The IRS 1023-EZ form is a streamlined application for recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. It is designed for smaller charities and non-profit organizations, simplifying the process to achieve tax-exempt status. This shorter version...

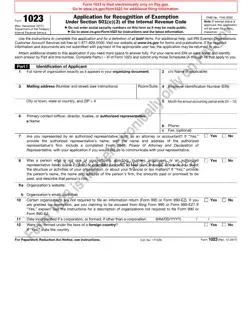

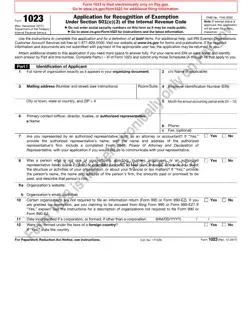

The IRS 1023 form is a critical document for organizations seeking federal tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. It serves as the application that must be thoroughly completed and submitted to the IRS for review. This...

The IRS 1024 form serves as an application used by organizations seeking to obtain tax-exempt status under certain sections of the Internal Revenue Code. It enables a wide range of organizations, including social clubs, to formally request recognition of exemption...

The IRS 1040-ES form serves as a tool for U.S. taxpayers to estimate and pay their taxes on income that is not subject to withholding. This encompasses earnings from self-employment, interest, dividends, alimony, and rental income, among others. It's essential...

The IRS 1040-ES form is used by individuals to report and pay estimated taxes on income that is not subject to withholding. This includes earnings from self-employment, interest, dividends, and rent. Individuals use this form to calculate and pay their...

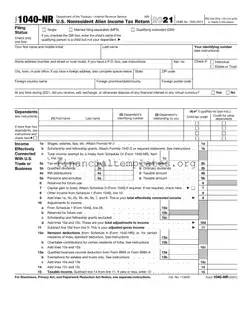

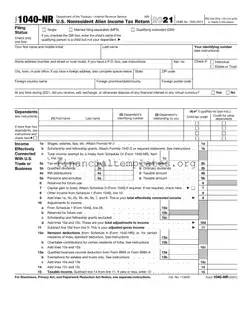

The IRS 1040-NR form is a tax document specifically for non-resident aliens who engage in business in the United States or otherwise earn income from U.S. sources. This form allows individuals to report their income, deductions, and credits to the...

The IRS 1040-NR form is a document used by nonresident aliens to report their income to the U.S. Internal Revenue Service. This form is necessary for those who earn money in the United States but do not pass the substantial...

The IRS 1040-NR form is specifically designed for nonresident aliens to file their income tax returns in the United States. This essential document ensures that individuals working or investing in the U.S. but not holding citizenship or residency comply with...

The IRS 1040-SR form is a version of the tax return designed for older adults, specifically taxpayers who are age 65 and older. This form simplifies the filing process, allowing for an easier way to report retirement income, social security...

The IRS 1040-SR form is designed for seniors, offering a more readable tax return option with a larger font size and a simplified income reporting structure. This form caters specifically to taxpayers aged 65 and over, helping them navigate their...

The IRS 1040-SR form is a tax document specifically designed for senior citizens, aged 65 and older, providing them a simplified means of filing their income taxes. Tailored to meet the needs of retirees, it accommodates the common types of...

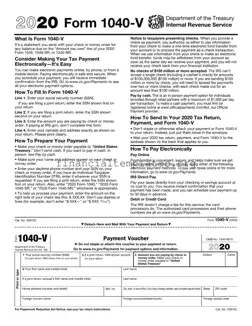

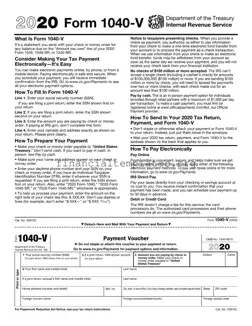

The IRS 1040-V form is a payment voucher used by individuals when submitting their federal income tax payments by mail. This form accompanies your payment and ensures that it is correctly applied to your tax account. It simplifies the payment...