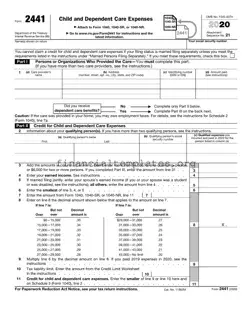

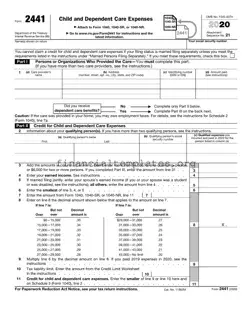

The IRS Form 2441 is a document used by taxpayers to calculate and claim the Child and Dependent Care Expenses tax credit. This form allows individuals and families to deduct a portion of their child or dependent care expenses from...

The IRS 2553 form, known as the "Election by a Small Business Corporation," is utilized by small businesses to opt for S corporation tax status. This election allows companies to pass corporate income, losses, deductions, and credits through to their...

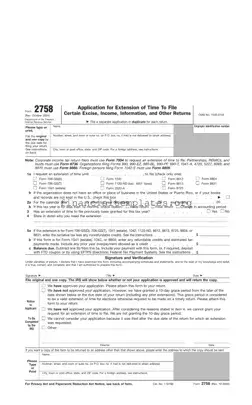

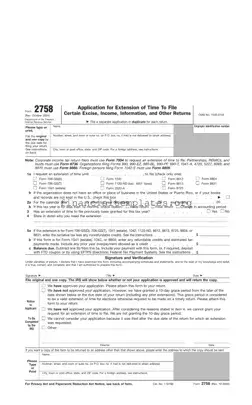

The IRS Form 2758, officially known as the Application for Extension of Time To File Certain Excise, Income, Information, and Other Returns, is a critical document for taxpayers requiring additional time to file various types of returns with the Internal...

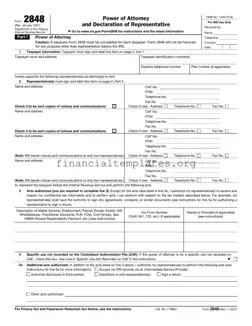

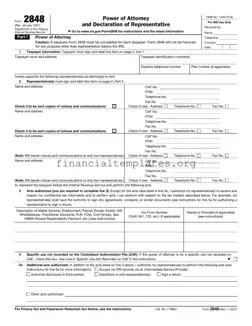

The IRS Form 2848, Power of Attorney and Declaration of Representative, is a critical document that enables a taxpayer to grant authority to an individual, such as an attorney, certified public accountant, or other eligible person, to represent them before...

The IRS Form 3010, officially known as the Department of the Treasury Publication 3010 (Rev.10-06), is a document issued by the Internal Revenue Service with the Catalog Number 25130F. This form plays a crucial role in the realm of tax...

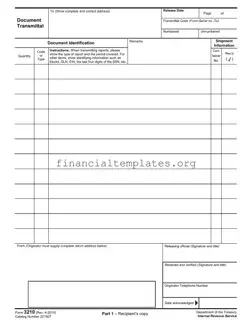

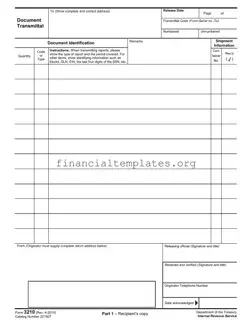

The IRS Form 3210 is used as a document transmittal within the Internal Revenue Service. This form plays a crucial role in ensuring that documents are sent and received with an acknowledgment between IRS offices, providing a reliable method of...

The IRS Form 3311, also known as the American Goods Returned Declaration (AGR), is a critical document for the Bureau of Customs and Border Protection within the U.S. Department of Homeland Security. It facilitates the duty-free re-entry of American products...

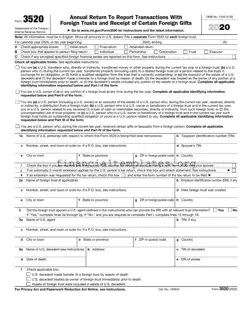

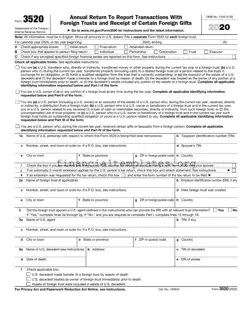

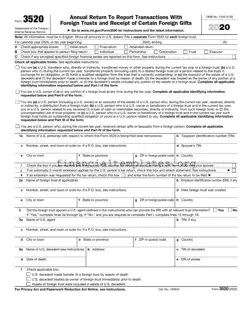

The IRS 3520 form, officially titled "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts," serves as a critical document for individuals in the United States who engage in transactions with foreign trusts or receive...

The IRS Form 3520 is a document required for reporting transactions with foreign trusts and receipt of certain foreign gifts. It serves as a critical tool for maintaining transparency in international financial activities involving the U.S. taxpayers. Failure to accurately...

The IRS 3800 form, officially known as the General Business Credit form, serves as a crucial tool for businesses to report their comprehensive credit. It consolidates various credits from different parts of tax law, offering a single platform for reporting....

The IRS 3800 form, known as the General Business Credit form, is a document used by businesses to claim various federal tax credits. These credits are designed to encourage certain business activities that align with federal policy objectives. The form...

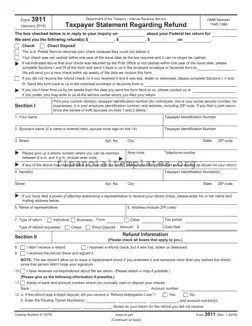

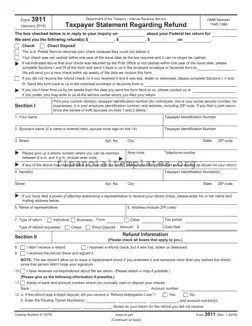

The IRS 3911 form is a tool for taxpayers to resolve issues related to missing tax refunds or economic stimulus payments. It acts as a tracer form that the Internal Revenue Service (IRS) uses to track down these unaccounted-for funds....