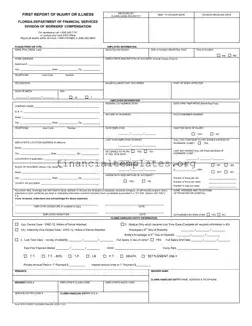

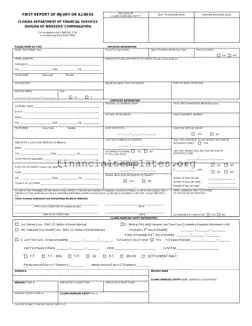

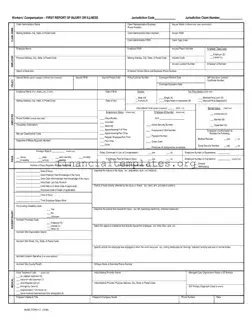

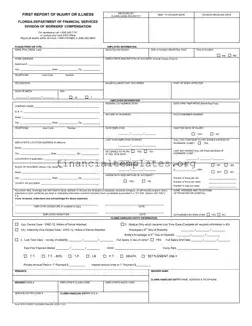

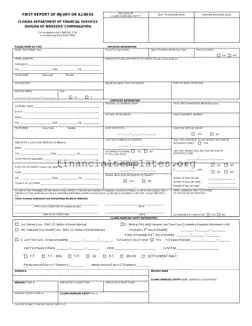

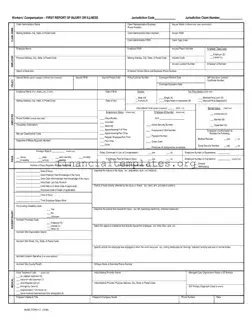

The First Report of Injury or Illness (DFS F2 DWC 1) form is a crucial document issued by the Florida Department of Financial Services, Division of Workers' Compensation. It is designed to report work-related injuries or illnesses, ensuring that all...

The First Report Of Injury Florida form is a crucial document managed by the Florida Department of Financial Services, Division of Workers' Compensation. It serves as the initial notification of an employee's injury or illness linked to their workplace, requiring...

The First Report of Injury or Illness form is a vital document in the workers' compensation process, serving as the initial notification that an employee has been injured or has fallen ill due to their work. This form records essential...

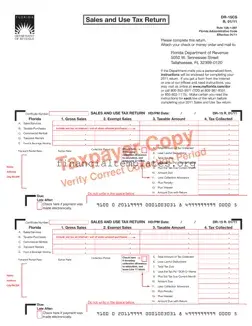

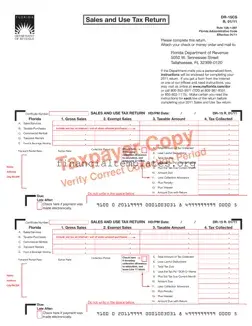

The Florida Sales Tax Form, officially known as the DR-15 Sales and Use Tax Return, is a crucial document for businesses in Florida, detailing how sales tax is calculated and reported for transactions. It serves the purpose of declaring taxable...

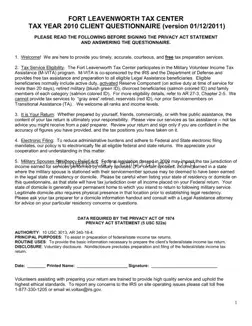

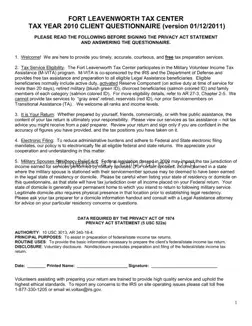

The Fort Leavenworth Tax Center provides a crucial service to military families and eligible individuals through the Military Volunteer Income Tax Assistance (M-VITA) program, as outlined in the Fort Leavenworth Tax Year 2010 Client Questionnaire. This free tax preparation service...

A Full Payment Certificate (FPC) is an essential document required by the City of Chicago Department of Finance for all property transfers within Chicago. This certificate confirms that all dues are cleared on a property at the time of its...

The Form G-45, issued by the State of Hawaii's Department of Taxation, is a critical document for reporting General Excise and Use Tax. This form is filled by businesses to declare taxable income after allowances for exemptions and deductions, across...

The Ga St 3 Tax form, formally recognized as the Sales and Use Tax Return (ST-3), plays a pivotal role for taxpayers in Georgia, serving as the foundational document for reporting sales, use tax, and various tax exemptions. Initially coming...

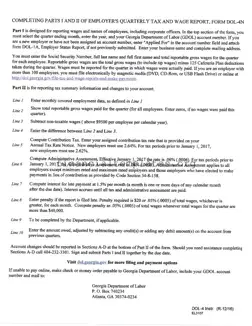

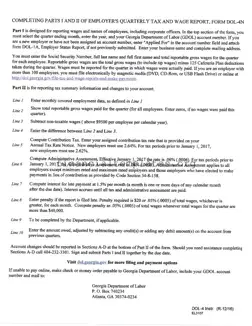

The Ga Tax Wage Report form, officially known as Form DOL-4N, is a crucial document for employers operating within Georgia. It serves a dual purpose: Part I is dedicated to listing employees' wages, names, and social security numbers, while Part...

The Generic Commercial Loan Application form is a comprehensive document designed to gather essential information from businesses seeking commercial loans. It includes various sections that require details about the business, including financial statements, tax returns, and personal financial information of...

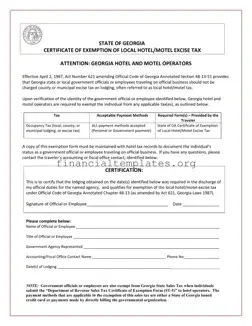

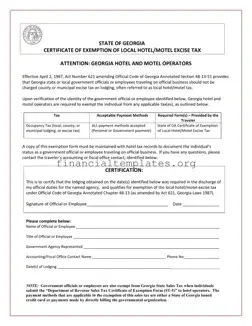

The Georgia Hotel Tax form, officially known as the Certificate of Exemption of Local Hotel/Motel Excise Tax, is a critical document for Georgia state or local government officials or employees who are traveling on official business. It was instituted following...

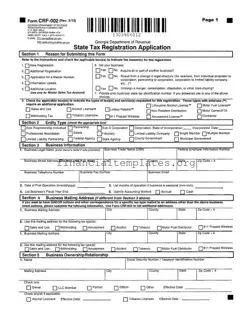

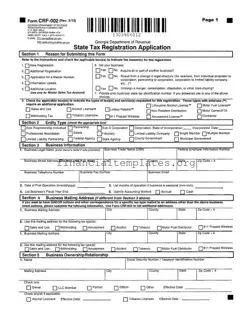

The Georgia State Tax Instruction form, officially named Form CRF-002, serves as a comprehensive guide for businesses to register or update their details with the Georgia Department of Revenue. The form addresses various situations, including new registrations, changes in business...