Get Oklahoma Legal Heirship Form

In the realm of estate management and the resolution of a decedent’s affairs, the Oklahoma Legal Heirship form emerges as a critical document, simplifying the process of transferring assets to the rightful heirs when a formal will is absent. Under the meticulous structure of this affidavit, claimants, often close relatives or legal successors, attest to their relationship with the deceased, laying out a clear pathway for the distribution of assets in accordance to state laws. The form demands comprehensive details, including the full names and addresses of all heirs, their relation to the deceased, and the proportions of the estate each is entitled to receive. It also emphasizes that there have been no prior petitions for a personal representative, assures that all debts and taxes of the estate have been settled or are non-applicable due to statutes of limitations, and verifies the overall value of the decedent’s estate within Oklahoma falls below the twenty thousand dollar threshold. Furthermore, it includes an indemnity clause for the Oklahoma Police Pension and Retirement System, underlining the legal accountability and seriousness of the declaration. This affidavit, thus, not only facilitates the transfer of assets in a more direct manner but also encapsulates a legal declaration, ensuring that the distribution of the estate adheres to the legal standards set by Oklahoma state law, all the while protecting the interests of both the heirs and the institutions involved in the disbursement of the decedent’s assets.

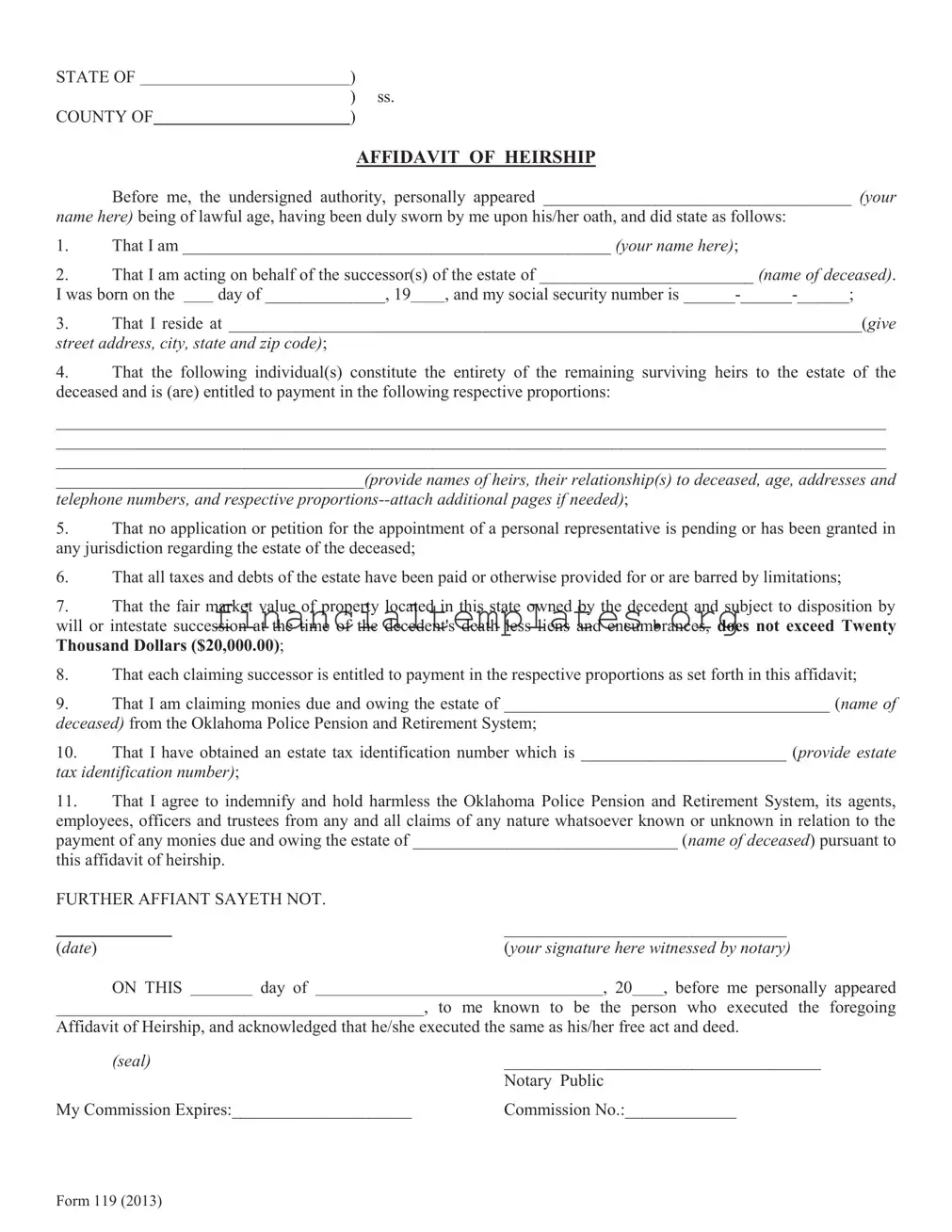

Oklahoma Legal Heirship Example

STATE OF |

) |

||

|

|

|

) ss. |

COUNTY OF |

|

) |

|

AFFIDAVIT OF HEIRSHIP

Before me, the undersigned authority, personally appeared ____________________________________ (your

name here) being of lawful age, having been duly sworn by me upon his/her oath, and did state as follows:

1.That I am __________________________________________________ (your name here);

2.That I am acting on behalf of the successor(s) of the estate of _________________________ (name of deceased).

I was born on the |

|

day of ______________, 19 |

, and my social security number is |

|

|

|

|

|

|

3.That I reside at __________________________________________________________________________(give street address, city, state and zip code);

4.That the following individual(s) constitute the entirety of the remaining surviving heirs to the estate of the deceased and is (are) entitled to payment in the following respective proportions:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

____________________________________(provide names of heirs, their relationship(s) to deceased, age, addresses and

telephone numbers, and respective

5.That no application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction regarding the estate of the deceased;

6.That all taxes and debts of the estate have been paid or otherwise provided for or are barred by limitations;

7.That the fair market value of property located in this state owned by the decedent and subject to disposition by will or intestate succession at the time of the decedent's death less liens and encumbrances, does not exceed Twenty Thousand Dollars ($20,000.00);

8.That each claiming successor is entitled to payment in the respective proportions as set forth in this affidavit;

9.That I am claiming monies due and owing the estate of ______________________________________ (name of deceased) from the Oklahoma Police Pension and Retirement System;

10.That I have obtained an estate tax identification number which is ________________________ (provide estate tax identification number);

11.That I agree to indemnify and hold harmless the Oklahoma Police Pension and Retirement System, its agents, employees, officers and trustees from any and all claims of any nature whatsoever known or unknown in relation to the payment of any monies due and owing the estate of _______________________________ (name of deceased) pursuant to this affidavit of heirship.

FURTHER AFFIANT SAYETH NOT. |

|

|

|

|

||||

|

|

|

|

|

_________________________________ |

|||

(date) |

|

|

|

(your signature here witnessed by notary) |

||||

ON THIS |

|

day of |

|

|

, 20 , before me personally appeared |

|||

|

|

|

|

|

|

|

|

|

___________________________________________, to me known to be the person who executed the foregoing

Affidavit of Heirship, and acknowledged that he/she executed the same as his/her free act and deed.

(seal) |

_____________________________________ |

|

Notary Public |

My Commission Expires:_____________________ |

Commission No.:_____________ |

Form 119 (2013)

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The form initiates with a declaration stating the state and county where the affidavit is being filed. |

| 2 | It requires the affiant (the person filling out the form) to provide personal identification details such as name, date of birth, and social security number. |

| 3 | The affiant must confirm their residence by providing a complete address. |

| 4 | Details of all surviving heirs, their relationship to the deceased, their ages, addresses, telephone numbers, and their entitled proportions of the estate must be listed. |

| 5 | The affidavit confirms that there are no pending applications or already appointed personal representatives for the estate in any jurisdiction. |

| 6 | It attests that all debts and taxes of the estate have been settled or are not enforceable due to statutory limitations. |

| 7 | The fair market value of the decedent's property in the state, after deducting debts and encumbrances, must not exceed $20,000. |

| 8 | The form is specific to claims relating to the Oklahoma Police Pension and Retirement System, including an indemnity clause protecting the system from claims related to the payment of estate monies. |

Guide to Writing Oklahoma Legal Heirship

Filling out the Oklahoma Legal Heirship form is a necessary step for individuals seeking to establish their entitlement to assets of a deceased relative's estate under specific circumstances. It's used when the value of the decedent's property in Oklahoma doesn't exceed $20,000, and there's no pending petition for the appointment of a personal representative. This document helps streamline the process of asset transfer to the rightful heirs without the need for a formal probate proceeding. By carefully following the instructions provided, you can accurately complete this form.

- Start by printing your full name where it says “personally appeared ____________________________________ (your name here)” to identify yourself as the affiant.

- Repeat your name in the blank space following “That I am” in the first statement to affirm your identity.

- Insert the full name of the deceased, whose estate you are claiming to succeed, in the blank space following “estate of” in the second statement.

- Provide your date of birth, your social security number in the spaces provided in the third statement.

- Enter your complete residential address in the blank space provided in the fourth statement.

- Detail the names, relationships to the deceased, ages, addresses, telephone numbers, and the respective proportions of all surviving heirs in the space provided in the fifth statement. Attach additional pages if necessary.

- Confirm that no application or petition regarding the estate is pending in any jurisdiction in the sixth statement.

- Affirm that all taxes and debts of the estate have been settled or are not applicable due to limitations in the seventh statement.

- Declare the fair market value of the decedent's property in the state at the time of death, confirming it does not exceed $20,000, in the eighth statement.

- State the proportion of payment entitled to each successor as previously outlined in the ninth statement.

- Specify your claim to any monies due to the estate from the Oklahoma Police Pension and Retirement System in the tenth statement.

- Provide the obtained estate tax identification number in the eleventh statement.

- Agree to indemnify the Oklahoma Police Pension and Retirement System against any claims related to the estate payments in the twelfth statement.

- Sign and date the form at the bottom where it says “(your signature here witnessed by notary)” and “(date)”, respectively.

- Ensure a notary public witnesses the signing, completes the acknowledgment section, affixes their seal, and records their commission expiration date and number.

After completing these steps, you have accurately filled out the Oklahoma Legal Heirship form. This document serves as a declaration of the rightful heirs to the estate and their entitlement, under oath. It's paramount to review all provided information for accuracy before submission, as this affidavit plays a crucial role in the legal transfer of assets from the decedent's estate to the stated heirs without formal probate.

Understanding Oklahoma Legal Heirship

What is an Oklahoma Legal Heirship Form?

An Oklahoma Legal Heirship Form is a legal document used to identify and attest to the rightful heirs of a deceased person's estate. When a person dies, especially without a will (intestate), this affidavit helps in the efficient distribution of the decedent's assets in accordance with Oklahoma laws. The form is presented before a legal authority, where the affiant (the person filling out the form) swears to the accuracy of the information provided. This includes their relationship to the deceased, details about the deceased's surviving heirs, and the distribution of the estate among those heirs. It’s crucial for transferring assets without the formal probate process, assuming the estate's value is within the specified limit and all taxes and debts have been settled.

Who needs to fill out this form, and why?

Individuals acting on behalf of the successors (heirs) of an estate should fill out this form. It’s particularly needed when there is no will left by the deceased, or when certain properties were not explicitly covered by a will. The primary reasons include legally identifying the deceased's heirs, facilitating the transfer of assets to them, and ensuring all financial obligations of the estate are recognized and addressed. Completing and notarizing this affidavit can significantly simplify the process of asset distribution among heirs, allowing for a clearer and more straightforward claim to the deceased's property held within Oklahoma.

What information is needed to complete the form?

To complete the Oklahoma Legal Heirship Form, several pieces of information are required:

- The full name and personal details of the affiant, including social security number and address.

- Comprehensive information about the deceased, including their name and the details surrounding their estate.

- Details of all surviving heirs, such as names, relationships to the deceased, ages, addresses, and telephone numbers, along with the specific proportions of the estate to which each heir is entitled.

- Confirmation that no applications or petitions for a personal representative are pending or granted in any jurisdiction.

- Assurances that all taxes and debts of the estate are settled or barred by limitations.

- A statement of the estate's fair market value and a confirmation of adherence to the stipulated value limit.

- An agreement to indemnify the Oklahoma Police Pension and Retirement System against claims relating to the estate's distribution.

Are there any special requirements for filing this form?

Yes, there are specific requirements:

- The fair market value of the deceased's property within Oklahoma at the time of death, less any debts and encumbrances, must not exceed $20,000.

- The affidavit must be sworn before and signed by a notary public to confirm the truthfulness and accuracy of the information provided.

- It’s essential that all information on taxes and debts be accurate, with confirmation that these have been paid or provided for.

- The form needs an estate tax identification number, which can be obtained through the IRS, to process any financial transactions related to the estate.

Common mistakes

Filling out the Oklahoma Legal Heirship form is an essential step in managing the estate of a deceased person, especially in the absence of a will. However, mistakes can happen and may lead to delays or complications. Here are five common mistakes people make when completing this form:

-

Inaccurately listing the names and relationships of all living heirs can lead to disputes or delays. It's crucial to provide complete and accurate information, including names, relationships to the deceased, ages, addresses, and telephone numbers. These details ensure that all entitled successors are correctly identified and can receive their respective proportions without confusion.

-

Failing to attach additional pages when necessary is another common mistake. The space provided on the form might not be sufficient to list all the heirs, especially in cases where the deceased has a large family or there are multiple beneficiaries. It's important to attach additional pages to provide comprehensive details about the heirs and their entitlements.

-

Overlooking the requirement to state that no application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction can have significant legal implications. This declaration helps to prevent overlapping claims or legal challenges to the estate's distribution.

-

Incorrectly assessing the fair market value of the decedent's property in Oklahoma can lead to inaccuracies in the affidavit. The form requires a declaration that the fair market value of the property, less liens and encumbrances, does not exceed twenty thousand dollars. Accurate valuation is essential for the affidavit to be valid and for the estate to be distributed according to Oklahoma laws.

-

Forgetting to obtain or provide an estate tax identification number can cause financial and legal complications. This number is crucial for tax purposes and for the estate's transactions with the Oklahoma Police Pension and Retirement System. It's a unique identifier that needs to be included in the affidavit.

When completing the Oklahoma Legal Heirship form, attentiveness to these details ensures the process goes smoothly and adheres to legal requirements. It helps in the rightful distribution of assets to successors and in reducing the likelihood of disputes or legal challenges.

Documents used along the form

When dealing with the estate of a deceased loved one in Oklahoma, the Affidavit of Heirship is a critical document for legally identifying heirs. However, this form often works in conjunction with other legal documents to ensure a smooth transition of assets and fulfilling of the deceased's wishes. Understanding these additional forms can provide a clearer pathway for managing estate affairs.

- Will - This legal document outlines how the deceased person (the testator) wants their property and assets distributed after their death. It may designate guardians for minor children and name an executor to manage the estate's affairs.

- Death Certificate - A certified document issued by a government official that declares the date, location, and cause of death. It's necessary for many estate proceedings to prove the testator has died.

- Last Statement of Account - This document shows the final account balance and activities. It's essential for closing bank accounts or claiming benefits due to the estate.

- Probate Application - Filed with the probate court, this application begins the process of legally recognizing a will (if there is one) and appointing an executor or administrator for the estate.

- Real Estate Deeds - Legal documents that transfer property rights. If the deceased owned real estate, deeds are necessary to transfer or sell the property according to the will or state succession laws.

- Trust Documents - If the deceased established a trust, these documents are essential for trustees to manage and distribute the trust's assets according to the terms laid out.

- Life Insurance Policies - These outline the beneficiaries and terms under which they receive benefits. Presenting the policy to the insurance company, along with a death certificate, can facilitate the payout process.

Utilizing the Affidavit of Heirship in conjunction with these documents can provide a comprehensive approach to handling the deceased's estate. While the Affidavit helps identify legal heirs, the additional documents help in managing and distributing the decedent's assets according to their wishes or state laws. For a more seamless process, each document should be carefully completed and duly submitted to the relevant authorities or institutions.

Similar forms

The Affidavit of Small Estate is a document significantly akin to the Oklahoma Legal Heirship form. Both documents are designed to simplify the probate process for estates that fall below a certain value threshold. Whereas the Affidavit of Heirship identifies heirs and outlines their entitlements, the Affidavit of Small Estate similarly bypasses formal probate by allowing a simple declaration of assets, debts, and heir entitlements for small estates. Both pave the way for a more streamlined asset distribution to heirs without the need for extensive court involvement.

The Transfer on Death Deed (TODD) shares a strategic purpose with the Oklahoma Legal Heirship form. While the Heirship form is used posthumously to claim and distribute assets, a Transfer on Death Deed is prepared in advance, stipulating the transfer of real property to a named beneficiary upon the owner’s death. Both documents reduce the probate process's complexity and facilitate a smoother transition of assets, albeit at different stages of planning and execution.

A Declaration of Paternity is another document that carries similarities with the Oklahoma Legal Heirship form, particularly in its role in legally identifying relationships. While the Heirship affidavit is employed to establish legal beneficiaries after someone's death, a Declaration of Paternity identifies a child's biological father, often impacting inheritance rights and responsibilities. Both documents are pivotal in defining legal relationships that directly influence rights to assets or obligations.

The Revocable Living Trust resembles the Oklahoma Legal Heirship form in its objective to manage and distribute assets. The trust allows a person (the grantor) to control their assets during their lifetime and specify beneficiaries after death, potentially avoiding probate altogether. In contrast, the Heirship form comes into play after death, designating heirs to receive the decedent’s assets in the absence of a will or trust but similarly aims to streamline asset distribution.

Last Will and Testament documents, though more comprehensive, share a fundamental similarity with the Oklahoma Legal Heirship form by designating beneficiaries and outlining the distribution of assets posthumously. While a will covers a broader range of directives, including the appointment of executors and guardians, the Heirship form is specifically focused on identifying heirs and confirming their rights to inherit in situations where a will might not exist or cover specific assets.

The Power of Attorney (POA) document authorizes someone to act on your behalf in various legal and financial matters. Its resemblance to the Oklahoma Legal Heirship form lies in how both delegate authority—either posthumously in identifying and distributing assets to heirs, or, in the POA’s case, allowing someone to manage your affairs while you're alive. Through these documents, control and decision-making are transferred to ensure personal wishes or legal necessities are fulfilled.

Finally, the Life Estate Deed is a document that, like the Oklahoma Legal Heirship form, pertains to the transfer of property, albeit in a different manner. A life estate deed allows a property owner to transfer ownership while retaining the right to occupy the property for life. This early designation of successors resembles the heirship form's goal of identifying future beneficiaries of an estate, facilitating a smoother transition of property upon the original owner’s passing.

Dos and Don'ts

When completing the Oklahoma Legal Heirship form, there are several important dos and don'ts to keep in mind to ensure the process is handled accurately and efficiently. Below are essential tips to guide you through this crucial legal procedure.

Things You Should Do:

- Provide accurate information: Ensure all the details you provide, including your name, the name of the deceased, addresses, and social security numbers, are correct and match official documents.

- Include all surviving heirs: Clearly list every surviving heir, their relationship to the deceased, their age, address, and phone number. This ensures all potential successors are appropriately considered.

- Attach additional pages if needed: If the space provided on the form is insufficient, attach additional sheets to include all necessary information, especially in listing the heirs and their details.

- Verify debts and taxes are settled or addressed: Confirm that all debts and taxes of the estate have been paid, provided for, or are barred by statute of limitations to avoid future legal complications.

- Ensure no other proceedings are pending: Confirm that no application or petition for a personal representative for the estate is pending or has been granted in any jurisdiction.

- Sign in the presence of a notary: Complete the affidavit in the presence of a notary public to ensure your signature is properly witnessed and the document is legally valid.

Things You Shouldn't Do:

- Guess information: Do not estimate or guess any details. This includes dates, social security numbers, or addresses. Incorrect information can invalidate the document or delay the process.

- Omit heirs: Failing to list all known heirs can result in a legally incomplete document, leading to potential disputes or challenges to the estate.

- Ignore additional documentation: If further documentation is necessary to support your affidavit, such as death certificates or proof of paid debts, do not overlook this requirement.

- Underestimate estate value: Providing an inaccurate valuation of the decedent's property that exceeds the stipulated maximum can lead to issues. Ensure the estate's valuation is correct and within the allowed limit.

- Proceed without legal advice if unsure: If any part of the process is unclear or if the estate's situation is complex, failing to consult with a legal professional can lead to errors.

- Forge signatures or fabricate information: Respect the legal process by ensuring all information and signatures are genuine and not altered or fabricated in any manner.

Misconceptions

Misconceptions about the Oklahoma Legal Heirship form can lead to confusion and delay in settling an estate. Understanding these misconceptions is crucial for properly managing the disposition of a loved one’s assets.

- Misconception 1: The form is only for claiming money from the Oklahoma Police Pension and Retirement System.

This notion is incorrect. While section 9 specifically mentions claiming monies due from the Oklahoma Police Pension and Retirement System, the form's broader use includes establishing the rightful heirs for various assets within the estate, not limited to pension funds.

- Misconception 2: Anyone can fill out and submit the form.

Only individuals legally acting on behalf of the successor(s) of the deceased's estate, typically close family members or legally appointed representatives, are authorized to fill out and submit this form. It requires detailed personal and estate information that not just anyone can provide.

- Misconception 3: You need an attorney to complete the form.

While legal advice can be beneficial, especially in complex estates, it's not mandatory to have an attorney complete the form. Laypersons can fill it out provided they have accurate and comprehensive information about the deceased and the estate.

- Misconception 4: The form is a substitute for a will.

This is incorrect. An Affidavit of Heirship is a tool used when there are small estates without a will and serves to establish lawful heirs - it does not distribute the property as a will does. It may be used where no will exists, or in conjunction with a will under certain circumstances.

- Misconception 5: Completion of the form settles all estate debts and taxes.

Filling out the form does not mean all estate debts and taxes are automatically settled. It asserts that taxes and debts have been addressed (section 6), but this is a declaration, not a settlement action. Proper steps must be taken outside of this form to ensure debts and taxes are paid.

Clearing up these misconceptions ensures the Affidavit of Heirship form is used correctly and effectively in the state of Oklahoma, aiding in a smoother transition of estate assets to rightful heirs.

Key takeaways

Filling out and using the Oklahoma Legal Heirship form is an important process for handling a deceased person's estate when there's no will. This form helps in identifying the legal heirs and distributing the assets according to state laws. Here are seven key takeaways about this form:

- Personal Information is Required: The person filling the form must provide their name, date of birth, social security number, and address. This identifies who is submitting the form and their contact information for any necessary follow-up.

- Details about the Deceased: The form requires the name of the deceased and a declaration that the person filling out the form is acting on behalf of the successors of the estate. This confirms the connection between the deceased and the individual submitting the form.

- Listing of Heirs: All surviving heirs must be listed with their names, relationships to the deceased, ages, addresses, telephone numbers, and the proportions of the estate they are entitled to. This section is crucial for the equitable distribution of the estate.

- No Ongoing Proceedings: A statement must be included to confirm that there are no applications or petitions pending or granted for appointing a personal representative for the estate in any jurisdiction. This prevents conflicts in the administration of the estate.

- Settlement of Debts and Taxes: It must be declared that all taxes and debts of the estate have been paid, provided for, or are barred by limitations. This ensures that the heirs won't be held responsible for any outstanding financial obligations of the deceased.

- Value Limitation of the Estate: The form asserts that the fair market value of the property located in Oklahoma, owned by the deceased and subject to disposition by will or intestate succession, does not exceed Twenty Thousand Dollars ($20,000.00). This value cap is significant for the affidavit of heirship process in Oklahoma.

- Indemnification Clause: There is an agreement in the form to indemnify and hold harmless the Oklahoma Police Pension and Retirement System (if applicable) against any claims in relation to the payment of monies due to the estate. This protects the system from potential legal challenges related to the distribution.

Correctly filling out and submitting the Oklahoma Legal Heirship form is essential for the smooth processing of estate claims and distributions. It is advised to review the form carefully and ensure all information provided is accurate and comprehensive.

Popular PDF Documents

Zanesville City Tax - The questionnaire underscores the importance of keeping the city informed about changes in business operations.

Pa Sales Tax Exemption Number Lookup - Understand how to include information on financial assistance and scholarships provided, for your tax exemption request.

Employer's Annual Federal Unemployment (FUTA) Tax Return - Non-profit organizations, government entities, and Indian tribes also have specific instructions for filing Form 940.