Get Ohio Sales Tax Ust 1 Form

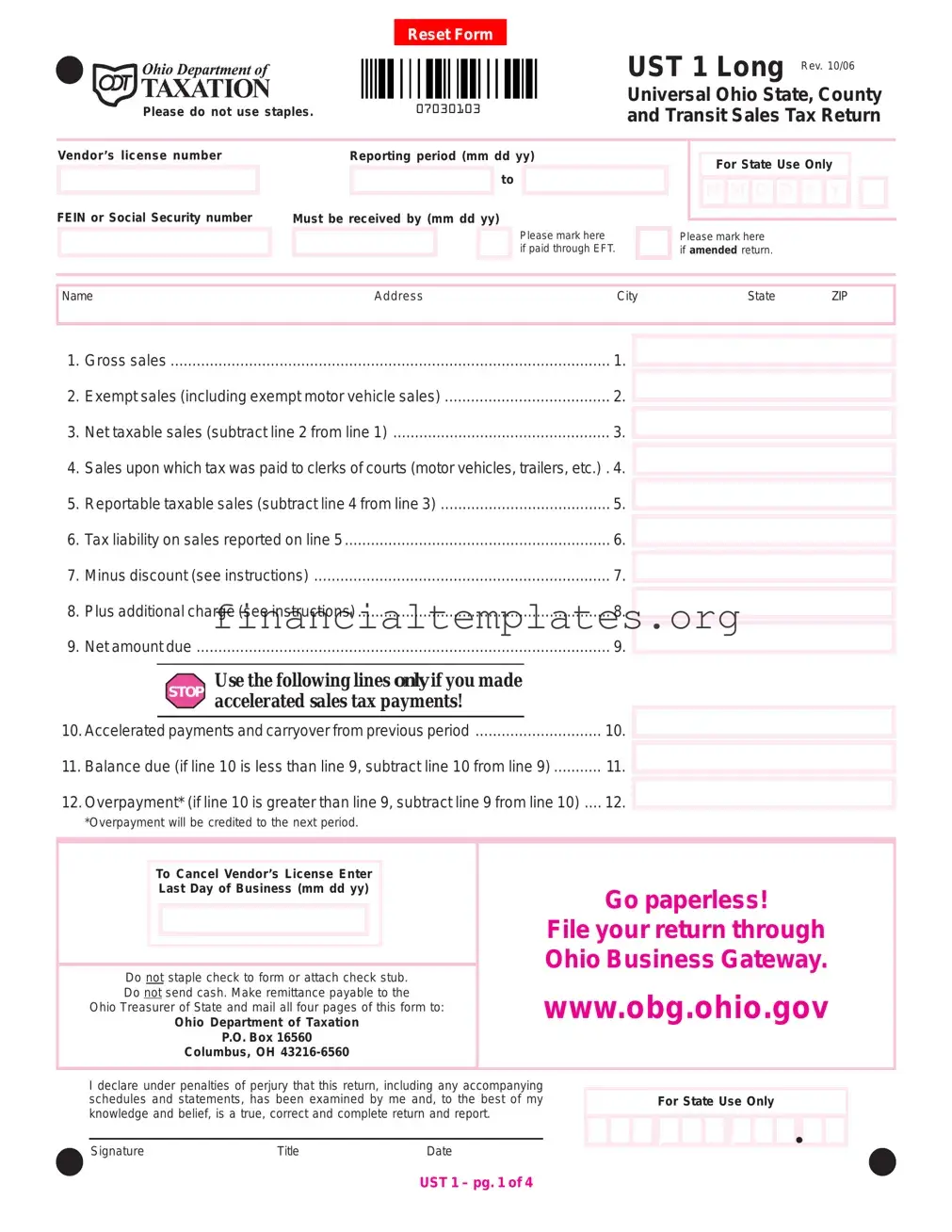

The Ohio Sales Tax UST 1 Form is a critical document utilized by vendors across Ohio to report and pay the sales tax collected from customers. Updated in October 2006, this form allows businesses to declare their gross sales, exempt sales—including those on motor vehicles—and net taxable sales. It also includes a section for sales on which tax has been paid directly to clerks of courts. Following the initial calculations, vendors must report their taxable sales, tax liability, and then adjust for any payments made through accelerated sales tax payments or for any overpayments to be credited to future periods. For businesses wishing to cancel their vendor's license, there’s a specific section to indicate the last day of business. The form emphasizes the convenience of electronic filing through the Ohio Business Gateway, alongside a firm reminder to avoid using staples and ensuring the remittance is payable to the Ohio Treasurer of State. Completing this form accurately is vital for compliance with Ohio's tax laws, and it includes detailed instructions to help vendors calculate their tax liability based on their sales across different counties, thus ensuring that the correct amount of tax is remitted to the state.

Ohio Sales Tax Ust 1 Example

|

|

|

|

|

|

|

|

|

Reset Form |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UST 1 Long Rev. 10/06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Universal Ohio State, County |

|

07030103 |

|

|

|

|

|

|

||||||||||||||||||||||||||||

Please do not use staples. |

|

|

|

|

|

|

|

|

|

|

|

and Transit Sales Tax Return |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Vendor’s license number

FEIN or Social Security number

Reporting period (mm dd yy)

to

Must be received by (mm dd yy)

Please mark here if paid through EFT.

For State Use Only

M M

M  D

D  D

D  Y

Y  Y

Y

Please mark here if amended return.

NameAddressCityState ZIP

1. |

Gross sales |

1. |

2. |

Exempt sales (including exempt motor vehicle sales) |

2. |

3. |

Net taxable sales (subtract line 2 from line 1) |

3. |

4. |

Sales upon which tax was paid to clerks of courts (motor vehicles, trailers, etc.) . 4. |

|

5. |

Reportable taxable sales (subtract line 4 from line 3) |

5. |

6. |

Tax liability on sales reported on line 5 |

6. |

7. |

Minus discount (see instructions) |

7. |

8. |

Plus additional charge (see instructions) |

8. |

9. |

Net amount due |

9. |

|

Use the following lines only if you made |

|

|

|

STOP accelerated sales tax payments! |

|

|

10. Accelerated payments and carryover from previous period |

10. |

||

11. Balance due (if line 10 is less than line 9, subtract line 10 from line 9) |

11. |

||

12. Overpayment* (if line 10 is greater than line 9, subtract line 9 from line 10) .... |

12. |

||

*Overpayment will be credited to the next period.

To Cancel Vendor’s License Enter

Last Day of Business (mm dd yy)

Do not staple check to form or attach check stub. Do not send cash. Make remittance payable to the

Ohio Treasurer of State and mail all four pages of this form to:

Ohio Department of Taxation

P.O. Box 16560

Columbus, OH

Go paperless!

File your return through Ohio Business Gateway.

www.obg.ohio.gov

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been examined by me and, to the best of my knowledge and belief, is a true, correct and complete return and report.

Signature |

Title |

Date |

For State Use Only

, ,

UST 1 – pg. 1 of 4

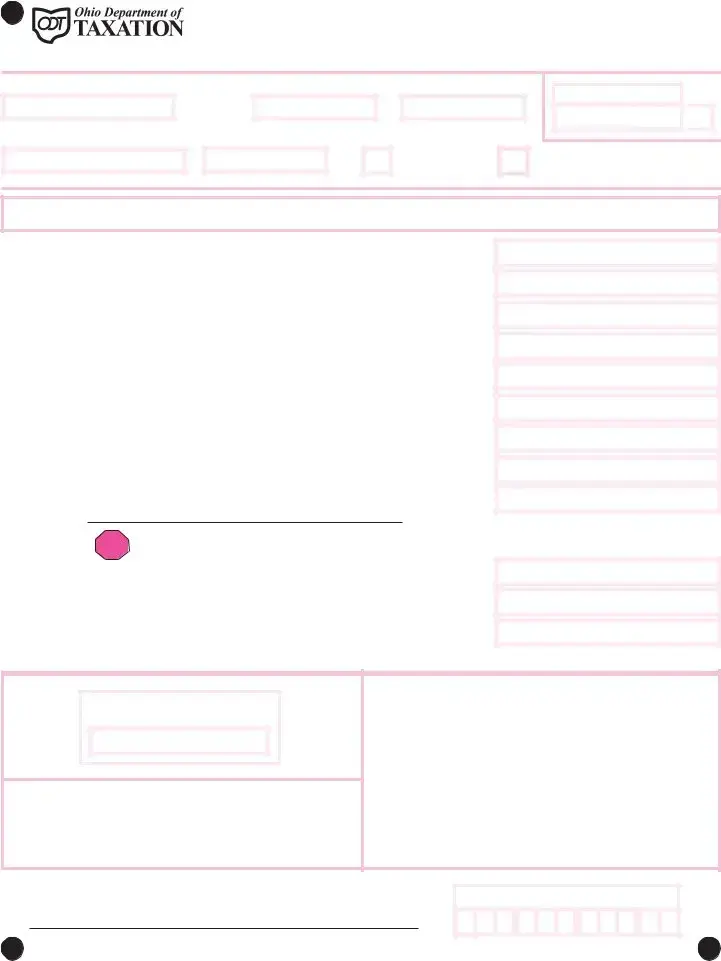

Please do not use staples. Vendor’s license number

UST 1 Long Rev. 10/06

Universal Ohio State, County and Transit Sales Tax Return

Supporting schedule must be completed showing taxable sales and the combined state, county and transit authority taxes on a

County Name |

County Number |

|

|

Taxable Sales* |

|

|

Tax Liability* |

|||

*If this amount is a negative, please mark an “X” in the box provided. |

||||||||||

|

|

|||||||||

Adams |

01 |

|

|

|

|

|

|

|

|

|

Allen |

02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ashland |

03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ashtabula |

04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Athens |

05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Auglaize |

06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Belmont |

07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Brown |

08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Butler |

09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Carroll |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Champaign |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Clark |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Clermont |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Clinton |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Columbiana |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Coshocton |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Crawford |

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Cuyahoga |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Darke |

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Defiance |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Delaware |

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Delaware (COTA) |

96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Erie |

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fairfield |

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fairfield (COTA) |

93 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fayette |

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Franklin |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fulton |

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Gallia |

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Geauga |

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Greene |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Guernsey |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Hamilton |

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 subtotal

UST 1 – pg. 2 of 4

Please do not use staples. Vendor’s license number

UST 1 Long Rev. 10/06

Universal Ohio State, County and Transit Sales Tax Return

Supporting schedule must be completed showing taxable sales and the combined state, county and transit authority taxes on a

County Name |

County Number |

|

|

Taxable Sales* |

|

|

Tax Liability* |

|||

*If this amount is a negative, please mark an “X” in the box provided. |

||||||||||

|

|

|||||||||

Hancock |

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Hardin |

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Harrison |

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Henry |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Highland |

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Hocking |

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Holmes |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Huron |

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Jackson |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Jefferson |

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Knox |

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lake |

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lawrence |

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Licking |

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Licking (COTA) |

94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Logan |

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Lorain |

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lucas |

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Madison |

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Mahoning |

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Marion |

51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Medina |

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Meigs |

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Mercer |

54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Miami |

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monroe |

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Montgomery |

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Morgan |

58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Morrow |

59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Muskingum |

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Noble |

61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Ottawa |

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Paulding |

63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Page 3 subtotal

UST 1 – pg. 3 of 4

|

|

|

|

|

|

|

|

|

|

|

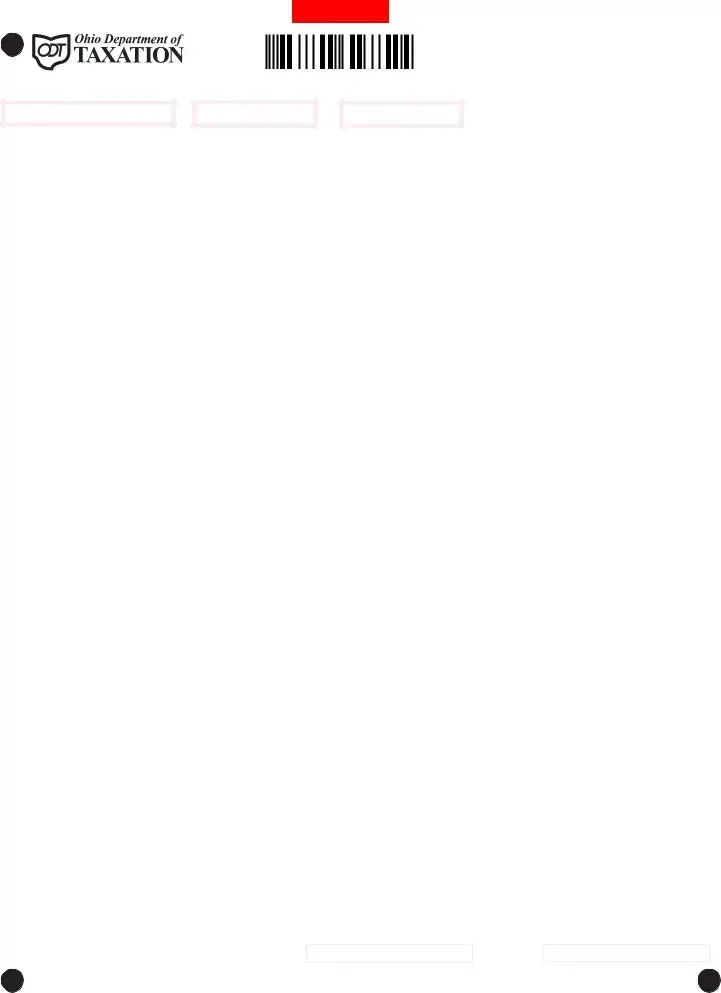

Reset Form |

||||||||||||||

Please do not use staples. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

07030403 |

|

||||||||||||||||||||||||

Vendor’s license number |

Reporting period (mm dd yy) |

||||||||||||||||||||||||

to

UST 1 Long Rev. 10/06

Universal Ohio State, County and Transit Sales Tax Return

Supporting schedule must be completed showing taxable sales and the combined state, county and transit authority taxes on a

County Name |

County Number |

|

|

Taxable Sales* |

|

|

Tax Liability* |

|||

*If this amount is a negative, please mark an “X” in the box provided. |

||||||||||

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Perry |

64 |

|

|

|

|

|

|

|

|

|

Pickaway |

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Pike |

66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Portage |

67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Preble |

68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Putnam |

69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Richland |

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ross |

71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Sandusky |

72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Scioto |

73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Seneca |

74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Shelby |

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Stark |

76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Summit |

77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Trumbull |

78 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Tuscarawas |

79 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Union |

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Van Wert |

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Vinton |

82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Warren |

83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Washington |

84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Wayne |

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Williams |

86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Wood |

87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Wyandot |

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal this page

Page 2 subtotal

Page 3 subtotal

Grand total*

*Enter totals on lines 5 and 6 on the front page of this return.

UST 1 – pg. 4 of 4

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title and Revision | The form is titled UST 1 Long Rev. 10/06, indicating it was revised in October 2006. |

| Purpose | Used for reporting state, county, and transit sales tax in Ohio. |

| Filing Method | Vendors have the option to file this return through the Ohio Business Gateway, encouraging paperless submissions. |

| Payment Information | Remittances must be made payable to the Ohio Treasurer of State, demonstrating the form's direct link to state financial operations. |

| Governing Laws | Governed by Ohio state laws concerning sales tax, highlighting the legal requirement for vendors to accurately report sales activities within the state. |

Guide to Writing Ohio Sales Tax Ust 1

Filling out the Ohio Sales Tax UST 1 form is a critical task for businesses operating in Ohio to comply with state tax regulations. This form is utilized to report sales, calculate the sales tax due, and remit the appropriate amount to the Ohio Department of Taxation. It's a straightforward process if the steps below are followed carefully. The form encompasses reporting gross sales, deducting exempt sales, and then calculating the net taxable sales. This includes adjustments for sales taxed at the point of vehicle registration, a calculation of the tax liability, and modifications for discounts or additional charges. For those who have made accelerated sales tax payments, there's also a section to report these amounts.

- Start with entering your Vendor’s license number and either your Federal Employer Identification Number (FEIN) or Social Security number at the top of the form.

- Fill in the reporting period dates (start and end) and the due date for the form submission.

- Indicate with a check mark if the payment was made through Electronic Funds Transfer (EFT) or if this is an amended return.

- Provide your business name and address, including city, state, and ZIP code in the designated area.

- Report your Gross Sales in line 1.

- Enter Exempt Sales (including exempt motor vehicle sales) on line 2.

- Calculate Net Taxable Sales by subtracting line 2 from line 1 and enter the result on line 3.

- For Sales upon which tax was paid to clerks of courts (motor vehicles, trailers, etc.), enter the amount on line 4.

- Determine your Reportable Taxable Sales by subtracting line 4 from line 3 and input this on line 5.

- Calculate the Tax Liability on sales reported on line 5 and enter it on line 6.

- If applicable, subtract any Minus Discount as per instructions on line 7.

- Add any Plus Additional Charge as instructed on line 8.

- Calculate the Net Amount Due, found on line 9, by adjusting the taxable amount with discounts or additional charges.

- For businesses that made accelerated sales tax payments, enter these amounts on line 10.

- Determine the Balance Due by subtracting line 10 from line 9 for those whose accelerated payments are less than their net amount due, and enter this on line 11.

- If accelerated payments exceed the net amount due, calculate the Overpayment and enter it on line 12. Remember that this amount will be credited to the next period.

- If canceling your Vendor’s License, enter the last day of business below this section.

- Double check all entries for accuracy, as mistakes could delay processing or result in penalties.

- Sign and date the form at the bottom, certifying that the information provided is true and correct.

- Detach the payment if you are mailing in a payment and do not staple it to the form. Payments should be made payable to the Ohio Treasurer of State. Mail the completed form and any payment to the Ohio Department of Taxation at the address provided on the form.

Remember, filing and payment submission can also be completed online through the Ohio Business Gateway for a more efficient process. Always refer to the most current instructions and guidelines provided by the Ohio Department of Taxation to ensure compliance with the latest tax laws and reporting requirements.

Understanding Ohio Sales Tax Ust 1

Frequently Asked Questions about the Ohio Sales Tax UST 1 Form

What is the Ohio Sales Tax UST 1 Form?

The Ohio Sales Tax UST 1 Form is a document required by the Ohio Department of Taxation for vendors to report and pay state, county, and transit sales taxes. It is used to calculate the net sales tax liability based on gross sales, exempt sales, and taxable sales during a specified reporting period. The form also allows for adjustments such as discounts, additional charges, and accelerated payments.

Who needs to file the UST 1 Form?

Any vendor with a vendor’s license in Ohio conducting taxable sales activities must file the UST 1 Form. This includes businesses selling goods or providing taxable services within Ohio's jurisdiction.

How often do I need to file the UST 1 Form?

Filing frequency is determined by the Ohio Department of Taxation and is based on the volume of sales. Vendors can be required to file on a monthly, quarterly, or annual basis.

What information do I need to complete the UST 1 Form?

To accurately complete the form, you will need:

- Your vendor’s license number

- FEIN or Social Security number

- Reporting period

- Gross sales amount

- Amount of exempt sales

- Amount of taxable sales

- Details of any sales tax previously paid to clerks of courts for items like motor vehicles

- Any accelerated sales tax payments made

Can I file the UST 1 Form online?

Yes, Ohio encourages vendors to file the UST 1 Form online through the Ohio Business Gateway. This paperless option facilitates faster processing and potentially quicker resolutions to any discrepancies or questions regarding the submission.

What happens if I miss the filing deadline?

If a vendor fails to file by the specified due date, the Ohio Department of Taxation may assess penalties and interest. It's crucial to file and pay sales taxes on time to avoid these additional charges.

How do I amend a previously filed UST 1 Form?

If you need to make changes to a UST 1 Form that was already submitted, you should mark the "amended return" option on the form. Be sure to provide the correct information and explain any adjustments from the original submission.

Common mistakes

Filling out the Ohio Sales Tax UST 1 form is a critical task for business owners in the state. Accuracy is key to ensuring compliance and avoiding potential penalties. Common mistakes can easily occur if one is not diligent. Here are five frequent errors to watch out for:

Not Reporting Gross Sales Accurately: The total amount of sales before any deductions is critical. Some mistake gross for net sales, underreporting their total sales figure.

Omitting Exempt Sales: Exempt sales, including those of exempt motor vehicles, must be carefully calculated and reported. Overlooking or misclassifying exempt sales can affect the net taxable sales figure.

Miscalculating Net Taxable Sales: Subtracting line 2 from line 1 should be done with care. Mistakes in arithmetic can result in incorrect tax liabilities being reported.

Forgetting to Report Sales Tax Paid to Clerks of Courts: Sales of motor vehicles, trailers, etc., that have tax paid directly to clerks of courts must be reported separately to avoid being taxed again. This is a common oversight.

Incorrectly Handling Overpayments: If there is an overpayment, it should be noted that this amount will be credited to the next period. Failing to properly account for this can lead to discrepancies in future filings.

Avoiding these mistakes requires careful attention to detail and a thorough understanding of the form's requirements. For those who may find this challenging, seeking assistance from a professional or using the Ohio Business Gateway for electronic submissions can help reduce errors. Remember, the goal is not just to comply, but to do so accurately and efficiently.

Documents used along the form

When businesses in Ohio handle the Universal Sales Tax (UST) Form 1, it's crucial for them to be familiar with a variety of other forms and documents that often accompany or support the sales tax process. These forms ensure compliance with tax laws, facilitate accurate reporting, and help in maintaining a transparent financial record. Each document serves a specific purpose in the wider framework of tax administration and business management.

- Vendor's License Application (Form ST-1): This document is necessary for businesses to apply for the authorization to collect sales tax in Ohio. It identifies the business and its type, allowing it to legally make taxable sales.

- Consumer's Use Tax Return (Form UUT 1): Similar to the sales tax return, this form is for reporting use tax. The use tax applies to purchases made outside of the state for use in Ohio, where sales tax was not charged at the time of purchase.

- Exemption Certificate (Form STEC B): This form is used by purchasers to claim exemption from sales tax at the time of purchase on qualifying transactions. Businesses need to keep these certificates on file to justify not charging sales tax on exempt sales.

- Annual Report (Form CAT 12): Required for businesses subject to the Commercial Activity Tax (CAT), this form reports the gross receipts for the year. It’s essential for entities that have taxable gross receipts from sales in Ohio.

- Sales and Use Tax Blanket Exemption Certificate (Form STEC U): Employed for recurring purchases of the same item, this document certifies that each purchase is for a tax-exempt purpose, removing the need to provide an exemption certificate for each transaction.

- Telecommunications Service Tax Return (Form TST-1): For businesses providing telecommunications services, this form reports the sales and use tax specific to telecommunications. It is necessary for accurately reporting tax liabilities in this sector.

Understanding these documents and their proper use is vital for businesses in Ohio to ensure they are correctly collecting and remitting sales and use taxes. Compliance not only helps avoid penalties but also supports the state in providing services and infrastructure that benefit everyone. Familiarity with these forms ensures businesses can navigate the complexities of tax reporting with confidence.

Similar forms

The Form 1040 for individual income tax returns shares similarities with the Ohio Sales Tax UST 1 form by necessitating the disclosure of financial figures to calculate tax responsibility. Both require taxpayers to report income, or in the case of UST 1, gross sales, and allow for deductions or exemptions to arrive at a net taxable figure. Adjustments in both forms can lead to a determination of either tax due to the government or an overpayment, which can be credited to future obligations.

State-specific sales and use tax forms from states other than Ohio, such as California's Sales and Use Tax Return, have analogous reporting requirements, aiming to calculate tax liability from sales. They collect details on gross sales, exemptions, and calculate net tax due. Much like the Ohio UST 1 form, these documents often have sections dedicated to specific types of transactions, adjustments, and detail county or local tax rates where applicable.

The Employer's Quarterly Federal Tax Return, known as Form 941, parallels the Ohio Sales Tax UST 1 form through its structured approach to reconciling amounts due over a set period. Form 941 requires employers to report wages paid, taxes collected from employees, and assess the employer's portion of Social Security and Medicare taxes, similarly detailing calculations that lead to either a due amount or overpayment.

Business Tax Returns, like the Federal Corporate Income Tax Return (Form 1120), share commonality with the Ohio Sales Tax UST 1 form through their need to categorize and report various types of income, deductions, and tax liability. Both forms serve as a means for entities to reconcile their taxable activities with the governing tax authorities, ensuring the right amount of tax is assessed and collected.

The General Excise Tax (GET) form used in states like Hawaii is similar to Ohio’s UST 1 in its purpose of collecting tax on business activities. However, GET notably encompasses a broader range of transactions beyond sales, including services and leasing. Both forms require the reporting of gross amounts followed by allowable subtractions to arrive at a net taxable base and respective tax due.

Sales Tax Exemption Certificates resemble the exempt sales reporting section of the UST 1 form. While not tax returns themselves, these certificates are crucial for businesses to document why certain sales are not subject to tax, aligning with the UST 1's requirement to separately report exempt sales, including specific exemptions such as motor vehicle sales.

VAT (Value-Added Tax) Returns used in many countries outside the United States share a conceptual similarity with Ohio’s UST 1 form in capturing the value added at each stage of production or distribution. Both types of documents aim at taxing the end consumer sale, requiring detailed reporting of sales and purchases to calculate the tax owed or refund due.

The Streamlined Sales and Use Tax Agreement (SSUTA) Exemption Certificate, like the Ohio UST 1 form, is used in the context of sales taxation but specifically for documenting exemptions under the streamlined sales tax project in participating states. This similarity is found in the management and reporting of exempt transactions, ensuring compliance with tax laws across state lines.

The Monthly Sales and Use Tax Return forms that many small businesses must file, similar to the Ohio UST 1, capture taxable sales on a more frequent basis. These forms maintain the theme of reporting gross sales, deductions for exempt sales, and calculating the amount of tax due or overpaid within the designated period, illustrating both the regularity and necessity of such tax reporting.

Lastly, the Commercial Importer’s Declaration forms, which account for the value and duty of imported goods, resemble the transactional reporting aspect of Ohio’s UST 1 form. Both require detailed itemization and valuation of activities (imports for the former, sales for the latter) that culminate in a tax or duty liability, showcasing the global breadth of tax and duty reporting mechanisms.

Dos and Don'ts

When it comes to handling the Ohio Sales Tax UST 1 form, accuracy and attention to detail are paramount. The list below outlines essential dos and don'ts that can guide you through the process, ensuring that your filing is both accurate and compliant.

- Do thoroughly review all the instructions provided before you start filling out the form. Understanding the requirements upfront can save you from making errors.

- Do double-check your Vendor’s license number, FEIN, or Social Security number for accuracy. Mistakes here can lead to processing delays.

- Do accurately report your Gross Sales, Exempt Sales, and Net Taxable Sales. Accuracy in these figures is crucial for correct tax calculation.

- Do use the EFT payment method if it's available and convenient for you, marking the form accordingly if you do.

- Do ensure that the form is signed and dated. An unsigned form is considered incomplete and can lead to penalties.

- Don't use staples to attach any checks or documents to the form, as this can cause damage to the documents and hinder processing.

- Don't wait until the last minute to submit. Late submission can result in late fees and other penalties. Be aware of the deadline, which is clearly stated on the form.

- Don't forget to include the reporting period. This information is vital for the Ohio Department of Taxation to process your form correctly.

- Don't send cash. Always make checks payable to the Ohio Treasurer of State and ensure all payment information is correct.

By following these guidelines, you can streamline the process of filing your Ohio Sales Tax UST 1 form, reducing the possibility of errors and ensuring compliance with state tax regulations. Remember, the key to a stress-free tax filing experience is preparation, attention to detail, and adhering to deadlines.

Misconceptions

When it comes to the Ohio Sales Tax UST 1 form, misunderstandings can easily arise. Here are four common misconceptions and the truths behind them:

- Every business must file the UST 1 form. Not all businesses are required to file this form. It's specifically for vendors operating within Ohio who need to report their sales tax. If a business does not make taxable sales in Ohio, it might not need to file this form. However, determining your obligation to file can depend on several factors related to your business activities in the state.

- You can only file the UST 1 form on paper. While the form includes a mailing address and discourages the use of staples, which might suggest a preference for paper filings, this is not the only way to file. In fact, the form itself encourages businesses to go paperless and file through the Ohio Business Gateway. This online method is not only environmentally friendly but also more convenient and potentially faster for businesses.

- If you make a mistake on the form, you can’t correct it. Mistakes happen, but they aren’t the end of the world. The UST 1 form actually has a provision for amendments. If you realize an error has been made after filing, you can mark your submission as an amended return and correct the mistake. This is crucial in ensuring that your business complies with Ohio tax laws accurately.

- Overpayments are lost if not immediately addressed. Overpayments are acknowledged in the structure of the form, with specific lines dedicated to reporting and applying these overpayments. If you pay more than what is due, the excess amount is credited to the next period. This measure ensures that overpayments are not lost but are instead applied to future liabilities, easing your business’s tax burden.

Navigating state tax forms can be daunting, but understanding these common misconceptions about the Ohio Sales Tax UST 1 form can simplify the process. Always review the most current forms and guidelines provided by the Ohio Department of Taxation or consult with a tax professional to ensure compliance and make the most of your filings.

Key takeaways

When dealing with the Ohio Sales Tax UST 1 form, it's crucial to navigate with accuracy and attentiveness. This form is not just a procedural requirement; it's your business's direct communication with the Ohio Department of Taxation regarding sales transactions over a specific period. To guide you through this process more smoothly, here are some key takeaways to keep in mind:

- Timeliness is Key: The Ohio Sales Tax UST 1 form stipulates clear deadlines for when it must be received by the Ohio Department of Taxation. Ensuring your form is prepared and submitted on time is paramount to avoid late filing penalties and interest charges. This punctuality also reflects well on your business’s commitment to compliance.

- Accurate Reporting: The form requires detailed inputs such as gross sales, exempt sales, and net taxable sales. It's imperative to conduct thorough reviews of your sales records to report these figures accurately. Inaccuracies can lead to audits, disputes, and possible penalties, making it essential to double-check each entry for precision.

- Electronic Filing Option: The reminder to go paperless and file through the Ohio Business Gateway offers a streamlined alternative to paper filing. This electronic option can save time, reduce errors, and expedite the processing of your sales tax return. It's an efficient and eco-friendly way to fulfill your tax obligations.

- Understanding Deductions and Additions: The form allows for deductions through 'discounts' and additions through 'additional charges'. Familiarizing yourself with what qualifies for these adjustments is crucial. This knowledge can help in lowering your net tax liability in a legitimate manner, ensuring you take full advantage of the tax code provisions.

Above all, remember the importance of keeping comprehensive sales records and staying updated with Ohio's sales tax laws. This proactive approach not only aids in preparing your UST 1 form but also positions your business for operational success and regulatory compliance.

Popular PDF Documents

Political Form - Form 1120-POL is the required document for political organizations to comply with U.S. tax laws.

Ach Form to Receive Payment - Financial institutions receiving ACH payments must furnish their routing transit number and account details on the form.