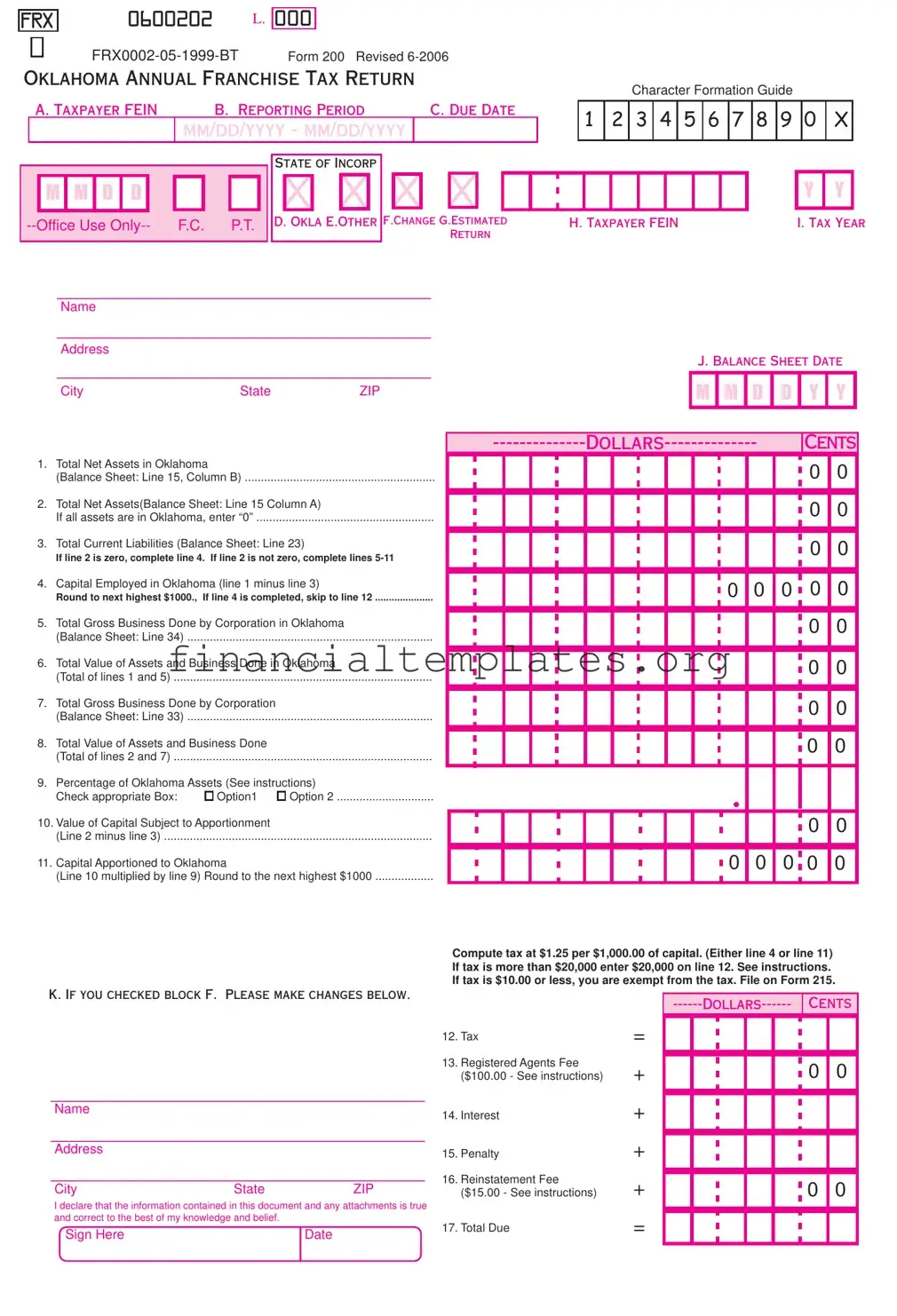

Get Oklahoma Tax Return 200 Form

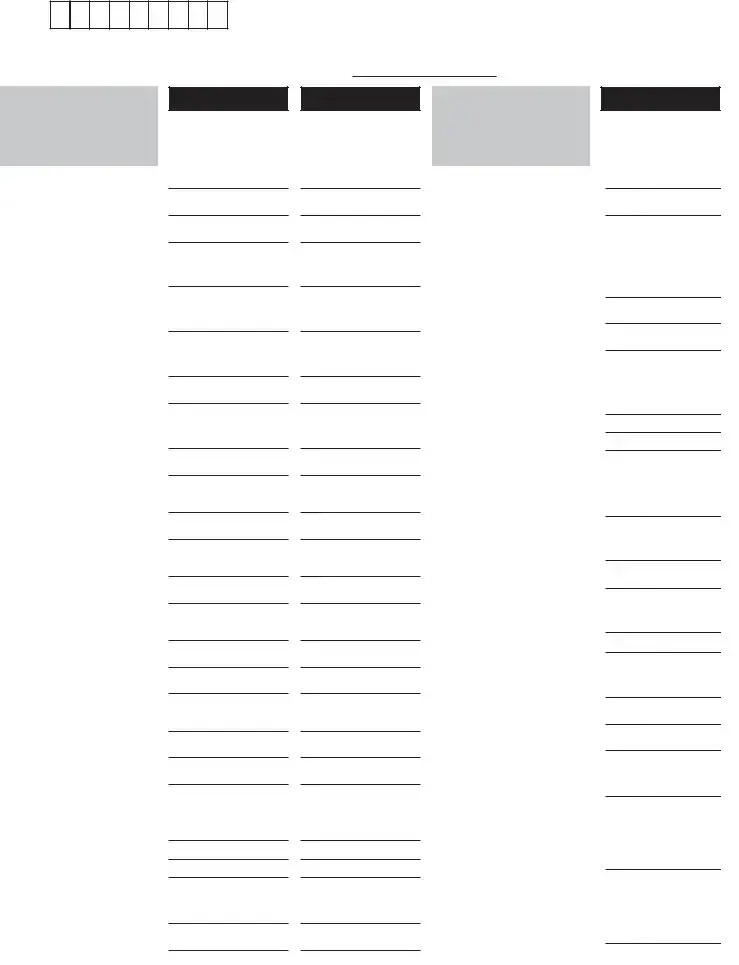

The Oklahoma Tax Return 200 form, formally recognized and updated last in June 2006, constitutes a crucial document for corporations operating within or in relation to the state, for the purpose of calculating and filing their annual franchise tax. This form meticulously captures a range of corporate data, beginning with basic identification details like the Taxpayer's Federal Employer Identification Number (FEIN) and progressing through financial specifics encompassing total net assets, both within Oklahoma and overall, alongside current liabilities and gross business metrics. It further delves into apportioning capital to Oklahoma, based on a series of calculations intended to proportionately relate the corporation's financial engagement within the state to its overarching financial footprint. The completion of this form necessitates an accurate representation of the corporation's financial standings, including a detailed balance sheet and schedules that outline the business structure, related companies, and debt details, which contribute to the calculated franchise tax and associated fees. Moreover, it stipulates the conditions for filing, including due dates, delinquency penalties, and the prerequisites for obtaining filing extensions, alongside illustrating the computation method for determining the franchise tax owed to the state, based on the corporation's allocated capital and business activities within Oklahoma. This form is instrumental for corporations to fulfill their legal obligations to the state, ensuring compliance and the accurate remittance of their franchise taxes.

Oklahoma Tax Return 200 Example

FRX |

0600202 |

|

L. |

000 |

|

|

|

||

|

|

|

Form 200 Revised |

||||||

|

|

|

|||||||

OKLAHOMA ANNUAL FRANCHISE TAX RETURN |

|

||||||||

|

A. TAXPAYER FEIN |

B. REPORTING PERIOD |

C. DUE DATE |

||||||

|

|

|

MM/DD/YYYY - MM/DD/YYYY |

|

|

||||

|

|

|

|

|

|

|

|

|

|

STATE OF INCORP

M M D D |

F.C. |

P.T. |

D. OKLA E.OTHER F.CHANGE G.ESTIMATED |

|

|

|

|

RETURN |

Character Formation Guide

1 2 3 4 5 6 7 8 9 0 X

Y Y

H. TAXPAYER FEIN |

I. TAX YEAR |

_____________________________________________

Name

_____________________________________________

Address

_____________________________________________ |

|

J. BALANCE SHEET DATE |

|||||||

|

|

|

|

|

|

|

|||

City |

State |

ZIP |

M |

M |

D |

D |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CENTS |

||

1.Total Net Assets in Oklahoma

(Balance Sheet: Line 15, Column B) ...........................................................

2.Total Net Assets(Balance Sheet: Line 15 Column A)

If all assets are in Oklahoma, enter “0” .......................................................

3.Total Current Liabilities (Balance Sheet: Line 23)

If line 2 is zero, complete line 4. If line 2 is not zero, complete lines

4.Capital Employed in Oklahoma (line 1 minus line 3)

Round to next highest $1000., If line 4 is completed, skip to line 12 .....................

5.Total Gross Business Done by Corporation in Oklahoma

(Balance Sheet: Line 34) ............................................................................

6.Total Value of Assets and Business Done in Oklahoma

(Total of lines 1 and 5) ................................................................................

7.Total Gross Business Done by Corporation

(Balance Sheet: Line 33) ............................................................................

8.Total Value of Assets and Business Done

(Total of lines 2 and 7) ................................................................................

9.Percentage of Oklahoma Assets (See instructions)

Check appropriate Box: |

Option1 |

Option 2 |

10.Value of Capital Subject to Apportionment

(Line 2 minus line 3) ...................................................................................

11.Capital Apportioned to Oklahoma

(Line 10 multiplied by line 9) Round to the next highest $1000 ..................

0 0

0 0

0 0

0 0 0 0 0

0 0

0 0

0 0

0 0

•

0 0

0 0 0 0 0

Compute tax at $1.25 per $1,000.00 of capital. (Either line 4 or line 11) If tax is more than $20,000 enter $20,000 on line 12. See instructions. If tax is $10.00 or less, you are exempt from the tax. File on Form 215.

K. IF YOU CHECKED BLOCK F. PLEASE MAKE CHANGES BELOW.

_____________________________________________

Name

_____________________________________________

Address

_____________________________________________

City |

State |

ZIP |

I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

Sign Here |

Date |

|

|

12.Tax

13.Registered Agents Fee

($100.00 - See instructions)

14.Interest

15.Penalty

16.Reinstatement Fee

($15.00 - See instructions)

17.Total Due

=

+

+

+

+

=

CENTS |

||

|

|

|

0 |

0 |

0 0

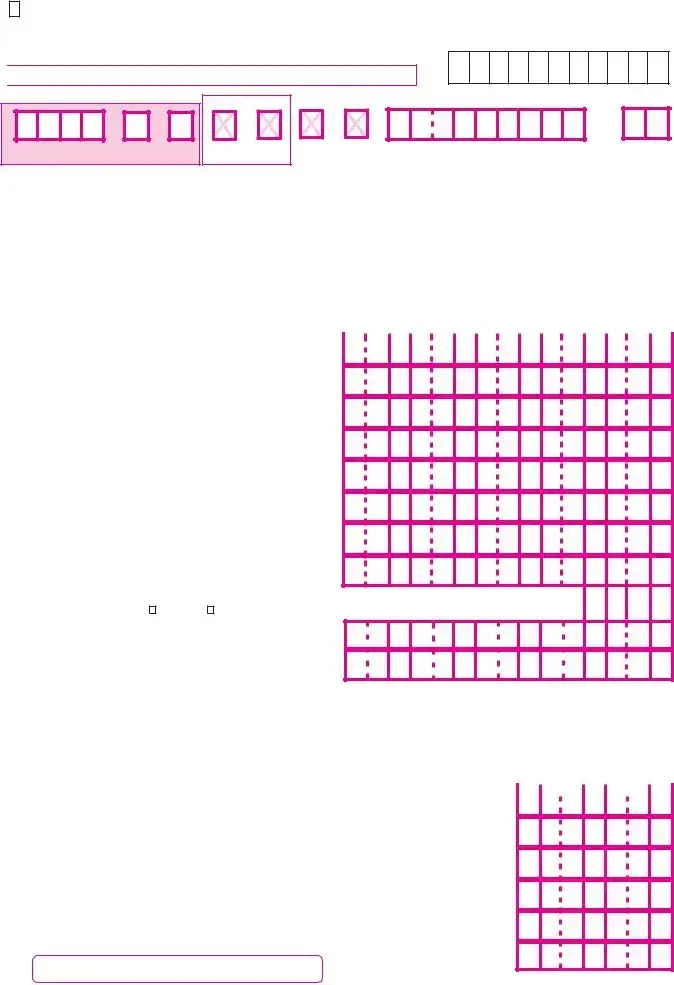

FRX

0600102 000

Name

Address

City |

State |

ZIP |

FEDERAL EMPLOYER’S

IDENTIFICATION NUMBER

SCHEDULE A: CURRENT OFFICER INFORMATION

CORPORATE OFFICERS EFFECTIVE AS OF

(Date)

Examples: Reporting period 07/01/2006 –

Reporting period 01/01/2006 –

Schedule A: Current Officer Information

Enter the current officers effective date. Example: if the reporting period is 07/01/2006 through 06/30/2007, the effective date should be 06/30/2006. The officers listed should be those whose term was in effect as of 06/30/2006. If any of the officer information is incorrect, please make the necessary changes on the Schedule A. Be sure to update names, addresses, and Social Security Numbers.

President |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

|

|

Vice President |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

|

|

Secretary |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

|

|

Treasurer |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

Please include Social Security Numbers of officers.

If

All returns, applications, and forms required to be filed with the Oklahoma Tax Commission (Commission) in the administra- tion of this State’s tax laws shall bear the Federal Employer’s Identification Number(s) or the Social Security Account Number (or both) of the person, firm, or corporation filing the item and of all persons required by law or agency rule to be named or listed. If more than one number has been issued to the person, firm, or corporation, then all numbers will be required. [Source: Amended at 16 Ok Reg 2628, eff

All Federal Employer’s Identification and/or Social Security Account Numbers are deemed to be included in the confidential records of the Commission.

Please Enter Your Federal Employer’s Identification

Number

Here...

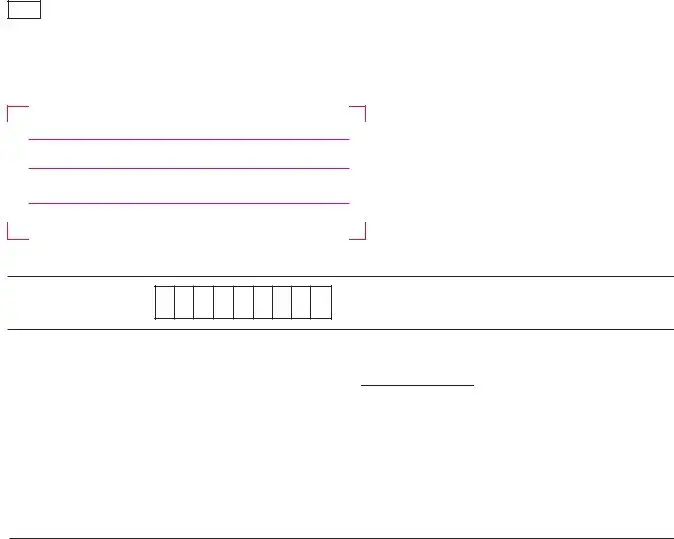

FORM # 203 SCH |

SCHEDULES B, C, D AND BALANCE SHEET |

REVISED |

(TO BE FILED WITH FORM 200: OKLAHOMA ANNUAL FRANCHISE RETURN)

This form contains Schedules B, C, and D and also a Balance Sheet for the completion of Form 200: Oklahoma Annual Franchise Tax Return. You may attach additional pages if further space is needed on Schedules C and D.

SCHEDULE B

GENERAL INFORMATION (TO BE COMPLETED IN DETAIL)

If the business is not a “corporation,” please list the type of business structure, the date of formation, and county in which filed.

Name and address of Oklahoma “registered agent”

Name of parent company and their FEI number, if applicable: |

|

|

|

|

FEI: |

|

|||||

Percent of your outstanding stock owned by the parent company, if applicable: |

|

|

% |

|

|

|

|||||

In detail, please list the nature of your business: |

|

|

|

|

|

|

|

||||

Amount of authorized capital stock or shares: |

|

|

|

|

|

|

|||||

(a) Common: |

|

|

shares, par/book value of each share |

$ |

|

|

$ |

|

|

||

(b) First Preferred: |

|

shares, par/book value of each share |

$ |

|

|

$ |

|

|

|||

Total capital stock or shares issued and outstanding at the end of fiscal year: ________________________ |

|

|

|||||

(a) Common: |

|

|

shares, par/book value of each share |

$ |

|

$ |

|

(b) First Preferred: |

|

shares, par/book value of each share |

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE C |

|

|

|

|

|

||

RELATED COMPANIES: SUBSIDIARIES AND AFFILIATES

•SUBSIDIARIES (Companies in which you own 15 percent or more of the outstanding stock)

Name of Subsidiary |

|

Federal Employer’s ID Number Percentage Owned (%) |

Financial Investment ($) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•AFFILIATES (Companies related other than by direct stock ownership)

Name of Affiliate |

|

Federal Employer’s ID Number How related? |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE D

DETAILS OF CURRENT DEBT SHOWN ON BALANCE SHEET

|

|

|

|

Original Amount |

Original Date of Issuance |

|

Maturity Date |

|

of Instrument |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance remaining of amounts payable within 3 years of Date of Issuance

Please Enter Your Federal Employer’s Identification

Number

Here...

BALANCE SHEET AS OF THE LAST

ASSETS

INCOME TAX YEAR

COLUMN A

Total Everywhere as per

Books of Account.

If all Property is in

Oklahoma,

Do Not Use this Column.

ENDED

COLUMN B

Total in Oklahoma

as per Books

of Account.

LIABILITIES AND

STOCKHOLDERS’

EQUITY

COLUMN C

Total Everywhere as per

Books of Account.

1.Cash .......................................

2.Notes and accounts receiveable

3.Inventories .............................

4.Government obligations and other bonds ...........................

5.Other current assets

(please attach schedule) ........

6.Total Current Assests

(add lines

7.Mortgage and real estate loans

8.Other investments

(please attach schedule) ........

9.(a) Building .............................

(b)Less accumulated depreciation .......................

10.(a) Fixed depreciable assets .

(b)Less accumulated depreciation ......................

11.(a) Depletable assets ............

(b)Less accumulated depletion ...........................

12.Land .....................................

13.(a) Intangible assets .............

(b)Less accumulated amortization .....................

14.Other assets .........................

15.Net Assets ...........................

(Lines:

16.

(a)From parent company ....

(b)From subsidiary company

(c)From affiliated company .

17.Bank holding company stock in subsidiary bank .......

18.TOTAL ASSETS ..................

(Lines:

19.Accounts payable ....................

20.Accrued payables ....................

21.Indebtedness payable three years or less after issuance

(see schedule D) .....................

22.Other current liabilities ............

23.Total Current Liabilities ........

(Lines:

24.

(a)To parent company ............

(b)To subsidiary company ......

(c)To affiliated company .........

25.Indebtedness maturing and payable in more than three years from the date of issuance

26.Loans from stockholders not payable within three years ......

27.Other liabilities ........................

28.Capital Stock

(a)Preferred stock ...................

(b)Common Stock ...................

29.

30.Retained earnings ...................

31.Other capital accounts ............

32.Total Liabilities and

Stockholders’ Equity ............

(Lines:

33.Total gross business done everywhere

(sales and service) ................

(from income tax return)

34.Total gross business done in Oklahoma

(sales and service) ................

(from income tax return)

Form

Revised

OKLAHOMA ANNUAL FRANCHISE TAX RETURN INSTRUCTION SHEET

• REQUIREMENT FOR FILING RETURN

Every corporation organized under the laws of this state, or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue of creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies and business trusts as defined by Oklahoma statutes unless exempt by statutes must file an Annual Franchise Tax Return Form 200.

The term “doing business” means and includes every act, power, or privilege exercised or enjoyed in this state as an incident to do or by virtue of powers and privileges acquired by the nature of all organizations falling within the purview of the Franchise Tax Code.

All Foreign

The Maximum annual franchise tax is $20,000.00. Corporations that owe the maximum tax may file on Form 215. If the tax computed is $10.00 or less, no tax payment is due. However, a Franchise Tax Return must be filed. When submitting the Franchise Tax Return, foreign corporations with a tax liability of $10.00 or less must also pay the registered agent fee.

Applications for refunds must include copies of your related Oklahoma Income Tax Returns. The use of the correct corporate name and Federal Employer Identification Number on your return and all correspondence will facilitate processing and handling.

• TIME FOR FILING AND PAYMENT INFORMATION

Oklahoma Franchise Tax is due and payable July 1st of each year. The report and tax will be delinquent if not paid on or before August 31. If you elected to change your filing date to be the same as the date of filing your corporate income tax, the report and tax will be delinquent if not paid by the fifteenth (15) day of the third month following the close of the corporate income tax year. A ten percent (10%) penalty and one and

If the Charter or other instrument is suspended, a fee of $15.00 is required for reinstatement. (Line 16 of Form 200.)

If you request an extension to file your corporate income tax return, a copy of your request to file an extension must accompany your franchise tax return. Extensions of time to file may be granted upon receipt of a tentative return and remittance based on an estimate of the tax due. However, the extension does not have the effect of waiving penalty or interest on remittances made after the due date.

If you wish to make an election to change your filing frequency for your next reporting period, please complete OTC Form 200F: Request to Change Franchise Tax Filing Period. You can download this form from the Oklahoma Tax Commission website @ www.tax.ok.gov.

• FRANCHISE TAX COMPUTATION

The basis for computing your Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of your last preceding income tax accounting year, or if you have elected to change your filing to match the due date of your corporate income tax, the balance sheet for that corporate tax year.

The franchise tax for corporations doing business both within and outside of Oklahoma, is computed on the proportion to which property owned, or property owned and business done, within Oklahoma, bears to total property owned, or total property owned and total business done everywhere.

“Property owned” is the book value of the assets. For the purpose of determining apportionment as between Oklahoma and elsewhere, liabilities are not to be deducted from gross assets.

The term “business done” means and includes the engaging in any activity or the performing of any act or acts in this state that constitutes the doing or transacting of business. Business done in Oklahoma includes sales shipped from Oklahoma to another state in which the corporation is not doing business.

The Oklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1000 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

FIRST STEP...

COMPLETE BALANCE SHEET AND SCHEDULES B, C & D

(Must be returned with annual return)

Line 1 through 3, cash, notes, accounts receivable, and inventories are to be reported at book value.

Line 4 United States, municipal, commercial and other bonds owned by the corporation.

Line 5 Prepaid expenses and deferred charges are to be included as assets at book value.

Line 8 Stock or other evidence of ownership in subsidiary organiza- tions as shown on the corporations books of account.

Lines 9b, 10b, 11b. If accumulated depreciation and depletion appear to be excessive, the excess may be disallowed.

Line 13 Patents, trademarks, copyrights, etc., and franchises are to be included as assets to the extent of their cost. In the case of a definite term franchise, the cost thereof may be amortized over its life. Good will is an asset and should be shown at book value. All intangibles including cash, are to be appor- tioned wholly to Oklahoma unless a commercial or business location for the intangibles has been established elsewhere.

Line 14 Life insurance, where the reporting taxpayer is beneficiary, is to be shown at cash surrender value.

Line 15 Total net amount of lines 6 through 14. Line 18 Total lines 15,16, and 17.

Line 20 Reserves for taxes are allowed to the extent such taxes are unpaid. Deferred credits are included in capital employed unless they can be shown to be actual liabilities.

Line 21 Current liability includes indebtedness payable in three (3) years or less after issuance.

Line 26 Stockholder loans must be repaid within three years of creation to be considered a current liability. Contingent assets or liabilities should not be included unless fully explained and the condition under which they become actual is clearly set forth.

Line 32 Total lines 23 through 31. The amounts as shown by the books of account shall be the measure of value of the assets and liabilities, except when the items on the books of account are in error or lack sufficient detail to truly reflect the amount of capital invested and employed in the business.

SECOND STEP...

COMPLETE THE OKLAHOMA ANNUAL FRANCHISE TAX RETURN

Item D Place an “X” in the box if you are incorporated in the State of Oklahoma.

Item E Place an “X” in the box if you are incorporated in a state other than Oklahoma.

Item F Place an “X” in the box if any of the preprinted information in Items A or B or the name or address is incorrect. Please make corrections in the space provided in Item H, J or K.

If Incorrect |

Then |

|

1. Taxpayer FEIN |

Write the correct federal employers |

|

|

|

identification number within the |

|

|

boxes in Block H. |

2. Reporting Period |

Place the last two digits of the year |

|

|

|

end which this return covers in the |

|

|

boxes in Block I. |

3. Corporate Name or Address |

Fill in only the corrected information |

|

|

|

in the space provided at the bottom |

|

|

of the form (Item K). |

Item G |

Place an “X” in the box if you have not completed a year end |

|

|

balance sheet and are therefore filing an estimated return. |

|

|

You must file an estimated return and remit tax due. |

|

Item H |

If your FEIN is not preprinted in Item A or is incorrect, please |

|

|

enter your FEIN. |

|

Item I |

If your reporting period is not printed in Item B or is incorrect, |

|

|

enter the tax year for which you are filing a return. |

|

Item J |

Enter your balance sheet date of your most recent income tax |

|

|

accounting year. (month/date/year) |

|

(Continued from lower left column)

Lines 1 through 11 (except 9) are derived from your balance sheet. Please put the date of the balance sheet in the date boxes provided (Item J).

Line 9 (Percent of Oklahoma Assets)

Select which option you will use to determine the apportion- ment of Oklahoma assets.

Option 1: Percent of Oklahoma assets and business done to total assets and business done. (line 6 divided by line 8). Round to four decimal points.

Option 2: Percent of Oklahoma assets to total net assets (line 1 divided by line 2). Round to four decimal points.

Line 12 (Tax)

Compute tax at $1.25 per $1,000.00 of capital. (Either line 4 or line 11) If tax is more than $20,000 enter $20,000 on line

12.If tax is $10.00 or less, you are exempt from the tax. File on Form 215.

Line 13 (Registered Agent Fee)

If your coproration originated in a state other than Oklahoma, the Oklahoma Secretary of State charges an annual regis- tered agent fee of $100.00 and is collected on the FRX return.

Line 14 (Interest)

If this return is postmarked after the due date the tax is subject to 1.25% interest per month from the due date until it is paid. Multiply the amount in Line 12 by .0125 for each month the report is late.

Line 15 (Penalty)

If this return is postmarked after the due date the tax is subject to a penalty of 10%. Multiply the amount in Line 12 by

.10 to determine the penalty. Line 16 (Reinstatement Fee)

If your corporate charter has been suspended, you must meet all outstanding filing and payment obligations in order to be reinstated. A $15.00 reinstatement fee is also required. Only one reinstatement fee is required even if multiple past due returns are being filed.

Line 17 (Total Due)

Total of Lines 12 through 16,

THIRD STEP...

Schedule A Officer Information

Enter the effective date of officers. Please refer to the examples on Schedule A. If any preprinted officer information (Schedule A) is incorrect, please make the necessary changes on Schedule A and mail with your tax return and payment. Be sure to update the corporate officers name, address and social security number. Failure to provide this information could result in the corporation being suspended.

FOURTH STEP...

Mail this return in the enclosed envelope. Please include your return, payment made payable to Oklahoma Tax Commission, balance sheet, and schedules A, B, C, and D.

Please Mail To:

Oklahoma Tax Commission

Franchise Tax

Post Office Box 26930

Oklahoma City, OK

Phone Number for Assistance – (405)

Mandatory inclusion of Social Security and/or Federal Employer’s Identification numbers is required on forms filed with the Oklahoma Tax Commission pursuant to Title 68 of the Oklahoma Statutes and regulations thereunder, for identification purposes, and are deemed to be part of the confidential files and records of the Oklahoma Tax Commission.

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in state laws.

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Identification | Oklahoma Annual Franchise Tax Return, Form 200 |

| Governing Law | Oklahoma Franchise Tax Code |

| Due Date | July 1st annually, delinquent if not paid by August 31 |

| Max Annual Tax | $20,000.00 |

| Exemption | Tax amounts $10.00 or less are exempt, but filing is required |

| Penalties | 10% penalty and 1.25% interest per month for late payment |

| Annual Registered Agent Fee | $100.00 for foreign corporations |

Guide to Writing Oklahoma Tax Return 200

Filling out the Oklahoma Tax Return 200 form is crucial for corporations operating within the state, as it ensures compliance with local tax obligations and helps maintain the state’s financial integrity for public services. This task may seem daunting at first, but breaking it down into manageable steps can simplify the process. Here’s how to accurately complete the form:

- Start with section A. TAXPAYER FEIN: Enter the Federal Employer Identification Number (FEIN) of your corporation.

- Proceed to section B. REPORTING PERIOD: Fill in the start and end dates of your reporting period using the MM/DD/YYYY format.

- Section C. DUE DATE should automatically be filled; however, ensure it aligns with your reporting period’s due date.

- For section D. STATE OF INCORP, indicate the state in which your corporation is incorporated.

- Under section E. OTHER, if there are any other pertinent details about your corporation, note them here. This could include changes in business operations or structure.

- If there has been a change of address or other administrative updates since your last filing, mark the appropriate checkbox in section F. CHANGE.

- In section G. ESTIMATED RETURN, mark whether this filing is based on estimated figures.

- Fill in the tax calculation parts:

- Enter total net assets in Oklahoma and total net assets overall in the respective lines.

- Indicate your total current liabilities.

- For capital employed in Oklahoma, subtract total current liabilities from total net assets in Oklahoma and round to the nearest $1000.

- If all assets are not in Oklahoma, you’ll need to also include details about total gross business and the value of assets and business done both within the state and overall.

- Determine the percentage of Oklahoma assets and use it to find the value of capital subject to apportionment.

- Compute your tax: Apply the indicated $1.25 per $1,000.00 of capital. Keep in mind the maximum and exemptions outlined in your instructions.

- Enter any applicable registered agents fee, interest, penalty, and reinstatement fee as instructed.

- The total due is computed by summing the tax, any registered agents fee, interest, penalties, and reinstatement fees.

- Lastly, verify that all information entered is correct and true, then sign and date the form at the bottom.

After completing the form, review it thoroughly to ensure that all information provided is accurate and all necessary sections are filled out. Submit the form along with any necessary documentation and payment to the Oklahoma Tax Commission by the due date to avoid penalties. By following these steps meticulously, corporations can fulfill their tax obligations efficiently, contributing to their state's economic health and ensuring smooth operations.

Understanding Oklahoma Tax Return 200

-

What is the Oklahoma Annual Franchise Tax Return Form 200?

This form is utilized by corporations operating within the State of Oklahoma to calculate and report their annual franchise tax. The document requires detailed financial information, including total net assets in Oklahoma, total gross business done by the corporation within the state, and a balance sheet. The franchise tax is calculated based on the value of the capital employed or apportioned to Oklahoma, with the tax rate set at $1.25 per $1,000 of capital.

-

Who needs to file the Form 200?

All corporations organized under the laws of Oklahoma, or doing business in Oklahoma in a corporate capacity, are required to file the Form 200, unless specifically exempt by statute. This encompasses foreign and domestic corporations including associations, joint stock companies, and business trusts as defined by Oklahoma statutes.

-

When is the Form 200 due?

The Oklahoma Franchise Tax, reported using Form 200, is due annually on July 1st. The payment and report become delinquent if not submitted by August 31st. If a corporation has elected to match the filing date of its corporate income tax, the report and tax are delinquent if not filed by the fifteenth day of the third month following the close of their fiscal year. Late submissions are subject to a ten percent penalty and interest of 1.25% per month.

-

How is the franchise tax calculated?

The franchise tax is calculated based on the financial information provided in the balance sheet from the last income tax accounting year. For corporations with both in-state and out-of-state business operations, the tax is computed on the proportion of property and business conducted within Oklahoma relative to total assets and operations. The tax rate is $1.25 for each $1,000 of capital employed or apportioned to Oklahoma. A maximum annual franchise tax of $20,000 can be imposed, and if the calculated tax is $10.00 or less, the corporation is exempt from payment but must still file a return.

-

What are the penalties for late filing or payment?

For late submissions, there is a ten percent penalty on the unpaid tax amount. Additionally, interest accrues at a rate of 1.25% per month on any tax due after the payment deadline. If a corporation's charter or other authorizing instrument is suspended, a reinstatement fee of $15.00 is also required. It's important to note that requesting an extension to file a corporate income tax return and appending this request to the franchise tax return can grant an extension. However, this does not waive the penalties or interest for late payments made after the due date.

Common mistakes

Incorrectly reporting the FEIN: Tax filers sometimes enter the Federal Employer Identification Number (FEIN) incorrectly. This number is critical for identification and must match the business's official records.

Misunderstanding the reporting period: The specific dates of the reporting period, as indicated by sections B and C, are often entered inaccurately. It's essential to match these dates with the fiscal year of the business.

Omitting the state of incorporation: Section D requires the state of incorporation, which is frequently overlooked. This information is crucial for identifying the jurisdiction governing the corporation.

Errors in net asset calculation: Mistakes in calculating total net assets in Oklahoma and total net assets overall (lines 1 and 2) can significantly affect tax liabilities. Correct calculation is paramount for an accurate return.

Overlooking current liabilities: The total current liabilities (line 3) are sometimes miscalculated or left blank, impacting the capital employed in Oklahoma's determination. It's critical to include all current liabilities.

Inaccurately determining capital employed in Oklahoma: Line 4, which requires subtracting total current liabilities from total net assets in Oklahoma, is often computed incorrectly due to errors in the preceding lines or misunderstanding the instructions.

Failing to accurately report gross business done: Lines 5 and 7, detailing the total gross business done by the corporation in Oklahoma and overall, respectively, are frequently filled out inaccurately, leading to incorrect apportionment calculations.

Incorrect apportionment of capital to Oklahoma: Line 11 often contains errors due to incorrect calculations in previous sections, especially if the gross business and asset values are not accurately reported.

Forgetting to include the registered agents fee: If applicable, the registered agent fee (line 13) is sometimes omitted, which can result in an underpayment of the total due.

Miscalculating the total due: A common error is incorrectly adding the tax, registered agent fee, interest, penalty, and reinstatement fee (lines 12 through 17), leading to incorrect payment amounts. Ensuring accurate addition is crucial for compliance.

When filling out the Oklahoma Tax Return 200 form, individuals and businesses often overlook crucial steps or misinterpret instructions, leading to common mistakes. Addressing these mistakes can streamline the tax filing process and ensure compliance with state guidelines. Here are ten prevalent errors:

Avoiding these mistakes requires careful review, attention to detail, and adherence to the instructions provided in the Oklahoma Annual Franchise Tax Return instruction sheet. Accurate completion of the Form 200 can help avoid unnecessary delays, penalties, and interest due to errors or omissions.

Documents used along the form

Completing your Oklahoma Tax Return 200 form is a substantial step in meeting your corporate responsibilities, but it's just one piece of the compliance puzzle. Often, several additional documents and forms accompany the Form 200 to ensure a comprehensive approach to your tax obligations in Oklahoma. Understanding these accompanying documents will streamline your filing process and help avoid unnecessary complications.

- Form 203-A: Oklahoma Annual Franchise Tax Return Instruction Sheet - A crucial companion to Form 200, providing detailed instructions, definitions, and requirements for filing the Oklahoma Annual Franchise Tax Return. It clarifies computation methods for the tax and explains filing deadlines and penalties for late submissions.

- Schedule A: Current Officer Information - This schedule is necessary for listing the current officers of the corporation, including their names, social security numbers, addresses, and contact information, effective as of the date specified by the reporting period of the Form 200.

- Schedules B, C, D, and Balance Sheet - Integral parts of the filing that offer a more detailed view of the company's financial health. These schedules cover general information, details about related companies (subsidiaries and affiliates), and specifics about current debt and assets, both within Oklahoma and total.

- Form 215 (if applicable) - For corporations whose calculated franchise tax is $10.00 or less, indicating exemption from the tax. This form still requires submission to acknowledge the exemption status.

- OTC Form 200F: Request to Change Franchise Tax Filing Period - If a corporation wishes to align its franchise tax filing period with its fiscal year or any other chosen time frame, this form facilitates that request.

- Application for Extension - Should the corporation need more time to file its Form 200, this document is necessary to request an extension. It's crucial to note that extension of time to file doesn't extend the deadline for tax payments due.

- Form for Change of Registered Agent/Office - If there have been changes to the corporation's registered agent or office location, this document ensures those changes are officially recorded with the Oklahoma Tax Commission.

Each document plays a vital role in the complete and accurate filing of the Oklahoma Tax Return 200 form. By familiarizing yourself with these forms and schedules, you can ensure a smoother filing process. Moreover, keeping these documents updated and readily available will aid in staying compliant with Oklahoma's tax regulations, ultimately safeguarding your business's good standing within the state.

Similar forms

The Form 215 is directly related to the Oklahoma Tax Return 200 form, serving as an alternative for entities owing a minimal franchise tax amount. Specifically, if the calculated tax due is $10.00 or less, the corporation is exempt from the franchise tax, but still required to file using Form 215. This ensures compliance with state regulations while acknowledging the minimal financial impact on smaller corporations, streamlining the administrative process for both the company and the state tax commission.

The Form 203 Schedule B, C, and D, along with a Balance Sheet, are intrinsic components supplementing the Oklahoma Annual Franchise Tax Return (Form 200). These schedules provide detailed information about the business structure, related companies, debt details, and a comprehensive financial overview. By requiring these schedules as additional documentation, Oklahoma ensures a thorough evaluation of a corporation’s financial standing and operations within the state, enabling a more accurate calculation of the franchise tax owed based on assets and business activities.

The Federal Employer Identification Number (FEIN) is a crucial piece of information requested in both the Oklahoma Tax Return 200 form and various other tax documents. The FEIN serves as a unique identifier for corporations, akin to a Social Security number for individuals, facilitating the tracking of tax obligations and filings. This number is mandatory for all corporate tax returns and other related filings, simplifying the identification process and ensuring the accurate application of tax laws to the correct entity.

The Oklahoma Annual Franchise Tax Return Instruction Sheet provides essential guidance for correctly filing Form 200, making it significantly akin to the form itself. It delineates the requirements, deadlines, computations, and potential penalties involved in the franchise tax process. Without this instruction sheet, corporations might struggle to comply with the complexities of the tax code, potentially incurring fines or processing delays. Hence, the instruction sheet acts as a navigator, helping corporations accurately fulfill their franchise tax responsibilities.

The Request to Change Franchise Tax Filing Period Form (OTC Form 200F) shares a functional connection with the Oklahoma Tax Return 200 form by allowing corporations to align their franchise tax filing dates with their corporate income tax filing dates. This synchronization can simplify financial processes for the corporation, ensuring that tax obligations are met in a more streamlined and efficient manner. This option is particularly beneficial for corporations seeking to consolidate their tax filing efforts into a single, more manageable timeframe.

The application for a tax extension is another document related to the Oklahoma Tax Return 200 form, offering corporations the ability to postpone their filing deadline under specific conditions. This is particularly useful for entities that need additional time to gather the necessary information or manage financial obligations. The extension does not alleviate the penalties and interest accrued from late payments, emphasizing the importance of timely financial planning and compliance.

The Requirement for Reinstatement, and the accompanying reinstatement fee noted in the Oklahoma Tax Return 200 form, shares similarities with documents involved in restoring a corporation’s good standing with the state. When a corporation’s charter or other authorizing document is suspended, possibly due to non-compliance with tax filing or payment, submission of the required form along with the reinstatement fee becomes necessary. This process reestablishes the corporation’s legal ability to conduct business in Oklahoma.

Documents detailing a corporation’s balance sheet, as required for the completion of Oklahoma Tax Return 200 form, are inherently similar to annual financial statements prepared by corporations. These documents provide a snapshot of the corporation’s financial health, including assets, liabilities, and equity at year-end. This information is critical for the state’s calculation of the franchise tax, demonstrating the direct link between routine corporate financial reporting and state tax obligations.

The Oklahoma Registered Agent Fee, specifically mentioned in the Oklahoma Tax Return 200 form for foreign corporations, bears resemblance to documents and fees associated with maintaining a registered agent. This fee is part of the broader responsibilities foreign corporations face when doing business in states outside their incorporation. The registered agent acts as the corporation’s official in-state contact for legal and tax correspondence, ensuring that the entity remains compliant with Oklahoma’s regulatory requirements.

Finally, the Oklahoma Franchise Tax computation formula, integral to the Oklahoma Tax Return 200 form, shares characteristics with other tax calculation documents that apportion taxes based on business activity within a jurisdiction. This formula considers assets and business done both within Oklahoma and elsewhere, offering a fair method of taxing corporations based on their actual economic footprint in the state. This method reflects broader principles of corporate taxation, where tax obligations are aligned with the scale and scope of a corporation’s operations.

Dos and Don'ts

When completing the Oklahoma Tax Return Form 200, certain practices should be followed to ensure accuracy and compliance with state requirements. Below are essential do's and don'ts to consider:

- Do ensure all the information provided matches the corporate records and federal tax returns. Inaccuracies can lead to processing delays or penalties.

- Do calculate the tax based on the capital employed in Oklahoma accurately. This calculation is crucial for determining the correct amount of franchise tax owed.

- Do include the Federal Employer Identification Number (FEIN) on the form. This number is essential for identification and is required on all submissions.

- Do remember to attach all required schedules and additional documents that are part of the Form 200 submission. This includes Schedules B, C, D, and the Balance Sheet.

- Do sign and date the form. An unsigned form is considered incomplete and could result in rejection.

- Do file and pay any due franchise tax by the prescribed deadline to avoid penalties and interest charges.

- Don't skip the computation of the Total Gross Business Done by Corporation in Oklahoma if your corporation has activities both within and outside the state. This figure is critical for accurately apportioning capital to Oklahoma.

- Don't forget to deduct total current liabilities from total net assets when determining capital employed in Oklahoma. This step is essential for an accurate tax calculation.

- Don't enter "0" in lines related to assets and activities outside of Oklahoma without carefully reviewing the instructions and ensuring that all your corporation's assets are indeed within the state.

- Don't leave the reporting period dates blank. This information helps define the fiscal period covered by the return.

- Don't ignore the instructions regarding the inclusion of the registered agent's fee if applicable to your corporation. This fee is a requirement for foreign corporations doing business in Oklahoma.

- Don't neglect to review the instruction sheet thoroughly before submission. The instruction sheet contains vital information on filing requirements, deadlines, and computation methods.

Misconceptions

When it comes to the Oklahoma Annual Franchise Tax Return, Form 200, several misconceptions commonly lead to confusion among taxpayers. Addressing and clarifying these misconceptions is crucial for ensuring accurate filing and compliance with Oklahoma tax laws.

- Misconception 1: All businesses operating in Oklahoma must file the Form 200 annually, regardless of their structure.

This is not accurate. The requirement to file Form 200 applies specifically to corporations, including foreign corporations doing business in Oklahoma, as well as associations, joint stock companies, and business trusts as defined by the statutes. Sole proprietorships, partnerships, and some other business types are exempt, unless they are organized in a corporate or similar legal structure.

- Misconception 2: The total net assets reported on Form 200 should include liabilities to calculate the capital employed in Oklahoma.

Actually, when determining the capital employed in Oklahoma (which is used to calculate the franchise tax), liabilities are not deducted from gross assets. This calculation focuses on the book value of the assets themselves, without considering the business's liabilities.

- Misconception 3: The franchise tax rate is variable and fluctuates annually.

The rate for the Oklahoma franchise tax has been set at $1.25 per $1,000 of capital employed within the state. This rate is not subject to annual change and remains constant unless legislatively amended.

- Misconception 4: If the computed franchise tax is $10 or less, the corporation does not need to file Form 200.

While it's true that if the franchise tax due is $10.00 or less, the corporation is exempt from paying the tax, a completed Franchise Tax Return must still be filed with the Oklahoma Tax Commission to remain in compliance with state filing requirements.

- Misconception 5: The due date for filing Form 200 is consistent across all corporations regardless of their fiscal year-end.

Actually, the due date for filing the form and paying the franchise tax can vary depending on the corporation's elected filing date, which may align with the close of their fiscal year. Typically, taxes are due by July 1st but can be delinquent after August 31st. For corporations aligning this filing with their fiscal year-end, the due date follows the fifteenth day of the third month following the close of their fiscal year.

- Misconception 6: All details about current officers must be filed with Form 200.

While Form 200 requires identification of corporate officers as of a specific effective date, it's pivotal to note that Schedule A of the form serves this purpose. This schedule should detail the current officers' names, addresses, and Social Security Numbers as of the effective date relevant to the reporting period. This schedule, crucial for contact and identification purposes, separates from the main body of Form 200 but is integral to the complete filing.

Understanding these misconceptions and their corrections can guide corporations in fulfilling their obligations under Oklahoma law accurately, ensuring compliance and avoiding potential penalties associated with incorrect filings.

Key takeaways

Filing your Oklahoma Tax Return 200 form is an essential duty for corporations operating in Oklahoma. Here are five key takeaways that can help ensure the process is handled accurately and efficiently:

- The due date for the Oklahoma Annual Franchise Tax Return, Form 200, is critical. Taxes are due and payable by July 1st of each year but will be considered delinquent if not paid by August 31st. Keeping these dates in mind can help avoid unnecessary penalties and interest.

- Every corporation, including foreign entities doing business in Oklahoma, must file Form 200 unless expressly exempt by statute. This rule underscores the importance of understanding your corporation's tax obligations to avoid potential legal issues.

- The calculation of the franchise tax is based on the balance sheet of the corporation at the close of the last preceding income tax year. For businesses operating both inside and outside Oklahoma, the tax is apportioned based on the ratio of in-state assets and business activities to total assets and activities. Understanding the components of your balance sheet is therefore essential for a correct tax calculation.

- A maximum annual franchise tax of $20,000 is imposed, but if the calculated tax is $10.00 or less, the corporation is exempt from payment, though still required to file. Knowledge of these thresholds can be beneficial for tax planning and financial management.

- Accurate identification is necessary when filing. The use of the correct corporate name and Federal Employer Identification Number (FEIN) on the return and all correspondence is crucial for processing the return smoothly and effectively.

Beyond just filling out a form, understanding these takeaways offers a deeper insight into the strategic elements of corporate taxation and compliance in Oklahoma. Proper preparation and attention to detail in filling out the Oklahoma Tax Return 200 form can save a lot of time and resources for any corporation.

Popular PDF Documents

What Is a 1099r - It assists in the financial planning for retirement by providing a clear record of distributions taken and their tax characteristics.

IRS 1040-ES - Used correctly, it can smooth out cash flow for those with variable income.

Wisconsin Department of Revenue Forms - Understanding the specific powers granted through this form helps in making informed decisions about tax representation.