Get Office Depot Tax Exempt Form

When organizations or individuals engage in purchasing supplies and equipment for their operations, understanding the nuances of tax-exempt status can lead to significant savings. Among the vital tools for those eligible for such exemptions is the Office Depot Tax Exempt form, a document designed to streamline the process of obtaining tax exemptions on purchases made at Office Depot. This form serves as an application for a tax exemption purchasing card and requires applicants to provide detailed information, including but not limited to, company information, and the type of exemption being claimed such as for a nonprofit organization, for resale, or for governmental use. Applicants are also required to attach a copy of their tax-exemption certificate to validate their claim. The form emphasizes the importance of clear communication by requesting an email address for updates regarding the tax-exempt processing. The instructions guide applicants to mail, fax, or email the completed document for verification, and once approved, a permanent tax exemption card is issued within approximately two weeks. This introduction helps demystify the application process for obtaining tax-exempt status with Office Depot, underlining the necessity of completing all sections accurately to expedite the approval process.

Office Depot Tax Exempt Example

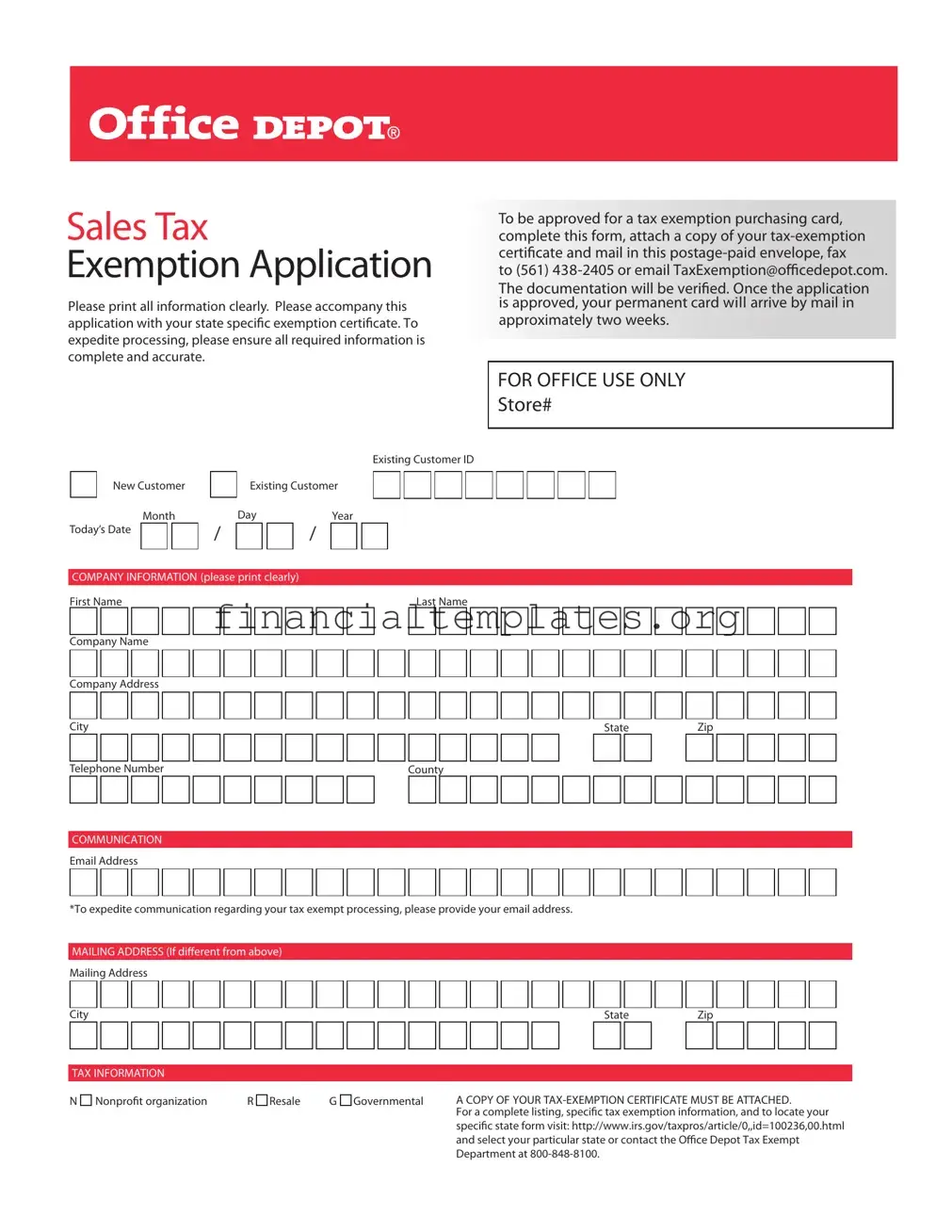

Sales Tax

Exemption Application

Please print all information clearly. Please accompany this application with your state speci

expedite processing, please ensure all required information is complete and accurate.

Existing Customer ID

|

New Customer |

|

|

Existing Customer |

|||||||

|

|

Month |

|

|

Day |

|

|

Year |

|||

|

|

|

|

|

|

||||||

Today’s Date |

|

|

|

/ |

|

|

|

/ |

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

To be approved for a tax exemption purchasing card, complete this form, attach a copy of your

to (561)

The documentation will be veri Once the application is approved, your permanent card will arrive by mail in

approximately two weeks.

FOR OFFICE USE ONLY

Store#

COMPANY INFORMATION (please print clearly) First Name

Company Name

Company Address

City

Telephone Number

COMMUNICATION

Email Address

Last Name

StateZip

County

*To expedite communication regarding your tax exempt processing, please provide your email address.

MAILING ADDRESS (If di

Mailing Address

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

TAX INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

N Nonproorganization |

|

R Resale |

|

G Governmental |

|

A COPY OF YOUR |

|

|

|

||||||||||||||||||||||||||||||||||||

For a complete listing, speci speci

and select your particular state or contact the O Department at

Document Specifics

| Fact Name | Description |

|---|---|

| Application Submission Methods | The Office Depot Tax Exempt form can be submitted via mail, fax to (561) 438-2405, or email at TaxExemption@officeDepot.com. |

| Processing Time | Once the application is verified and approved, the permanent tax exemption purchasing card is mailed out and should arrive within approximately two weeks. |

| Required Attachments | A copy of the applicant's tax-exemption certificate must be attached to the form for it to be processed. |

| Eligible Entities | The form accommodates applications from non-profit organizations, resellers, and governmental entities by providing specific fields to indicate the nature of the tax exemption (coded as N for non-profit, R for resale, G for governmental). |

| State-Specific Variations | Applicants are advised to provide state-specific tax exemption certificates and can obtain a complete listing of specific requirements by contacting the Office Depot Tax Department at 800-848-8100, indicating that tax laws governing exemptions vary by state. |

Guide to Writing Office Depot Tax Exempt

Going through the process of filling out the Office Depot Tax Exempt form is straightforward. It's a vital step for organizations entitled to tax exemption, ensuring they can purchase supplies without paying sales tax. Properly completing this form requires attention to detail and accurate information to prevent any delays. Below is a guide to help navigate through each section of the form, ensuring a smooth submission process.

- Start with the "Sales Tax Exemption Application" header. Ensure you have the form printed out clearly to avoid any confusion during its review.

- Under the existing customer identification section, check the appropriate box to indicate if you are a New Customer or an Existing Customer. If you're an existing customer, fill in your Customer ID.

- Enter today's date in the Month/Day/Year format.

- In the COMPANY INFORMATION section, print your first name, last name, and the company name clearly.

- Provide your company's physical address, including the city, state, zip code, and county.

- To enhance communication, it's recommended to provide an email address in the space available. This ensures you'll receive updates on your tax-exempt status and any other necessary communication.

- If your mailing address differs from the company address, fill in the MAILING ADDRESS section with the appropriate details: mailing address, city, state, and zip code.

- Identify the nature of your tax exemption by ticking the appropriate box in the TAX INFORMATION section. The options include Nonprofit organization, Resale, or Governmental.

- Attach a copy of your tax-exemption certificate. This is an essential step, as the application can't be processed without this document.

- For additional assistance or to inquire further about exemption categories, consider reaching out to the Office Depot Exemption Department at 800-848-8100.

- Once all sections are filled out and your documentation is attached, review the application to ensure all information is complete, accurate, and legible.

- You can submit the completed form and attachments via mail in the provided postage-paid envelope, fax it to (561) 438-2405, or email it to TaxExemption@office.com.

After submitting your application, it will go through a verification process. Approval usually takes a short period, after which your permanent tax exemption card will be mailed to you, typically arriving within two weeks. Ensuring each step is carefully followed and all information provided is correct can expedite this process, moving you closer to enjoying tax-exempt purchasing benefits with Office Depot.

Understanding Office Depot Tax Exempt

How can I apply for a tax exemption purchasing card with Office Depot?

To apply for a tax exemption purchasing card from Office Depot, you need to fill out the Sales Tax Exemption Application form. Please print your information clearly on the form. Along with this application, you must attach a copy of your state-specific tax exemption certificate. To submit your application, you can choose to mail it using the postage-paid envelope provided, fax it to (561) 438-2405, or email it to TaxExemption@officedepot.com. Ensure all required information is complete and accurate to expedite the processing of your application.

What types of organizations can apply for a tax exemption purchasing card?

Different types of organizations, including non-profit organizations, resale businesses, and governmental entities, can apply for a tax exemption purchasing card. When filling out the application, select the appropriate category that describes your organization best. Be sure to attach the correct state-specific tax exemption certificate to support your application.

What information is needed to complete the application?

For your application to be considered complete, you must provide your personal information, including your first name, last name, company name, company address, telephone number, and email address for communication. Additionally, you should specify if the provided mailing address differs from your company address. Don't forget to classify your tax status (nonprofit, resale, governmental) and attach the corresponding tax-exemption certificate.

How long does it take to receive the tax exemption purchasing card once my application is approved?

Once your application has been successfully verified and approved, you can expect to receive your permanent tax exemption purchasing card by mail within approximately two weeks. For expedited processing, ensure all the requested information is accurate and complete when submitting your application.

Who should I contact if I have questions about the application process or need assistance?

If you have any questions or require assistance during the application process, you are encouraged to contact the Office Depot Tax Department at 800-848-8100. They can provide additional information and help clarify any doubts regarding the form or required documentation.

Is an email address necessary to apply for the tax exemption purchasing card?

While providing an email address is not mandatory, it is recommended. Including an email address can expedite communication regarding your tax exempt processing. This means any updates or questions about your application can be addressed quickly, ensuring a smoother and faster processing experience.

Common mistakes

When filling out the Office Depot Tax Exempt form, attention to detail is crucial. Unfortunately, individuals often overlook certain aspects or make errors that can hinder the process. Here are seven common mistakes to be aware of:

- Not printing information clearly: The form explicitly requests that all information be printed clearly. Unclear handwriting can lead to misinterpretation of details, resulting in processing delays or even rejection of the application.

- Incomplete information: All sections of the application must be completed in full. Missing information, such as leaving out the Existing Customer ID or not specifying the type of tax exemption (Nonprofit, Resale, Governmental), can stall the process.

- Forgetting to attach the tax-exemption certificate: This document is vital for verifying your tax-exempt status. Failure to attach the certificate can automatically invalidate your application.

- Incorrect contact information: Providing an incorrect email address or telephone number can lead to communication issues. Since the form mentions expedited communication through email, ensuring your email address is correct is particularly important.

- Not specifying the mailing address when it differs from the company address: If your mailing address is different from your company address, it's essential to specify this. Otherwise, you might not receive your permanent tax exemption card.

- Neglecting to specify the type of tax exemption: The form requires you to indicate your exemption category by marking Nonprofit, Resale, or Governmental. Without this specification, Office Depot cannot process your exemption accurately.

- Failure to provide a current date: The form requires today's date, which confirms the application's timeliness. A missing or incorrect date could cause unnecessary delays.

Here are further tips to ensure a smooth process:

- Review all entries before submitting the form. This includes double-checking contact information, the tax-exemption certificate, and the clarity of your handwriting.

- For quick processing, consider using digital methods like email or fax for submission when possible, ensuring all documents are legible and complete.

- Contact Office Depot's Tax Department if you have any questions about your form or require assistance. Their helpline is available for clarifications on tax-exemption categories specific to your state.

By avoiding these common mistakes and following the provided tips, the process of applying for a tax exemption purchasing card with Office Depot can be both efficient and successful.

Documents used along the form

When handling tax-exempt purchases, especially for organizations such as non-profits, educational institutions, and governmental bodies, the Office Depot Tax Exempt form is a crucial document. However, to ensure compliance and streamline the purchasing process, other forms and documents often accompany this form. Being aware of these additional documents can significantly enhance the efficiency of tax-exempt transactions.

- Certificate of Exemption: This document serves as proof that an entity is exempt from paying sales tax on purchases due to its nature or purpose. It typically requires renewal every few years.

- IRS Determination Letter: For non-profit organizations, this letter from the Internal Revenue Service confirms their tax-exempt status under 501(c)(3) and other relevant sections.

- State Tax Exemption Certificate: Similar to the Certificate of Exemption, but specific to state-level tax laws. Requirements and acceptance vary by state.

- Purchase Order: This document, issued by the buyer to the seller, outlines the types, quantities, and agreed prices for products or services. Tax-exempt entities often use it as a formal request to procure goods or services under their tax-exempt status.

- Articles of Incorporation: For organizations, this legal document establishes the entity's existence under state law. It might be required to verify eligibility for tax-exempt purchasing.

- Bylaws or Operating Agreement: These documents outline the internal rules governing the management of the organization. They may be requested to confirm the non-profit or tax-exempt nature of the entity.

- Government Purchase Order: Specific to governmental entities, this legal document authorizes a purchase and leverages the government's tax-exempt status.

- Annual Report: Some entities may be required to submit an annual report detailing their operations and financial status, which can be used to substantiate their ongoing tax-exempt status.

- Minutes of Board Meetings: Documenting decisions made by the organization's board, these minutes can sometimes support the entity's tax-exempt purpose and activities.

- Exemption Renewal Application: Depending on the jurisdiction, entities may need to periodically renew their tax-exempt status, requiring submission of a renewal application along with relevant supporting documents.

Understanding and gathering these documents in addition to completing the Office Depot Tax Exempt form can greatly simplify tax-exempt purchases. This careful preparation not only ensures compliance with tax laws but also facilitates smoother transactions, benefiting both the purchaser and the supplier.

Similar forms

The Office Depot Tax Exempt form shares similarities with the IRS Form W-9, "Request for Taxpayer Identification Number and Certification". Both documents are pivotal for tax-related procedures within the United States, focusing on the accuracy of taxpayer information. The IRS Form W-9 is often required by entities engaging in financial transactions to ensure accurate reporting to the IRS, mirroring the Office Depot form's emphasis on providing clear and precise information for tax exemption purposes. Moreover, each form necessitates the disclosure of an entity's tax identification number, underscoring their role in maintaining tax compliance and facilitating financial activities without the imposition of unnecessary tax burdens.

Similarly, the Uniform Sales & Use Tax Exemption/Resale Certificate - Multijurisdiction, frequently used by businesses to claim tax exemption across multiple states, echoes the functionality of the Office Depot Tax Exempt form. Both documents serve as gateways for organizations to assert their eligibility for tax-exempt purchases, albeit the Multijurisdiction Certificate covers a broad spectrum of states rather than a single jurisdiction. These forms are instrumental for non-profit organizations, governmental entities, and businesses with a resale certificate, emphasizing the need for thorough documentation to qualify for tax exemptions.

Another comparable document is the State Specific Tax Exempt Forms, which vary by state but uphold the same premise as the Office Depot Tax Exempt form. Each state's form caters to entities eligible for tax-exempt purchases within that specific jurisdiction. These forms require detailed information about the organization, similar to the Office Depot Tax Exempt form, including but not limited to the entity's tax-exemption certificate and other pertinent details that validate their exemption status. This parallel underscores the importance of detailed record-keeping and compliance with local tax laws for entities seeking tax relief.

The Federal Excise Tax Exemption Certificate mirrors the Office Depot Tax Exempt form in its purpose and utility. Aimed at entities that are exempt from federal excise taxes on specific goods or services, this certificate requires entities to provide comprehensive documentation to substantiate their exemption eligibility. Both documents facilitate a financial advantage for eligible entities, reducing the fiscal burden by exempting them from certain tax obligations. The detailed information gathered ensures compliance with tax regulations while recognizing the eligible entities' special status.

Lastly, the Nonprofit Organizations’ Certificate of Exemption parallels the Office Depot Tax Exempt form by serving non-profit entities in their quest to obtain tax-exempt status on purchases. This certificate is crucial for non-profits seeking to maximize their financial resources by minimizing tax expenditures. Similar to the Office Depot form, the Nonprofit Organizations’ Certificate of Exemption requires the organization to provide detailed information, including their tax exemption number and the nature of their exemption. This similarity highlights the broader framework within which these documents operate, facilitating tax efficiency for eligible entities across various sectors.

Dos and Don'ts

When filling out the Office Depot Tax Exempt form, there are several important steps to follow and pitfalls to avoid to ensure a smooth process. Here are key dos and don'ts:

Do:- Print all information clearly: This ensures that your application is processed efficiently without delays due to unreadable information.

- Include all required attachments: A copy of your tax-exemption certificate is crucial for the application process. Make sure it is attached.

- Provide accurate and complete information: Double-check all entered information for completeness and accuracy to help expedite the processing of your application.

- Use the provided contact methods for submission: You can mail, fax, or email your application. Choose the method that is most convenient and reliable for you.

- Provide your email address for efficient communication: This can significantly speed up the process by facilitating quick communication regarding your tax-exempt processing.

- Forget to designate your customer status: Clearly indicate whether you are an existing or new customer to streamline the approval process.

- Leave sections incomplete: Missing information can delay or even halt your application process. Every section is important.

- Overlook the choice of tax classification: Whether you're applying on behalf of a nonprofit, in resale, or as a governmental entity, selecting the correct classification is crucial.

- Send in without a tax-exemption certificate: This document is vital for your application. Not including it will prevent your application from being processed.

Misconceptions

A common misconception is that the Office Depot Tax Exempt form is only for nonprofit organizations. This form is actually designed for various types of organizations, including nonprofit organizations, resale businesses, and governmental entities. Each of these entities can apply for tax exemption by providing the relevant documentation and specifying their category (Nonprofit, Resale, or Governmental) on the form.

Another misconception is that the form and its accompanying tax-exemption certificate can only be submitted by mail. This form offers flexibility in submission methods; it can be emailed to TaxExemption@officedepot.com or faxed to (561) 438-2405, in addition to being mailed. Providing multiple submission options helps expedite the approval process for a tax-exempt purchasing card.

Many believe that the process to become tax-exempt with Office Depot is time-consuming and complicated. However, the form is designed to be user-friendly, requesting straightforward company and contact information. By ensuring that all required information is complete and accurate, the approval process can be expedited, with the permanent tax exemption purchasing card arriving by mail in approximately two weeks.

There is a misconception that once the tax exemption application is submitted, there is no need to provide an email address for communication purposes. Contrary to this belief, providing an email address is highly recommended and benefits the applicant. It is specified in the application form that an email address should be provided to expedite communication regarding the tax exempt processing, thus facilitating a smoother and more efficient approval process.

Key takeaways

Applying for an Office Depot Tax Exemption Purchasing Card requires detailed attention to ensure the process is smooth and efficient. Here are key takeaways to help applicants navigate the process successfully:

- Application Accuracy: It's crucial to print all information clearly on the application to avoid any delays in the processing of your tax exemption request.

- Documentation: Always attach a copy of your state-specific tax-exemption certificate with your application. This document is vital for the verification process.

- Submission Options: Office Depot provides multiple submission options for your convenience. You can mail, fax, or email your application and supporting documents to the address or numbers provided on the form.

- Processing Time: After your application has been approved, expect to receive your permanent tax exemption purchasing card by mail within approximately two weeks.

- Company Information: Fill in all the required fields regarding your company information. This includes your name, company name, address, telephone number, and email address for efficient communication.

- Email Address: Providing your email address is recommended to expedite communication regarding your tax exemption processing status.

- Mailing Address: If your mailing address is different from your company address, ensure to provide it in the designated section to prevent any mailing issues.

- Tax Information Types: Specific codes (Non-profit, Resale, Governmental) are used to classify your tax exemption. Be sure to select the code that accurately represents your organization’s qualification for tax exemption.

- State-Specific Requirements: Recognize that tax-exemption requirements can vary by state. It’s important to provide state-specific documentation as required. For a complete listing of specific state requirements, contact Office Depot directly.

- Customer ID: For existing customers, don't forget to include your Customer ID. New customers should ensure all other information is filled out in full to create a new account.

Following these guidelines closely will help ensure a smooth process for obtaining your Office Depot Tax Exemption Purchasing Card, thereby enabling your organization to make tax-exempt purchases efficiently.

Popular PDF Documents

What Is a Cp575 - Getting IRS 7575 right is more than just a bureaucratic hurdle; it’s a pathway to improved local transportation networks.

Tax Form 1040 - For detailing payments that could affect your refund, such as the prior year's minimum tax or excess social security taxes.

Federal Form 8822 - Form 8822 facilitates a necessary update process when taxpayers relocate to a new address.