ form is a simplified document designed for individuals to request a tax transcript. This form is specifically tailored to those who need to provide proof of income to lenders, without needing the full detailed tax return. It...

The IRS 4506T-EZ form is a streamlined document designed for individuals to request a copy of their most recent tax return information. This form caters specifically to those applying for consumer loans and mortgages, making it a critical tool in...

The IRS Form 4549, also known as the Income Tax Examination Changes form, is a document used by the Department of the Treasury Internal Revenue Service to outline adjustments to a taxpayer’s income, deductions, and tax liability following an examination...

The IRS Form 4562 is used for reporting depreciation and amortization. It covers a wide range of assets including listed property, and it must be attached to taxpayers' returns. It is crucial for businesses to accurately report the depreciation of...

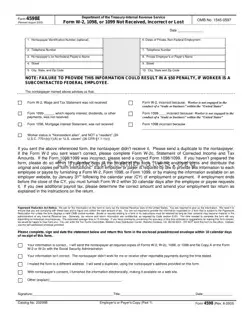

The IRS Form 4598E, officially named "Form W-2, 1098, or 1099 Not Received, Incorrect, or Lost," serves as a critical notification tool for individuals who have not received these forms, have received incorrect versions, or have lost them. Issued by...

The IRS Form 4681, officially known as Publication 4681 ("Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals)"), provides crucial information for individuals preparing their tax returns, specifically in cases where debt has been canceled, forgiven, or otherwise resolved without full...

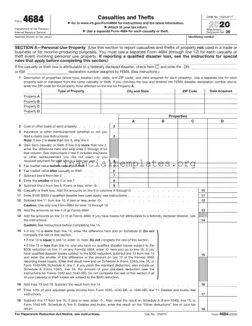

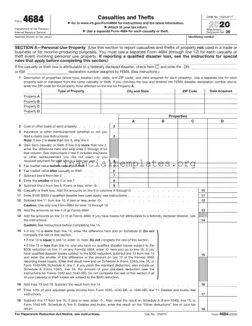

The IRS 4684 form, often known as the Casualties and Thefts form, is a document used to report property losses that aren't compensated by insurance or other means. These losses can result from sudden events like natural disasters, theft, or...

The IRS 4684 form is a document for taxpayers to report damages or losses linked to disasters, thefts, or other unfortunate events. It plays a critical role in determining possible tax deductions or credits related to these losses. Filling out...

The IRS 4797 form is a document used by taxpayers to report the sale or exchange of property used in a trade or business. This form is crucial for individuals who need to accurately report gains or losses from such...

The IRS 4797 form is a tax document used by taxpayers to report the sale or exchange of property used in a trade or business. This can include real estate, vehicles, and equipment among others. It plays a crucial role...

The IRS 4797 form is a crucial document for reporting the sale or exchange of business property. It helps taxpayers to distinguish between ordinary gains and losses and those that qualify as capital gains or losses, which can significantly impact...

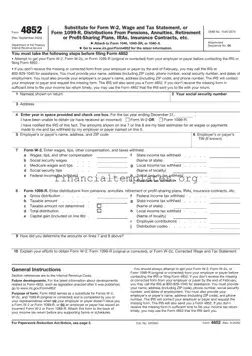

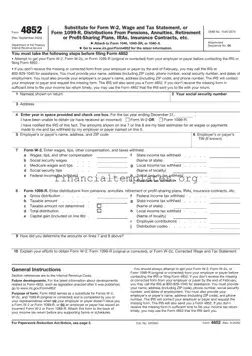

The IRS 4852 form serves as a substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., when the employer or payer has not provided one or...