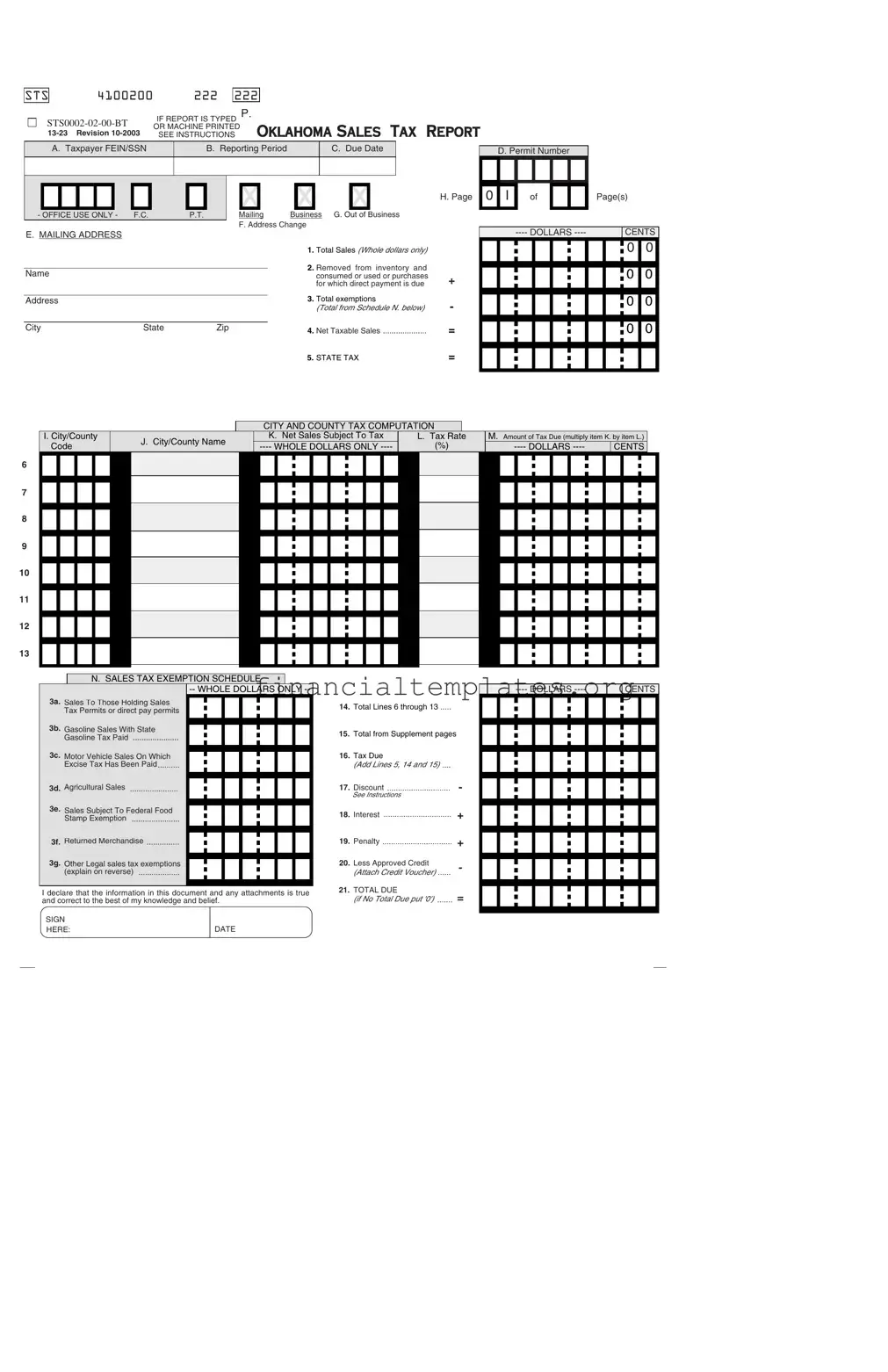

Get Oklahoma Sales Tax Report Form

The Oklahoma Sales Tax Report form, officially referenced as STS 4100200 222 222 STS0002-02-00-BT, stands as a critical document for all vendors within the state accountable for the collection and remittance of sales taxes to the Oklahoma Tax Commission. It meticulously outlines the process for reporting taxable and non-taxable sales, including special categories such as removed inventory items or those consumed by the business. The form facilitates the calculation of net taxable sales, applying the state, city, and county tax rates accordingly to determine the total tax due. Additionally, it accommodates exemptions and credits, underscoring its utility in ensuring accurate tax reporting. With sections for detailing taxpayer identification, reporting period, due date, and permit number, among other necessary business information, the form ensures comprehensive compliance with state tax laws. Furthermore, it includes specific instructions for filling out each section, from the general entries to more detailed schedules such as the Sales Tax Exemption Schedule. This document serves a vital role in the financial operations of businesses in Oklahoma, ensuring they meet their tax obligations correctly and efficiently.

Oklahoma Sales Tax Report Example

STS |

|

4100200 |

222 |

222 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

IF REPORT IS TYPED P. |

|

|

|

|

|

||||||

OR MACHINE PRINTED |

OKLAHOMA SALES |

TAX |

|||||||||

Revision |

|||||||||||

SEE INSTRUCTIONS |

|||||||||||

|

|

|

|

|

|

|

|

|

|||

|

A. Taxpayer FEIN/SSN |

|

B. Reporting Period |

C. Due Date |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- OFFICE USE ONLY - |

F.C. |

P.T. |

Mailing |

Business |

G. Out of Business |

REPORT |

|

|

|

|

|

D. Permit Number |

|

H. Page |

0 |

I |

of |

Page(s)

F. Address Change

E.MAILING ADDRESS

1. Total Sales (Whole dollars only)

|

|

|

2. |

Removed from inventory and |

Name |

|

|

||

|

|

|

consumed or used or purchases |

|

|

|

|

|

for which direct payment is due |

|

|

|

3. |

Total exemptions |

Address |

|

|

||

|

|

|

|

(Total from Schedule N. below) |

|

|

|

|

|

City |

State |

Zip |

4. |

Net Taxable Sales |

|

|

|

5. STATE TAX

+

-

=

=

|

|

CENTS |

|||||||

|

|

||||||||

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY AND COUNTY TAX COMPUTATION

I. City/County |

J. City/County Name |

K. Net Sales Subject To Tax |

L. Tax Rate |

M. Amount of Tax Due (multiply item K. by item L.) |

||

Code |

(%) |

CENTS |

||||

|

||||||

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

N. SALES TAX EXEMPTION SCHEDULE

3a. Sales To Those Holding Sales Tax Permits or direct pay permits

3b. Gasoline Sales With State

Gasoline Tax Paid .....................

3c. Motor Vehicle Sales On Which

Excise Tax Has Been Paid ..........

3d. Agricultural Sales ......................

3e. Sales Subject To Federal Food

Stamp Exemption ......................

3f. Returned Merchandise ...............

3g. Other Legal sales tax exemptions

(explain on reverse) ...................

Ideclare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

SIGN |

|

HERE: |

DATE |

14.Total Lines 6 through 13 .....

15.Total from Supplement pages

16.Tax Due

(Add Lines 5, 14 and 15) ....

17.Discount .............................

See Instructions

18.Interest ...............................

19.Penalty ................................

20.Less Approved Credit (Attach Credit Voucher) ......

21.TOTAL DUE

(if No Total Due put '0') .......

-

+

+

-

=

CENTS

GENERAL INSTRUCTIONS

Please use a #2 pencil or pen with black ink to make your entries on this form. If you type your report, please type "XXX" over "222" in box P. at the top of the form. If your mailing address or your business address has changed place an "X" in the proper Box F and enter the correct information in space provided below. If you are not required to file this form, call the Oklahoma Tax Commission at

|

SPECIFIC INSTRUCTIONS |

ITEM A. - |

Enter your taxpayer identification number. |

ITEM B. - |

Enter the month(s) and year for the sales being reported.(Begin with |

|

the month when you made your first sale) |

ITEM C. - |

Enter the date the report is due. |

ITEM D. - |

Enter your Sales Tax Permit Number. |

ITEM E. - |

Provide your name and mailing address. |

ITEM H. - |

Enter the total number of pages enclosed in the boxes to the right of |

|

the word "of." |

If you are closing your business and this will be your last sales tax return, mark over the "X" in block "G." and return your permit card with this report to the Oklahoma Tax Commission for cancellation.

LINE 1 (TOTAL SALES)- Enter the total amount of gross receipts of all sales, including taxable and

LINE 2 (REMOVED FROM INVENTORY)- Enter the sales value of tangible personal property purchased for resale and consumed or used in this reporting period. Any merchandise purchased tax exempt with your sales tax permit and withdrawn for use by you or your business is to be included in this line. Also include amounts for purchases for which you are paying the sales tax directly to the Oklahoma Tax Commission.

LINE 3 (TOTAL SALES TAX EXEMPTIONS)- Use the Exemption Schedule, Item N, to compute the authorized exemptions from gross receipts for this reporting period. (Use Lines 3a. thru 3g.). Enter the amount of total sales tax exemptions on Line 3, at top.

3g. Explanation of 'Other Sales tax exemptions':

LINE 4 (NET TAXABLE SALES)- Subtract line 3 from the total of lines 1 and 2 to arrive at net taxable sales. If you have no amount subject to tax, leave blank.

LINE 5 (STATE TAX)- Multiply Line 4 by the applicable tax rate. If there is no tax due, leave blank.

LINES 6 THROUGH LINE 13 - We are aware the computer printed information is subject to change: therefore, we have provided blank lines for you to add cities/counties as needed. If any computer printed information is incorrect line through the incorrect information and write in the correct data. If no taxable sales were made for a computer printed City/County, leave the line blank.

Column I. - Enter the code for each city or county for which you are

If additional space is needed to report more cities/counties, call our office at

LINE 14 (TOTAL LINES 6 THROUGH 13)- Add the City/County tax due from lines 6 through 13, Column M.

LINE 15 (TOTAL FROM SUPPLEMENT PAGES)- Total the tax due amounts from Line 39 of all supplement pages of city/county taxes.

LINE 16 (TAX DUE)- Add the amounts on Line 5, 14 and 15. This will be the total state, city, county tax due before any discount, interest, or penalty is applied.

LINE 17 (DISCOUNT)- If this report and remittance is not filed electronically by the due date shown in Item C, you are only eligible for a 1.25% discount for timely payment. Multiply Line 16 (tax) by .0125. The maximum discount allowed is $3,300.00. Make no entry if this report is late. No discount allowed for Direct Pay.

LINE 18 (INTEREST)- If this report and remittance is postmarked after the due date shown in Item C, the tax is subject to interest from the due date (Item C) until it is paid. Multiply the amount on Line 16 by .0125 the applicable rate for each month or part thereof that the report is late.

LINE 19 (PENALTY)- If this tax report and remittance is not postmarked within 15 calendar days of the due date, a 10% penalty is due. Multiply the tax amount on Line 16 by .10 to determine the penalty.

LINE 20 (LESS APPROVED CREDIT)- Enter the amount of credit taken. Use any OTC credit voucher(s) issued for a previous over payment of taxes. Attach the credit voucher(s) to this report.

LINE 21 (TOTAL DUE)- Total the report: Line 16, minus Line 17 and 20, plus line 18 and Line 19.

Sign and date the report and mail it with your payment in the enclosed return envelope to:

OKLAHOMA TAX COMMISSION

P.O. BOX 26850

OKLAHOMA CITY, OK

WHO MUST FILE

Every vendor who is responsible for collecting/remitting payment of Oklahoma sales tax must file a Sales Tax Report. Reports must be filed for every period even though there is no amount subject to tax nor any tax due.

WHEN TO FILE

Reports must be postmarked on or before the 20th day of the month following each reporting period. The due date for filing this report is printed in Item C.

PAYMENT

Please send a separate check with each report submitted and put your Taxpayer No. (Item A.) on your check.

WHO TO CONTACT FOR ASSISTANCE

For assistance, call (405)

Mandatory inclusion of Social Security and/or Federal identification numbers is required on forms filed with the Oklahoma Tax Commission pursuant to Title 68 of the Oklahoma Statutes and regulations thereunder, for identification purposes, and are deemed part of the confidential files and records of the Oklahoma Tax Commission.

Column J. -

Column K. -

Column L. -

Column M.

-

remitting tax that has not been computer printed.

Print the name of the city or county for which you are remitting tax that has not been computer printed.

Enter the "taxable sales" for each city or county. If no "taxable sales" were made, leave blank.

Enter the current sales tax rate for each city/county for which you are remitting tax that has not been computer printed. Multiply the amounts in Col. K times the rates in Col. L and enter the sales tax due for each city/county.

The Oklahoma Tax Commission is not required to give actual notice of changes in any state tax law.

Changes in Business Mailing Address: |

Changes in Business Location Address: |

||||||||

FEIN/SSN |

|

|

FEIN/SSN |

|

|

||||

|

|

|

|

||||||

NAME |

|

|

NAME |

|

|

||||

|

|

|

|

||||||

ADDRESS |

|

ADDRESS |

|

||||||

|

|

||||||||

CITY |

|

CITY |

|

||||||

|

|

||||||||

STATE |

|

|

ZIP |

STATE |

|

|

ZIP |

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The Oklahoma Sales Tax Report form is identified as STS 4100200 222 222 STS0002-02-00-BT. |

| Revision Date | The form's revision date is October 2003, as indicated by "Revision 10-2003". |

| Governing Law | Mandatory inclusion of Social Security and/or Federal identification numbers on the form is required under Title 68 of the Oklahoma Statutes and regulations for identification purposes. |

| Due Date | Reports must be postmarked on or before the 20th day of the month following each reporting period as designated in the form's Item C. |

| Filing Requirements | Every vendor responsible for collecting/remitting Oklahoma sales tax must file this report, even if there is no amount subject to tax or tax due. |

| Discounts and Penalties | A 1.25% discount is available for timely payment if not filed electronically, with a maximum discount of $3,300.00. A 10% penalty is applied if the report and remittance are not postmarked within 15 calendar days of the due date. |

Guide to Writing Oklahoma Sales Tax Report

Preparing the Oklahoma Sales Tax Report form requires accuracy and attention to detail. This report plays a crucial role for vendors in the state, ensuring compliance with tax regulations by accounting for sales, exemptions, and due taxes within a specified period. The information provided helps the Oklahoma Tax Commission in overseeing and managing the collection of sales taxes effectively. Following the steps outlined below will guide you through completing the form accurately.

- Under ITEM A, enter your Taxpayer Identification Number, which could be your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

- In ITEM B, input the reporting period by specifying the month(s) and year that correspond to the sales being reported.

- For ITEM C, indicate the due date of the report as prescribed by the Oklahoma Tax Commission.

- Write your Sales Tax Permit Number in ITEM D.

- Provide your full name and current mailing address including city, state, and ZIP code under ITEM E. If there's a change in address, mark an "X" in Box F and supply the updated information.

- In ITEM H, denote the total number of pages you are enclosing by filling in the "Page __ of __ Page(s)" section.

- If you are ending your business operations, mark the "X" in block "G" and include your permit card with the report for cancellation.

- Enter the total gross receipts of all sales in LINE 1. This includes taxable and non-taxable sales, leases, and rentals of tangible personal property.

- In LINE 2, specify the sales value of tangible personal property removed from inventory for use or consumption.

- Calculate and enter the total sales tax exemptions using the Exemption Schedule (Item N) on LINE 3.

- Subtract Line 3 from the total of lines 1 and 2 to arrive at net taxable sales, and record this on LINE 4.

- Multiply Line 4 by the applicable state tax rate to find the state tax due, and write the amount in LINE 5.

- Add city/county tax due from lines 6 through 13, and input the total in LINE 14.

- Sum the tax due amounts from all supplemental pages, if any, and enter in LINE 15.

- Add the amounts in Line 5, 14, and 15 to determine the total tax due before adjustments, and indicate this in LINE 16.

- Calculate any eligible discount and record in LINE 17. Remember, if the report is late, no discount is allowed.

- Compute any interest due for late submission and enter this in LINE 18.

- If applicable, calculate and note the penalty amount in LINE 19.

- Enter any approved credit amount in LINE 20. Attach any relevant credit voucher(s).

- Total the amount due, considering the tax, discount, interest, penalty, and credit, and input this in LINE 21.

- Sign and date the report at the bottom, ensuring the information is true and correct.

- Send the completed report and your payment to the Oklahoma Tax Commission at the address provided on the form.

Once the form has been thoroughly filled out and reviewed for accuracy, submitting it on time is imperative to avoid penalties. Keeping a copy for your records ensures that you have documentation of your compliance. This process, while detailed, aids in the transparent reporting and contribution to state and local infrastructure and services funded by sales tax.

Understanding Oklahoma Sales Tax Report

Who needs to file an Oklahoma Sales Tax Report?

Every vendor responsible for collecting and remitting Oklahoma sales tax is required to file a Sales Tax Report. This includes entities that conduct sales, leases, or rentals of tangible personal property within the state. It is mandatory to file reports for each period, even if there were no taxable sales or tax due for that period.

How do I determine the due date for my Oklahoma Sales Tax Report?

The due date for filing your Sales Tax Report is indicated in Item C of the form. Generally, reports must be postmarked on or before the 20th day of the month following the reporting period. It’s crucial to adhere to this deadline to avoid potential penalties and interest charges.

What should be included in the Total Sales (Line 1)?

In Line 1, you must enter the total gross receipts from all sales, including both taxable and non-taxable sales, leases, and rentals of tangible personal property. This amount should represent the entire sales volume for the reporting period, denominated in whole dollars only. If no sales were made, leave this line blank.

How is Net Taxable Sales (Line 4) calculated?

To calculate Net Taxable Sales, subtract the total of authorized exemptions (Line 3) from the sum of Total Sales (Line 1) and Removed from Inventory (Line 2). This figure represents the portion of sales subject to sales tax. If there are no sales subject to tax, this line should be left blank.

What if I need to change my mailing or business address?

If your mailing or business address has changed, you should mark an "X" in the appropriate box (F) on the form and provide the updated information in the space below it. This ensures that all future communications and documents from the Oklahoma Tax Commission are sent to the correct address.

How can I apply for credit if I've overpaid in the past?

If you have an approved credit from a previous overpayment, you can apply this amount to Line 20 (Less Approved Credit). Attach any Oklahoma Tax Commission (OTC) credit vouchers to your report to substantiate the credit amount taken. This can reduce the total amount due with your current report.

What should I do if I am closing my business?

If you are closing your business and filing your final Sales Tax Report, you need to mark over the "X" in block "G" indicating that your business is out of operation. Additionally, return your permit card with the report to the Oklahoma Tax Commission for cancellation. This officially notifies the OTC that you no longer engage in activities requiring sales tax collection and remittance.

Common mistakes

Filling out the Oklahoma Sales Tax Report form accurately is crucial for businesses to comply with state regulations and avoid penalties. However, some common mistakes can lead to errors in the submission. By being aware of these, businesses can ensure their reports are correctly filled out and submitted on time.

Not reporting all sales, including both taxable and non-taxable receipts. Businesses sometimes overlook reporting leases and rentals of tangible personal property or the total amount of gross receipts. All sales, regardless of tax status, must be reported on Line 1 to ensure accuracy in tax calculations.

Inaccurately handling inventory removals and consumed items. On Line 2, businesses are required to report the sales value of tangible personal property purchased for resale but consumed or used by the business. Mistakes occur when these items are not properly accounted for, leading to discrepancies in the total reported sales.

Failing to accurately calculate or report exemptions. The Sales Tax Exemption Schedule, represented in Line 3 and detailed in Item N, requires careful consideration. Common errors include misunderstanding which sales are exempt and incorrectly calculating these exemptions, impacting net taxable sales and potentially leading to overpayment of sales tax.

Incorrectly reporting city and county tax computations. Lines 6 through 13 involve reporting city and county taxes, which some businesses mistakenly overlook or miscalculate. This includes not updating computer-printed information, omitting taxable sales for specific cities or counties, or inaccurately calculating the amount of tax due for each jurisdiction.

These mistakes can be costly, resulting in underpayment or overpayment of taxes, and potentially incur fines or penalties. It's essential to meticulously review each part of the Sales Tax Report form, ensuring that all sales are accurately reported, proper exemptions are applied, and city and county taxes are correctly calculated. Taking the time to double-check these areas can save businesses from unnecessary complications with the Oklahoma Tax Commission.

Documents used along the form

When preparing and filing an Oklahoma Sales Tax Report, several additional forms and documents might be needed for accurate and compliant submission. These documents facilitate a thorough reporting process, ensuring businesses meet state tax obligations comprehensively.

- Business Registration Application: Before filing sales tax reports, new businesses must register with the Oklahoma Tax Commission, obtaining a sales tax permit.

- Change of Address Form: Used to update the business or mailing address with the Oklahoma Tax Commission to ensure all correspondences and documents reach the correct location.

- Exemption Certificate: Required when purchasing goods for resale, this document exempts the business from paying sales tax on such items, affecting the total tax reported.

- Use Tax Return: Accompanies the sales tax report if the business purchases items from out-of-state vendors for use in Oklahoma, on which no sales tax was collected at the time of purchase.

- Monthly Sales Tax Collection Report: Although not officially required by the tax commission, maintaining monthly internal reports helps in preparing the periodic sales tax report by detailing taxable and exempt sales.

- Annual Resale Certificate: Used by businesses to purchase goods for resale without paying sales tax at the time of purchase, necessitating annual renewal and affecting reported sales tax.

- Sales Tax Discount and Penalty Calculation Worksheet: Helps businesses calculate timely filing discounts or penalties and interest due for late filings, ensuring correct amounts are reported and paid.

- Sales Tax Payment Voucher: Used when submitting sales tax payments, especially if payment is made separately from the online filing of the sales tax report.

- Direct Pay Permit Application: For businesses that wish to pay sales tax directly to the state rather than through vendors, affecting how purchases are reported on the sales tax report.

- City and County Tax Rate Schedule: Provides current tax rates for various municipalities and counties in Oklahoma, essential for accurately calculating the total sales tax due on taxable sales.

Effectively managing sales tax reporting responsibilities requires attention to various supporting documents and forms, each playing a role in ensuring businesses accurately calculate and report sales taxes due. By familiarizing with these additional forms, businesses can navigate the complexities of tax reporting with greater ease, maintaining compliance with Oklahoma tax laws.

Similar forms

The Federal Income Tax Return is one document that shares similarities with the Oklahoma Sales Tax Report due to both requiring taxpayer identification and reporting periods. While the sales tax report focuses on sales transactions within a state, the income tax return assesses an individual's or a company's income over a year. Both forms play a critical role in the taxation process, ensuring compliance with tax laws and contributing to state and federal revenues.

Another document akin to the Oklahoma Sales Tax Report is the State Unemployment Tax Filing form. This form, used by employers to report wages and pay unemployment taxes, requires similar identification details, such as the employer's FEIN and details about the reporting period. Though serving different purposes—one for sales tax collection and the other for unemployment insurance funding—both are essential for compliance with state regulations and support of state-funded programs.

The Business Personal Property Tax Form, required in many states, shares resemblances with the Oklahoma Sales Tax Report by necessitating the disclosure of business assets for taxation purposes. While personal property tax focuses on the assets and equipment owned by businesses, the sales tax report focuses on sales transactions. Both forms are integral to the financial management and taxation strategy of businesses in the United States.

Quarterly Sales and Use Tax Returns used by businesses to report and remit sales and use taxes to state tax authorities are similarly structured to the Oklahoma Sales Tax Report. Both require detailed reporting of sales, exemptions, and calculations of taxes due. They are pivotal for state tax collection, ensuring businesses accurately report and remit taxes based on their sales and transactions.

The Employer's Federal Quarterly Tax Return, known as Form 941, is used to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and also resembles the Oklahoma Sales Tax Report. It requires employer identification, reporting period details, and calculation of taxes due to federal authorities, paralleling the sales tax report in its function of tax reporting and remission, albeit in different tax realms.

The Vehicle Inventory Tax (VIT) Declaration forms, used by vehicle dealerships to report the inventory for property tax purposes, bears similarities to the Oklahoma Sales Tax Report in terms of requiring inventory reporting. While the VIT deals with inventory for property tax estimation, the sales tax report covers sales for sales tax collection. Both are critical for accurate tax calculation and compliance.

The Excise Tax Return on specific goods such as alcohol, tobacco, and fuel also has similarities with the Oklahoma Sales Tax Report. Both forms deal with the taxation of goods, requiring detailed reporting on the quantity of goods sold or used and the calculation of taxes due. These forms ensure compliance with tax laws specific to certain products, reflecting the government's regulatory and revenue-collecting roles.

Lastly, the Local Business License Renewal forms, required by some municipalities, share commonalities with the Oklahoma Sales Tax Report. These forms often require businesses to report gross receipts as a basis for calculating license fees, similar to how sales tax reports require sales figures to compute taxes owed. Both types of documents are vital for businesses to lawfully operate within their respective jurisdictions.

Dos and Don'ts

When filling out the Oklahoma Sales Tax Report form, there are several essential dos and don'ts to ensure accurate and timely filing. Understanding these will help prevent common mistakes and ensure the process goes smoothly.

Do:- Use black ink or type the report if handwritten entries are not your forte. This ensures clarity and legibility.

- Verify all entered information for accuracy, including FEIN/SSN, business name, and address, to ensure compliance and proper tax processing.

- Report total sales in whole dollars, excluding any cents, to comply with the form’s requirements.

- Clearly outline any address changes by marking the designated box and including the new address information to keep records up to date.

- Include all pages of the report if additional pages are used and indicate the total number of pages at the top of the form to ensure the entire report is reviewed.

- Attach any required documents, such as credit vouchers, to support claims made on the tax report and facilitate processing.

- Sign and date the report to verify that the information provided is accurate and complete to the best of your knowledge.

- Leave the total sales field blank if no sales were made during the reporting period; instead, enter "0" to indicate inactivity.

- Forget to cross out and correct any pre-printed information that is not applicable or accurate to avoid processing errors.

- Ignore the sales tax exemption schedule, which helps to accurately calculate your tax obligations by accounting for authorized exemptions.

- Miss the filing deadline, as doing so could result in penalties or interest charges that increase your tax liability.

- Use pencil or non-approved ink colors which can smudge or fade, leading to processing delays or inaccuracies.

- Omit the calculation for discounts, interest, or penalties owed, as these can affect the total amount due.

- Send payment without including the taxpayer identification number on the check, as this ensures the payment is properly applied to your account.

Misconceptions

When it comes to filing the Oklahoma Sales Tax Report Form, misconceptions can lead to unnecessary mistakes. Here’s a look at some common misunderstandings and the realities behind them:

One common misconception is that only businesses with physical locations in Oklahoma need to file. In fact, any vendor responsible for collecting and remitting Oklahoma sales tax, including online and out-of-state businesses with a nexus in Oklahoma, must file a report.

Many assume that if their business didn’t make any sales during the reporting period, they don’t have to file. However, reports must be filed for every period, even if there were no sales or if no tax is due.

Some believe the total sales amount entered on Line 1 should only include taxable sales. Actually, this line should reflect the total amount of all sales, both taxable and non-taxable, including leases and rentals of tangible personal property.

There’s a misunderstanding that the sales tax rate applied on the form is a flat statewide rate for all sales. The reality is that sales tax is computed based on the state rate plus any applicable city and county rates, requiring accurate computation for each location where sales were made.

Several businesses think that exempt sales don’t need to be reported. All exempt sales, however, should be thoroughly documented and included in Line 3 under Total Sales Tax Exemptions.

A misunderstanding exists around Line 2, with some thinking it's for inventory items not sold. Line 2 actually refers to items removed from inventory for use or consumption by the business or for purchases directly taxable by the Oklahoma Tax Commission.

Some believe that discounts offered to customers reduce the amount of sales tax owed. Discounts do not affect the sales tax obligation reported, except in the calculation of the taxable amount.

Another misconception is that the form doesn’t need to be filed if the business is closed during the reporting period. Even if a business is going out of business, the form must be filed for the period up until closure, and the permit card returned for cancellation.

Many think that late filing penalties are negotiable or can be easily waived. Late filings are subject to interest and a fixed penalty, which are strictly enforced.

Finally, there’s the belief that manual completion and mailing of the form is the only submission method. Electronic filing is not only available but encouraged, offering conveniences such as electronic payment and automatic calculation features.

Understanding these aspects of the Oklahoma Sales Tax Report Form can simplify the reporting process, ensuring compliance and avoiding common pitfalls.

Key takeaways

Filling out the Oklahoma Sales Tax Report form correctly is essential for businesses to comply with state tax regulations. Here are key takeaways for navigating this process:

- Accuracy is crucial: Ensure all information is correct, particularly your taxpayer identification number (Item A), reporting period (Item B), and Sales Tax Permit Number (Item D).

- Report all sales: Total sales, including taxable, non-taxable, leases, and rentals of tangible personal property, must be entered in Line 1.

- Account for inventory removal: If you’ve removed items from inventory for personal or business use, report this in Line 2.

- Deductions for exemptions: Utilize the Sales Tax Exemption Schedule (Item N) to deduct authorized exemptions before calculating net taxable sales (Line 4).

- City and County Taxes: Be prepared to report taxes due for each city and county, ensuring accurate tax rates are applied (Lines 6 through 13).

- Discounts and penalties: Understand how to calculate discounts for timely payments, and be aware of interest and penalties for late submissions (Lines 17 through 19).

- Sign and date your report: Your signature attests to the accuracy of the report. Ensure it is signed and dated before submission.

- Regular Updates: Stay informed of changes in tax laws or rates, as the Oklahoma Tax Commission may not provide direct notification of such changes.

It is imperative to use a #2 pencil or pen with black ink for clarity, and type over "222" in the designated box if the report is typed. Should there be changes in business or mailing address, mark the appropriate box (F) and provide the new information. This meticulous attention to detail helps ensure compliance with Oklahoma sales tax regulations.

Ultimately, the Oklahoma Sales Tax Report requires thoroughness and precision from businesses to fulfill their tax obligations. By keeping these key takeaways in mind, businesses can navigate the filing process more effectively and avoid potential penalties associated with inaccuracies or late filings.

Popular PDF Documents

2253 Form - IRS form 2553’s instructions include detailed eligibility criteria, filing procedures, and deadlines, all of which are essential for compliant submission.

Transcript Id Me - Part of due diligence in handling international aspects of estate planning and taxation for nonresidents.

College Tax Form - Parents who are legally obligated to repay a student loan may receive a 1098-E form if they have made eligible interest payments.