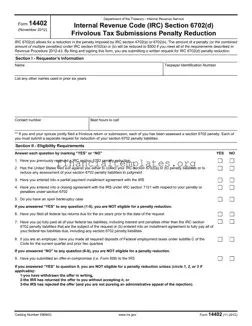

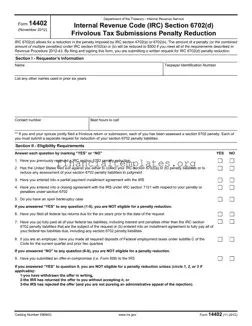

The IRS Form 14402 serves as a formal application for individuals seeking a reduction in penalties associated with frivolous tax submissions, as delineated under Internal Revenue Code (IRC) Section 6702(d). This provision allows the penalty, originally assessed by IRC sections...

The IRS Form 14420, titled "Verification of Reported Income," is a document issued by the Department of the Treasury - Internal Revenue Service. It's designed to provide additional information and clarification, specifically when the gross receipts from card sales and...

The IRS 2106 form is a document used by employees to deduct work-related expenses not reimbursed by their employer. This form allows employees to itemize these expenses in order to reduce their taxable income. It's crucial for individuals who incur...

The IRS 2106 form, often enveloped in complexity, is designed for employees to deduct work-related expenses not reimbursed by their employer. This form plays a crucial role for individuals seeking to mitigate their taxable income through the documentation of valid...

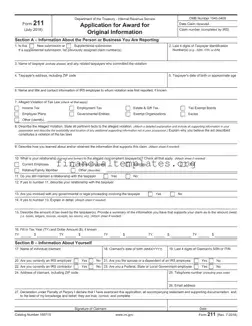

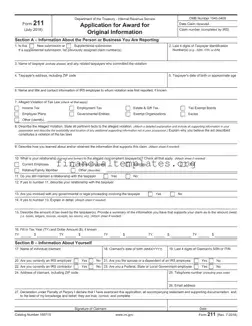

The IRS 211 form, also known as the Whistleblower Award Application, allows individuals to report others who are failing to pay the tax they owe. By filling out this form, a person can help the IRS identify and address tax...

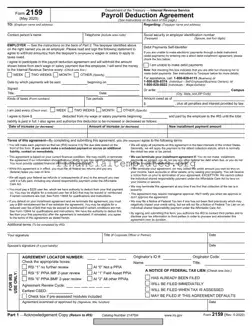

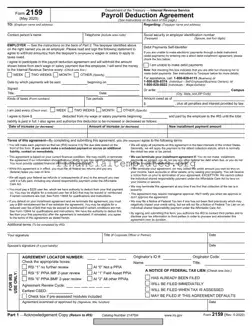

The IRS Form 2159, issued by the Department of the Treasury and the Internal Revenue Service, facilitates a Payroll Deduction Agreement. This form serves as a formal arrangement between taxpayers and their employers, allowing for the direct withholding of tax...

The IRS 2210 form is a document taxpayers use to calculate underpayment of estimated tax by individuals, estates, and trusts. It helps determine if the taxpayer has paid enough in taxes throughout the year via withholding or estimated tax payments....

The IRS 2210 form is used to determine if an individual owes a penalty for underpaying their estimated tax throughout the year. It's designed for taxpayers who did not pay enough tax either through withholding or by making estimated tax...

The IRS 2210 form is a document taxpayers use to calculate underpayment or late payment penalties for not paying estimated taxes throughout the year. It serves as a tool for individuals who did not pay enough tax through withholding or...

The IRS 2439 form is a document that shareholders use to report undistributed long-term capital gains from mutual funds or Real Estate Investment Trusts (REITs). These gains are not directly received but are instead credited to the shareholders and taxed...

The IRS 2439 form is a document that mutual funds and real estate investment trusts (REITs) use to report undistributed long-term capital gains to shareholders and to the IRS. This form allows shareholders to increase their basis in the fund...

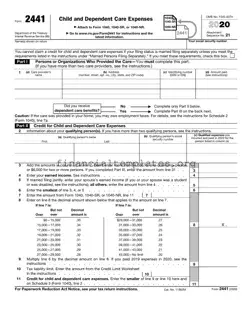

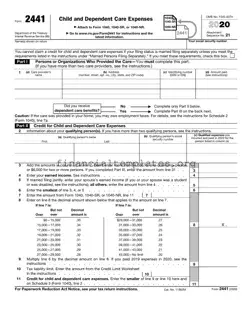

The IRS 2441 form is a crucial document for taxpayers seeking to receive a tax credit for child and dependent care expenses. It allows individuals to detail the costs associated with childcare or the care of a dependent, enabling them...