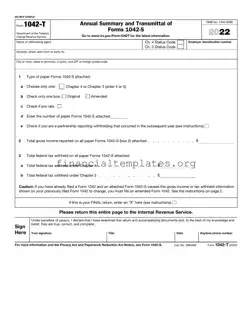

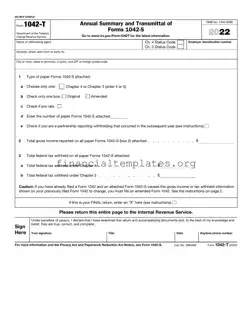

The IRS Form 1042-T is designed for the annual summary and transmittal of Forms 1042-S, which report the U.S. source income of foreign persons subject to withholding. It serves as a critical document for withholding agents to summarize and submit...

The IRS 1065 form is a document used by partnerships in the United States to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). It serves as a critical tool for these entities to maintain...

The IRS 1065 form is a tax document used by partnerships to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form helps partners in a business to accurately share the tax responsibilities of their...

The IRS 1065 form is a tax document designed for partnerships in the United States. It's essential for reporting the income, gains, losses, deductions, and credits of a business partnership to the Internal Revenue Service. This form helps determine the...

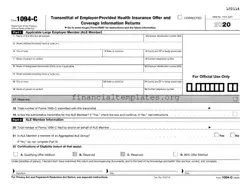

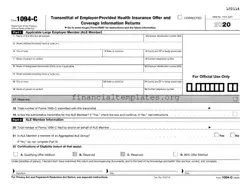

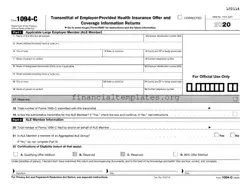

The IRS 1094-C form serves as a transmittal document for the 1095-C forms, which are used by applicable large employers to report information about health insurance coverage offered to their full-time employees. This form plays a crucial role in complying...

The IRS 1094-C form is a crucial document for employers, serving as a transmittal form for the 1095-C forms, which report information about health insurance coverage offered to employees. This form plays a vital role in compliance with the Affordable...

The IRS 1095-A form, officially known as the Health Insurance Marketplace Statement, is a document that serves a crucial role for individuals who have obtained health insurance through the Health Insurance Marketplace. This form provides detailed information about the insurance...

The IRS 1095-A form, officially known as the Health Insurance Marketplace Statement, plays a pivotal role in the lives of individuals who opt for health coverage through the Health Insurance Marketplace. This document serves as a proof of insurance, detailing...

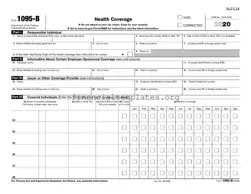

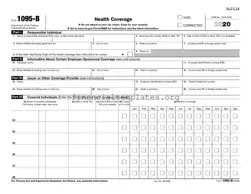

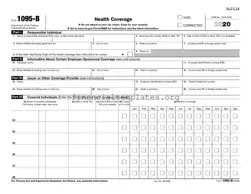

The IRS 1095-B form is a document that reports the type of health coverage you have, any dependents covered by your insurance plan, and the period of coverage within the year. It's an essential piece of paper for individuals when...

The IRS 1095-B form is a document that provides information about an individual’s health coverage. It serves as proof that a person has met the minimum essential coverage requirement under the Affordable Care Act. This form is typically sent by...

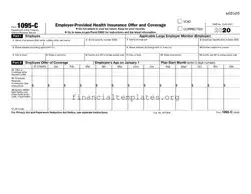

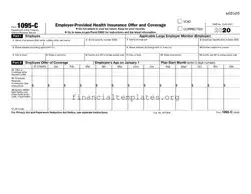

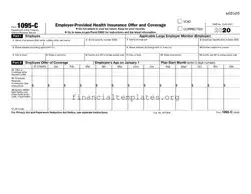

The IRS 1095-C form is a document that employers with 50 or more full-time employees are required to provide. It details the health insurance coverage offered to their employees. This form plays a crucial role in ensuring compliance with the...

The IRS 1095-C form is a document that employers with 50 or more full-time employees are required to send to both the IRS and their employees. This form plays a crucial role in reporting information about health insurance coverage offered...