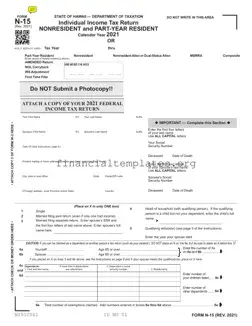

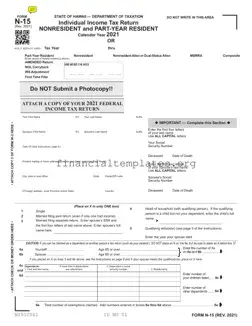

The Hawaii N15 Tax Form is a document designed for nonresident and part-year resident individuals to file their state income tax returns with the Hawaii Department of Taxation. Specifically tailored for those who do not reside in Hawaii year-round, this...

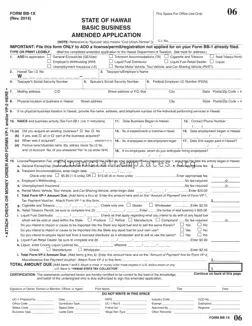

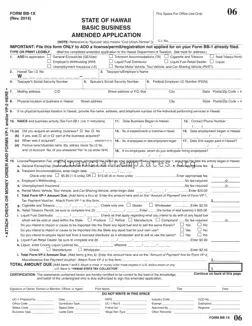

The Form BB-1X, revised in 2014 by the State of Hawaii, serves as an essential document for businesses requiring amendments to their initial Basic Business Application (Form BB-1). Defined for the specific purpose of adding licenses, permits, or registrations not...

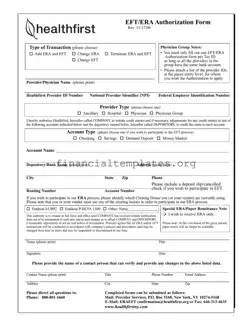

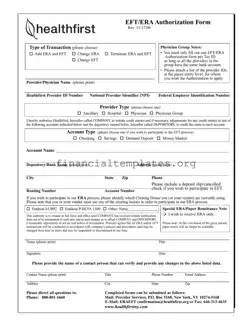

The Healthfirst EFT/ERA Authorization Form serves as a crucial document for healthcare providers wishing to enable or adjust Electronic Funds Transfer (EFT) and Electronic Remittance Advice (ERA) transactions with Healthfirst. This form, revised on November 17, 2006, streamlines the financial...

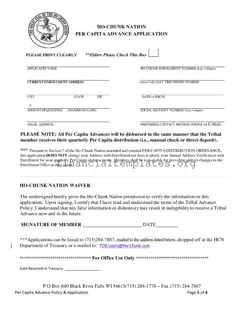

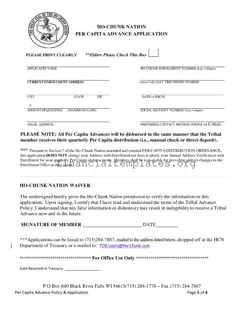

The Ho-Chunk Nation Per Capita Advance Application is a document designed for members of the Ho-Chunk Nation who are seeking an advance on their quarterly Per Capita distributions. Applicants are required to provide personal details, including the last four digits...

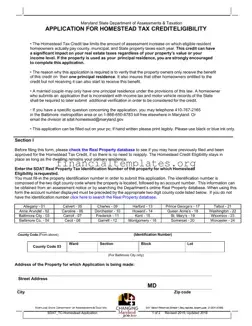

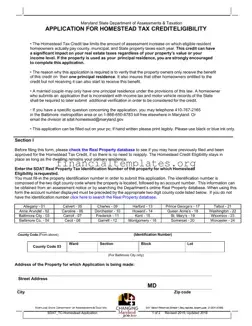

The Homestead Tax Credit is a vital provision overseen by the Maryland State Department of Assessments & Taxation, designed to limit the assessment increase applicable for property taxes that eligible homeowners are required to pay. It aims to ensure that...

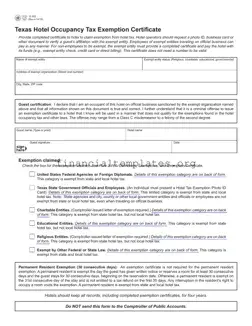

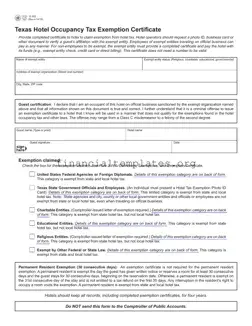

The Hotel Tax Exemption Missouri form is a crucial document for guests affiliated with certain exempt entities, allowing them to claim exemption from hotel occupancy taxes in Texas. Individuals representing religious, charitable, educational, or governmental organizations can use this form...

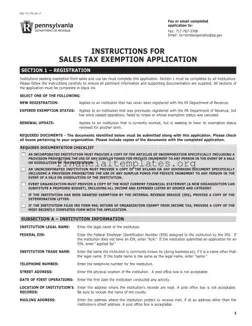

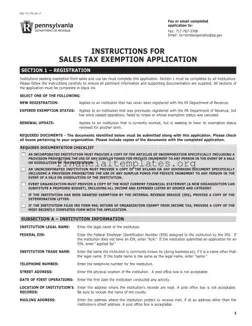

The PA Tax Exempt Number form, officially known as REV-72 (TR), is a critical document for institutions in Pennsylvania seeking exemption from sales and use tax. Aimed at both new registrations and those looking to renew or update their expired...

The Form I-9, issued by the U.S. Citizenship and Immigration Services, serves a critical function in the hiring process, aiming to document and verify the eligibility of new employees, both citizens and noncitizens, to legally work in the United States....

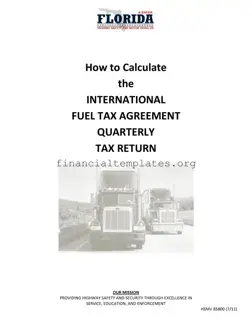

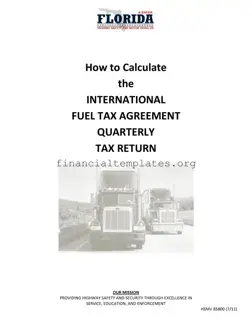

The International Fuel Tax Agreement (IFTA) Quarterly Tax Return is designed to streamline the process of reporting fuel taxes for carriers operating in multiple jurisdictions. This form ensures that highway safety and security are supported through excellence in service, education,...

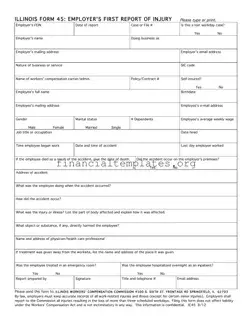

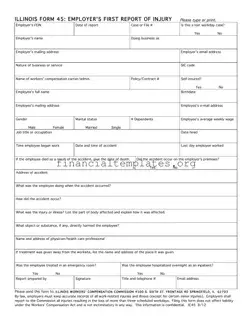

The Illinois Form 45, known as the Employer's First Report of Injury, is a crucial document for recording workplace accidents. It is required to be completed by employers to document all the pertinent details regarding an employee's work-related injury or...

The PTAX-203-A Illinois Real Estate Transfer Declaration Supplemental Form A is required for non-residential real estate transactions where the sale price exceeds $1 million. This form accompanies the main PTAX-203, Illinois Real Estate Transfer Declaration, and the original deed or...

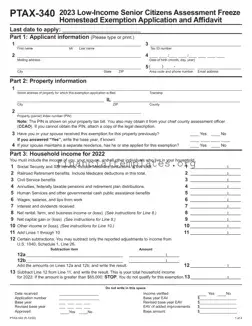

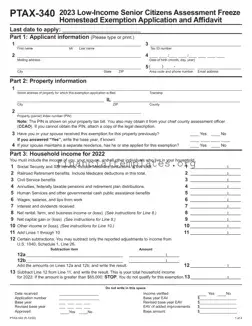

The Illinois PTAX-340 form, formally known as the Senior Citizens Assessment Freeze Homestead Exemption Application and Affidavit, serves a crucial role in aiding senior citizens by potentially freezing the assessed value of their primary residence. This mechanism is primarily designed...