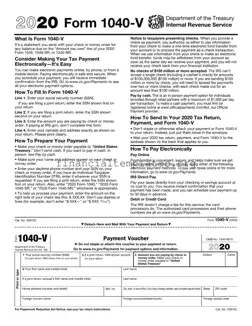

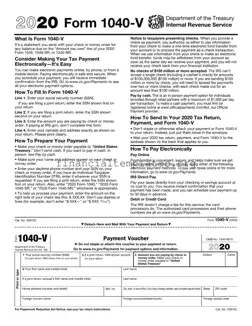

The IRS 1040-V form is a payment voucher used by taxpayers to submit their federal income tax payments. This form accompanies a taxpayer's payment whenever they owe a balance on their federal tax return and choose to mail the payment...

The IRS 1040-X form is a document used to amend previously filed tax returns. It allows taxpayers to correct errors or make changes to an already submitted Form 1040, 1040-A, or 1040-EZ. This form is essential for ensuring that your...

The IRS 1040-X form is designed for taxpayers who need to amend a previously filed tax return. Whether it's due to reporting errors, overlooked deductions, or income adjustments, this form allows individuals to make necessary corrections. Understanding and accurately completing...

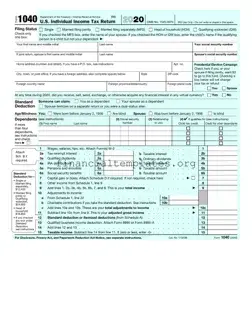

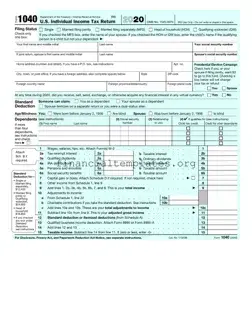

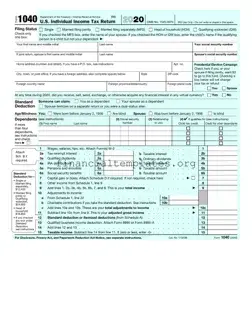

The IRS 1040 form is the standard federal income tax form used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). It serves as the foundation for assessing an individual's tax liability...

The IRS 1040 form is a standard document used by U.S. taxpayers to file their annual income tax returns. It serves as the primary vehicle through which individuals report their income, deductions, and credits to the Internal Revenue Service. This...

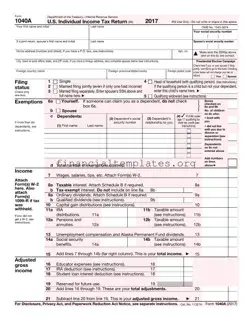

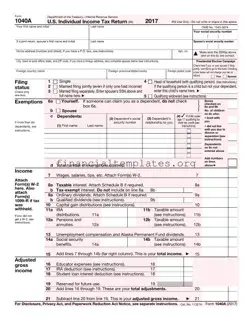

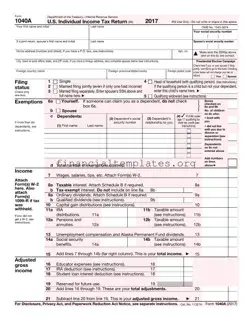

The Form 1040A, issued by the Department of the Treasury—Internal Revenue Service, serves as a simplified version of the standard U.S. Individual Income Tax Return for the year 2017. It's designed for U.S. taxpayers to report their annual income, claim...

The IRS 1040A form, specifically focusing on lines 14a and 14b, serves as a worksheet to help individuals determine the taxability of their social security benefits. This section ensures that taxpayers, especially those married filing separately and living apart from...

The IRS 1041 form is a crucial document for the tax world, acting as the income tax return for estates and trusts. It ensures that these entities comply with the U.S. tax obligations, reporting income, deductions, and any credits they...

The IRS 1041 form is a tax document used by estates and trusts to report their income. It's essential for legal entities managing assets on behalf of beneficiaries or heirs to accurately fill out and submit this form. Understanding its...

The IRS 1041 form, officially known as the U.S. Income Tax Return for Estates and Trusts, serves as a crucial document for reporting income, deductions, and gains of a deceased person's estate or a trust. This form ensures that any...

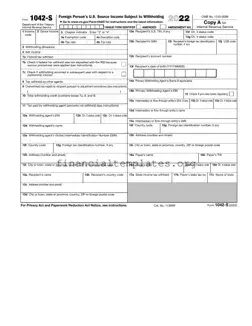

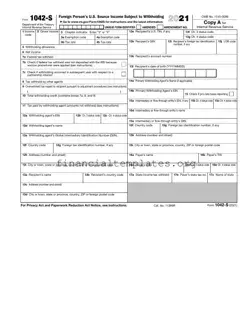

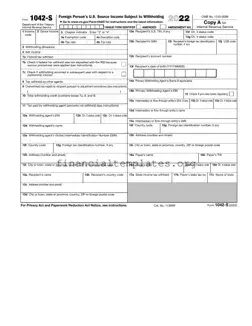

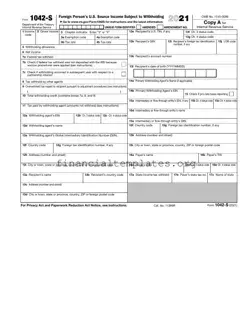

The IRS 1042-S form is an important document used to report income paid to foreign individuals and entities. This includes payments such as interest, dividends, royalties, and compensation for services. Its primary purpose is ensuring compliance with tax laws applicable...

The IRS 1042-S form is an important tax document used for reporting income paid to a foreign person, including individuals, corporations, partnerships, or estates, within the United States. This form covers various types of income, from dividends and royalties to...