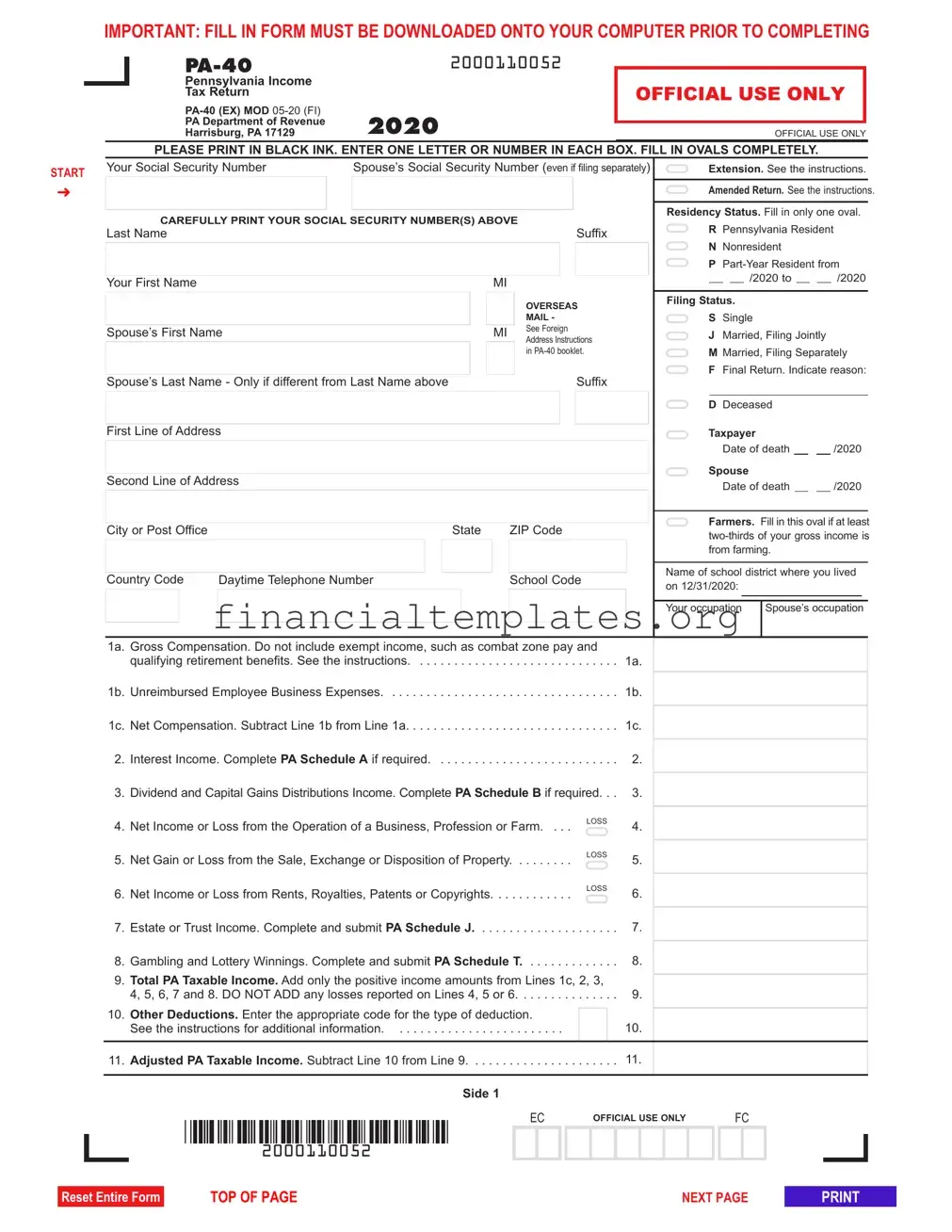

Get Pa 40 Tax Form

The PA-40 tax form is a crucial document for anyone filing a Pennsylvania Income Tax Return. Made available by the Pennsylvania Department of Revenue, this form records various types of income, deductions, and credits, thereby determining one's tax liability within the state. It's designed for different types of filers, accommodating Pennsylvania residents, nonresidents, and part-year residents with specific sections dedicated to each group's needs. At the outset, filers are obliged to provide personal identification information, including Social Security Numbers and addresses, along with their filing statuses which could range from single to married, filing jointly or separately, and even addressing instances of deceased taxpayers. The form details income sources such as gross compensation, interest, dividends, and gains or losses from business operations, property sales, and other investments, scrutinizing each to accurately compute taxable income. It also delves into specifics such as unreimbursed business expenses, offering sections for school codes, which relate to local tax responsibilities, and residency status to establish tax jurisdiction. Notably, the PA-40 form elaborates on deductions and credits that might reduce taxable income or tax owed, including those for educational expenses, health savings account contributions, and taxes paid to other states. Additionally, instructions for claiming tax forgiveness via the PA Schedule SP for eligible taxpayers, reflecting on the state's effort to alleviate tax burdens on lower-income families. With sections dedicated to calculating tax owed, reporting tax withheld, estimated payments, and other credits, as well as delineating penalties, interest, and overpayments, the PA-40 offers a comprehensive framework for taxpayers to reconcile their annual financial obligation to the Commonwealth of Pennsylvania.

Pa 40 Tax Example

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

|

|

|

2000110052 |

|

|

|

|

|

Pennsylvania Income |

|

|

|

|

|

|

Tax Return |

|

|

OFFICIAL USE ONLY |

|

|

|

2020 |

|

|

|

|

|

|

PA Department of Revenue |

|

|

|

|

|

|

Harrisburg, PA 17129 |

|

OFFICIAL USE ONLY |

||

PLEASE PRINT IN BLACK INK. ENTER ONE LETTER OR NUMBER IN EACH BOX. FILL IN OVALS COMPLETELY.

START

➜

Your Social Security Number |

|

Spouse’s Social Security Number (even if filing separately) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

CAREFULLY PRINT YOUR SOCIAL SECURITY NUMBER(S) ABOVE |

|||||||||||||||||

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your First Name |

|

|

|

|

|

|

|

|

|

MI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OVERSEAS |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL - |

||||

Spouse’s First Name |

|

|

|

|

|

|

|

|

MI |

|

See Foreign |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Instructions |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

in |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

||||

Spouse’s Last Name - Only if different from Last Name above |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Line of Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Line of Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City or Post Office |

|

|

|

|

|

State |

ZIP Code |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Country Code |

Daytime Telephone Number |

|

|

|

|

|

|

School Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Extension. See the instructions.

Amended Return. See the instructions.

Residency Status. Fill in only one oval.  R Pennsylvania Resident

R Pennsylvania Resident  N Nonresident

N Nonresident

P

___ ___/2020 to ___ ___/2020

Filing Status.

S Single

J Married, Filing Jointly

M Married, Filing Separately

F Final Return. Indicate reason:

D Deceased

Taxpayer

Date of death ___ ___/2020

Spouse

Date of death ___ ___/2020

Farmers. Fill in this oval if at least

Name of school district where you lived on 12/31/2020:

Your occupation |

Spouse’s occupation |

|

|

1a. Gross Compensation. Do not include exempt income, such as combat zone pay and qualifying retirement benefits. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

1b. Unreimbursed Employee Business Expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b.

1c. Net Compensation. Subtract Line 1b from Line 1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c.

2. Interest Income. Complete PA Schedule A if required. . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Dividend and Capital Gains Distributions Income. Complete PA Schedule B if required. . . 3.

4. |

Net Income or Loss from the Operation of a Business, Profession or Farm. . . . |

LOSS |

4. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5. |

Net Gain or Loss from the Sale, Exchange or Disposition of Property |

LOSS |

5. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

6. |

Net Income or Loss from Rents, Royalties, Patents or Copyrights |

LOSS |

6. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

7. |

Estate or Trust Income. Complete and submit PA Schedule J |

. |

. 7. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

. . . . |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8. |

Gambling and Lottery Winnings. Complete and submit PA Schedule T |

. |

. 8. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

. . . . |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9. |

Total PA Taxable Income. Add only the positive income amounts from Lines 1c, 2, 3, |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

4, 5, 6, 7 and 8. DO NOT ADD any losses reported on Lines 4, 5 or 6 |

. . . . . |

. 9. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10. |

Other Deductions. Enter the appropriate code for the type of deduction. |

|

10. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

See the instructions for additional information |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

11. |

Adjusted PA Taxable Income. Subtract Line 10 from Line 9 |

. . . . . |

. 11. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EC |

OFFICIAL USE ONLY |

FC |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2000110052

Reset Entire Form

TOP OF PAGE |

NEXT PAGE |

START |

Social Security Number (shown first) |

|

➜

2000210050

Name(s)

OFFICIAL USE ONLY

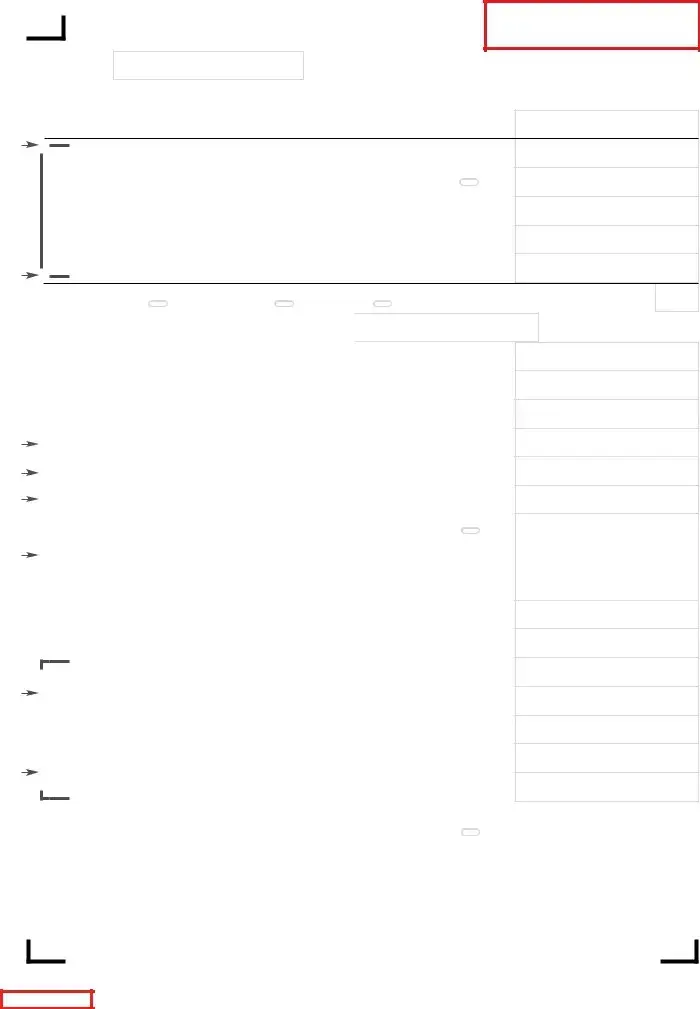

12. |

PA Tax Liability. Multiply Line 11 by 3.07 percent (0.0307) |

12. |

|

|

|

|

|

13. |

Total PA Tax Withheld. See the instructions |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

PAID |

|

14. |

Credit from your 2019 PA Income Tax return |

||||||||

|

|||||||||||

15. |

2020 Estimated Installment Payments. Fill in oval if including Form |

||||||||||

TAX |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||

ESTIMATED |

16. |

2020 Extension Payment |

. . . . . . . . . |

. . . . . . . . |

. . . . . . . . . . . . . |

||||||

17. |

Nonresident Tax Withheld from your PA Schedule(s) |

||||||||||

|

|||||||||||

|

|

18. |

Total Estimated Payments and Credits. Add Lines 14, 15, 16 and 17. |

. . . . . . . . . . . . |

|||||||

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

Tax Forgiveness Credit, submit PA Schedule SP |

|

|

|

||||||

|

19a. |

|

Filing Status: |

Unmarried or |

Married |

Deceased |

|||||

|

|

|

|

|

|

|

Separated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

20. |

Total Eligibility Income from Section III, Line 11, PA Schedule SP. . . |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

14.

15.

16.

17.

18.

Dependents, Section II, Line 2,

19b. PA Schedule SP. . . . . . . . . . . .

|

21. |

Tax Forgiveness Credit from Section IV, Line 16, PA Schedule SP |

21. |

|

||

|

|

|

|

|

||

|

22. |

Resident Credit. Submit your PA Schedule(s) |

22. |

|

||

|

23. |

Total Other Credits. Submit your PA Schedule OC |

23. |

|

||

|

24. |

TOTAL PAYMENTS and CREDITS. Add Lines 13, 18, 21, 22 and 23 |

24. |

|

||

|

25. |

USE TAX. Due on internet, mail order or |

25. |

|

||

|

26. |

TAX DUE. If the total of Line 12 and Line 25 is more than Line 24, |

|

|

||

|

|

enter the difference here |

26. |

|

||

|

27. |

Penalties and Interest. See the instructions for additional |

|

|

|

|

|

|

|

|

|||

|

|

information. Fill in oval if including Form |

|

|

27. |

|

|

28. |

TOTAL PAYMENT DUE. See the instructions |

28. |

|

||

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DONATIONS

29. |

OVERPAYMENT. If Line 24 is more than the total of Line 12, Line 25 and Line 27 |

29. |

|

enter the difference here |

|

|

The total of Lines 30 through 36 must equal Line 29. |

|

30. |

Refund – Amount of Line 29 you want as a check mailed to you.. . . . . . . . REFUND |

30. |

31. Credit – Amount of Line 29 you want as a credit to your 2021 estimated account. . . . . 31.

|

|

|

|

|

|

32. |

Refund donation line. Enter the organization code and donation amount. |

|

32. |

||

|

See the instructions |

|

|||

|

|

|

|||

33. |

Refund donation line. Enter the organization code and donation amount. |

|

33. |

||

|

See the instructions |

|

|||

34. |

Refund donation line. Enter the organization code and donation amount. |

|

|

||

|

See the instructions |

|

34. |

||

35. |

Refund donation line. Enter the organization code and donation amount. |

|

|

||

|

|

||||

|

See the instructions |

|

35. |

||

36. |

Refund donation line. Enter the organization code and donation amount. |

|

|

||

|

See the instructions |

|

36. |

||

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE(S). Under penalties of perjury, I (we) declare that I (we) have examined this return, including all accompanying schedules and statements, and to the best of my (our) belief, they are true, correct, and complete.

|

Your Signature |

|

|

|

|

|

Date MM/DD/YY |

|

Preparer’s PTIN |

||||||||||||||||||||||||||||||||||||||||||||||||

➜ Please sign after printing. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the instructions. |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Spouse’s Signature, if filing jointly |

|

|

|

|

|

Preparer’s Name and Telephone Number |

|

Firm FEIN |

||||||||||||||||||||||||||||||||||||||||||||||||

Please sign after printing. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE. |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 2 |

|

2000210050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2000210050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE.

Reset Entire Form

RETURN TO PAGE 1 |

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Title | PA-40 Pennsylvania Income Tax Return |

| Relevant Authority | PA Department of Revenue |

| Key Features | Includes sections for personal information, income and loss reports, tax deductions, tax credits, and payments. |

| Special Instructions | Includes instructions for overseas mail, amended returns, residency status, designation for farmers, and the option to donate part of a refund to specific causes. |

Guide to Writing Pa 40 Tax

When the time comes to file a Pennsylvania (PA) Income Tax Return, residents are guided through the process with the PA-40 tax form. This form is essential for reporting income, calculating taxes owed, or determining any refunds due back to the taxpayer. Given the importance of accurate and timely filing, the following step-by-step instructions aim to simplify the procedure, ensuring compliance and possibly even optimizing returns. Before diving into the form, remember to download and save a blank copy to your computer - this little step can save you a great deal of hassle down the line. Let's walk through how to fill out the PA-40 tax form correctly.

- Using black ink, start by entering your Social Security Number and, if filing jointly, your spouse's Social Security Number in the designated boxes.

- Carefully print your last name, suffix if applicable, first name, and middle initial. Repeat this step for your spouse if their last name is different.

- Include your complete address: the first and second lines, city or post office, state, zip code, and country code if residing outside of the U.S.

- Provide a daytime telephone number, including the school code and extension if known.

- Mark the appropriate oval for your residency status (Pennsylvania Resident, Nonresident, or Part-Year Resident) and fill in the dates if you were a Part-Year Resident.

- Select your filing status by filling in the corresponding oval (Single, Married Filing Jointly, Married Filing Separately, or Filing a Final Return). If the final return is due to the death of the taxpayer or spouse, provide the date of death.

- If applicable, fill in the oval indicating if at least two-thirds of your gross income is from farming.

- Enter the name of the school district where you lived as of December 31, 2020, and specify your and your spouse’s occupation.

- For the income section, start with your gross compensation (line 1a), subtract any unreimbursed employee business expenses (line 1b), and enter your net compensation (line 1c).

- Fill in lines 2 through 8 as they apply to your financial situation, regarding interest income, dividends and capital gains, net income or loss from business operations, and other specific income types. Remember to complete and attach any required schedules.

- Add only the positive income numbers from lines 1c through 8 to get your Total PA Taxable Income (line 9).

- List any other deductions on line 10, referring to the instructions for the appropriate code.

- Subtract your deductions (line 10) from your Total PA Taxable Income (line 9) to get your Adjusted PA Taxable Income (line 11).

- Calculate your PA Tax Liability (line 12) by multiplying your Adjusted PA Taxable Income by 3.07 percent.

- Fill in the Total PA Tax Withheld (line 13), and add any credits from your 2019 PA Income Tax Return (line 14).

- Report any estimated tax payments, extension payments, and nonresident tax withheld as applicable (lines 15 through 17).

- Add the amounts from lines 14 through 17 to get your Total Estimated Payments and Credits (line 18).

- Continue with the form by completing sections related to Tax Forgiveness Credit, Resident Credit, and Other Credits as they apply to you, following through to line 28.

- If applicable, enter any overpayment and how you'd like it to be handled (refund, credit to next year's estimated tax, or donation).

- Sign and date the form, ensuring both you and your spouse sign if filing jointly. E-file opt out and Preparer’s PTIN section should also be completed if relevant.

Once you've thoroughly reviewed your PA-40 form for accuracy and completeness, you're ready to submit it to the Pennsylvania Department of Revenue. Keep in mind, filing accurately and on time is essential to avoid any potential penalties or delays in processing. Also, remember not to call about your refund until at least eight weeks after you filed, as processing times can vary. With careful attention to detail, you can successfully navigate through the PA-40 form and fulfill your state income tax obligations.

Understanding Pa 40 Tax

What is the PA-40 tax form used for?

The PA-40 tax form is utilized for filing personal income tax returns in the state of Pennsylvania. It is required by individuals to report their annual income, tax deductions, and tax liabilities to the Pennsylvania Department of Revenue.

How do I know if I need to file a PA-40 tax form?

If you are a resident, part-year resident, or a nonresident of Pennsylvania and have earned income during the tax year, you are likely required to file a PA-40 tax form. This includes different types of income such as wages, interest, dividends, and profits from business operations.

Can I file the PA-40 tax form electronically?

Yes, the PA-40 tax form can be filed electronically. This method is encouraged as it is faster and more secure. The Pennsylvania Department of Revenue offers options on their website for e-filing, either directly or through approved software providers.

What information do I need to complete the PA-40 tax form?

To complete the PA-40 tax form, you need your Social Security Number, information about your residency status, income details (such as gross compensation and interest income), and information on deductions. Details of your spouse's income are also required if filing jointly.

What are the filing statuses available on the PA-40?

The PA-40 tax form offers several filing statuses: Single, Married Filing Jointly, Married Filing Separately, and Final Return in case of a deceased taxpayer. Choose the status that correctly represents your situation for the tax year.

How do I report income from out-of-state sources on the PA-40?

Income from out-of-state sources should be reported on the PA-40 form in the same way as income earned within Pennsylvania. The state allows residents to claim a credit for taxes paid to other states on the PA Schedule G-L (if applicable).

Can I claim deductions on my PA-40 tax form?

Yes, taxpayers can claim various deductions on the PA-40 tax form, such as unreimbursed employee business expenses and other specified deductions. Refer to the instructions for the form and PA Schedule UE for details on allowable deductions.

What should I do if I made a mistake on my filed PA-40 tax form?

If you discover an error on your filed PA-40, you should file an amended return using the same form but fill in the oval for "Amended Return." Provide all corrected information and an explanation for the changes on the form.

Is there a deadline for filing the PA-40 tax form?

The deadline for filing the PA-40 tax form typically falls on April 15th, following the end of the tax year. If April 15th is a weekend or a holiday, the deadline is the next business day. Extensions are available if you cannot meet the filing deadline.

Where can I get help with filling out my PA-40 tax form?

Assistance with completing the PA-40 tax form can be found through the Pennsylvania Department of Revenue's website, which offers comprehensive guidelines and a booklet for instructions. Additionally, tax preparers and software programs approved by the state can provide help.

Common mistakes

Filling out tax forms can be a complex process, ripe for errors, and the Pennsylvania PA-40 tax form is no exception. Paying close attention to common mistakes can ensure a smoother filing process and potentially speed up your refund time. Below is a list of nine common mistakes people make when completing their PA-40 tax forms.

- Not using black ink or a computer to fill out the form. The instructions emphasize the need for clarity, and not adhering to this simple request can cause processing delays.

- Entering incorrect Social Security numbers for themselves or their spouse. This mistake can lead to processing delays and may affect your tax liabilities or refunds.

- Failing to completely fill ovals as instructed. Partially filled ovals might not be read correctly by processing machines.

- Incorrect residency status selection. Whether you're a full-year resident, part-year resident, or non-resident dramatically affects your tax calculations on the form.

- Not correctly reporting all sources of income, such as exempt income, interest income, or dividends, which can lead to underreporting or overreporting your tax obligation.

- Omitting or inaccurately filling out supplemental schedules and attachments required for specific types of income or deductions, like Schedule A for interest income or Schedule SP for tax forgiveness eligibility.

- Miscalculating the total PA taxable income by incorrectly adding positive income amounts and failing to ignore reported losses in certain sections.

- Forgetting to sign the form or, if filing jointly, not having both spouses sign, which is mandatory for the form to be processed.

- Not filling in the oval if including certain forms like Form REV-459B for estimated payments, which could lead to missed credits.

It's essential to review your PA-40 form carefully before submitting it to avoid these common errors. Taking your time to double-check figures and ensure every required part of the form is completed can reduce processing times and help avoid notices from the Pennsylvania Department of Revenue.

Documents used along the form

When completing and filing the Pennsylvania (PA) Form 40 for income tax returns, individuals often need to include additional forms and documents to provide a complete picture of their financial situation. These additional documents support the information entered on the PA Form 40, ensuring that the tax return is accurate and compliant with state tax regulations. The following list outlines some of the most commonly used forms and documents that accompany the PA Form 40.

- PA Schedule A: This document is used for reporting interest income. It's essential for taxpayers who have earned interest from bank accounts, investments, or any other sources over the tax year.

- PA Schedule B: Taxpayers use this schedule to report dividend and capital gains distributions. It's necessary for individuals who receive income from stocks, mutual funds, or other investments that distribute dividends.

- PA Schedule J: This form is dedicated to reporting income from estates or trusts. Beneficiaries of estates or trusts need to include this schedule when they receive income that is to be reported on their PA tax return.

- PA Schedule T: Used for reporting gambling and lottery winnings. This is important for individuals who have received income from gambling, lottery winnings, raffles, or other similar sources.

- PA Schedule SP: This document is required for those seeking tax forgiveness credits. It's designed to provide relief for eligible low-income taxpayers, and its completion is necessary to apply for this credit.

- Form REV-459B: Necessary for taxpayers making estimated tax payments. This form is used to accompany any estimated payments made toward the taxpayer’s PA income tax liability.

- REV-1630/REV-1630A: These forms are related to penalties and interest for underpayment of estimated tax or late filing. Taxpayers include these with their return if they owe penalties or interest on their state tax return.

Understanding and correctly using these documents in conjunction with the PA Form 40 can be crucial for accurately reporting income, claiming deductions, and taking advantage of tax credits. Each document serves to provide detailed information regarding specific areas of an individual’s financial situation, which helps the Pennsylvania Department of Revenue assess and process tax returns more effectively. Assembling the necessary forms and accurately filling them out plays a critical role in fulfilling one’s tax obligations and potentially securing favorable tax outcomes.

Similar forms

The federal Form 1040, U.S. Individual Income Tax Return, closely resembles the PA-40 form in its purpose and structure. Both forms are designed for taxpayers to calculate and report their annual income tax to the respective tax authority. Each form gathers personal information, income details, deductions, and credits to determine tax liability or refund. They both also accommodate various income types, including wages, interest, dividends, and capital gains, ensuring a comprehensive accounting of an individual's financial activities within the fiscal year.

Form W-2, Wage and Tax Statement, is another document with similarities to the PA-40 form. While the W-2 is primarily for reporting wages paid to employees and taxes withheld by employers, it directly feeds into the PA-40 and its federal counterpart by providing essential data used to fill out these returns. Taxpayers use the information from Form W-2 to report their gross earnings and withheld taxes on the PA-40, making it an indispensable document during the tax-filing process.

The PA Schedule A, which details interest income, shares a purpose with sections of the PA-40 form that handle various types of income. This schedule is necessary for individuals who receive considerable amounts of interest over the tax year, requiring them to report this income separately for accuracy. This process mirrors how the PA-40 itself collects and categorizes different income sources to ensure that the tax calculations reflect the taxpayer's financial situation correctly.

Similarly, PA Schedule B is designed for dividend and capital gains distributions, paralleling the PA-40’s treatment of diverse income types. Taxpayers must use this schedule if they have income from dividends or capital gains, providing a detailed account that integrates with the broader tax return. This approach ensures clear and precise reporting, which is critical for accurate tax calculation and compliance.

Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, shares a functional resemblance with the PA-40 in terms of tax administration. While not a direct part of the income reporting process, it impacts the filing deadline of the PA-40 by allowing taxpayers extra time. This extension is crucial for individuals who need additional time to gather information, ensuring their returns are complete and accurate.

The Schedule SP for PA Tax Forgiveness Credit, much like the federal Earned Income Credit, is aimed at reducing the tax burden on lower-income families. This schedule is an adjunct to the PA-40, meant for eligible residents to calculate and claim a state-specific relief measure. It highlights the broader system's approach to incentivize and support economically disadvantaged groups, integrating seamlessly with the main tax return form to assess and apply these benefits.

Form REV-459B, PA Estimated Tax Payment Voucher, is akin to the PA-40 in its role in tax payment processes. Though focused on estimated taxes for those not subject to withholding or who have additional income sources, it complements the PA-40 by accounting for tax liabilities outside of regular employment. This prepayment method ensures that taxpayers meet their tax obligations throughout the year, preventing underpayment penalties and aiding in smoother financial planning.

The Nonresident Tax Withheld (PA Schedule(s) NRK-1) serves nonresidents with income from Pennsylvania sources, analogous to the PA-40’s comprehensive income reporting for residents. This schedule ensures that nonresidents comply with Pennsylvania’s tax laws, reflecting the inclusive and detailed approach of the state’s tax system to account for all income attributable to its jurisdiction, thus maintaining equity and accuracy in tax matters.

Dos and Don'ts

When completing the Pennsylvania PA-40 tax form, there are specific guidelines you should follow to ensure accuracy and compliance with state tax laws. Below are 10 dos and don'ts to consider:

- Do download the form onto your computer before you start filling it out.

- Do fill in all the fields with black ink and ensure legibility.

- Do enter one letter or number in each box as instructed on the form.

- Do fill in ovals completely where required.

- Do carefully check your Social Security Number(s) and ensure they are correctly entered.

- Don't overlook the instructions for specific sections such as "Overseas Mail" or "Amended Return".

- Don't include exempt income, such as combat pay or qualifying retirement benefits, where it's not applicable (e.g., in Gross Compensation).

- Don't forget to complete additional schedules as required (e.g., PA Schedule A for Interest Income).

- Don't add any losses reported on specific lines (e.g., Net Income or Loss from the Operation of a Business) to your total PA Taxable Income.

- Don't call about your refund until at least eight weeks after filing, as per the instructions.

Following these guidelines will help you complete the PA-40 form accurately and efficiently, reducing the likelihood of errors and ensuring compliance with Pennsylvania's tax filing requirements.

Misconceptions

When it comes to filing taxes, understanding the ins and outs of specific forms like the PA-40 tax form is essential. However, there's a lot of misinformation and confusion surrounding this process. Here are six common misconceptions about the PA-40 tax form and the truth behind them.

Only Pennsylvania residents need to file a PA-40 form. This is incorrect. The form must be filed by residents, part-year residents, and nonresidents who have earned income in Pennsylvania. The form accommodates different residency statuses and includes sections specifically for nonresidents to report income earned within the state.

The PA-40 tax form is only for reporting income. While reporting income is a major component of the PA-40 form, it also includes sections for deductions, tax credits, and other payments, which can significantly impact your tax liability or refund. It's not just about income; expenses, tax credits, and prior payments towards your tax liability are also crucial parts of the document.

If you don’t owe taxes, you don’t need to file a PA-40. Even if you believe you do not owe any taxes, filing a PA-40 can be necessary. For instance, you may be eligible for refunds or credits like the Tax Forgiveness Credit. Filing can also prevent potential issues with the Pennsylvania Department of Revenue down the line.

All types of income are reported the same way on the PA-40. This is not true. The PA-40 form requires different types of income to be reported in specific ways. For example, there are distinct sections for wages, interest income, dividends, and gains from property sales, each with its instructions and stipulations.

Filing an amended return is complicated. While filing an amended return requires attention to detail, the PA-40 form includes clear instructions for amending a previously filed return. By following these instructions and filling out the amended return accurately, taxpayers can correct any mistakes or include information they may have previously omitted.

Direct deposition is only for refunds. Contrary to this belief, the PA-40 form allows for the direct deposit of refunds, but also for overpayments to be credited toward future tax liabilities. This option provides flexibility for taxpayers in managing their finances.

Understanding these misconceptions can help taxpayers approach the PA-40 form with more clarity and confidence, ensuring that they meet their tax obligations accurately and take advantage of any benefits available to them.

Key takeaways

When it comes to filling out and using the PA-40 tax form, here are some key takeaways to keep in mind:

- Preparation is key: Before you start filling out the PA-40 form, make sure to download it onto your computer. This step is crucial to properly complete the form.

- Details matter: Use black ink and print clearly. Each letter or number should be entered in its own box, and ovals need to be filled in completely. Attention to these details ensures accuracy and helps avoid processing delays.

- Social Security numbers are crucial: You must carefully print your Social Security number at the start of the form, as well as your spouse’s if you're filing jointly. Incorrect or missing numbers can lead to significant delays and issues with your return.

- Know your residency status: The PA-40 form requires you to indicate your residency status by filling in the appropriate oval for Pennsylvania Resident, Nonresident, or Part-Year Resident. This information affects how you'll be taxed and which parts of the form you need to complete.

- Income reporting is specific: This form separates income into various categories including gross compensation, interest income, and dividends, among others. Make sure to report each type of income accurately, including any losses, which have specific lines for reporting.

- Deductions and credits require careful attention: If you are claiming deductions or credits, such as the Tax Forgiveness Credit, ensure you have all the necessary schedules and documentation to support your claims. Incorrect or incomplete information could delay processing or result in a denial of these benefits.

Lastly, double-check the form for any errors or missing information before submission. Remember, the signature at the end of the form is a declaration that everything stated is true and complete to the best of your knowledge. Filing a tax return correctly can ensure a smoother process and potentially faster refund.

Popular PDF Documents

Irs 1023 Ez - The 1023-EZ streamlines the approval process, with many organizations receiving their determination within a few weeks.

Inherited Money Taxable - The form serves as a legal document, verifying the estate’s compliance with state tax laws.