The IRS 1099-R form is an official document used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, or any fund established for retirement. This form is critical for individuals who have received such distributions, as...

The IRS 1099-R form is a document that reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. It is essential for individuals who have received $10 or more from such sources within the tax year. This...

The IRS 1099-S form is a document used by the Internal Revenue Service (IRS) to report proceeds from real estate transactions. It applies to sales or exchanges of property, including homes, land, and buildings. Individuals who oversee the closing of...

The IRS 1099-S form is a critical document used by the Internal Revenue Service to report proceeds from real estate transactions. This form plays a vital role in ensuring the proper reporting of income from the sale or exchange of...

The IRS 1099-SA form is a document that individuals receive if they've used money from a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage (MA) MSA. This form reports the distributions taken from these accounts over...

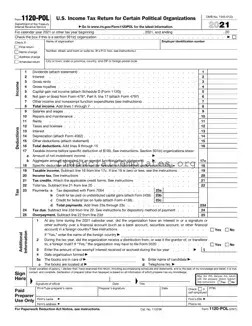

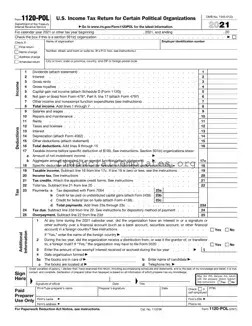

The IRS 1120-POL form is the U.S. Income Tax Return required for certain political organizations. It is designed for entities that need to report their political organization taxable income and income tax liability under section 527. Through this form, organizations...

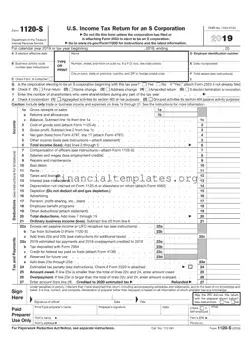

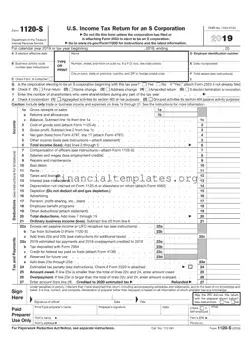

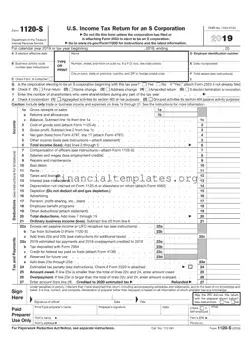

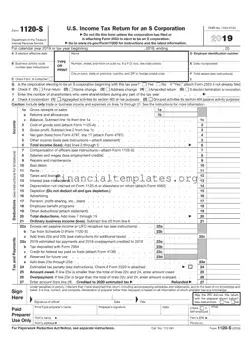

The IRS 1120-S form is a tax document filed by S corporations for the purpose of reporting their annual income, gains, losses, deductions, and credits. This form allows S corporations to pass corporate income, deductions, and tax credits directly to...

The IRS 1120-S form is a tax document required for S corporations to report their annual income, losses, deductions, and credits. This form allows the IRS to assess the tax obligations of these corporations based on their shared income among...

The IRS 1120-S form serves a critical role in the U.S. tax system, designed specifically for S corporations to report their annual income, deductions, losses, and other financial activities. This form allows these corporations to pass their income directly to...

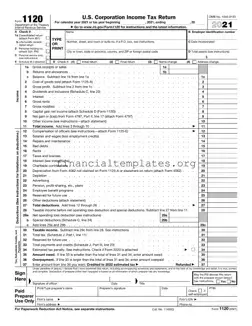

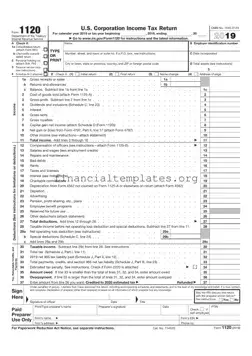

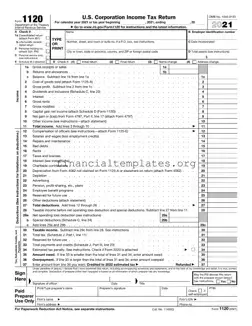

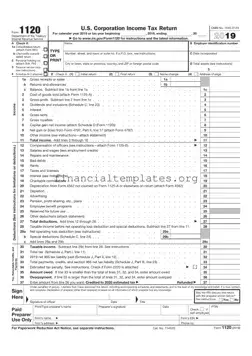

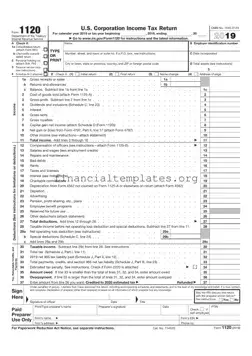

The IRS 1120 form, commonly known as the U.S. Corporation Income Tax Return, is a document that most corporations operating in the United States are required to fill out annually. Its primary role is to report the corporation's income, gains,...

The IRS 1120 form, also known as the U.S. Corporation Income Tax Return, is a document that corporations must file annually to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form serves as...

The IRS 1120 form is a document that U.S. corporations use to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. It plays a crucial role in determining the tax liability of a corporation. This form...