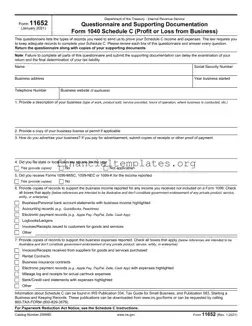

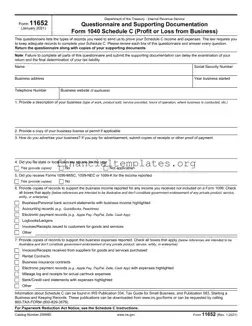

The IRS 11652 form, officially titled "Questionnaire and Supporting Documentation for Schedule C (Profit or Loss from Business)," serves as a comprehensive checklist for taxpayers to provide necessary records that validate their income and expenses as reported on Schedule C....

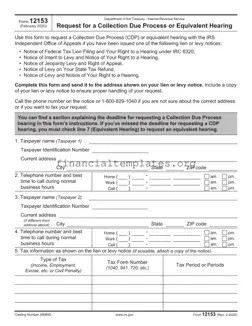

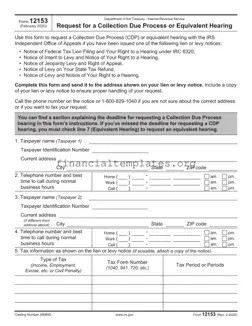

The IRS 12153 form is a request for a Collection Due Process or Equivalent Hearing. This form is used by taxpayers who wish to challenge or appeal certain IRS decisions, including liens or levies against their property. It acts as...

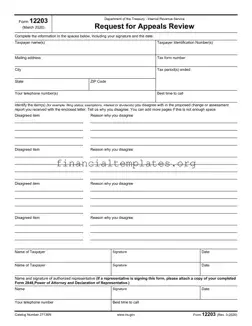

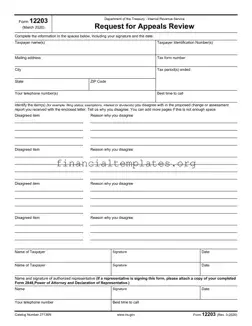

The IRS Form 12203, also known as the Request for Appeals Review, serves as a formal way for taxpayers to contest proposed adjustments or changes made by the Internal Revenue Service (IRS) that total $25,000 or less for a specified...

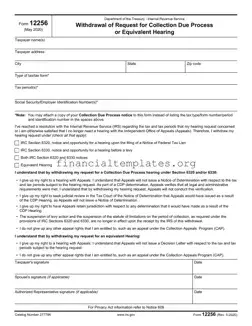

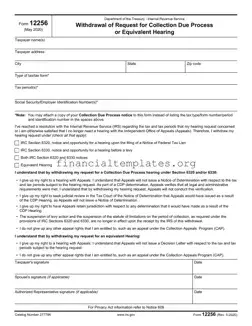

The IRS Form 12256 is a document filed by taxpayers who wish to withdraw their request for a Collection Due Process (CDP) or Equivalent Hearing with the Internal Revenue Service. This form is used when a taxpayer has resolved the...

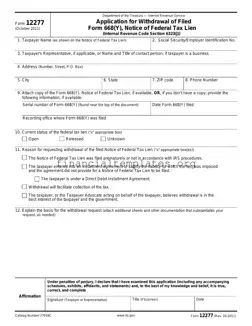

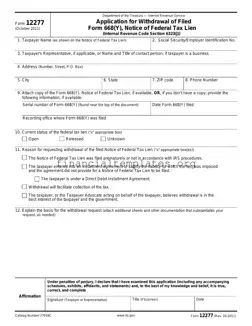

The IRS 12277 form is a vital tool for individuals aiming to get a tax lien withdrawal. This form allows taxpayers to request the removal of a public tax lien notice, potentially helping to improve their credit score. It's a...

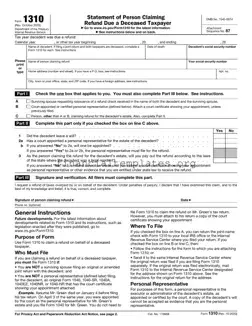

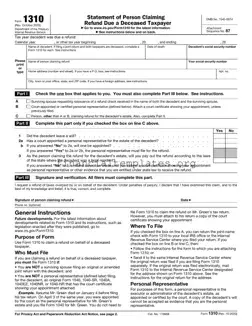

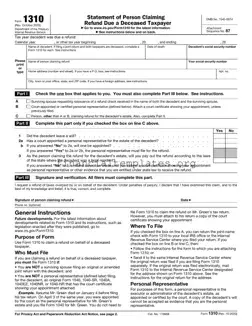

The IRS 1310 form serves a critical purpose for individuals claiming a refund on behalf of someone who has passed away. It is essential for ensuring that the refund reaches the rightful person or estate, thereby upholding the integrity of...

The IRS 1310 form is a document intended for use by individuals who are claiming a federal tax refund on behalf of someone who has died. It is essential when the deceased taxpayer did not have the opportunity to claim...

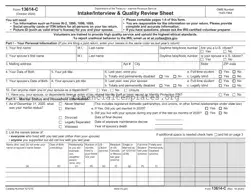

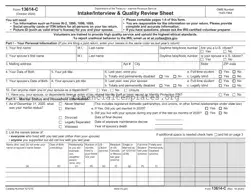

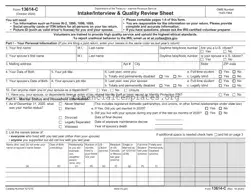

The IRS 13614-C form, also known as the Intake/Interview & Quality Review Sheet, is a crucial document for individuals seeking assistance with their tax preparations. It serves as a comprehensive guide for taxpayers and preparers alike to ensure all necessary...

The IRS 13614-C form, more commonly known as the Intake/Interview & Quality Review Sheet, plays a fundamental role in the tax preparation process for those participating in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE)...

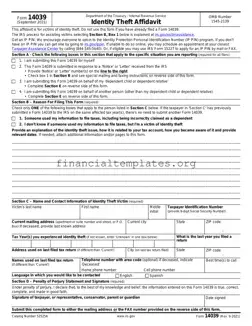

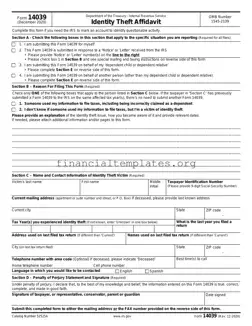

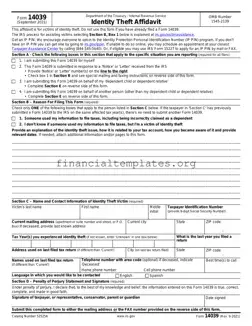

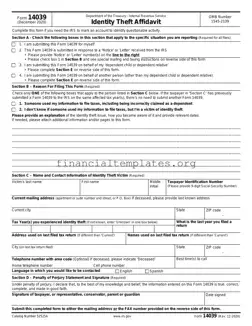

The IRS 14039 form is an Identity Theft Affidavit that individuals use to report suspected fraud and unauthorized transactions to the Internal Revenue Service. It acts as a pivotal step in safeguarding taxpayers' identities and initiating the process to resolve...

The IRS 14039 form, officially called the Identity Theft Affidavit, is a document used to alert the Internal Revenue Service (IRS) that someone’s identity may have been used fraudulently to file taxes. This form plays a crucial role for individuals...

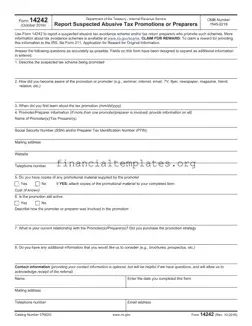

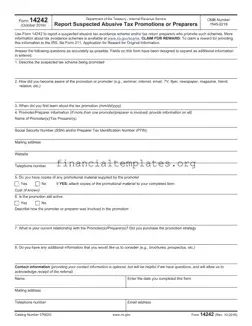

The IRS Form 14242 serves as a crucial tool for reporting suspected abusive tax avoidance schemes and the tax return preparers who promote them. Issued by the Department of the Treasury - Internal Revenue Service, it's designed for individuals to...