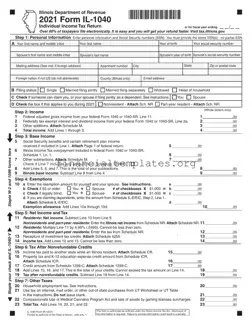

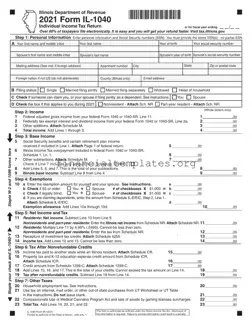

The Illinois Tax Form IL-1040 is an Individual Income Tax Return document required by the Illinois Department of Revenue from residents and non-residents who earn income in Illinois. It outlines the process for declaring annual income, calculating taxes owed or...

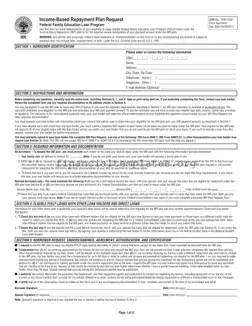

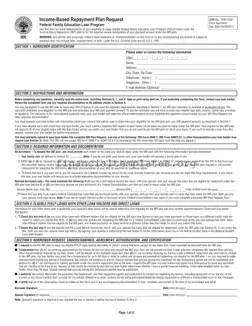

The Income-Based Repayment Plan Request form is designed for individuals seeking to determine their eligibility or for the annual reevaluation of their payment amount for repaying eligible Federal Family Education Loan Program (FFELP) loans under the Income-Based Repayment (IBR) plan....

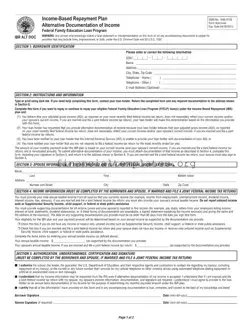

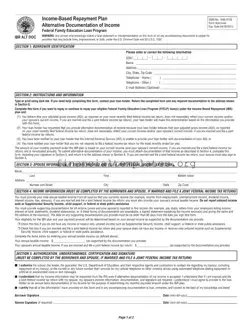

The Income-Based Repayment Plan (IBR) Alternative Documentation of Income form is a crucial document for borrowers under the Federal Family Education Loan Program (FFELP) who seek to adjust their monthly payment amounts based on their current income. This form allows...

The Income-Based Repayment (IBR) form is designed to adjust your monthly student loan payments according to your income and family size, potentially easing the financial strain on borrowers. By completing the IBR application packet, individuals can apply for reduced monthly...

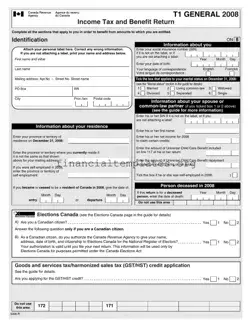

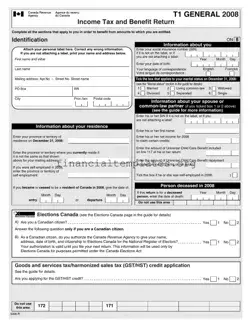

The T1 General 2008 Income Tax and Benefit Return form is a comprehensive document employed by Canadian residents to file their annual income tax and benefits. It requires individuals to fill out sections pertinent to their financial activities and personal...

The Income Tax Return form serves as a crucial document for individuals to report yearly earnings, calculate taxes owed to the federal or state government, and claim any deductions or credits available. Designed to ensure accuracy and fairness in the...

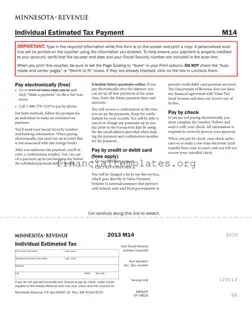

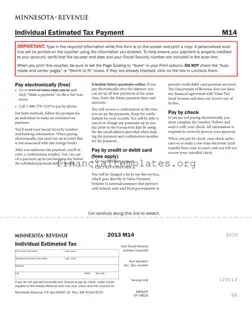

The Individual Estimated Tax Payment form, known simply as Form M14, plays a crucial role for individuals who need to make estimated tax payments throughout the year. It's designed to facilitate these payments by allowing taxpayers to input their information...

The Inheritance Tax Worksheet 500 form serves as a critical tool for those navigating the nuances of inheritance tax within Nebraska. Designed to streamline the process of calculating the applicable taxes on property bequests, devises, or transfers, this form, along...

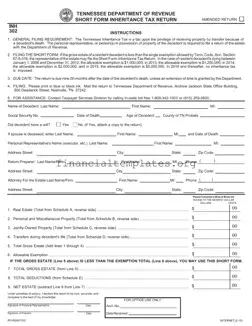

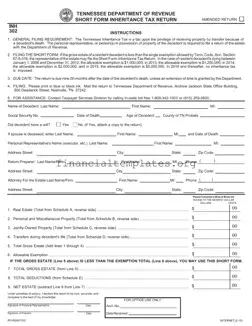

The Tennessee Inheritance Tax form, known as the Short Form Inheritance Tax Return (INH 302), is designed for estates that fall beneath the single exemption threshold specified by the Tennessee Code. This document must be completed by the personal representative...

The Insolvency IRS Form serves as a worksheet designed for individuals to document their financial condition immediately before the cancellation of a debt. It requires a detailed listing of both liabilities and the fair market value of assets owned at...

The Inventory Tax 50-246 form is a crucial document for Texas motor vehicle dealers, designed in accordance with the Tax Code Section 23.122. It requires dealers to report and prepay taxes based on their motor vehicle sales monthly, ensuring compliance...

The 2020 IA 1040 Iowa Individual Income Tax Return form is a critical document for Iowa residents to report their annual income for tax purposes. It outlines detailed steps starting from filling in personal information to detailing income, deductions, credits,...