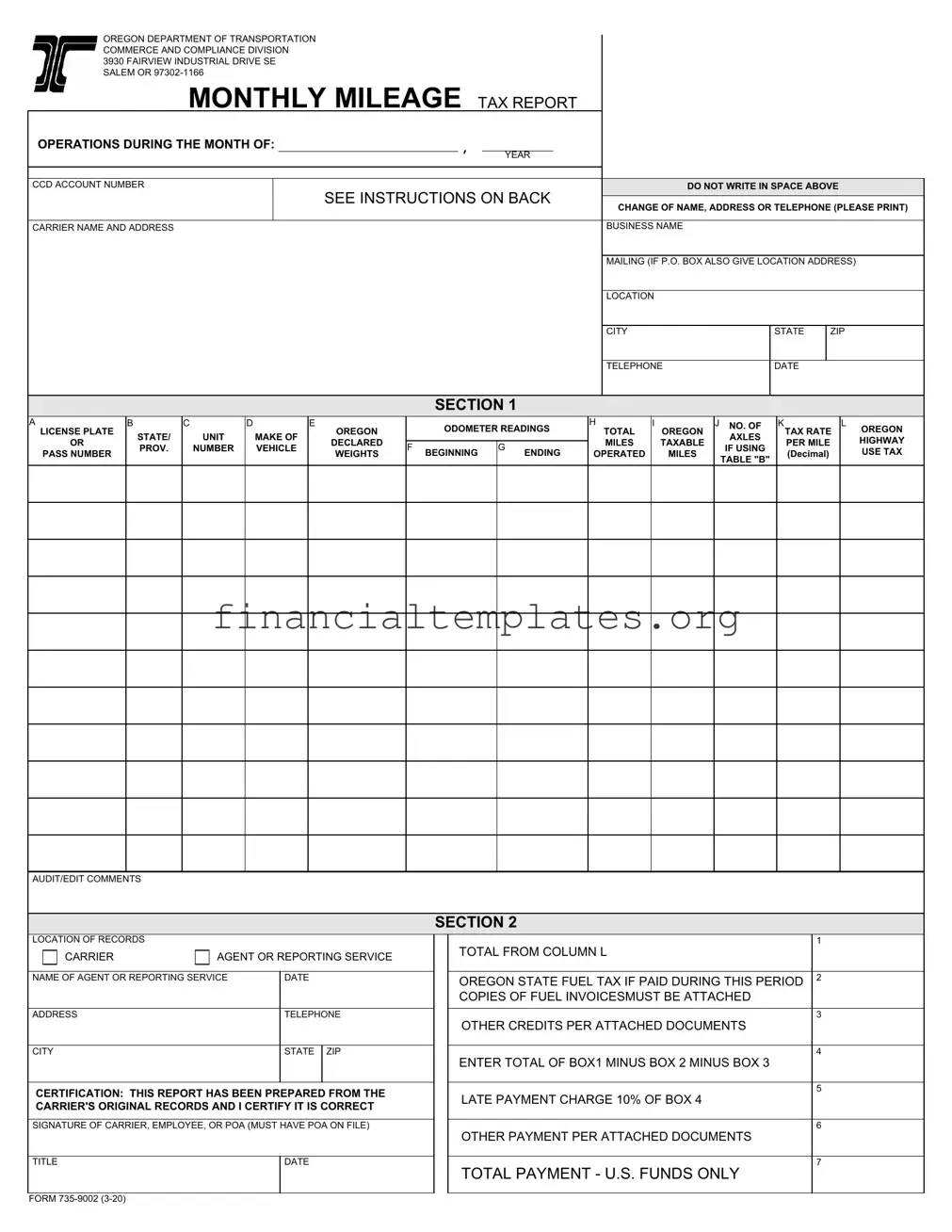

Get Oregon Monthly Mileage Tax Form

The Oregon Monthly Mileage Tax form is a crucial document for carriers operating within the state, meticulously designed by the Oregon Department of Transportation, Commerce and Compliance Division. This form is a comprehensive tool that allows businesses to report the miles their vehicles have operated on Oregon's highways, a key component in calculating the highway use tax due for a given month. All carriers with vehicles bearing ODOT plates and/or participating in the Oregon Weight-Mile Tax Program must submit this form, even if no tax is due or if the vehicle was not in operation, to avoid penalties. It captures detailed information including carrier and vehicle identifying details, odometer readings, taxable miles operated, and applicable tax rates based on the vehicle's weight. Further, it outlines the process for reporting fuel tax credits and other deductions which may affect the final tax payment. Accurate completion and timely submission of this form, along with the correct payment, are vital to comply with state regulations. The form not only serves as a financial document but also assists carriers in maintaining records of their operations, with the state requiring these records be kept for three years to support reported information. Additionally, the Oregon Department of Transportation encourages the use of Trucking Online for easier filing and payment, demonstrating the state's commitment to leveraging technology for efficiency. The penalty for late submission underscores the importance of punctuality, with a 10 percent late payment charge applied to overdue reports, emphasizing the urgency in adhering to filing deadlines.

Oregon Monthly Mileage Tax Example

OREGON DEPARTMENT OF TRANSPORTATION COMMERCE AND COMPLIANCE DIVISION 3930 FAIRVIEW INDUSTRIAL DRIVE SE SALEM OR

MONTHLY MILEAGE TAX REPORT

OPERATIONS DURING THE MONTH OF: |

|

, |

|

|

|

|

|

|

|

||

|

|

|

YEAR |

||

|

|

|

|

|

|

|

|

|

|

|

|

CCD ACCOUNT NUMBER |

|

|

|

|

DO NOT WRITE IN SPACE ABOVE |

SEE INSTRUCTIONS ON BACK

CHANGE OF NAME, ADDRESS OR TELEPHONE (PLEASE PRINT)

CARRIER NAME AND ADDRESS |

BUSINESS NAME |

MAILING (IF P.O. BOX ALSO GIVE LOCATION ADDRESS)

LOCATION

CITY

TELEPHONE

SECTION 1

A

LICENSE PLATE

OR

PASS NUMBER

B

STATE/

PROV.

C

UNIT

NUMBER

D

MAKE OF VEHICLE

E

OREGON

DECLARED

WEIGHTS

ODOMETER READINGS

F BEGINNING G ENDING

HI

TOTAL OREGON

MILES TAXABLE OPERATED MILES

JNO. OF AXLES

IF USING

TABLE "B"

AUDIT/EDIT COMMENTS

SECTION 2

LOCATION OF RECORDS |

|

|

|

||

|

|

CARRIER |

AGENT OR REPORTING SERVICE |

||

|

|

||||

|

|

|

|

|

|

|

|

|

|||

NAME OF AGENT OR REPORTING SERVICE |

DATE |

||||

|

|

|

|

||

ADDRESS |

|

TELEPHONE |

|||

|

|

|

|

||

CITY |

|

STATE |

ZIP |

||

|

|

|

|

|

|

CERTIFICATION: THIS REPORT HAS BEEN PREPARED FROM THE CARRIER'S ORIGINAL RECORDS AND I CERTIFY IT IS CORRECT

SIGNATURE OF CARRIER, EMPLOYEE, OR POA (MUST HAVE POA ON FILE)

TITLE |

DATE |

|

|

TOTAL FROM COLUMN L

OREGON STATE FUEL TAX IF PAID DURING THIS PERIOD COPIES OF FUEL INVOICESMUST BE ATTACHED

OTHER CREDITS PER ATTACHED DOCUMENTS

ENTER TOTAL OF BOX1 MINUS BOX 2 MINUS BOX 3

LATE PAYMENT CHARGE 10% OF BOX 4

OTHER PAYMENT PER ATTACHED DOCUMENTS

TOTAL PAYMENT - U.S. FUNDS ONLY

FORM

MONTHLY MILEAGE TAX REPORT

GENERAL REPORTING INFORMATION

DO NOT PAY ROAD USE ASSESSMENT FEES OR INVOICES FROM THE

DUE DATE: Your report and payment must be postmarked by the Postal Service by the last day of the month following the end of the calendar month. An illegible or unreadable report will be returned and considered unfiled in accordance with OAR

ODOT requires you to file reports and pay for all operations within the reporting period, as long as you have ODOT plates and/or vehicle(s) enrolled in the Oregon

Enter the ACCOUNT NUMBER. Enter the NAME AND ADDRESS OF THE BUSINESS as filed with Oregon Department of Transportation, Commerce and Compliance Division (CCD).

COLUMN A |

= Enter the plate or pass number of the power unit for which you are reporting. |

|

COLUMN B |

= Enter the state or province that issued the license plate. |

|

COLUMN C |

= Enter the company's unit number for the power unit for which you are reporting. |

|

COLUMN D |

= Enter the make of the vehicle. |

|

COLUMN E |

= You must declare and report operations at the heaviest weight operated per configuration. This should be one of the weights you declared with |

|

|

|

ODOT. If returning empty, use the same declared weight and tax rate as when loaded. |

COLUMN F |

= Enter the beginning odometer reading from the first day of the month for which you are reporting. This should be the same as the ending |

|

|

|

odometer reading from the preceding month. |

COLUMN G |

= Enter the ending odometer reading from the last day of the month for which you are reporting. |

|

COLUMN H |

= Enter the total miles operated for each vehicle (Column G minus Column F). |

|

COLUMN I |

= Enter the Oregon taxable miles (miles operated on Oregon public roads). |

|

COLUMN J |

= Enter the number of axles for any declared weight greater than 80,000 pounds. |

|

COLUMN K |

= Enter the appropriate rate as indicated on Form |

|

|

|

Table A rates. If returning empty, use the same declared weight and tax rate as when loaded. Empty operations associated with Special |

|

|

Transportation Permits (STP) are to be reported at 80,000 pounds. If you are operating between 80,001 and 105,000 pounds under an extended |

|

|

weight permit complete all columns. Use Table B Tax Rates. Raising a lift axle is not a change in configuration and does not constitute a change |

|

|

in rate. Do not use Table B rates for heavy haul operations conducted under STP when in excess of 98,000 pounds. |

COLUMN L |

= Compute and enter the Oregon Highway Use Tax (Column I times Column K). |

|

PAYMENT INSTRUCTIONS (SECTION 2) |

||

BOX 1 |

= |

Enter the total fees from Column L. |

BOX 2 |

= |

Enter Oregon state fuel tax paid during this month. You may claim a credit if you pay Oregon state fuel tax on fuel purchases. Fuel must have been |

purchased in the same report month credit is claimed. Attach copies of fuel invoices to the report. The invoice must contain:

Date of purchase |

Type of fuel |

ODOT plate or Pass No |

Name & Location of supplier |

Number of gallons |

Amount of Oregon state fuel tax paid |

BOX 3

BOX 4

BOX 5

BOX 6

BOX 7

If you buy fuel in bulk, you can only claim credit for fuel pumped into a qualified vehicle during the reporting period. In addition to the invoice, you must attach records to show the amount of fuel pumped into each qualified vehicle.

=Enter the amount of other credits as indicated on monthly Statement of Account and attach a copy. Do not use credits that have not yet appeared on the monthly Statement of Account.

=Enter the total of the amounts in Box 1 minus Box 2 minus Box 3.

=If you file your report late, enter 10% of Box 4.

=Add other payments and attach the supporting documents. Payments received without supporting documentation may not be correctly applied to your account.

=Enter the total of the amounts in Box 4 plus Box 5 plus Box 6.

An authorized company representative or agent must sign the Report. An agent must have Power of Attorney on file with CCD before they are an authorized representative.

Be sure to enclose the payment. Make a copy for your records and mail the original to: ODOT Commerce and Compliance Division, 3930 Fairview Industrial Drive SE, Salem, Oregon

Trucking Online is available for your convenience in filing and paying reports online. You may also amend your vehicle information using Trucking Online. Visit our Website at www.oregontruckingonline.com. For additional record keeping requirements and tax reporting information, please see Instructions for Filing Highway- Use Tax Reports available on our website at https://www.oregon.gov/ODOT/MCT/Pages/FormsandTables.aspx or call

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Body | Oregon Department of Transportation, Commerce and Compliance Division |

| Form Number | 735-9002 (3-20) |

| Address | 3930 Fairview Industrial Drive SE, Salem, Oregon 97302-1166 |

| Reporting Period Requirement | Reports and payment must be postmarked by the Postal Service by the last day of the month following the end of the calendar month reported. |

| Late Payment Charge | If a report is filed late, a 10% late payment charge is added to Box 5. |

| Tax Rate Document | For the appropriate tax rate, consult Form 735-9928, "Mileage Tax Rates". |

| Record Keeping Duration | Carriers are required to maintain records for three years to support the information contained in the report. |

Guide to Writing Oregon Monthly Mileage Tax

Filling out the Oregon Monthly Mileage Tax form requires a careful approach to ensure accuracy in reporting and compliance with state regulations. This process involves documenting vehicle operation details, calculating taxes based on miles traveled within Oregon, and adhering to specific guidelines for credits and payments. Designed to streamline the reporting for businesses and individuals operating commercial vehicles, this form plays a crucial role in maintaining fair use of Oregon's public roadways. By following the step-by-step instructions provided, carriers ensure their operations are accurately reflected, thereby contributing to the state's infrastructure and compliance efforts.

- Locate the ACCOUNT NUMBER and enter it in the designated space.

- Write the NAME AND ADDRESS OF THE BUSINESS as it is registered with the Oregon Department of Transportation, Commerce and Compliance Division.

- In SECTION 1, COLUMN A, input the plate or pass number of the power unit being reported.

- For COLUMN B, specify the state or province that issued the vehicle's license plate.

- In COLUMN C, detail the unit number assigned to the power unit by the company.

- Enter the make of the vehicle in COLUMN D.

- Declare and report the vehicle's operations at the heaviest weight operated for COLUMN E. Use the weight declared with ODOT.

- For COLUMN F, record the beginning odometer reading on the first day of the month being reported.

- In COLUMN G, enter the ending odometer reading on the last day of the month being reported.

- Calculate and enter in COLUMN H the total miles operated by subtracting the beginning odometer reading (COLUMN F) from the ending odometer reading (COLUMN G).

- Record the Oregon taxable miles in COLUMN I, reflecting miles operated on Oregon public roads.

- If applicable, denote the number of axles for the reported vehicle in COLUMN J, for any declared weight over 80,000 pounds.

- Identify the appropriate tax rate in COLUMN K, as indicated on Form 735-9928, and enter it.

- Compute the Oregon Highway Use Tax in COLUMN L by multiplying the taxable Oregon miles (COLUMN I) by the applicable tax rate (COLUMN K).

For SECTION 2, regarding payment instructions:

- Enter the total fees from COLUMN L in BOX 1.

- Document any Oregon state fuel tax paid during this period in BOX 2 and attach copies of fuel invoices. Ensure invoices include necessary details such as date, type of fuel, etc.

- In BOX 3, report the amount of other credits based on the monthly Statement of Account, attaching a copy for reference.

- Calculate the tax owed by subtracting the amounts in BOX 2 and BOX 3 from BOX 1, and enter this in BOX 4.

- If filing the report late, calculate and enter a 10% late payment charge in BOX 5 based on the total in BOX 4.

- Add other payment amounts in BOX 6 with the necessary supporting documents attached.

- Compute the total payment by adding the amounts in BOX 4, BOX 5, and BOX 6. Place this sum in BOX 7.

Ensure the form is signed by an authorized company representative or agent with a Power of Attorney on file. Enclose the payment, make a copy for your records, and mail the original form to the address provided on the form instructions. Remember, your report is not considered filed until received in full by the ODOT Commerce and Compliance Division.

Understanding Oregon Monthly Mileage Tax

-

What is the Oregon Monthly Mileage Tax Report, and who needs to file it?

This form is a mandatory report for carriers who operate vehicles in Oregon under the Oregon Weight-Mile Tax Program. It requires carriers to calculate the total miles their vehicles have operated on Oregon public roads during a given month and pay a tax based on these miles. The report must be filed by any carrier that has vehicles with ODOT plates and/or are enrolled in the program, whether or not there was any operation within the reporting period. If no vehicle was operated, carriers are still required to file a report indicating zero miles operated.

-

How is the tax calculated on the Oregon Monthly Mileage Tax Report?

The tax is calculated by multiplying the total Oregon taxable miles operated by the applicable tax rate determined for the vehicle. The actual rate can be found on Form 735-9928, "Mileage Tax Rates," and varies depending on the vehicle's declared weight and whether it falls within specified weight ranges. Vehicles operating between 26,001 and 80,000 pounds use Table A rates, while those operating above this range, up to 105,000 pounds with an extended weight permit, use Table B Tax Rates.

-

What are the key sections and entries on the form?

- Section 1: Used for reporting specific vehicle and operation information, including license plate number, state/province of registration, unit number, vehicle make, odometer readings at the beginning and end of the month, total Oregon miles, taxable miles operated, and applicable tax rates.

- Section 2: Focuses on the financial aspect, where carriers enter total fees due, credits from Oregon state fuel tax paid, other credits, late payment charges if applicable, and the total payment to be made in U.S. funds only.

-

When is the report due, and what happens if it’s filed late?

The report and corresponding payment must be postmarked by the last day of the month following the reporting month. If the report is filed late, a 10% late payment charge is applied to the total amount due, as indicated in Box 5 of the payment instructions. It is critical to ensure timely filing to avoid these additional charges.

-

What are the requirements for the fuel tax credit?

To claim a credit for the Oregon state fuel tax, the fuel must have been purchased in the same reporting month the credit is claimed. Carriers need to attach copies of fuel invoices indicating the date of purchase, type of fuel, ODOT plate or Pass No., name and location of the supplier, number of gallons purchased, and the amount of Oregon state fuel tax paid. For bulk fuel purchases, records showing the amount of fuel pumped into each qualifying vehicle during the reporting period must be provided alongside invoices.

Common mistakes

-

Not updating the carrier name and address section when there have been changes. This includes not providing the updated mailing address, especially if a P.O. Box is used.

-

Incorrectly entering the license plate or pass number in Column A, leading to confusion in identifying the vehicle.

-

Failing to correctly enter the state or province that issued the license plate in Column B.

-

Omitting or inaccurately recording the company's unit number for the vehicle in Column C.

-

Not correctly declaring and reporting operations at the heaviest weight operated per configuration in Column E, which could affect the tax rate applied.

-

Miscalculating the total miles operated due to incorrect entries in the beginning and ending odometer readings (Columns F and G).

-

Forgetting to enter the Oregon taxable miles operated on Oregon public roads in Column I, which are crucial for calculating the Highway Use Tax.

-

Incorrectly applying the tax rate per mile by not using the appropriate rate from Form 735-9928 or Table B Tax Rates when necessary in Column K.

-

Overlooking the necessity to attach copies of fuel invoices when claiming Oregon state fuel tax credits, leading to incomplete filings in Section 2, Box 2.

-

Submitting the form without the signature of an authorized company representative or agent, rendering the report unofficial.

By steering clear of these common errors, carriers can ensure their Monthly Mileage Tax Reports are filed accurately and timely, thereby avoiding potential penalties and processing delays.

Documents used along the form

Completing and filing the Oregon Monthly Mileage Tax report necessitates careful attention to detail and often requires additional forms and documents to ensure accurate and compliant submissions. These forms play crucial roles in meeting the state's requirements and optimizing a carrier's tax position. Understanding each document’s purpose can significantly streamline the compliance process for carriers operating within Oregon.

- Form 735-9928 "Mileage Tax Rates": This document provides the tax rates applicable for different weight categories and is essential for accurately calculating the tax due per mile as required in the Monthly Mileage Tax Report.

- Fuel Purchase Invoices: Carriers must attach copies of fuel purchase invoices when claiming credits for Oregon state fuel tax paid. These invoices should detail the date of purchase, type of fuel, ODOT plate or pass number, the supplier’s name and location, quantity in gallons, and the amount of Oregon state fuel tax paid.

- Bulk Fuel Storage Records: For carriers purchasing fuel in bulk, detailed records showing the amount of fuel pumped into each qualified vehicle during the reporting period are necessary. This documentation supports claims for fuel tax credits.

- Statement of Account: This document outlines other credits that a carrier might claim against the tax due. It's important to attach a copy of this statement when filing the Monthly Mileage Tax report if other credits are being claimed.

- Power of Attorney (POA): If a report is filed by an agent or a reporting service on behalf of the carrier, a POA must be on file with the Oregon Department of Transportation, Commerce and Compliance Division. This document authorizes representatives to act on behalf of the carrier.

- Vehicle Registration Documents: Though not directly attached to the Monthly Mileage Tax report, current registration documents should be readily available to ensure the information provided in the report accurately reflects the vehicles operated and their respective declared weights.

- ODOT Plates or Pass Numbers Records: Documentation or a record listing all ODOT plates or pass numbers under the carrier’s account must be maintained and available. This is vital for ensuring accurate reporting of operations for each commercial vehicle.

- Over-Dimensional Permit Records: If applicable, carriers must keep separate records for mileage covered under Over-Dimensional Permits, as this mileage is not reported on the Monthly Mileage Tax report but requires communication with the Over-Dimensional Permits unit.

For carriers navigating the complexities of Oregon's tax requirements, maintaining these documents and understanding their applications is paramount. Not only do they support a transparent and hassle-free reporting process, but they also ensure carriers meet their fiscal obligations accurately. Timely and accurate filing supported by the appropriate documentation protects carriers from potential penalties and ensures compliance with Oregon's tax laws.

Similar forms

Similar to the Oregon Monthly Mileage Tax form, the Federal Heavy Vehicle Use Tax (HVUT) Form 2290 is another tax document required for vehicles with a gross weight of 55,000 pounds or more operating on public highways. It focuses on reporting and paying the annual federal use tax. Both forms share a common purpose in taxing heavy vehicle operation, but while the Oregon form focuses on mileage within the state, Form 2290 is broader, covering federal tax obligations based on vehicle weight, regardless of the miles driven.

The International Fuel Tax Agreement (IFTA) Quarterly Fuel Use Tax Return bears resemblance to the Oregon Mileage Tax form as both require detailed travel and fuel usage records for heavy vehicles. Carriers file IFTA reports with their base jurisdiction, detailing fuel purchases and miles traveled in all participating jurisdictions. Like the Oregon form, the IFTA return is crucial for tax compliance in commercial transportation, streamlining fuel tax payments across states.

Similar in administrative function, the Quarterly Federal Excise Tax Return (Form 720) is used by businesses to report and pay excise taxes on specific goods, services, and activities, including fuel. While Form 720 covers a wide range of products and services subject to excise taxes, its goal of collecting taxes for federally regulated activities aligns with the Oregon Mileage Tax form's purpose of taxing road usage by heavy vehicles within Oregon.

The Unified Carrier Registration (UCR) Application and the Oregon Monthly Mileage Tax form share similarities in that both involve regulatory compliance for carriers operating commercial vehicles. The UCR program requires interstate carriers to register their businesses and pay an annual fee based on the size of their fleet, similar to how the Oregon form mandates monthly mileage reporting for tax calculation.

Another document resembling the Oregon Mileage Tax form is the Commercial Vehicle Registration Application used in various states. These applications often require information on vehicle weight and usage to calculate registration fees, quite like how the Oregon tax form requires detailed mileage and vehicle data for tax purposes. Both sets of documents play a role in ensuring commercial vehicles are legally registered and taxed according to their road use.

The State Sales and Use Tax Return shares a fundamental similarity with the Oregon Monthly Mileage Tax report in its role in tax collection. While sales and use tax applies to the sale, lease, or rental of goods and certain services, the Oregon form focuses on taxing vehicle miles. Both forms are critical for state revenue and require accurate business records to calculate the taxes owed.

Lastly, the Employer's Quarterly Federal Tax Return (Form 941) is analogous in its periodic reporting requirement, although it deals with payroll taxes. Like the Oregon Mileage Tax form, which mandates monthly reporting on vehicle operation to assess tax, Form 941 collects information on wages, tips, and other compensation to calculate Social Security, Medicare, and withheld income taxes. Both documents ensure compliance and proper funding of government programs through systematic reporting.

Dos and Don'ts

When completing the Oregon Monthly Mileage Tax form, it's crucial to ensure accuracy and timeliness to meet the Oregon Department of Transportation's requirements. Here are some dos and don'ts to keep in mind:

- Do make sure that all information is legible. An unreadable report may be returned, leading to delays and possibly late fees.

- Do file your report and make the necessary payment by the last day of the month following the end of the calendar month to avoid a 10% late payment charge.

- Do record the beginning and ending odometer readings accurately for the month you are reporting to calculate total miles operated correctly.

- Do report all Oregon taxable miles. This includes all miles driven on Oregon public roads during the reporting period.

- Do claim credits for Oregon state fuel tax paid during the month by attaching copies of fuel invoices and documenting the quantity of fuel pumped into each qualified vehicle.

- Don't forget to include your Account Number, and the Business Name and Address as filed with the Oregon Department of Transportation.

- Don't mix up the vehicle information. Ensure that the license plate number, state/province that issued the license plate, and the vehicle's make are correctly entered for each vehicle you are reporting.

- Don't leave columns blank. If a vehicle did not operate, enter zero (0) in columns I and L to indicate no operation or tax due.

- Don't use incorrect tax rates for your vehicle. Verify the correct rate based on the vehicle's declared weight and use the appropriate rate from Table A or Table B as specified on the form.

Accuracy and punctuality in filing your Oregon Monthly Mileage Tax report are essential for compliance and avoiding unnecessary charges. Always double-check your entries and calculations before submission. For additional assistance or clarification, visiting the Oregon Department of Transportation's website or contacting their office directly is advisable.

Misconceptions

When navigating the complexities of the Oregon Monthly Mileage Tax form, there are several misconceptions that frequently arise. Understanding these misconceptions is essential for accurate tax reporting and compliance.

Misconception 1: Only motor carriers operating heavy vehicles need to file the Oregon Monthly Mileage Tax report. This is incorrect. All motor carriers operating vehicles with a declared weight over 26,000 pounds on Oregon public roads must file this report, regardless of whether the vehicle is considered "heavy" by general standards.

Misconception 2: The tax rate is the same for all vehicles. The tax rate varies depending on the declared weight of the vehicle and the type of operation (e.g., loaded vs. empty). Table A is for vehicles operating between 26,001 and 80,000 pounds, and Table B for those over 80,000 pounds, with specific conditions applied.

Misconception 3: If no miles were operated in Oregon during the month, the report does not need to be filed. This is not true. Even if the vehicle was not operated in Oregon during the reporting period, a report still needs to be filed with zeros entered in the appropriate columns to maintain compliance.

Misconception 4: Fuel tax credits are automatically applied. Carriers must claim fuel tax credits by attaching fuel invoices and showing the amount of Oregon state fuel tax paid. These credits are not automatically applied and require documentation for verification.

Misconception 5: Information on the form only pertains to Oregon operations. While the tax report focuses on miles operated on Oregon roads, carriers must provide comprehensive vehicle information, regardless of where the vehicle was predominantly used, as long as it was used on Oregon roads during the reporting period.

Misconception 6: The late payment charge is negotiable. The 10% late payment charge is mandatory and calculated based on the amount due in Box 4. It is applied to reports filed after the due date without exception.

Misconception 7: Digital filing is optional. While the Oregon Department of Transportation encourages digital filing for efficiency, it is not mandatory. Carriers have the option to mail their completed forms, but digital filing through Trucking Online is available and may offer a more convenient process.

Clear understanding and attention to the details of the Oregon Monthly Mileage Tax form can save time and prevent potential penalties for inaccuracies or non-compliance. It's important for carriers to review the instructions and requirements carefully each reporting period.

Key takeaways

Filling out the Oregon Monthly Mileage Tax form is a mandatory process for many carriers operating within the state, ensuring that they comply with tax obligations based on the miles their vehicles travel on Oregon's highways. Here are several key takeaways to help individuals understand and successfully navigate this process:

- Accurate Reporting: Carriers must report the operations of each vehicle by accurately filling out columns A through L in Section 1, detailing everything from license plate numbers to the total Oregon miles operated.

- Meticulous Record-Keeping: It is essential to maintain original records supporting the information provided in the form, as these may be requested for verification by the Oregon Department of Transportation (ODOT) Commerce and Compliance Division (CCD).

- Declaration of Weight: When reporting, carriers must declare and report operations at the heaviest weight per configuration that was operated, ensuring the tax rate applied is accurate.

- Fuel Tax Credits: Carriers can claim credits for Oregon state fuel taxes paid during the report month by attaching fuel invoices. These credits are then deducted from the total fees owed.

- Late Payment Penalties: A 10 percent late payment charge is applied to reports not postmarked by the due date, emphasizing the importance of timely submissions.

- Zero Operation Reporting: Even if a vehicle did not operate during the reporting period, a report must still be filed with zeroes in the relevant columns, avoiding any misunderstanding of non-compliance.

- Keeping Track of Changes: Any changes to name, address, or telephone must be promptly communicated to the CCD, ensuring that all records remain current.

- Online Resources: The ODOT provides numerous online resources, including a trucking online service and detailed instructions for filling out highway-use tax reports, offering convenience and assistance to carriers.

- Detailed Payment Instructions: Section 2 outlines the process for calculating the total payment due, including how to account for other credits and additional payments that might affect the final amount owed to the state.

This overview of completing the Oregon Monthly Mileage Tax form highlights the importance of detailed and accurate reporting, timely filings, and the utility of available resources to comply with state tax regulations. By understanding these key aspects, carriers can ensure they meet their tax obligations efficiently and effectively.

Popular PDF Documents

Income Tax Exemption - Highlights how the information obtained through this form becomes part of the service member's active duty pay system of records.

Trillium Drug Program Application Online - Description of an application process for Ontario seniors aiming to reduce their prescription medication expenses through a $2 co-payment system.