The IRS 3921 form is a document used in the United States to report exercises of incentive stock options (ISOs) to the IRS. Employers provide this form to the employee who has exercised the options, detailing the exercise date and...

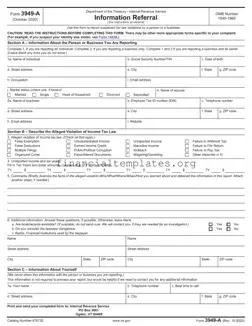

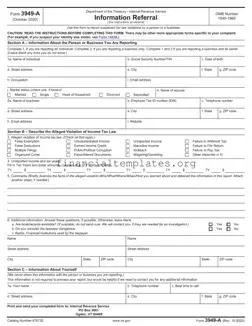

The IRS 3949-A form is designed for the reporting of suspected tax law violations by an individual, a business, or both. This form allows individuals to notify the Internal Revenue Service (IRS) of activities that may indicate fraud or misconduct...

The IRS 4136 form is a document used by taxpayers to claim a credit for certain types of fuel taxes paid. This credit can apply to fuels used for off-highway business purposes, in farming, in a trade or business involving...

The IRS 4136 form is a document taxpayers use to claim a credit for certain taxes paid on fuels. This form can be pivotal for individuals and businesses seeking to reduce their tax obligations related to fuel usage. It's a...

The IRS 4136 form is a document used by taxpayers to claim a credit for federal excise taxes paid on fuels. It applies to various types of fuel used for business purposes, including gasoline, diesel, and kerosene. This credit is...

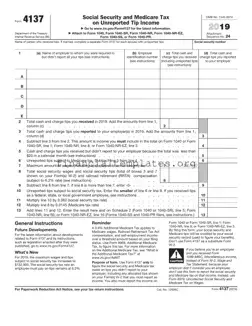

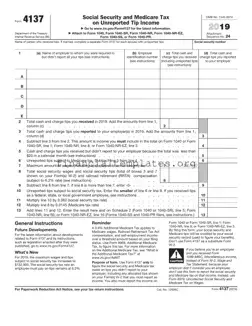

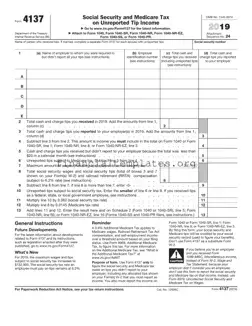

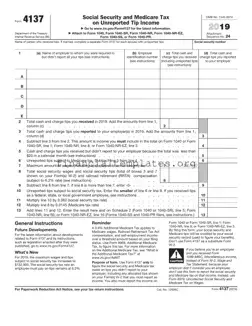

The IRS 4137 form is a crucial document used by individuals to report tips and gratuities not accounted for by their employers on their tax returns. This form helps to ensure that all earned income is reported accurately to the...

The IRS 4137 form is a document that taxpayers use to report tips that they received directly from customers, which were not reported to their employer. This includes cash tips, tips from credit and debit card charge customers, and the...

The IRS 4137 form is an important document for taxpayers who need to report tips received that were not allocated by their employers. It is designed to ensure that income from tips is accurately reflected for tax purposes. This form...

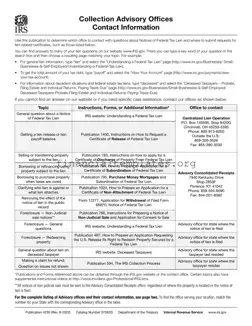

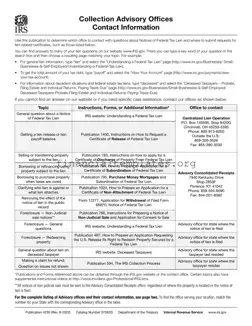

The IRS Form 4235, titled "Collection Advisory Group Numbers and Addresses," serves as a critical resource for individuals needing to contact a local Collection Advisory office. It provides detailed instructions on how to handle a range of lien-related issues, with...

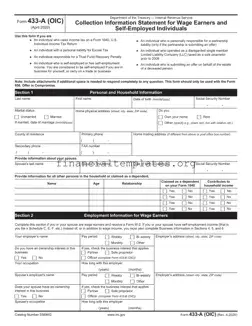

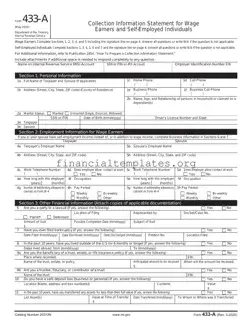

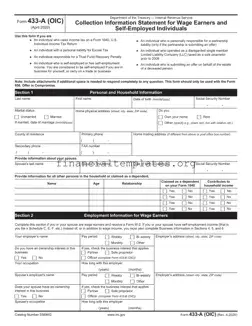

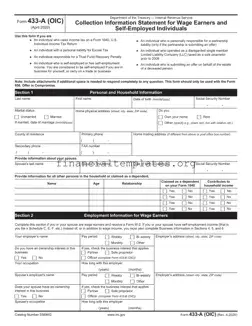

The IRS 433-A (OIC) form is a document that taxpayers can use to apply for an Offer in Compromise (OIC) with the Internal Revenue Service. This option allows individuals to settle their tax debts for less than the full amount...

The IRS 433-A (OIC) form is a crucial document for individuals seeking to settle their tax liabilities for less than the full amount owed. Its purpose is to provide the Internal Revenue Service with detailed information about the taxpayer's financial...

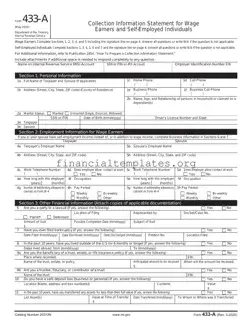

The IRS 433-A form, known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a crucial document for those seeking to establish a payment plan or compromise with the IRS over owed taxes. This form provides the...