Get Otc 901 Oklahoma Tax Form

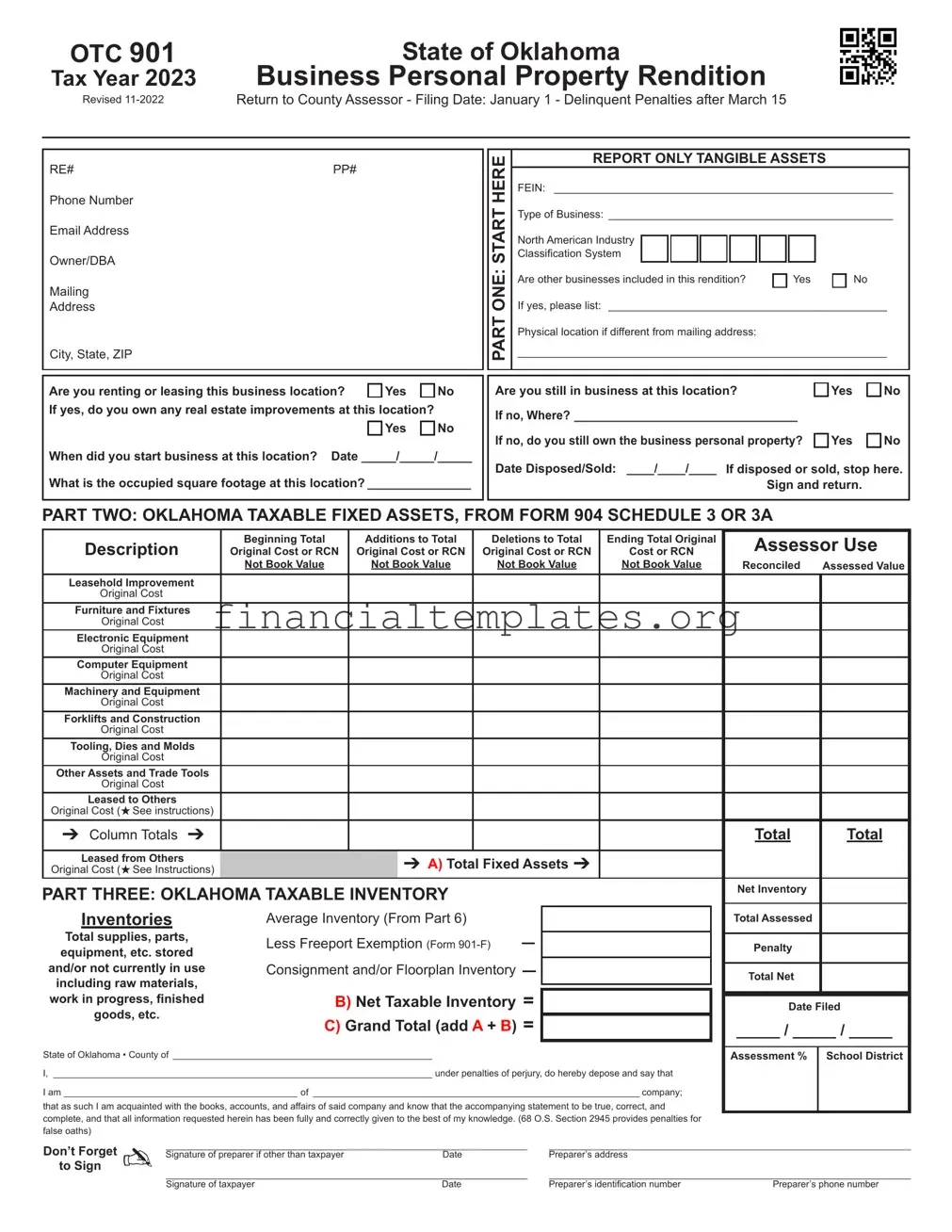

In the complex world of business and taxation, understanding and completing tax forms correctly is crucial for compliance and minimizing penalties. The OTC 901 Oklahoma Tax form plays a significant role for businesses in Oklahoma, covering the 2022 tax year. This form, officially known as the Business Personal Property Rendition, is designed for businesses to report tangible assets and is required to be returned to the County Assessor by a specific deadline. Filing dates commence on January 1, with penalties for late submission kicking in after March 15. The form encompasses various sections, including detailed information about the business, a report on Oklahoma taxable fixed assets and inventory, leasing details, and additions or deletions during the reporting year. Accuracy in reporting North American Industry Classification System codes, physical location details, and the comprehensive list of assets is paramount. Penalties for non-compliance are stringent, emphasizing the importance of timely and accurate submission. Clear instructions provided within the document guide taxpayers through the process, aiming to streamline the otherwise daunting task of asset declaration.

Otc 901 Oklahoma Tax Example

OTC 901 |

State of Oklahoma |

Tax Year 2023 |

Business Personal Property Rendition |

Revised |

Return to County Assessor - Filing Date: January 1 - Delinquent Penalties after March 15 |

RE# |

PP# |

Phone Number

Email Address

Owner/DBA

Mailing

Address

City, State, ZIP

PART ONE: START HERE

PART ONE: START HERE

REPORT ONLY TANGIBLE ASSETS

FEIN: ________________________________________________________

Type of Business: _______________________________________________

North American Industry

Classification System

Are other businesses included in this rendition? |

|

Yes |

|

No |

If yes, please list: ______________________________________________

Physical location if different from mailing address:

_____________________________________________________________

Are you renting or leasing this business location? |

Yes |

No |

If yes, do you own any real estate improvements at this location? |

|

|

|

Yes |

No |

When did you start business at this location? Date _____/_____/_____

What is the occupied square footage at this location? _______________

Are you still in business at this location? |

Yes |

No |

If no, Where? __________________________________ |

|

|

If no, do you still own the business personal property? |

Yes |

No |

Date Disposed/Sold: ____/____/____ If disposed or sold, stop here.

Sign and return.

PART TWO: OKLAHOMA TAXABLE FIXED ASSETS, FROM FORM 904 SCHEDULE 3 OR 3A

Description |

Beginning Total |

Additions to Total |

Deletions to Total |

Ending Total Original |

Assessor Use |

||||||||

Original Cost or RCN |

Original Cost or RCN |

Original Cost or RCN |

Cost or RCN |

||||||||||

|

Not Book Value |

Not Book Value |

Not Book Value |

Not Book Value |

Reconciled |

Assessed Value |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold Improvement |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Furniture and Fixtures |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

Computer Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery and Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forklifts and Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tooling, Dies and Molds |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets and Trade Tools |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leased to Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost (★See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

➔ Column Totals ➔ |

|

|

|

|

|

|

|

|

|

|

|

Total |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leased from Others |

|

|

➔ A) Total Fixed Assets ➔ |

|

|

|

|

||||||

Original Cost (★See Instructions) |

|

|

|

|

|

|

|||||||

PART THREE: OKLAHOMA TAXABLE INVENTORY |

|

|

|

|

|

|

|

|

Net Inventory |

|

|||

|

|

|

|

|

|

|

|

|

|

||||

Inventories |

Average Inventory (From Part 6) |

|

|

|

|

|

|

|

|

Total Assessed |

|

||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||

Total supplies, parts, |

Less Freeport Exemption (Form |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Penalty |

|

|||||

equipment, etc. stored |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and/or not currently in use |

Consignment and/or Floorplan Inventory |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Total Net |

|

||||||

|

|

|

|

|

|

||||||||

including raw materials, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

work in progress, finished |

B) Net Taxable Inventory = |

|

|

|

|

|

|||||||

|

|

Date Filed |

|||||||||||

goods, etc. |

C) Grand Total (add A + B) = |

|

|

|

_____ / _____ / _____ |

||||||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

State of Oklahoma • County of __________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Assessment % |

School District |

||||

I, _________________________________________________________________________ under penalties of perjury, do hereby depose and say that |

|

|

|||||||||||

I am _____________________________________________ of _______________________________________________________________ company; |

|

|

|||||||||||

that as such I am acquainted with the books, accounts, and affairs of said company and know that the accompanying statement to be true, correct, and |

|

|

|||||||||||

complete, and that all information requested herein has been fully and correctly given to the best of my knowledge. (68 O.S. Section 2945 provides penalties for false oaths)

Don’t Forget

to Sign

✍

Signature of preparer if other than taxpayer

Date |

Preparer’s address |

Signature of taxpayer |

Date |

|

Preparer’s identification number |

Preparer’s phone number |

Form 901

Page 2

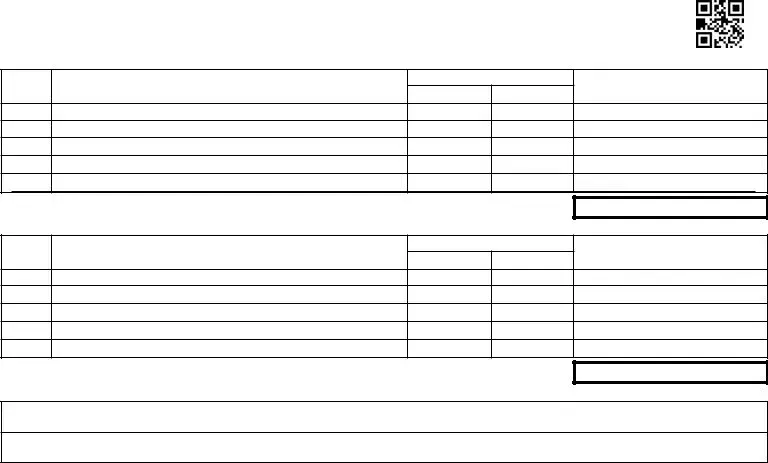

PART FOUR: ADDITIONS DURING THE REPORTING YEAR, OR SCHEDULE 3, OR 3A

Item

Number

Item Description

Year Acquired

New Used

Total Original Cost or RCN

Total

PART FIVE: DELETIONS DURING THE REPORTING YEAR

▲

Item

Number

Item Description

Year Acquired

New Used

Total Original Cost or RCN

Total

PART SIX: BEGINNING OR MONTHLY INVENTORY

▲

January |

February |

March |

April |

May |

June |

|

|

|

|

|

|

|

▲ |

July |

August |

September |

October |

November |

December |

|

|

|

|

|

|

|

|

Average

▲

Form 901 Instructions

Who Must File...

All business concerns, corporations, partnerships and professionals are required by Oklahoma statutes to file each year a statement of taxable assets as of January

1, which are located within this county. This rendition must be signed by an owner, partner, officer of the corporation or a bonafide agent.

Penalties...

Failure to file by March 15th will subject the taxpayer to a mandatory penalty of 10 percent, or a 20 percent penalty if not filed by April 15th (68 OS Sec. 2836C). If received through the mail by this office, it must be postmarked no later than March 15th. Postage metered mail overstamped by the Post Office after March 15th, will carry the mandatory

penalty.

Taxpayers Filing Form 901 in this County ...

Attach a complete detailed listing of all TANGIBLE assets used in business, grouped by description, year acquired and original cost, and items that have zero book value, use reporting Asset Listing 904 Schedule 3 or 3A, which is available from the county assessor. Report ONLY TANGIBLE ASSETS.

North American Industry Classification System (NAICS)...

This is your six digit Federal Business Activity Code.

Location of Property...

You must file a separate rendition for each location for assessment allocation to the

various school districts.

Original Cost Values or RCN...

Report the total new or used total cost or replacement cost new, including

Year Acquired...

This is the purchase date. Depreciation cannot be calculated unless the year acquired is reported.

Leasehold Improvements...

Report cost and detailed description of improvements to property owned by others. Do not report building expansions or repairs, rough plumbing or electrical service, which are included in real estate values. Report all other items such as partitions, new store fronts, etc.

Furniture and Fixtures...

Items included: office desks, chairs, credenzas, file cabinets, table booths, shelving display cases, racks, gondolas, retail fixtures, hotel and motel furnishings, apartment

appliances, etc.

Electronic Equipment ...

Items included: calculators, copiers, drafting machines, blueprinting machines, fax machines, postage machines, telephone equipment, typewriters, lunch room appliances, etc. Also, include electronic and computer controls used with machinery and equipment.

Computer Equipment ...

Items included: computer hardware, monitors, drives and other such hardware compo- nents, custom software is exempt as an intangible.

Machinery and Equipment...

Items included: auto repair, agricultural, bakeries, barber and beauty shops, cleaning and laundry, fuel storage tanks, gas pumps, medical, restaurants, signs, theaters, etc.. All equipment and machinery (forklifts, mobile yard cranes, drilling rigs, tools) is also included. Equipment installed on trucks or trailers after purchase must also be reported. Do not list licensed vehicle such as autos, trucks, semitrailers, boats over 10 h.p., etc.

Forklifts and Construction Equipment...

Items include: forklifts, back hoes, compactor, dozers, draglines, earth movers, graders,

mobile cranes, rollers, trenchers, etc.

Tooling, Dies and Molds...

Items include: Tooling, dies, punches, molds, patterns, jigs, etc.

Trade Tools and Equipment...

Include items used by carpenters, cement finishers, craftsmen, electricians, mason,

mechanics, repair services, roofers, etc.

★Leased to Others...

List lessee, address, asset type, original cost, and age of asset. Additional sheets may be attached if necessary.

★Leased from Others...

List lessor, address, asset type, age of asset, and beginning year of lease. Additional sheets may be attached if necessary.

Inventories...

Add your total monthly inventories. Then divide the sum by the number of months you have inventory in this county for the year to determine your average inventory. Inventories held for others or cosigned must be reported separately. Inventory claimed exempt must be accompanied by a Freeport Exemption Form

selling of lumber and other building material including cement and concrete except for home centers classified under Industry No. 444110 of the North American Industrial Classification Systems (NAICS) Manual, shall be assessed at the average inventory value on hand each January, 1 and December, 31 of the same calendar year.

If the Business is Sold, Closed or Name Changed...

To avoid possible incorrect or duplicate assessment, taxpayers should provide information as follows:

•Business Sold: date of sale, name and address of new owner.

•Business Closed: date of closing or date all personal property was disposed, report location and value of any remaining property still owned on the assessing date, even if in storage.

•Business Name Change: date of change and new name.

Intangible Business Personal Property...

If any intangible property is imbedded in the reported assets the intangible property must be identified and valued to the county assessor with supporting documentation. Supplemental

Form

Document Specifics

| Fact Name | Description |

|---|---|

| Form Designation | OTC 901 State of Oklahoma Tax Year 2022 Business Personal Property Rendition |

| Revision Date | Revised November 2021 |

| Submission Requirement | Return to County Assessor - Filing Date: January 1 |

| Penalty Deadlines | Delinquent Penalties after March 15 |

| Purpose of Form | To report all tangible assets used in business within the county for the purpose of tax assessment. |

| Governing Law | Sections 68 O.S. Section 2945 and 68 O.S. Section 2836C of Oklahoma Statutes |

Guide to Writing Otc 901 Oklahoma Tax

Ensuring accurate and timely filing of the OTC 901 Oklahoma Tax form is a critical duty for businesses operating within Oklahoma. This form allows for the detailed declaration of business personal property, ensuring taxable assets are correctly documented and taxes are duly assessed. The following steps, derived from reviewing the provided document, are designed to guide taxpayers through each section of the OTC 901 form. By following these steps, businesses can adequately meet state requirements and avoid potential penalties stemming from late or inaccurate filings.

- Start by entering the tax year and revision date as noted at the top of the form.

- Record the property account number (RE#) and personal property account number (PP#), along with contact phone number and email address.

- Provide the owner's name or Doing Business As (DBA) along with the mailing address, city, state, and ZIP code.

- In Part One, indicate your Federal Employer Identification Number (FEIN) and type of business, then specify your North American Industry Classification System (NAICS) code.

- Answer questions regarding additional businesses included in this rendition, rental or leasing details, business start date at the location, square footage occupied, and business operation status.

- For Oklahoma taxable fixed assets, follow the provided structure in Part Two to list assets by description, noting beginning total, additions, deletions, and ending total alongside their original cost or replacement cost new (RCN), not their book value.

- In Part Three, accurately calculate your net taxable inventory. This is achieved by detailing total supplies, parts, and equipment, including any applicable exemptions, and summing these figures to determine a final taxable inventory.

- Complete the owner, officer, or agent certification section by providing names, titles, and confirming the truthfulness of the provided information under penalties of perjury.

- Ensure that the form is signed by the preparer (if different from the taxpayer), including the preparer's identification number and contact information.

- For additions and deletions during the reporting year, detailed in Parts Four and Five respectively, list item numbers, descriptions, years acquired, and note whether items are new or used along with their original cost or RCN.

- Part Six requires a detailed monthly inventory breakdown, helping ascertain an average monthly inventory which impacts taxable inventory values.

- Review the documentation for accuracy and completeness, ensuring all required signatures and dates are in place.

- Submit the completed form and any necessary supporting documentation to the county assessor by the specified filing date to ensure timely processing and avoid delinquent penalties.

Once the OTC 901 form is submitted, businesses should prepare for the next steps which include awaiting assessment notifications and being ready to provide any additional information if the county assessor's office requests it. Prompt and precise completion of the OTC 901 form plays a key role in maintaining compliance with Oklahoma's tax obligations, thereby positioning businesses favorably in terms of both legal standing and community reputation. Remember, adherence to filing deadlines—January 1 to March 15 for on-time filings and acknowledging the increase in penalties post-March 15—cannot be overstressed.

Understanding Otc 901 Oklahoma Tax

-

What is the purpose of the OTC 901 Oklahoma Tax Form?

The OTC 901 form, known as the Business Personal Property Rendition, is designed for businesses operating within Oklahoma to report their tangible assets as of January 1st each year. By tangible assets, we mean any physical property like furniture, computers, machinery—basically anything you can touch and is used in the daily operation of a business. This information helps the county assessors determine the correct amount of personal property tax a business should pay. Remember, accurately reporting your assets is not just a good practice—it's a requirement by Oklahoma statutes.

-

Who needs to file the OTC 901 form?

If you're running a business concern, corporation, partnership, or working as a professional in Oklahoma, you'll need to fill out this form annually. It's crucial for any entity that possesses tangible business personal property within the county to provide a detailed account of such assets for tax purposes. Ensuring you file this rendition shows compliance with state law and helps avoid any unnecessary penalties for your business.

-

Are there any deadlines or penalties associated with the OTC 901 form?

Yes, there are critical deadlines to keep in mind. The form must be filed by January 1st and becomes delinquent after March 15th. If you miss the March 15th deadline, a mandatory penalty of 10% will apply. Wait even longer, until after April 15th, and that penalty increases to 20%. Additionally, if you choose to mail your form, it must be postmarked by March 15th to avoid penalties. Oklahoma doesn't play around with deadlines, so mark your calendar to stay ahead of the game!

-

What should be included on the OTC 901 form?

The form requests specific details about your business personal property. This includes a comprehensive list of all tangible assets grouped by description, the year acquired, and the original cost. You should report items such as leasehold improvements, furniture and fixtures, electronic and computer equipment, machinery, and any items leased to or from others. Remember, reporting should be based on the original cost which includes freight-in and installation costs, and not on depreciated or net book values. Assets disposed of or sold must also be indicated.

-

What happens if a business is sold, closed, or undergoes a name change?

In such cases, it's important to inform the county assessor to avoid incorrect or duplicate assessment. If your business is sold, provide the date of sale along with the new owner's name and address. For businesses that close, report the closing date or when all personal property was disposed of, and detail any remaining property still owned as of the assessing date. In instances of a name change, give both the date of this change and the new business name. Prompt communication ensures your business's tax obligations are updated and accurately reflected in county records.

Common mistakes

Not reporting only tangible assets. The form explicitly requires businesses to report tangible assets. Oftentimes, individuals mistakenly include intangible assets like patents or trademarks, which are not supposed to be listed on this particular form.

Incorrectly listing the Type of Business and the North American Industry Classification System (NAICS) code. Providing inaccurate business type information or an incorrect NAICS code can lead to improper assessment of your business assets.

Omitting or inaccurately filling in the original cost values or Replacement Cost New (RCN). It's crucial to report the total cost (new or used), including freight-in and installation costs, without deducting trade-in allowances or depreciation. Estimations need backing by documents if the original costs are unknown.

Failing to include additions or deletions during the reporting year. Forgetting to update the Part Four: Additions and Part Five: Deletions sections fails to account for changes in asset inventory, leading to discrepancies in the assessed values.

Improper calculation of average inventory. In Part Six, it's imperative to accurately add monthly inventories and divide by the number of months with inventory, to properly determine the average inventory. Missteps here can affect the net taxable inventory calculation.

Not signing the form or missing the deadline. The form must be signed by an owner, partner, officer of the corporation, or a bona fide agent and submitted by March 15th to avoid penalties. Late submissions or unsigned forms will face mandatory penalties.

When filling out the OTC 901 Oklahoma Tax form, several common mistakes can lead to errors in submission. Understanding these pitfalls can ensure more accurate and timely processing of your business personal property rendition. Here are six mistakes to watch out for:

Always double-check the form's instructions to verify you've completed each section correctly.

Keep records and documentation for all reported values in case verification is needed.

Contact your county assessor's office if you have questions or need clarification on how to accurately fill out the form.

Beyond these specific mistakes, here are some additional tips to ensure successful submission:

Documents used along the form

When managing business personal property taxes in Oklahoma, ensuring compliance involves several documents beyond the OTC 901 form. Understanding these forms is crucial for accurate reporting and avoiding penalties.

- Form 901-F (Freeport Exemption Declaration): This document is essential for businesses that hold inventory not intended for sale in Oklahoma. Businesses can apply to exempt such inventory from personal property tax under the Freeport Exemption, reducing their taxable assets.

- Form 904 (Asset Listing Schedule): Used in conjunction with the OTC 901, this form provides a detailed listing of all tangible assets by category. It ensures a thorough account of acquisitions and disposals within the tax year, facilitating accurate assessment.

- Form 901-IP (Intangible Personal Property Schedule): If a business has intangible assets embedded within its tangible personal property, this form must be completed. It helps in identifying and valifying these intangible assets to the county assessor, ensuring proper tax treatment.

- Change of Business Information Form: Should there be significant changes, such as a business sale, closure, or name change, this form must be submitted to update the county assessor's records. It helps in avoiding incorrect or duplicate assessments.

- Oklahoma Business Registration Form: While not directly related to personal property tax, this form is crucial for new businesses or those undergoing changes. It registers the business with the state, ensuring eligibility for tax filings and compliance with state regulations.

Accurately completing and submitting these documents is essential for compliance with Oklahoma's tax regulations. Businesses should pay careful attention to deadlines and requirements to avoid penalties and ensure proper assessment of their personal property taxes.

Similar forms

The Form 1120, U.S. Corporation Income Tax Return, parallels the OTC 901 in complexity and purpose for different taxpayer groups. While the OTC 901 serves businesses in Oklahoma reporting personal property, the 1120 form is a federal requirement for corporations to declare their income, gains, losses, deductions, and credits to calculate their federal income tax liability. Both forms are critical for compliance with taxation laws and require detailed financial information about the business's operations.

Form 1040, U.S. Individual Income Tax Return, though primarily for individuals, shares similarities with the OTC 901 in its importance for annual tax reporting. Individuals use Form 1040 to report their income and deductions to the IRS, much like businesses use OTC 901 to report tangible assets to the county assessor in Oklahoma. Both documents are essential for their respective filers to fulfill their tax obligations and potentially impact the calculation of taxes owed or refunds received.

The Schedule C (Form 1040), Profit or Loss from Business, is akin to the OTC 901 as it caters to small business owners or sole proprietors. This form requires detailed reporting of income and expenses from business activity, paralleling the OTC 901's focus on tangible business assets. Both forms are crucial for accurately reporting financial details that affect tax responsibilities.

Form 1065, U.S. Return of Partnership Income, resonates with the OTC 901's intent by targeting a specific group—partnerships. The form gathers information on the income, deductions, gains, losses, etc., of partnerships, similar to how the OTC 901 collects details on business personal property. Each form fulfills a critical role in ensuring partnerships and business entities, respectively, report their operations comprehensively for tax purposes.

The UCC-1 Financing Statement parallels the OTC 901 in function by identifying personal property used as collateral for secured transactions, although its primary role is in the identification of liens rather than tax valuation. Both documents require detailed descriptions of property, ensuring accurate representation of assets for their respective purposes.

The Form 571-L, Business Property Statement, employed in certain states like California, bears resemblance to the OTC 901 as it also deals with the assessment of business personal property for taxation. Similar to the OTC 901, businesses must report their equipment, fixtures, and supplies, ensuring local compliance and correct tax assessment based on assets held.

The Personal Property Tax Declaration forms used by various municipalities across the country share a common goal with the OTC 901—assessing tax based on the tangible personal property owned by businesses. Though details and specifics may vary by jurisdiction, the fundamental requirement for businesses to report their personal property assets remains consistent, underlining the broader adherence to tax reporting responsibilities across different levels of government.

Dos and Don'ts

When completing the OTC 901 Oklahoma Tax form for Business Personal Property Rendition, there are specific steps you should follow and mistakes to avoid ensuring accurate and timely filing. Here’s a helpful guide:

Do:

- Read all the instructions carefully before you start filling out the form.

- Use the correct tax year and make sure all information reflects that period.

- Report only tangible assets as instructed in PART ONE of the form.

- Make sure to list all Oklahoma taxable fixed assets accurately in PART TWO.

- Include detailed listings of additions and deletions during the reporting year as required.

- Calculate the net taxable inventory correctly in PART THREE.

- Sign the form; it is mandatory for validation.

- Attach any additional sheets if needed, clearly identifying the section they relate to.

- File before the due date to avoid penalties.

- Retain a copy of the completed form and any attachments for your records.

Don't:

- Leave any required fields blank. If a section does not apply to you, mark it accordingly.

- Report intangible assets or exempt items as tangible personal property.

- Forget to list any leased assets, whether leased to others or from others. Detailed information is required.

- Misreport the original cost or replacement cost new (RCN) values. Do not deduct depreciation or investment credits.

- Overlook the inventory section. This must be accurately reported and documented.

- Ignore the requirements for reporting inventory held for others or consigned which must be reported separately.

- Fail to update the county assessor on changes such as business closure, sale, or name change.

- Submit the form without the signature of the owner, partner, officer of the corporation, or a bonafide agent.

- Miss the deadlines for filing to avoid mandatory penalties.

- Use estimated costs without supporting documentation for assets where original cost is unknown.

Misconceptions

There are several common misconceptions about the Oklahoma Tax form OTC 901, which is essential for businesses operating within the state. Understanding these misconceptions can help business owners comply more effectively with state tax regulations.

Misconception 1: The OTC 901 form is only for large businesses. This is not true. All businesses, including small enterprises, corporations, partnerships, and professionals, are required to file an OTC 901 form if they have taxable assets located within the state as of January 1st of the filing year. This ensures that every business contributes its fair share to the community's infrastructure and services.

Misconception 2: Only tangible assets need to be reported. Actually, this statement is accurate but often misunderstood. The form specifically requires businesses to report only tangible assets such as machinery, equipment, and inventory. Despite this focus, some business owners mistakenly believe they should also include intangible assets like software and patents, which are not required on this form.

Misconception 3: Depreciation reduces the reported asset value on the form. The form explicitly asks for the original cost or replacement cost new (RCN) of assets, not their depreciated book value. This approach helps standardize assessments and ensures that depreciation practices do not affect the tax base.

Misconception 4: Filing the OTC 901 form is complicated and requires professional help. While business taxes can be complex, the OTC 901 form is designed to be straightforward. It requires basic information about the business and a detailed listing of all tangible assets, grouped by description, year acquired, and original cost. Most businesses can complete this form without professional assistance, although consulting with a tax professional is advised if there are specific concerns or complications.

Misconception 5: Late filing of the OTC 901 form carries a minimal penalty. In reality, failing to file by March 15th subjects the taxpayer to a mandatory penalty of 10 percent, with the penalty increasing to 20 percent if not filed by April 15th. These significant penalties underscore the importance of timely compliance with filing requirements.

Addressing these misconceptions is crucial for any business operating in Oklahoma. Proper understanding and compliance with the OTC 901 form not only help businesses avoid unnecessary penalties but also contribute to the fair and equitable distribution of the tax burden across all sectors of the economy.

Key takeaways

- The OTC 901 form must be returned to the County Assessor, with a filing due date of January 1, and delinquent penalties applicable after March 15.

- Business owners, partners, corporate officers, or authorized agents must report all tangible assets owned by the business as of January 1 of the filing year.

- It is mandatory to list all tangible assets, omitting intangible ones, such as custom software, as specified in the instructions.

- Failure to file by March 15 results in a 10% mandatory penalty, which increases to 20% if the form is not filed by April 15. If mailed, the form must be postmarked by March 15 to avoid penalties.

- Assets must be listed with original cost or replacement cost new (RCN), without deductions for investment credit, trade-in allowances, or depreciation.

- The North American Industry Classification System (NAICS) code, a six-digit Federal Business Activity Code, must be provided, reflecting the type of business.

- For each asset category listed, such as machinery, equipment, furniture, and computer equipment, detailed descriptions, year acquired, and the original cost must be reported.

- Any leased assets, both leased to and from others, need to be included with detailed information about the lessee or lessor, asset type, original cost, and asset age.

- Inventory calculation should reflect the average inventory value derived from total monthly inventories divided by the number of months inventory was held within the county during the taxable year.

- If the business is sold, closed, undergoes a name change, or if there’s any disposal of personal property, detailed information about these changes must be provided to avoid incorrect or duplicate assessment.

- Intangible assets that are embedded within reported tangible assets must be identified and valued separately, with supporting documentation provided to the county assessor using supplemental Form 901-IP.

Popular PDF Documents

Personal Property Tax California - Identify key information about your business, from operational details to supporting documentation, for a comprehensive property tax return.

Airsev Application For Employment - The inclusion of a 10-year employment/background history section reflects the thoroughness of Air Serv’s vetting process, particularly for roles related to airline duties.